Bounce forex dabarun

Ƙarshen da ke billa dabarun ciniki na forex yana da fiye da mafi yawan dabarun ciniki na forex shine cewa yana taimaka wa 'yan kasuwa na forex don yin tsinkaya ainihin ainihin saman da ƙananan farashin farashin sa'an nan kuma shiga da wuri a kan cinikin don kama mafi yawan kowane farashin farashi don haka yin haka. riba mai yawa. Wannan yana yiwuwa akan nau'ikan kadari na kasuwar kuɗi daban-daban kamar hannun jari, shaidu, fihirisa, zaɓuɓɓuka da sauransu.

Bounce forex dabarun ya dace da kowane lokaci, sigogi ko salon ciniki kamar ciniki na lilo, ciniki na matsayi na dogon lokaci, ciniki na gajeren wando da fatar fata. Hakanan ana iya canza dabarun don dacewa da ƙwarewar ɗan kasuwa.

Menene bounce ciniki da gaske duka game da

Ka yi tunanin ƙwallon ƙwallon yana ci gaba da tashi daga sama zuwa ƙasa na tsayi daban-daban da matakan tushe, wani lokaci tare da motsi daban-daban ko sauri a cikin motsin farashi kuma a cikin kwatance daban-daban na farashi (bullish ko bearish).

Zaɓan ainihin saman da kasan billa a cikin motsin farashi shine tushen dabarun billa na forex.

Don kasuwanci da dabarun billa na forex, 'yan kasuwa za su nemi babban yiwuwar saitin da ke ba da shawarar cewa farashin zai canza alkiblarsa ko billa a wasu mahimman tallafi da matakin juriya da aka gano.

Menene wannan goyon baya da matakan billa da za a gano

Taimako da juriya suna taka muhimmiyar rawa wajen nazarin fasaha na kasuwar kuɗi. Yana haɓaka hoto mai haske na tsarin kasuwa a cikin motsin farashi kuma yana kuma yin hasashen manyan yuwuwar matakan juyawa ko canjin motsin farashi. Ba kamar hanyar gargajiya na zana goyan baya a kwance da matakan billa ba, ana iya gano wannan matakan ta kayan aikin ciniki daban-daban azaman takamaiman matakan farashi, yankuna ko wuraren sha'awa. Kayan aikin ciniki sune kamar haka;

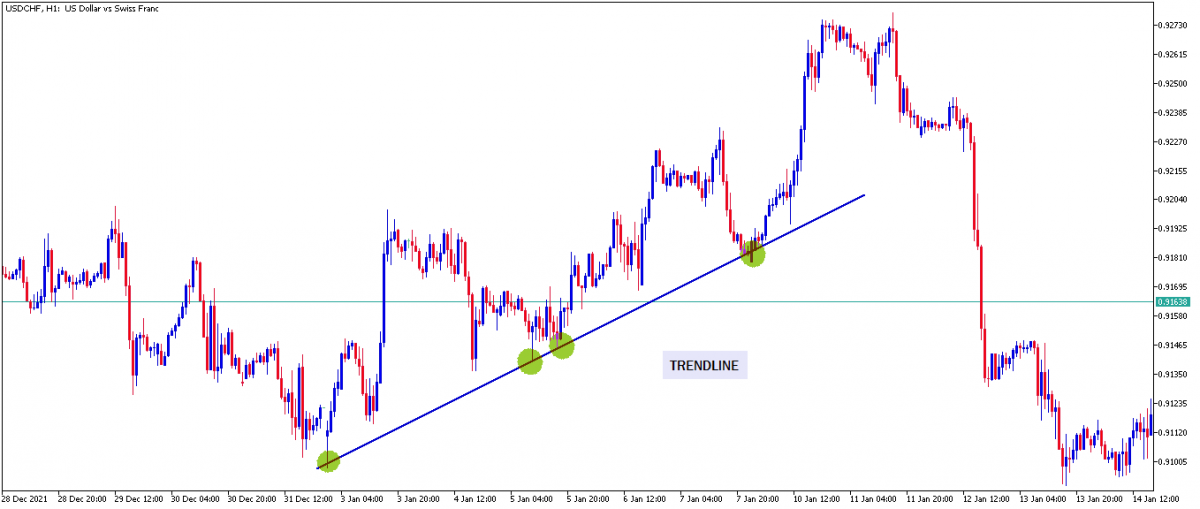

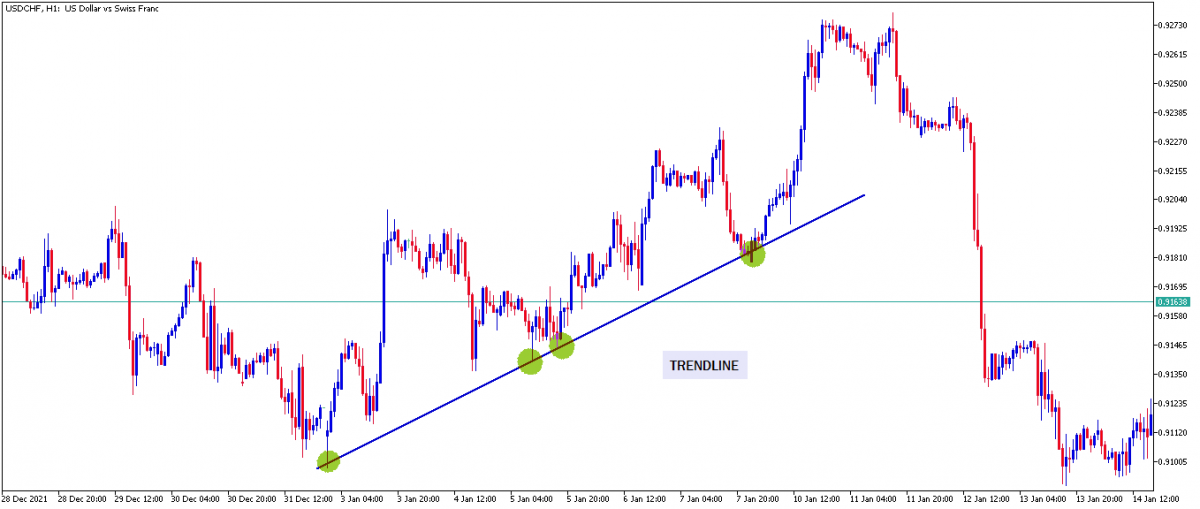

Trendlines: Trendline shine madaidaiciyar layin diagonal mai haɗawa biyu ko uku ko ƙananan motsin farashi don gano matakan tallafi na gaba na yanayin haɓaka ko matakan juriya na gaba na yanayin bearish.

Misalin Bullish Trendline

Tashar layin Trend: Har ila yau, an san shi da tashar farashin, saitin layi na layi na layi wanda aka bayyana ta hanyar tsayin daka da ƙananan motsin farashi ko rashin ƙarfi. Babban layin diagonal na tashar yawanci yana aiki azaman maki na gaba don juriya da ƙananan layin diagonal na tashar yawanci yana aiki azaman maki na gaba don tallafi.

Tashar layin Trend: Har ila yau, an san shi da tashar farashin, saitin layi na layi na layi wanda aka bayyana ta hanyar tsayin daka da ƙananan motsin farashi ko rashin ƙarfi. Babban layin diagonal na tashar yawanci yana aiki azaman maki na gaba don juriya da ƙananan layin diagonal na tashar yawanci yana aiki azaman maki na gaba don tallafi.

Misalin Tashoshin Farashi da Haushi

motsi Averages : Kamar yadda aka tattauna a cikin ɗaya daga cikin labaranmu na baya, matsakaicin motsi shine layi mai laushi wanda ke wakiltar matsakaicin ƙididdiga na motsi na farashi a kan wani lokaci. Matsakaicin layi mai motsi yana aiki azaman tallafi mai ƙarfi da matakan juriya don bullish da bearish billa a cikin motsin farashi.

Hoton motsin farashi yana tashi sama da ƙasa akan matsakaicin motsi.

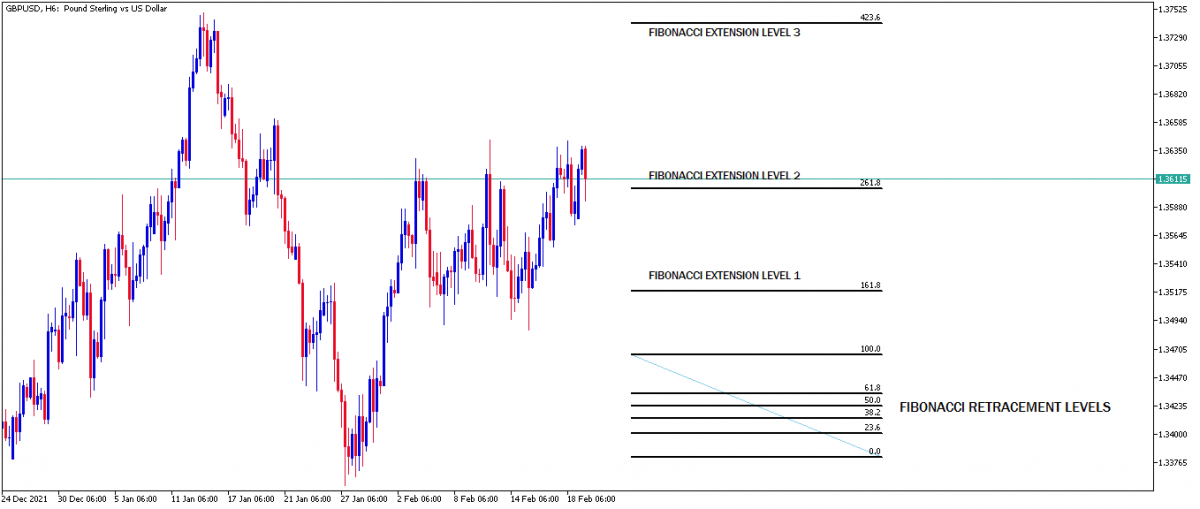

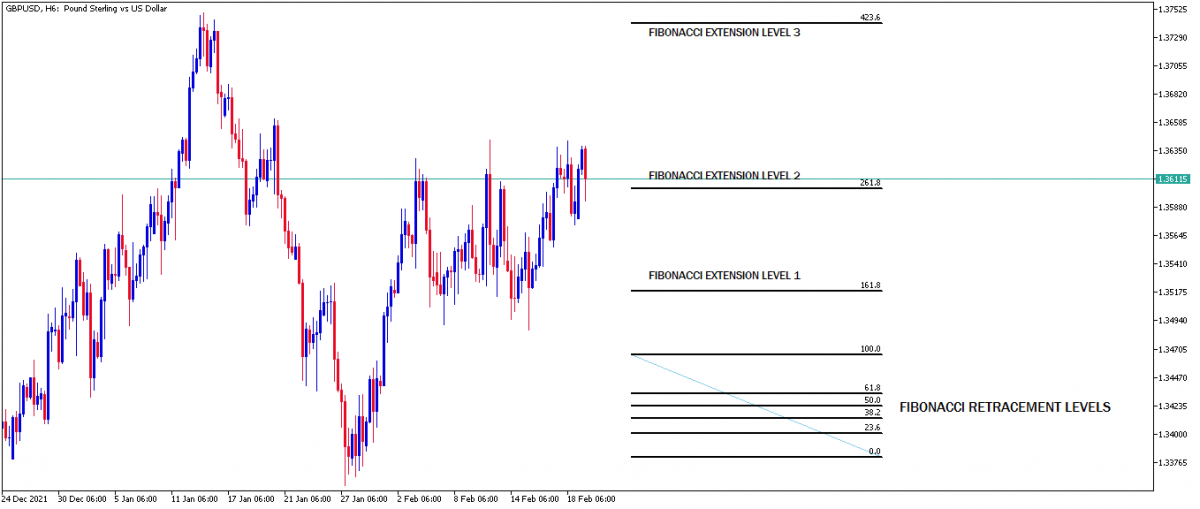

Fibonacci retracement & matakan haɓakawa: Waɗannan mahimman ma'auni ne waɗanda aka samo daga takamaiman jerin lambobi waɗanda ke tafiyar da yanayi. Muhimmin tasirin waɗannan ma'auni ya haɗa zuwa aikin injiniya, ilmin halitta, gini da kuma ciniki na forex. Matakan rabo iri biyu ne. Na farko shine matakan retracement na Fibonacci; 27.6%, 38.2%, 61.8% da 78.6%.

Sauran shine matakan haɓaka Fibonacci; 161.8%, 231.6% da sauransu

Hoton Fibonacci retracement da matakan haɓakawa

Ana zana waɗannan matakan a kwance lokacin da aka tsara kayan aikin Fibonacci akan ƙayyadaddun farashin farashin.

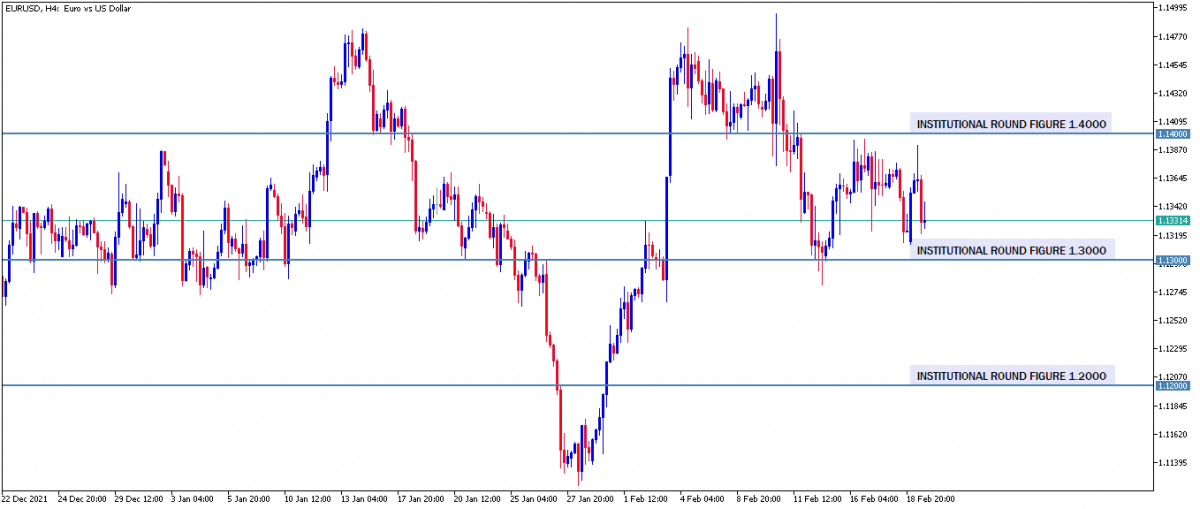

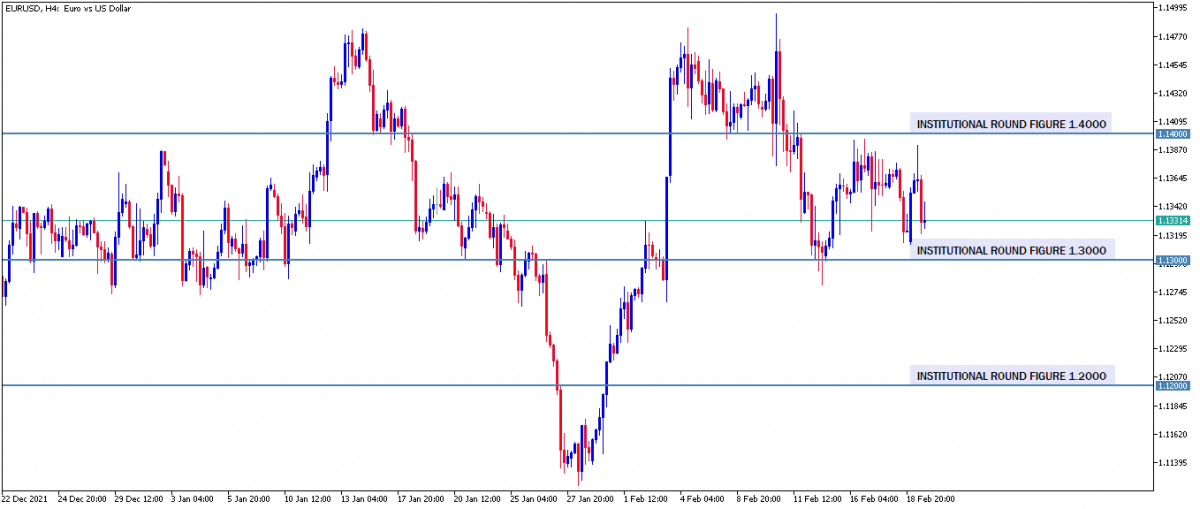

Matsayin farashin hukumomi: Waɗannan matakan farashi ne waɗanda ke ƙarewa da ƙididdiga masu zagaye kamar (.0000) ko tsakiyar adadi kamar (.500). Waɗannan mahimman matakan farashin galibi ana yin su ne don sake tara dogon ko gajerun odar kasuwa ta manyan mahalarta kasuwar.

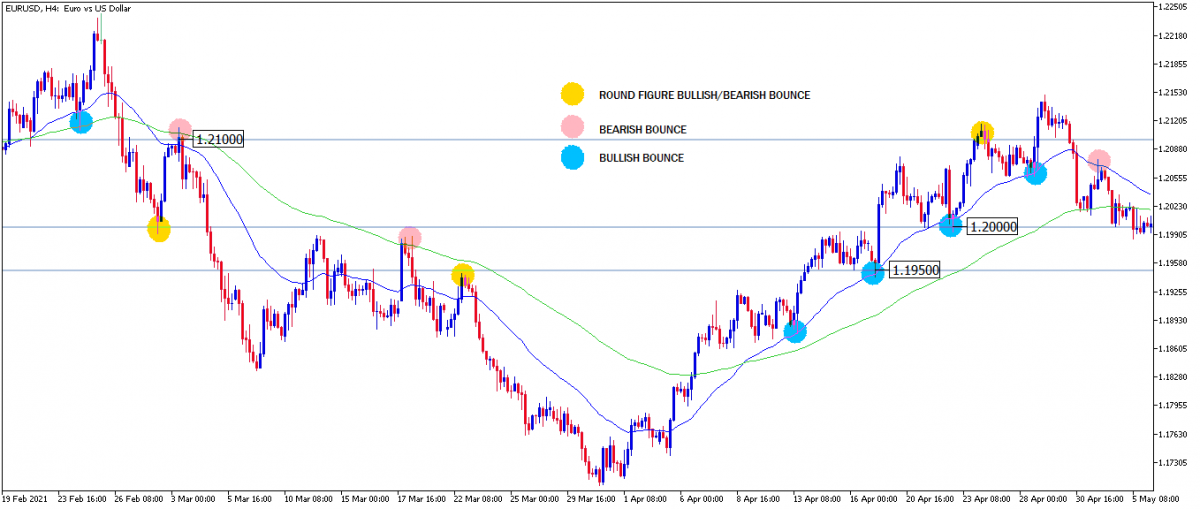

Misali na zagaye na adadi da matakan farashin matsakaicin adadi da aka gano akan ginshiƙi na EURUSD.

Mahimmin tushe: Waɗannan su ne mahimmin tallafi da matakan juriya bisa ƙayyadaddun ƙididdiga waɗanda za a iya amfani da su don gano babban yiwuwar billa kasuwancin saitin.

Waɗannan manyan matakan yuwuwar billa waɗanda waɗannan kayan aikin ciniki ke bayarwa ana nufin gano su kuma a sanya su a matsayin yankuna, mahimman matakan farashi da wuraren sha'awa don manufar riba, haifar da shigarwar kasuwanci da ƙayyadaddun tallafi da matakan juriya don tsammanin billa ko fashewar bounce dangane da yanayin kasuwa.

Me yasa motsi farashin zai yi billa a wannan matakan da aka yiwa alama

Lokacin da aka sami raguwar motsin farashi zuwa matakin tallafi, ba tare da la'akari da ƙarfin ƙarfin bearish ba, idan babban ɗan kasuwan kasuwa ya tara nauyin matsayi mai tsawo a matakin tallafi. Farashin zai yi girma daga wannan wurin. Ana kiran wannan da Bullish bounce.

Yi tsammanin cinikin farashi ta hanyar ko karya matakin tallafi. Wannan matakin na iya yin aiki azaman juriya don billa billa idan an sake gwada shi. Ana kiran wannan a matsayin Breakout Bearish Bounce.

Sabanin haka, lokacin da aka sami motsi a cikin farashin farashin zuwa matakin juriya, ba tare da la'akari da ƙarfin ƙarfin ƙarfin hali ba, idan babban ɗan kasuwan kasuwa ya tara nauyin ɗan gajeren matsayi a matakin juriya. Motsin farashin zai ragu daga wurin. Wannan ana kiransa da Bearish Bounce.

Yi tsammanin cinikin farashi ta hanyar ko karya matakin juriya. Wannan matakin na iya aiki azaman goyan bayan billa idan an sake gwada shi. Ana kiran wannan da Breakout Bullish Bounce.

Daban-daban tsarin kula da ciniki bounces a daban-daban kasuwar yanayi

Akwai hawan keke na farko guda biyu ko yanayin motsin farashi a cikin kasuwar forex da aka sani da Yanayin Kasuwa na Trending da Haɓaka.

Yanayin kasuwa mai tasowa

A cikin Tsarin Bullish: Ana iya amfani da matakan tallafi masu alama don tsinkaya babban yuwuwar juyewar tabo don faɗaɗa farashi mai girman gaske daidai da yanayin bullish. Yawancin lokaci wannan yana faruwa bayan ja da baya.

A cikin Trend Bearish: Ana iya amfani da matakan juriya masu alama don tsinkaya babban tabo mai yuwuwa don faɗaɗa farashin bearish daidai da yanayin bearish. Yawancin lokaci wannan yana faruwa ne bayan sake dawowa.

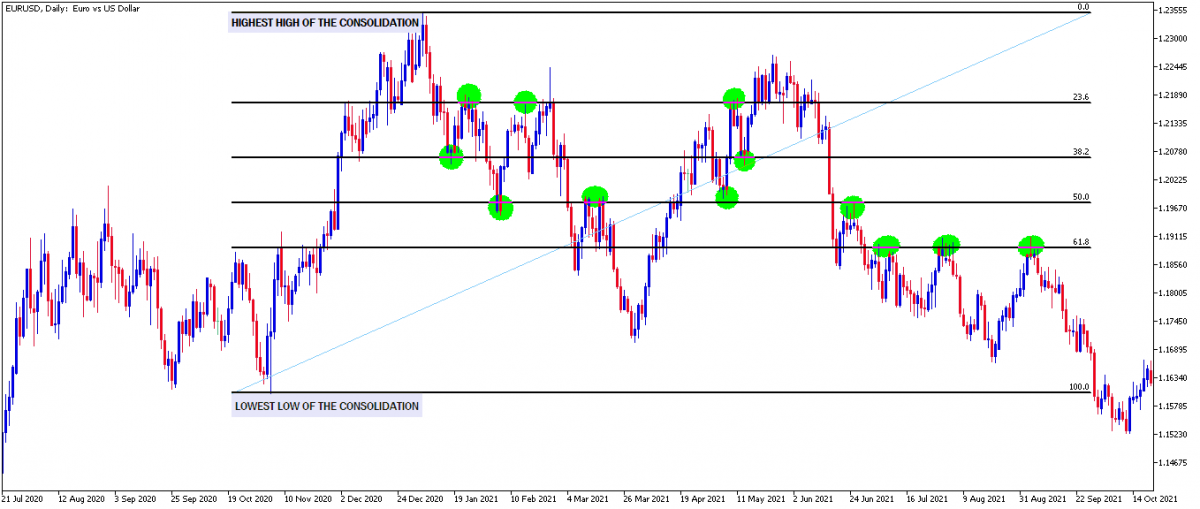

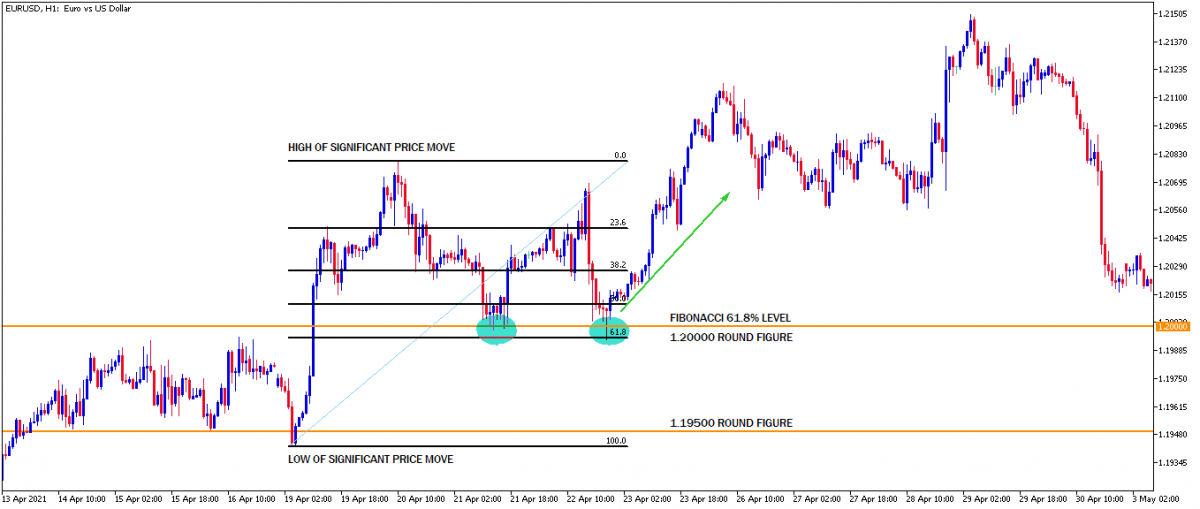

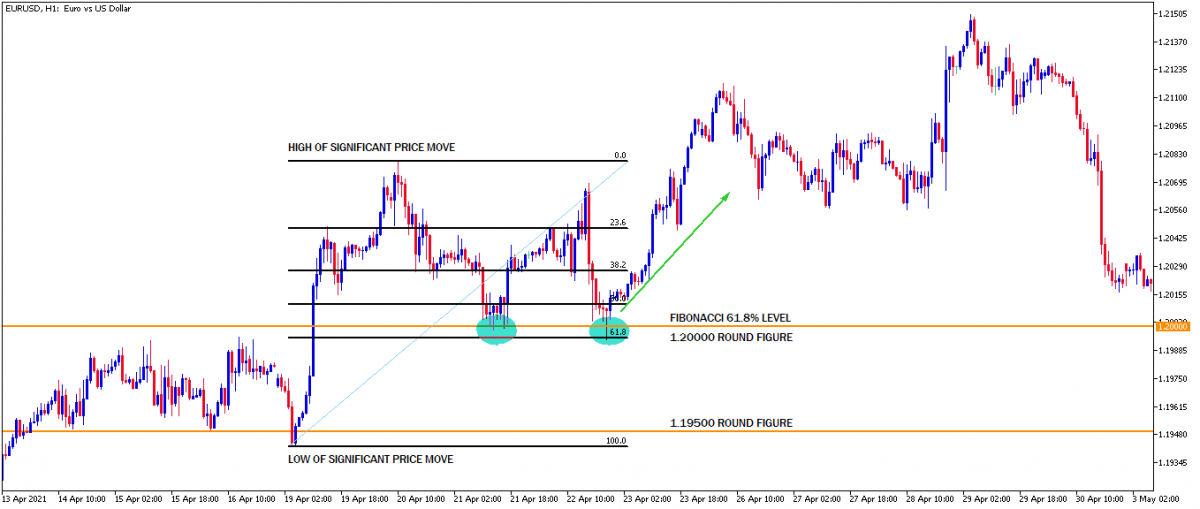

Wannan misali ne na saitin cinikayyar billa a matakin 61.8% a cikin haɗuwa tare da matakin farashin adadi (1.2000).

Saitunan billa guda biyu sun samo asali ne daga sake dawo da haɓakar farashi mai girma a cikin haɓakawa.

Wani misali shine tashar Trend. Kamar yadda sunan ke nunawa, yawanci ana ƙulla ƙirƙira akan yanayin don hasashen yanayin yuwuwar haɓakar yiwuwar biyowa da saitin billa mai sabani. Akwai misalai guda biyu anan: Tashar farashin sama da ƙasa. Ƙaramar da'irar ja tana nufin saitin billa (bullish da bearish) billa yayin da shuɗin yana nuna yanayin da ke biye (bulish da bearish) saitin billa.

Hoton tashar Bearish Trend

Hoton Bullish Trend Channel

Hoton Bullish Trend Channel

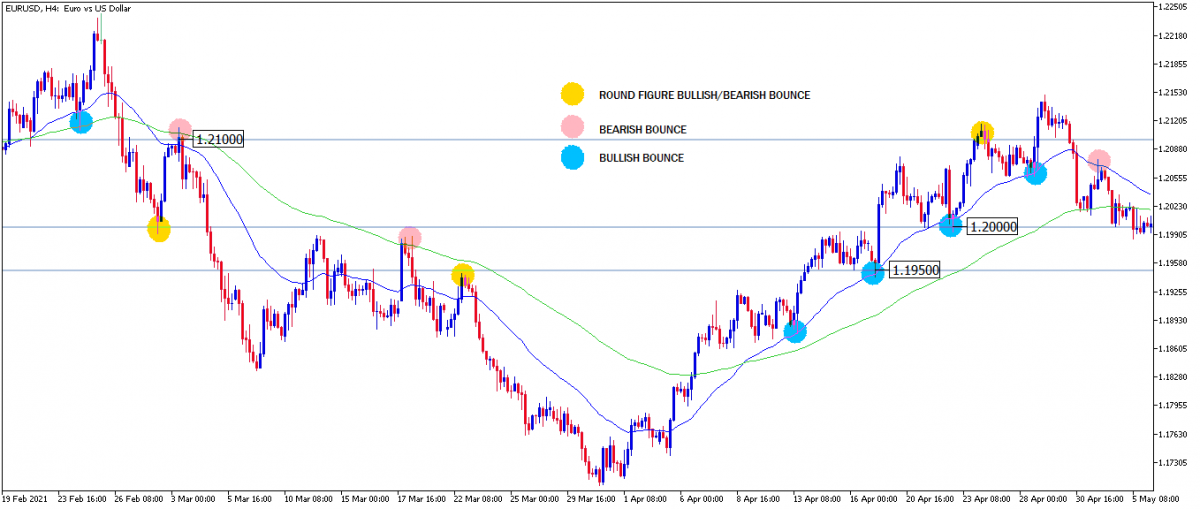

Wani misali shine babban yuwuwar bullish da saitin ciniki na bearish ta hanyar madaidaitan madaidaicin madaidaicin madaidaicin maƙasudin guda biyu. Matsakaicin motsi na ɗan gajeren lokaci da dogon lokaci.

Ƙaramar da'irar ja tana nuna babban yuwuwar billa daga matsakaicin motsi

Shuɗi yana nuna babban yuwuwar bullish billa akan matsakaicin motsi

Zinare yana nuna babban yuwuwar bullish ko billa lokacin da kowane ɗayan matsakaitan motsi ke cikin saɓani da alkalumman zagaye na hukuma.

Ƙarfafa yanayin kasuwa

Ƙungiyoyin haɓakar haɓakar gefen hanya sun fi wayo don kasuwanci amma ko da a wancan lokacin, ana iya yin bounces na ciniki a cikin kasuwa mai haɓakawa cikin sauƙi da sauƙi ta amfani da kayan aikin da suka dace daidai akan ginshiƙi.

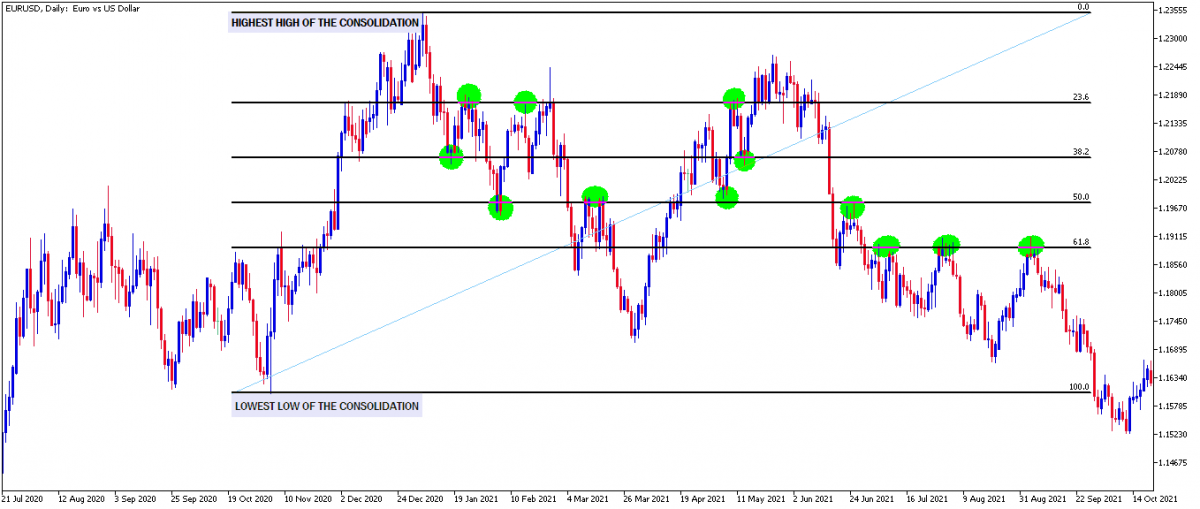

Hanyar 1: Ana iya amfani da matakan Fibonacci don nemo saitin ciniki mai yuwuwar billa a cikin kasuwa mai ƙarfafawa. Shirya kayan aikin Fibonacci daga mafi girma zuwa mafi ƙanƙancin ƙarancin motsin farashi a cikin haɓakawa. Za a sami saitin cinikin kasuwanci mai girma a Fibonacci retracement da matakan haɓaka kamar 32.8%, 50%, 61.8%, 78.6%.

Misalin matakin retracement na fibonacci da aka ƙulla akan babban haɗin gwiwa.

Hanyar 2: A cikin babban ƙarfafawa, yawanci ana samun juzu'i na ƙaramin yanayin a cikin babban haɓaka don haka ana iya amfani da layukan da tashoshi don tsinkaya manyan yuwuwar saman da ƙasa na ƙaramin yanayin a cikin babban haɓakawa.

Misalin layukan ci gaba da tashoshi da aka yi amfani da su don gano babban saitin cinikin billa a cikin babban haɗin gwiwa.

Buɗe wuraren ciniki

Ikon buɗe saitin ciniki a daidai lokacin tare da hanyar shigar da ta dace yana da matukar mahimmanci don gudanar da haɗari da haɓaka riba.

Billa shigar ciniki ta amfani da odar kasuwa kai tsaye

Bude odar siyar da kasuwa kai tsaye a matakin juriya lokacin da ake sa ran farashin zai koma baya kuma ya juya nan take zuwa kasa.

Bude odar siyan kasuwa kai tsaye a matakin goyan baya lokacin da ake tsammanin farashin zai koma baya kuma ya juya nan take zuwa sama.

Billa shigar ciniki ta amfani da oda iyaka

A ɗauka farashin yana kan gaba ga babban matakin juriya mai yuwuwa.

Sanya odar siyar da iyaka a waccan matakin tare da ƙayyadadden asarar tasha.

A ɗauka farashin yana kan gaba ga babban matakin tallafi mai yuwuwa.

Sanya odar iyakacin siya a waccan matakin tare da ƙayyadadden asarar tasha.

Bounce shigarwar kasuwanci ta amfani da fractals

Don fahimtar yadda ake amfani da fractal, karanta cikakken labarin akan dabarun fractal na forex.

Duk lokacin da motsin farashi ya kasance a kowane muhimmin tallafi ko matakin juriya.

Jira babban tsayi don tabbatarwa da tabbatar da raguwar motsin farashi daga matakin juriya.

Jira ƙananan ƙananan don tabbatarwa da tabbatar da taro a motsin farashi daga matakin tallafi.

Bude odar kasuwa mai tsayi a raguwa na tsayin kyandir na 4 na bullish fractal da kuma sanya asarar tasha a kasan fractal.

Bude wani ɗan gajeren tsari na kasuwa a lokacin raguwa na ƙananan kyandir na 4 na bearish fractal da kuma sanya asarar tasha a saman fractal.

Note: Kamar yadda koyaushe akwai babban haɗari a cikin ciniki don haka kuyi aiki akan asusun demo har sai nasarar ku zuwa asarar asarar ku ta inganta sosai kafin ciniki tare da kuɗin rayuwa.

Tare da wannan shawarar da aka ɗauka da gaske akan dabarun billa, an ba da tabbacin samun nasarar kasuwanci.

Danna maɓallin da ke ƙasa don Zazzage Jagorar "Bounce forex dabarun" a cikin PDF

Tashar layin Trend: Har ila yau, an san shi da tashar farashin, saitin layi na layi na layi wanda aka bayyana ta hanyar tsayin daka da ƙananan motsin farashi ko rashin ƙarfi. Babban layin diagonal na tashar yawanci yana aiki azaman maki na gaba don juriya da ƙananan layin diagonal na tashar yawanci yana aiki azaman maki na gaba don tallafi.

Tashar layin Trend: Har ila yau, an san shi da tashar farashin, saitin layi na layi na layi wanda aka bayyana ta hanyar tsayin daka da ƙananan motsin farashi ko rashin ƙarfi. Babban layin diagonal na tashar yawanci yana aiki azaman maki na gaba don juriya da ƙananan layin diagonal na tashar yawanci yana aiki azaman maki na gaba don tallafi.

Hoton Bullish Trend Channel

Hoton Bullish Trend Channel