Dabarun Ciniki na Ichimoku Cloud

Babu shakka cewa Jafananci sun ba da gudummawa mai girma da haɓakawa ga masana'antar kasuwancin hada-hadar kuɗi tare da ƙirar kayan aikin ƙirƙira waɗanda ke sanya duk nau'ikan ciniki, saka hannun jari, fasaha da bincike mai mahimmanci na duk kadarori a cikin kasuwar kuɗi mafi sauƙi kuma mafi kyau ga yan kasuwa. , masu zuba jari da manazarta fasaha. Ba wai kawai sun ƙirƙira shahararrun zane-zanen kyandir ɗin Jafananci da aka fi amfani da su ba waɗanda za a iya ƙirƙira su akan duk wata kadara ta kuɗi da za a iya siyar da su, daga cikin alamun da suka ƙirƙira akwai wata ma'ana mai mahimmanci kuma cikakkiyar alama wacce aka sani da girgije Ichimoku.

Girgizar Ichimoku Jafanawa sun san shi da "Ichimoku Kinko Hyo" wanda ke nufin "taswirar ma'auni a kallo ɗaya".

Wani dan jarida dan kasar Japan mai suna Gocchi Hosada ne ya samar da girgijen Ichimoku a cikin shekarun 1930. Ba sai bayan shekaru talatin na ci gaba da kamala, Gocchi ya fito da mai nuna alama ga al'adar 'yan kasuwa a cikin 1960s. Ƙoƙarin da ya yi don kammala ma'aunin girgije na Ichimoku ya sanya mai nuna alama a cikin matsayi na ɗaya daga cikin shahararrun kayan aikin nazari na fasaha a tsakanin 'yan kasuwa na kasuwar hada-hadar kuɗi, manazarta fasaha, manazarta kasuwar hada-hadar kuɗi da masu zuba jari na kowane nau'i wanda za'a iya samuwa a kan sashin mai nuna alama. daban-daban dandamali na ciniki.

Alamar girgije ta Ichimoku da farko tana aiki azaman mai nuna alama mai ɗorewa mai ɗorewa da aka yi amfani da ita don haskaka damar kasuwanci mai yuwuwa a cikin ƙaƙƙarfan kasuwa mai tasowa ta ikon haskaka matakan farashi masu ƙarfi na tallafi da juriya.

Abubuwan da ke cikin alamar girgijen Ichimoku

Alamar girgije ta Ichimoku tana da layuka 5 waɗanda sune abubuwan da suka samo asali na matsakaicin motsi daban-daban guda 3. Waɗannan layukan guda biyar (5) an lulluɓe su akan ginshiƙi farashin akan motsin farashi amma biyu (2) na layin biyar (5) sun zama girgije wanda yawanci ko dai sama ko ƙasa motsin farashi. Lokacin da aka ƙulla ƙira a kan ginshiƙi farashin, suna iya zama kamar rudani, rashin jin daɗi da ɓarna ga ɗan kasuwa wanda aka ƙaddamar da shi zuwa ga alamar girgije na Ichimoku amma yana da haske da ma'ana ga ƙwararren ɗan kasuwan girgije na Ichimoku.

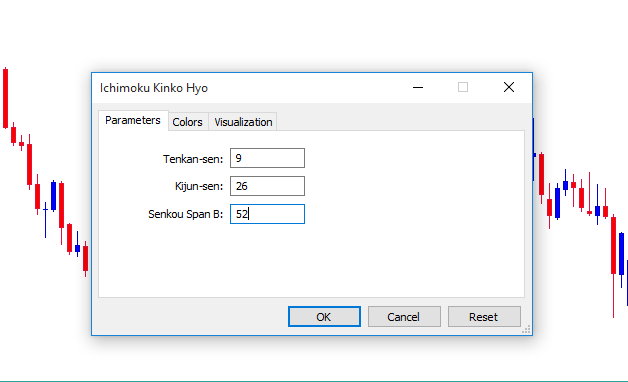

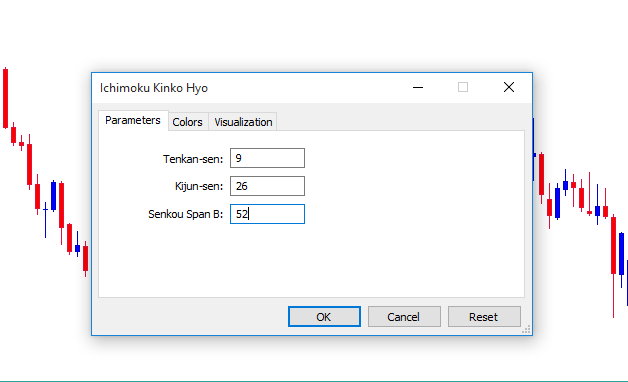

Saitin sigar shigarwa na alamar Ichimoku Cloud

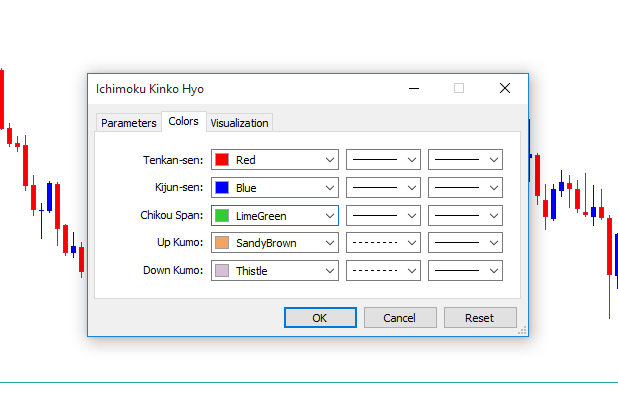

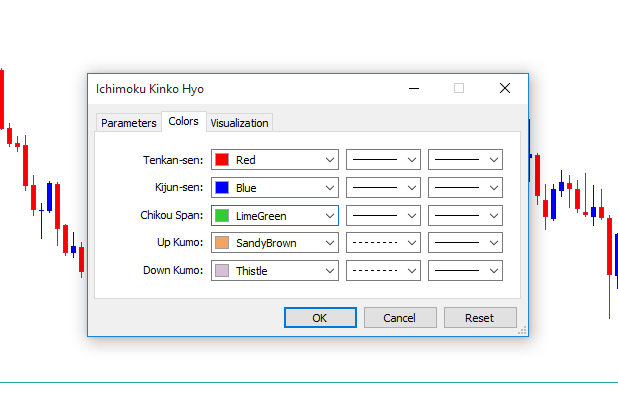

Saitin launi na layin alamar Ichimoku Cloud

Matsakaicin shigarwar tsoho na girgijen Ichimoku wanda ya ƙunshi mahimman layukan 3 da iyakokin faɗaɗawa da haɓaka girgije sune 9, 26, 52.

Layuka uku da aka bambanta da launuka suna da ma'anoni daban-daban da ayyukansu.

Layin jajayen mai nuna alama shine layin juyawa da aka sani da "Tenkan Sen". An samo layin ta matsakaicin bayanan farashin kowane kyandir ɗin 'mafi girma da fa'ida a cikin lokacin kallon baya na sanduna 9 ko sanduna akan kowane lokaci.

Layin launin shuɗi na mai nuna alama shine tushen kuma aka sani da "Kijun Sun". Layin da aka ƙulla an samo shi ta matsakaicin bayanan farashi na kowane maɗaukakin kyandir da ƙasa a cikin lokacin duban kyandir ko sanduna 26 akan kowane lokaci.

Layin launin kore na mai nuna alama wanda aka sani da "Chikou Span" yana ƙididdige matsakaita na farashin rufewa a cikin lokacin duban kyandir ko sanduna 26 akan kowane lokaci.

Girgije An rufe shi da layi biyu da aka sani da "Senkou Span A da Senkou Span B".

- Senkou Span A: layin sama na girgije shine matsakaicin ƙimar jimlar Tenkan Sen da Kijun Sen.

- Senkou Span B: ƙananan layin gajimare yana samuwa ta hanyar matsakaicin bayanan farashi na mafi girma da raguwa a cikin lokacin dubawa na 52 fitilu ko sanduna akan kowane lokaci.

Yadda ake yin nazarin fasaha tare da Ichimoku Cloud Indicator

Lokacin yin bincike na fasaha ta amfani da alamar girgije na Ichimoku, ƙwararren ɗan kasuwa na tushen Ichimoku da manazarcin fasaha koyaushe yana fara nazarinsa da tsarin ciniki tare da bayanan da aka samo daga gajimare.

Farawa da gajimare: Ana ɗaukar kasuwa a matsayin ƙwanƙwasa lokacin da girgijen ya yi kore kuma ana ɗaukarsa yana cikin haɓaka lokacin da motsin farashin ke sama da gajimare watau ana goyan bayan girgijen. A gefe guda kuma, ana ɗaukar kasuwa a matsayin bearish lokacin da gajimare yayi ja kuma ana la'akari da cewa yana cikin raguwa lokacin da motsin farashin ke ƙasa da gajimare watau tsayin daka da girgijen.

Bugu da ƙari, faɗin iyakar iyakar girgijen zuwa wata hanya ta musamman yana nuna babban juzu'in motsin farashi zuwa wannan alkibla.

Matsakaicin iyakar iyakar girgijen zuwa kowane shugabanci yana nuna rashin ƙarfi da motsin farashi a cikin kewayo ko ƙarfafawa.

An san layin kore da "Chikou Span". Hakanan za'a iya amfani da shi don ƙarin haɗuwa a cikin al'amuran al'ada. Misali, Idan gajimare kore ne kuma yana goyan bayan motsin farashi a cikin haɓakawa. Duk lokacin da koren layin ya ketare motsin farashi a cikin jagorar ƙasa zuwa sama kuma yana cikin rikicewa tare da ra'ayin gizagizai. Ƙimar ƙarin haɓaka farashi zuwa haɓaka yana ƙaruwa. Sabanin haka, Idan girgijen ja ne kuma yana aiki azaman juriya ga motsin farashi a cikin ƙasa. A duk lokacin da koren layin ya ketare motsin farashi zuwa sama zuwa ƙasa kuma yana cikin haɗuwa da ra'ayin bearish na gajimare. Rashin daidaituwa na ƙarin haɓaka farashi zuwa raguwa yana ƙaruwa.

Wani abu mai mahimmanci shine tsaka-tsaki tsakanin tushe (Kijun San) da layin ja (Tenkan Sun). A duk lokacin da duk waɗannan rikice-rikicen suka daidaita zuwa wata hanya ta musamman, ga ƙwararren ɗan kasuwan Ichimoku yana nuna ƙarfi da ƙarfin motsin farashi zuwa wannan hanyar, don haka saitin kasuwanci za a sa ran kawai a cikin wannan son zuciya.

Dabarun ciniki na girgije Ichimoku: Yadda za a ƙirƙiri babban saitin kasuwanci mai yiwuwa akan kowane nau'in kuɗi

Ana iya amfani da ma'aunin girgije na Ichimoku azaman mai nuni ga kasuwanni masu tasowa saboda cikakken nazari na halin kasuwa na motsin farashi a cikin haɓaka ko ƙasa.

Za'a iya ƙara wasu kayan aikin don dacewa da ra'ayoyin kasuwanci da sigina waɗanda girgijen Ichimoku ke bayarwa sannan kuma za'a iya amfani da rikice-rikice tare da waɗannan sauran kayan aikin don ƙaddamar da ƙananan haɗari da manyan saitunan kasuwanci mai yiwuwa. A nuna alama aiki a kan duk timeframes tare da tsoho shigar da siga kazalika da shi ne tasiri ga kowane irin ciniki kamar matsayi ciniki, dogon lokaci ciniki, gajeren lokaci ciniki, rana ciniki da scalping.

Layukan da yawa na mai nuna alama (ciki har da gajimare) sune matakan yuwuwar matakan tallafi mai ƙarfi lokacin da motsin farashin ke cikin haɓakawa da juriya mai ƙarfi lokacin da farashin farashin ke cikin ƙasa.

Dole ne a sami ƙayyadaddun tsarin ciniki ko dabarun da ke kaiwa ga daidaitattun sigina da siyar da sigina.

Ichimoku tsarin ciniki na girgije don saitin saitin

Don tsinkaya da ƙirƙira manyan ƙima na haɓaka saitin ciniki akan matakan tallafi masu ƙarfi (tushen, layin juyawa da gajimare).

Alamar girgije ta Ichimoku dole ne ta tabbatar da nuna son kai na wannan kadari ta

- Na farko, gano cewa motsin farashin ya ƙetare sama da layin juyawa da tushe.

- Bayan haka, tabbatar da cewa girgijen Ichimoku ya bayyana kore kuma yana faɗaɗawa bayan giciye na layin Senkou Span.

Misali na Ichimoku girgije bullish saitin ciniki akan GBPUSD 4Hr Chart

A kan GBPUSD 4hr ginshiƙi, za mu iya gano giciye na ƙasa na layin kore "Chikou Span" akan motsin farashi. Hakanan zamu iya gano motsin farashin sama da layin launin shuɗi (tushe) da layin launi ja (layin juzu'i), sannan faɗaɗawar Senkou Span A da B crossover (watau faɗaɗa koren girgije). Waɗannan duk sharuɗɗan da ake buƙatar cika su ne don haɓaka ƙima na ra'ayin ciniki mai fa'ida don haka ana iya gano saitin ciniki na bullish da yawa azaman tallafi mai ƙarfi akan duka tushe da layin juyawa.

Ichimoku tsarin ciniki na girgije don saitin siyarwa

Don tsinkaya da ƙirƙira manyan saitunan kasuwancin bearish akan matakan juriya masu ƙarfi (tushen, layin juyawa da gajimare).

Alamar girgije ta Ichimoku dole ne ta tabbatar da nuna son kai na wannan kadari ta

- Na farko, gano cewa motsin farashin ya ƙetare ƙasa da layin juyawa da tushe.

- Na gaba, tabbatar da cewa girgijen Ichimoku ya bayyana ja kuma yana faɗaɗawa bayan tsallake-tsallake na layin Senkou Span.

Misali na Ichimoku girgije bearish saitin ciniki akan USDX Daily Chart

Wannan babban misali ne na saitin ciniki na dogon lokaci na bearish akan ginshiƙi na Usdx na yau da kullun. Za mu iya gano ƙetare saman-sasan layin kore "Chikou Span" akan motsin farashi. Hakanan zamu iya gano motsin farashi a ƙasan layin tushe mai launin shuɗi (Kijun Sun) da layin juyawa masu launin ja (Tenkan Sen), sannan faɗaɗawar Senkou Span A da B crossover (watau faɗaɗa koren girgije) a cikin jagorar bearish.

Tsawon lokacin cinikin matsayin bearish (babban siyar da siyar da ke rufe kewayon fiye da pips 400) daga shigarta don fita ya kasance tsakanin 1 ga Yuli zuwa 31st na Yuli 2020, tsawon wata ɗaya.

Kammalawa

Ko da yake Ichimoku girgije mai nuna alama babban kayan aiki ne don nazarin fasaha na kadarorin kasuwancin kuɗi daban-daban. Ƙarfin mai nuna alama ya ta'allaka ne a cikin ikonsa na gano yanayin ci gaba mai ɗorewa da kuma ƙera manyan saiti mara kyau a cikin kasuwa mai tasowa. Don haka yana iya bambanta tsakanin kasuwa mai tasowa daga kasuwar da ba ta canzawa amma alamun sa galibi suna da rauni kuma ba za a iya amfani da su ba a cikin waɗanda ba su canzawa, haɓaka kasuwanni.

Danna maballin da ke ƙasa don Zazzage Jagoranmu "Dabarun Ciniki na Ichimoku Cloud" a cikin PDF