Dabarun ciniki na oda

A matsayin ɗan kasuwa wanda ya kasance a cikin masana'antar ciniki na forex na ɗan lokaci, akidar wadata da buƙata tabbas ba sabon ra'ayi ba ne. Tabbas, akwai wasu nau'ikan motsin farashi a kasuwannin hada-hadar kuɗi waɗanda ke tafiyar da abubuwan samarwa da buƙatu amma ba za su iya isa ga tushen abin da cibiyoyi ke yi ba dangane da siye da siyarwa.

Baya ga wuraren samarwa da buƙatu da aka saba amfani da su, shingen oda sune takamaiman matakan motsin farashi waɗanda za'a iya tace su zuwa madaidaicin matakan farashi (ba a matsayin faffadan kewayo ko yanki ba) akan ƙananan lokutan lokaci.

Babban Bankuna da manyan cibiyoyi su ne jiga-jigan hada-hadar kudaden waje na kasuwannin hada-hadar kudi; suna saita sautin motsin farashi da kuma nuna son kai a kan mafi girman sigogin lokaci ta hanyar tara manyan ƙididdiga na umarni (bulish ko bearish) a wani matakin farashi na musamman, ana fitar da waɗannan juzu'i na umarni a cikin ƙananan fakiti ta hanyar toshe oda a cikin hanya ɗaya akan. mafi girma, matsakaici da ƙananan ginshiƙi na lokaci.

Kalmar 'oda toshe' tana nufin wasu gyare-gyaren gyare-gyare ko sanduna waɗanda ke ba da shawarar abin da aka sani da 'saye da siyar da kuɗaɗe masu wayo' idan aka duba su a cikin mahallin hukuma (watau musayar musayar waje tsakanin bankunan tsakiya, shingen kasuwanci da 'yan kasuwa) waɗanda aka nuna akan farashi. zane-zane. Za a fi amfani da kalmar kuɗi mai wayo a cikin wannan labarin don ba da labari bayyananne kuma madaidaiciyar hanya ga ka'idar blocklock da yadda ake kasuwanci tare da dabarun toshe oda yadda ya kamata.

Wannan na iya zama farkon fahimtar ku (daga hangen nesa) na yadda matakan motsin farashi daban-daban ke kayyade ta waɗannan manyan ma'auni (bankuna da cibiyoyi). Hakanan za ku fahimci dalilin da yasa kasuwa ke motsawa yadda take, injiniyoyi a bayan manyan manyan abubuwa da ƙarancin da ke haifar da motsin farashi, lokacin da ake sa ran zazzagewar farashin zai koma baya, inda za a yi tsammanin faɗaɗa motsi na gaba na farashin farashi da girman girman. na fadadawa.

Samar da oda

Kayayyakin oda yawanci suna samuwa ne a matsananci da asalin motsin farashi. Suna iya bayyana ta nau'i daban-daban amma ganewarsu ya bambanta ta takamaiman tsarin farashi.

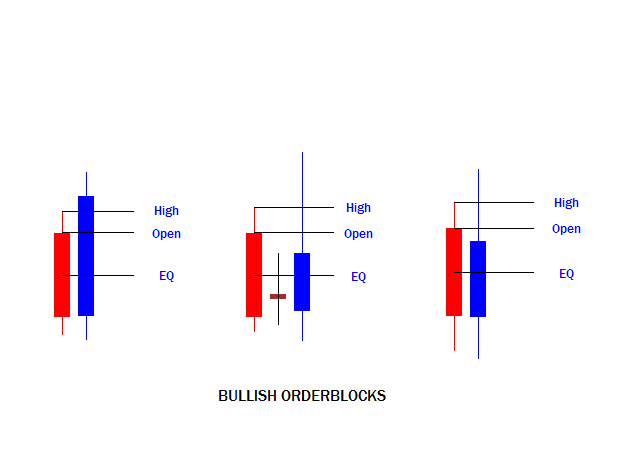

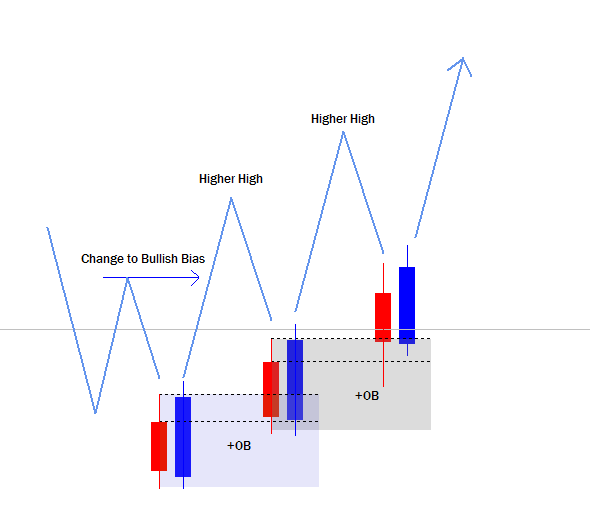

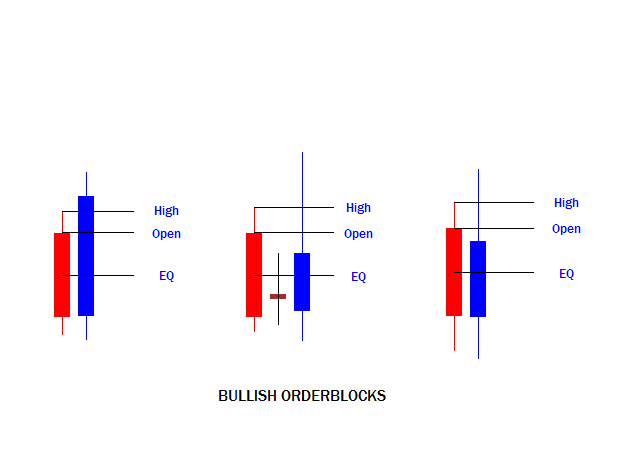

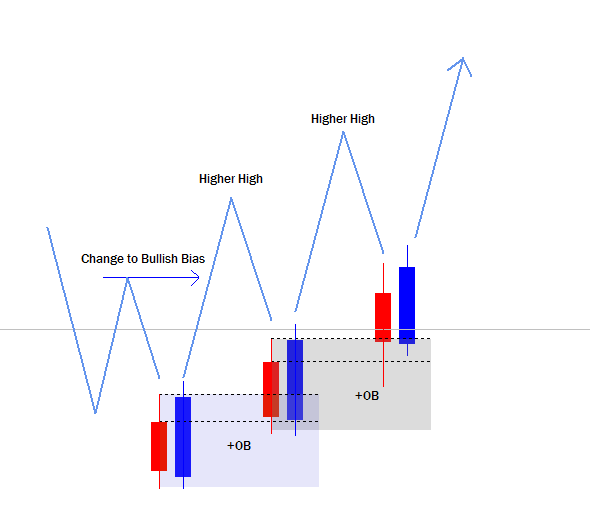

An gano shingen oda na bullish ta hanyar kyandir na kusa-kusa (bearish) na baya-bayan nan wanda ke biye da kyandir mai kusa (bullish) wanda ya shimfida sama da babban na kwanan nan kusa da kyandir (bearish).

Misalai daban-daban na shingen oda na Bullish

Wannan na iya bayyana akan duka tashin hankali da hauhawar farashin amma yana da yuwuwa sosai akan yunƙurin farashi mai ƙima da nuna son kai.

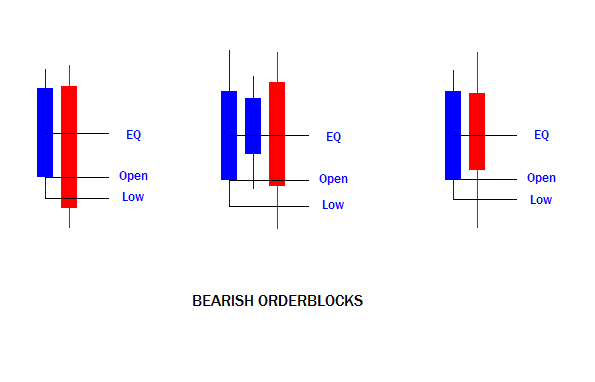

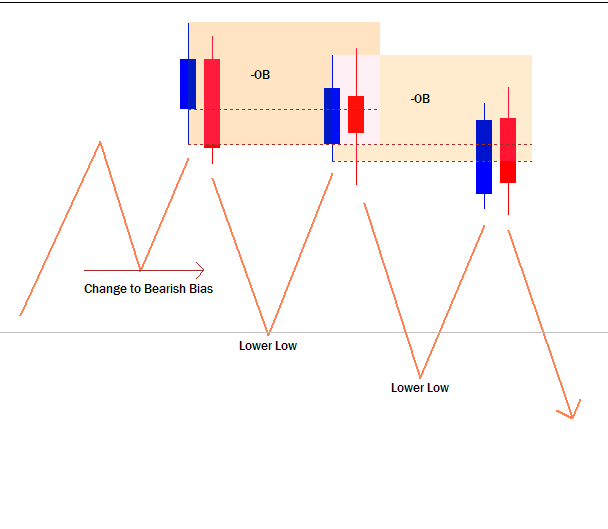

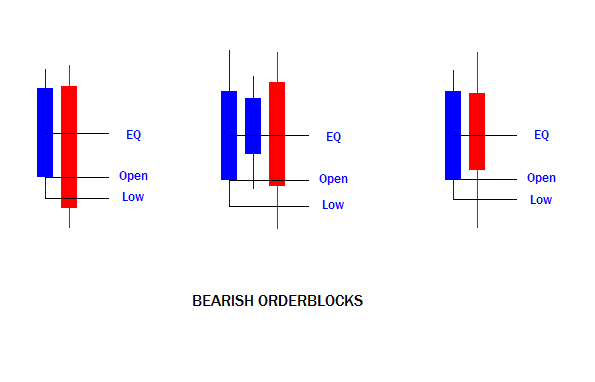

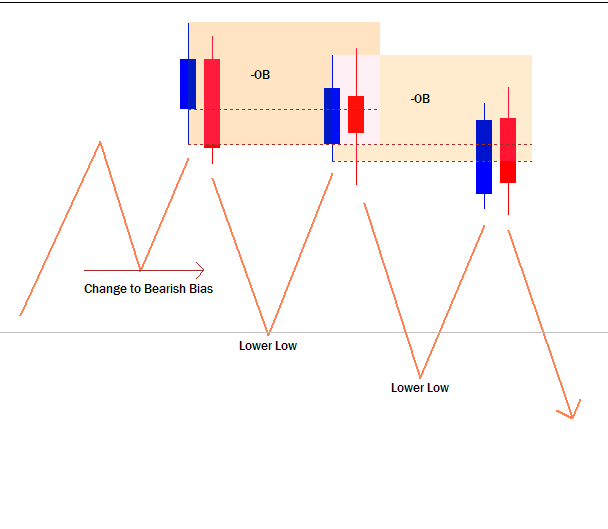

Akasin haka, an gano shingen odar bearish ta hanyar kyandir na baya-bayan nan kusa da (bullish) kyandir wanda ke biye da kyandir na kusa (bearish) wanda ya shimfiɗa ƙasa da ƙananan ƙarancin kyandir na kwanan nan.

Misalai daban-daban na shingen oda na Bearish

Wannan na iya bayyana akan duka yunƙurin ƙwaƙƙwaran ƙwanƙwasa da haɓaka amma yana da yuwuwa sosai akan motsin farashin bearish da nuna son kai.

Wannan tsarin farashin sau da yawa yana rikicewa tsakanin yan kasuwa masu siyarwa, kamar yadda samar da kayayyaki da buƙatu ko kuma wani lokacin ana ganin su azaman ɓarna ce ta ɓarna ko ɓoyayyiyar ɓarna amma makanikai da ka'idar da ke tattare da samar da shingen oda da tasirin su a cikin motsin farashin yana ba da ƙarin haske don kasuwanci tare da oda. ciniki dabarun riba.

Takaitaccen bita akan injiniyoyi na toshe oda

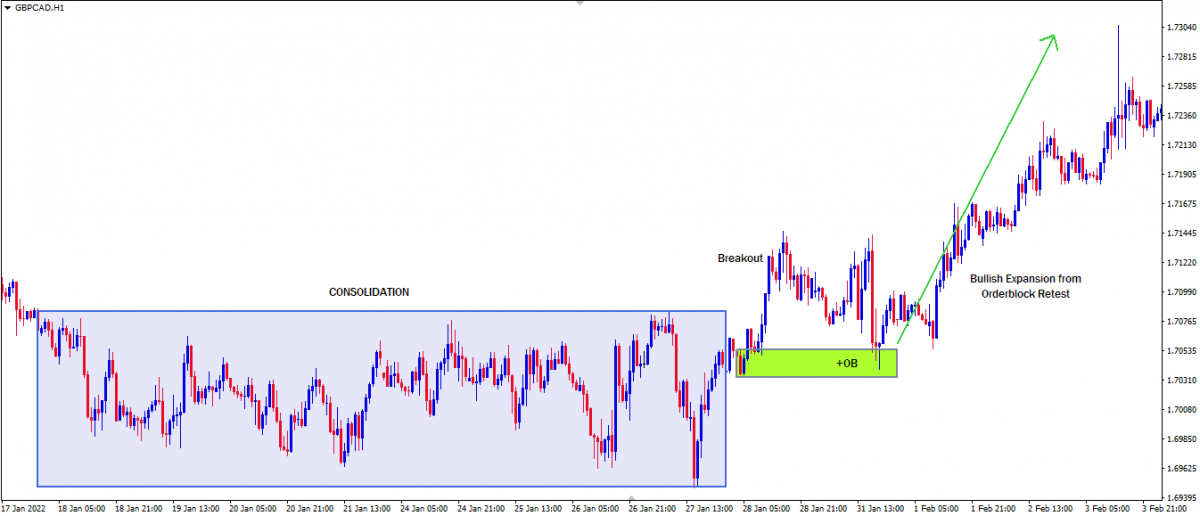

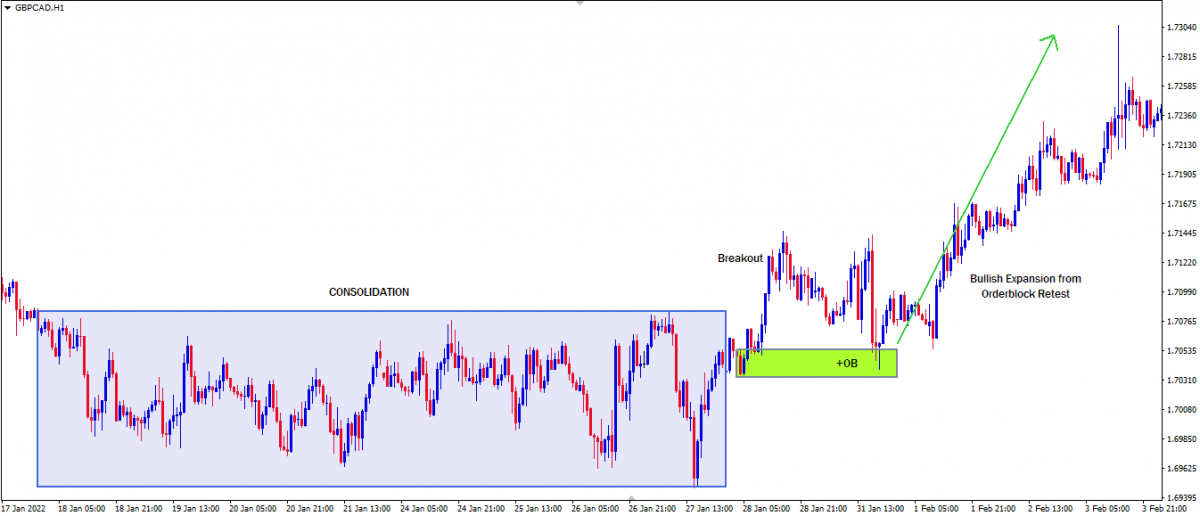

Mafi sau da yawa, samar da fitilar oda, lokacin da aka duba shi akan ƙananan lokutan lokaci, ana ganin shi azaman tsawaita lokacin ƙarfafawa wanda kawai ke nufin cewa manyan bankuna da cibiyoyi sun gina oda kafin bazara na babban farashin da aka cire daga shingen oda ( ƙananan ƙarfin ƙarfafa lokaci).

Misali, toshe oda na yau da kullun idan aka duba shi akan ginshiƙi na sa'o'i, ana ganinsa azaman haɓakawa (lokacin gini) kafin zanga-zangar ɓacin rai a cikin farashi.

Hoton hoto na babban shingen oda mai yuwuwa

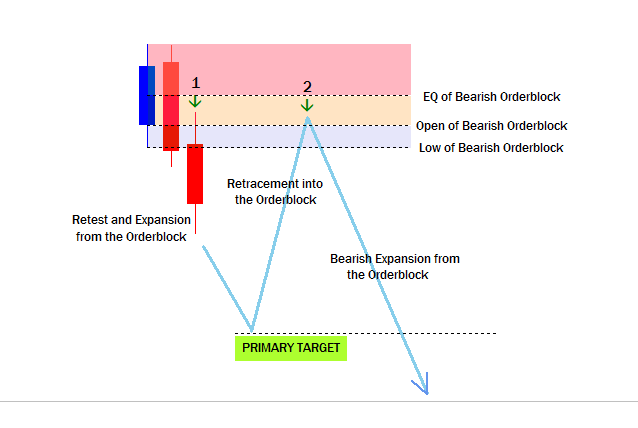

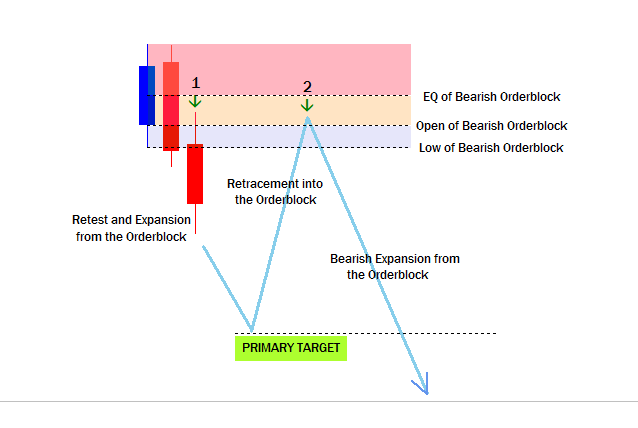

Hoton hoto na babban shingen oda mai yuwuwar bearish

Yanzu da za mu iya gano a sarari bullish da bearish orderblocks. Akwai wasu abubuwa da za a tattauna a sashe na gaba kuma waɗannan sharuɗɗan dole ne a cika su kafin a ɗauki toshe oda a matsayin mai yiwuwa sosai.

Lokacin da katangar oda ya cika ma'auni na babban yuwuwar motsin farashi, babban ƙaƙƙarfan motsin farashi ana yaɗa shi ta hanyar gwaji tare da ɗayan jerin sandunan kyandir ko sanduna na gaba zuwa wajen toshe oda. Motsin farashi yana da alaƙa da faɗaɗa farashi mai ƙwaƙƙwalwa da koma baya saboda haka bayan haɓakar farashi mai ƙima daga toshewar oda, yawanci akan sami koma baya cikin babban shingen tsari mai yuwuwar ƙafa na biyu na faɗaɗa farashi mai ɗaci.

Ma'auni don tsara manyan shingen oda mai yiwuwa

- Hanyoyi masu tsayi: Da farko dai, an ba da fifiko kan abubuwan da ke faruwa na dogon lokaci. Shahararriyar maganar cewa yanayin yanayin ku shine kuma ya shafi dabarun ciniki na oda. Saboda manyan bankuna da cibiyoyi suna sanya mafi yawan odar su akan taswirar lokutan lokaci, don haka haɓakawa da haɓaka kan mafi girman lokacin kowane wata, mako-mako, yau da kullun da 4hr suna da mahimmanci don zaɓar manyan shingen oda don farautar saitin kasuwanci. Duk lokacin da ke ƙasa da kowane wata, mako-mako, yau da kullun da sa'o'i 4 yana nufin barin mafi girman tsarin lokaci zuwa tushen cikin rana.

- Fadada farashin yanzu: Fahimtar faɗaɗa farashin yanzu yana da mahimmanci daidai don gano ayyukan siye da siyarwar kuɗi masu wayo. Ya kamata a mai da hankali kan abin da waɗannan sauye-sauyen farashin lokaci mafi girma ke iya kaiwa ga. Don haka ciniki a cikin wannan babban jigo na lokaci zai kawar da yawancin rashin tabbas da ke addabar mafi yawan yan kasuwa a farautarsu don saitin ciniki lokacin amfani da dabarun ciniki na oda.

- Tsarin kasuwa: Ƙarfin gano ƙananan tsarin kasuwancin lokaci na motsin farashi a cikin mafi girma yanayi ko mafi girman lokaci shine mabuɗin don gano babban shingen oda a kan tsaka-tsaki da ƙananan sigogin lokaci.

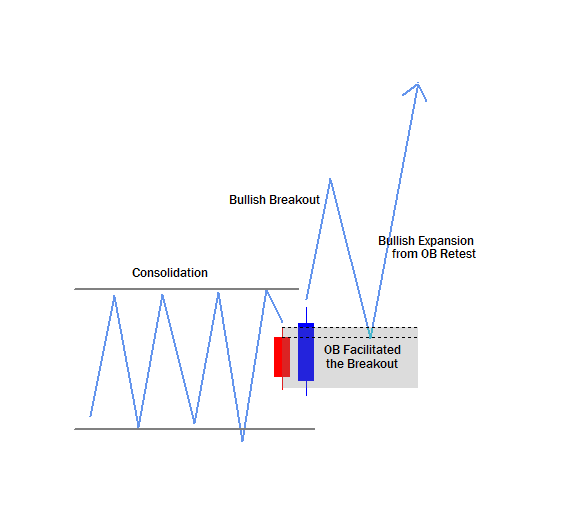

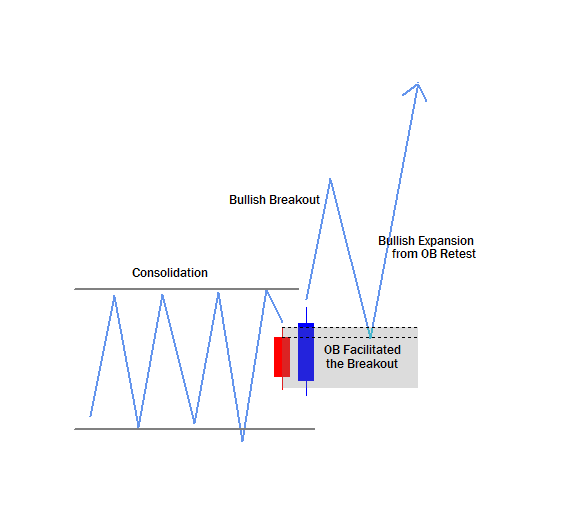

Idan farashin yana cikin haɓakawa, za mu iya ƙirƙira manyan tubalan oda bayan farashin ya faɗaɗa daga kewayo. Ana ganin sake dawowa zuwa 'katangar oda' wanda ya sauƙaƙa fashewar haɗin gwiwar yana da yuwuwa.

Hoton Hoton Babban toshewar oda mai yuwuwa wanda ya sauƙaƙe haɓakawa daga haɓakar motsin farashi

Idan farashin yana yin haɓaka mai girma a jere, toshewar oda kawai za a gano azaman babban tubalan oda.

Hoton hoto na babban shingen oda mai yuwuwar bullish a cikin yanayin tashin hankali na mafi girma na gaba

Idan farashin yana yin ƙananan raguwa a jere, shingen oda na bearish kawai za a gano azaman babban tubalan oda.

Hotunan hoto na babban shingen oda mai yuwuwar bearish a cikin yanayin ɓangarorin ɓangarorin ƙasa mai zuwa

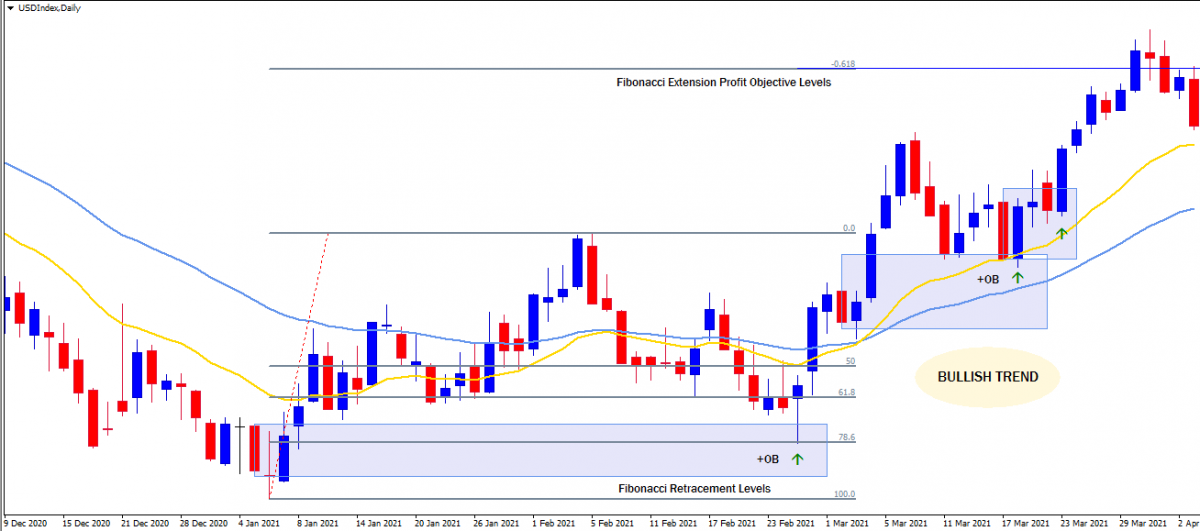

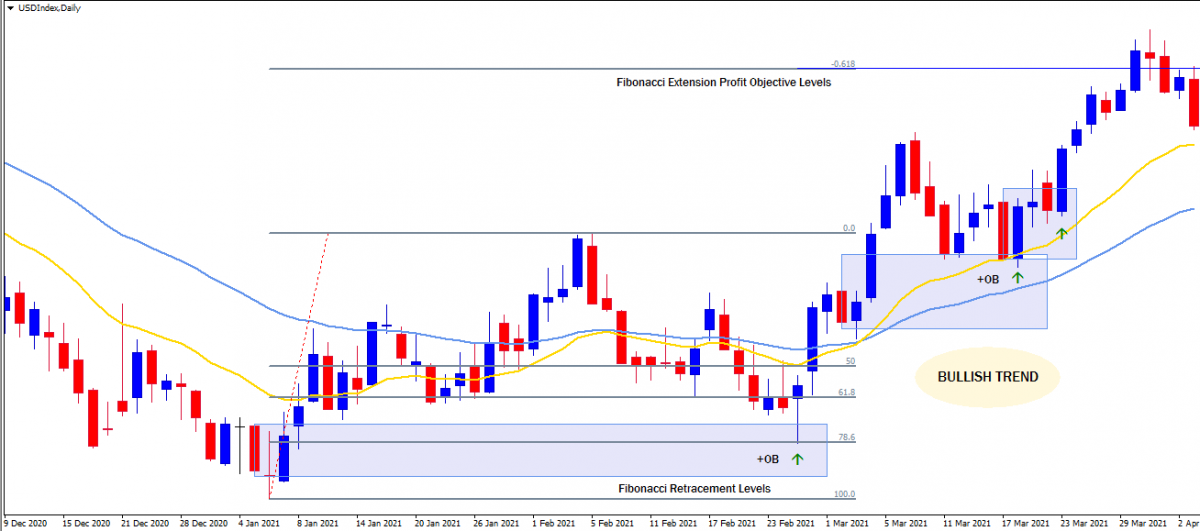

- Matsakaicin matsakaita: Za a iya ƙirƙira madaidaicin madaidaicin motsi guda biyu akan motsin farashi don taimakawa ci gaba da mai da hankali kan jigo na kasuwa. Matsakaicin madaidaicin motsi wanda za'a iya amfani dashi shine ko dai 18 & 40 EMA ko 9 & 18 EMA. Ba lallai ba ne a buƙaci ƙetare amma daidaitaccen tarawa ko buɗe waɗannan matsakaita masu motsi a hanya ɗaya na nuni da shirin siye ko siyarwa. A cikin shirin siye, toshe-tsare na oda kawai ana ganin abu ne mai yuwuwa kuma a cikin shirin siyarwa, toshe odar bearish ne kawai ake ganin mai yiwuwa ne.

- Fibonacci retracement da matakan haɓakawa: A cikin shirin siye, ana iya amfani da kayan aikin Fibonacci don ƙirƙirar babban shinge mai yuwuwar bullish a farashi mai rahusa wanda yawanci a ko ƙasa da matakin shigar da ciniki mafi kyau na 61.8% na ƙayyadaddun farashin farashi da akasin haka a cikin shirin siyarwa, kayan aikin Fibonacci. ana iya amfani da shi don ƙirƙira babban shingen oda mai yuwuwa a farashi mai ƙima wanda yawanci a ko ƙasa da 61.8% mafi kyawun matakin shiga ciniki sama da ƙayyadadden ƙayyadaddun farashin bearish.

Kayan aikin Fibonacci ba alamar sihiri ba ce a nan amma ana amfani da ita don tsara babban shingen odar ragi mai yuwuwa a cikin shirin siye da babban shingen oda mai yuwuwa a cikin shirin siyarwa. Manufar da ke bayan tasiri na Fibonacci shine cewa kuɗi mai wayo yana tara dogon umarni a farashin rahusa mai arha wanda ke ƙasa da 50% na ƙayyadaddun farashin ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun farashin Fibonacci kuma suna tara oda a farashi mafi girma sama da 50% na ƙayyadaddun farashin bearish. motsawa.

- Mafi mahimmancin matakan farashi na toshe oda: lokacin farauta don saitin ciniki mai ban sha'awa, matakin mafi mahimmancin farashi na bulogin oda don tsammanin halayen farashi mai kaifi ko buɗe odar kasuwa mai tsayi shine babba, buɗewa da tsaka-tsaki (matakin farashin ƙarshe na ƙarshe)

na jikin na karshe saukar kyandir na bullish orderblock.

Lokacin farauta don saitin ciniki na bearish, matakin mafi mahimmancin farashi na ƙaƙƙarfan tsari na bearish don tsammanin halayen farashi masu kaifi ko buɗe wani ɗan gajeren oda na kasuwa shine ƙananan, buɗewa da tsakiyar tsakiya (matakin farashin ƙarshe na ƙarshe) na jikin na ƙarshe. sama kyandir na bearish order block.

Za a iya amfani da ɗayan waɗannan matakai masu mahimmanci guda uku azaman shigarwar kasuwanci dangane da haɗarin ci da matakin ƙwarewa.

Misalai na kasuwanci na babban shingen oda mai yiwuwa

Misali 1: Fihirisar Dala akan jadawalin yau da kullun

Zamu iya ganin ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙa'idodin bearish, fibonacci retracement da matakan haɓakawa, 18 & 40 biyu EMA.

Misali 2: UsdCad akan jadawalin yau da kullun

Zamu iya ganin ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙa'idodin bearish, fibonacci retracement da matakan haɓakawa, 18 & 40 biyu EMA.

Misali 3: GbpCad akan ginshiƙi 1hr

Yi la'akari da shingen oda wanda ya sauƙaƙa fashewa daga haɗin kai tare da ƙayyadaddun ƙayyadaddun ƙayyadaddun farashi. Sannan haɓakar haɓakawa daga sake gwadawa na toshe oda.

Akwai ingantattun misalan kasuwanci da yawa na dabarun ciniki na oda waɗanda za'a iya yin bita a baya kuma ana iya amfani da wannan dabarar don haɓaka daidaiton riba a cikin ciniki.

Danna maballin da ke ƙasa don Zazzage Jagorar "Tsarin ciniki" a cikin PDF