RSI forex dabarun

Daga cikin alamomin ƙungiyar oscillator waɗanda ke ba da labari da yawa game da kuzari da yanayin motsin farashi shine babban jagora na musamman wanda aka sani da “Mai nuna RSI”.

RSI gajarta ce don Ƙarfin Ƙarfi. Alamar da wani mashahurin manazarci na fasaha wanda aka sani da Jay Wells Wielder ya ɓullo da shi don manufar gano yanayin da aka yi fiye da kima na ɗan lokaci, ciniki mai ƙarfi da tantance ƙima tsakanin ma'auratan kuɗi ko kayan aikin kuɗi da aka yi ciniki.

Sunan 'Dan uwan' 'Ƙarfi'' 'Fihirisar', yana nufin cewa mai nuna alama yana kwatanta aikin kuɗin kuɗi a cikin wani ɗan lokaci zuwa jimillar matsakaicin aiki na motsin farashin kuɗin, ta haka ne auna ƙarfin canje-canjen farashin kwanan nan.

Wannan labarin ya ƙunshi duk abin da kuke buƙatar sani game da alamar RSI, yadda zaku iya amfani da haɗawa da RSI da dabarun kasuwancin ku zuwa nazarin fasahar ku na kasuwar forex don haɓaka fahimtar motsin farashi da haɓaka ribar kasuwancin ku.

Menene bayanin nuni da ainihin saituna na alamar RSI.

Alamar RSI kyakkyawar alama ce mai sauƙi mai sauƙi tare da keɓance mai sauƙin amfani. Kamar yadda yake tare da duk sauran alamomin ƙungiyar oscillator, alamar RSI kuma an ƙirƙira ta daga ginshiƙi.

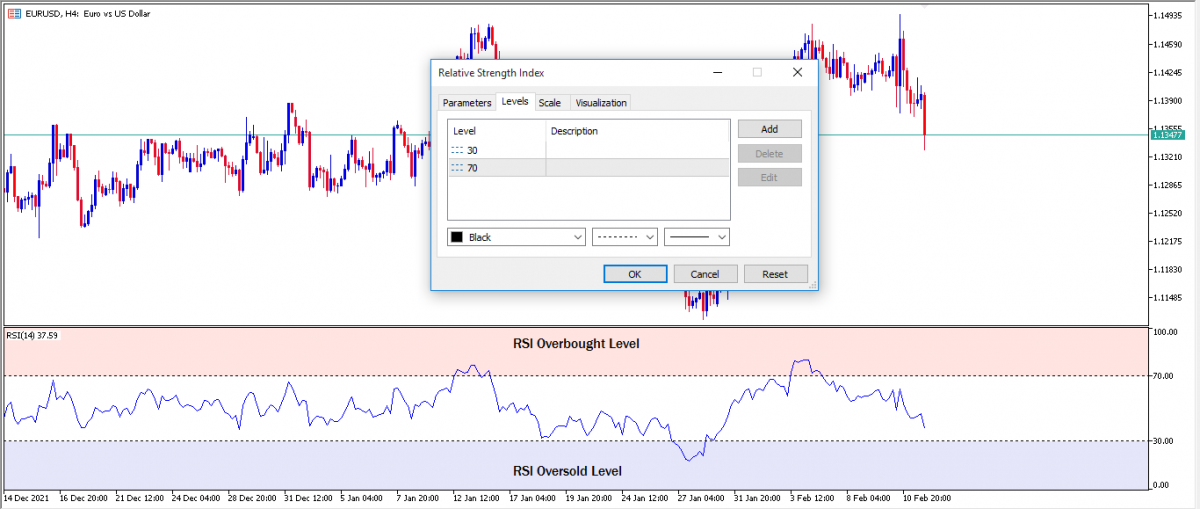

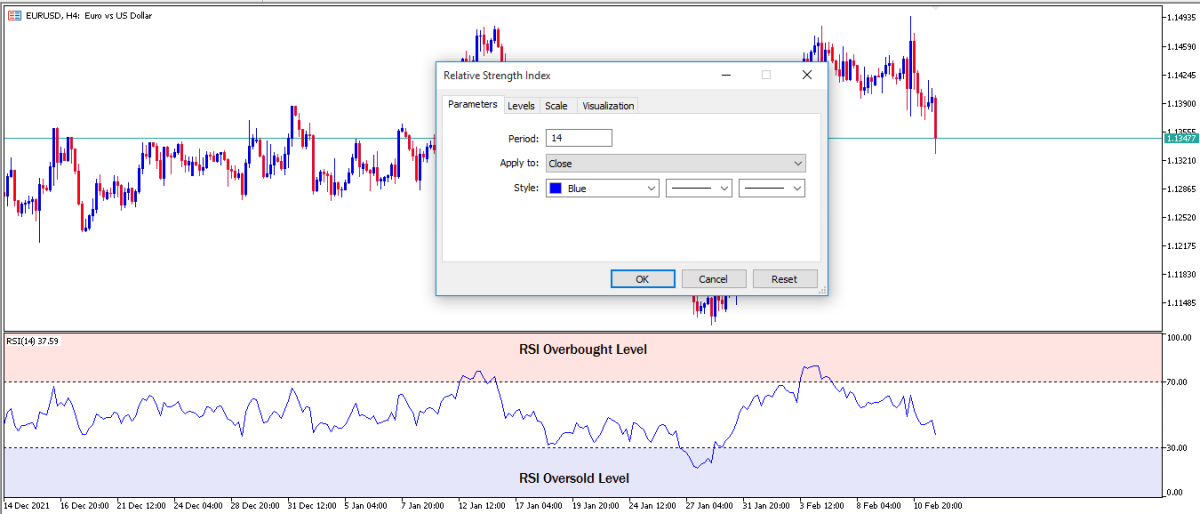

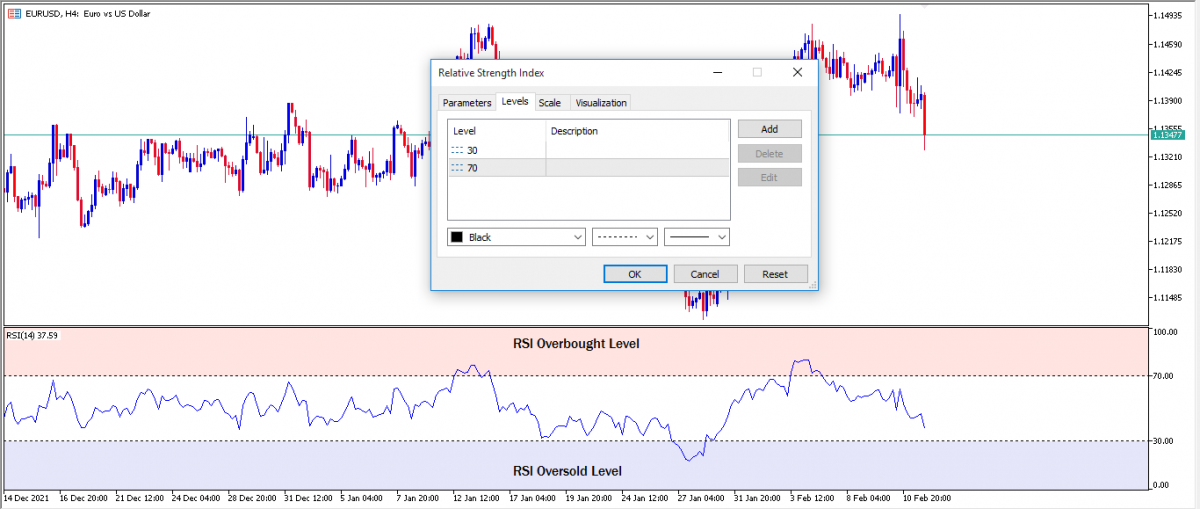

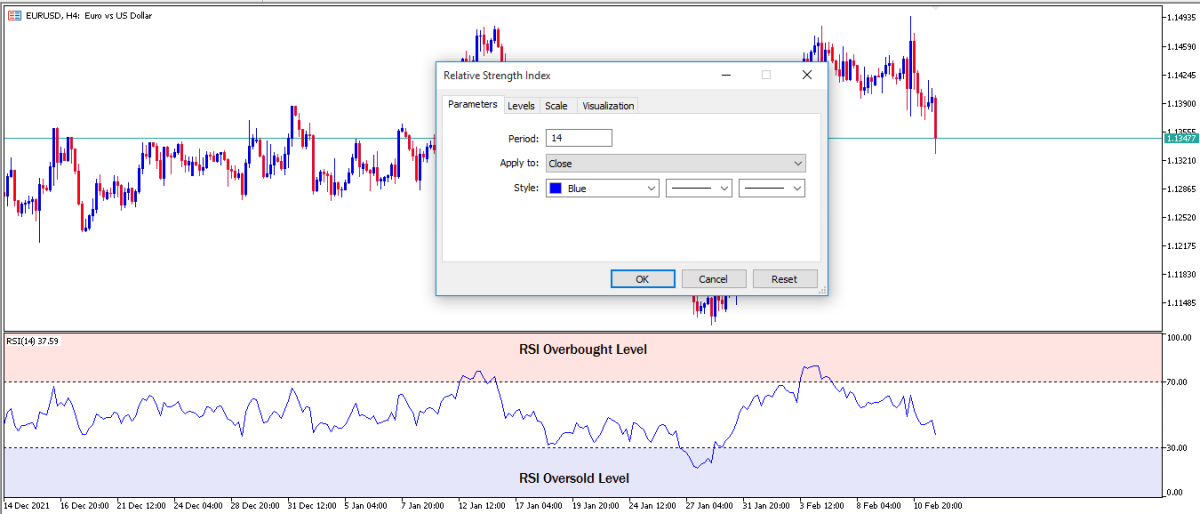

Ƙarfin Ƙarfin Ƙarfi na nau'i-nau'i na forex yana wakilta a kan mai nuna alama ta hanyar layi guda ɗaya wanda ke motsawa da baya a cikin ma'auni na 0 zuwa 100. Tsakanin 0 zuwa 100 na mai nuna alama shine tsoffin ma'auni guda biyu ko matakan kofa na 30 kuma 70 wanda ake amfani da shi don tantance yawan siyayyar da aka yi fiye da kima na motsin farashi.

An ƙididdige layin da ke wakiltar Ƙarfin Ƙarfin Dangi tare da tsohowar lokacin duba baya na 14 azaman ƙimar shigarsa watau 14 yana wakiltar sanduna 14 da suka gabata ko alkunu. Ana iya canza wannan ƙimar shigarwa don samar da siginonin RSI akai-akai ko žasa waɗanda za mu tattauna ƙarin a cikin ƙaramin jigo na gaba.

Daidaita saitunan alamar RSI

Za a iya daidaita saitin RSI na forex don haɓaka ko rage yawan siginar da mai nuna ke samarwa da kuma dacewa da dabarun ciniki daban-daban da salon ciniki.

Matsakaicin ƙimar shigarwar tsoho don duban lokacin shine 14 kuma madaidaicin madaidaicin madaidaicin madaidaicin madaidaicin madaidaicin matakan farashin da aka wuce gona da iri shine 30 da 70.

Ƙara ƙimar shigarwar lokacin duba baya zai rage yawan sigina da aka yi fiye da kima da siyayyar da mai nuna alama ke samarwa.

Sabanin haka, rage ƙimar shigarwar lokacin duba baya zai ƙara yawan siginar da aka yi fiye da kima da kima da mai nuna alama ke samarwa.

'Yan kasuwa na rana sukan ƙara matakin 30 da 70 na kofa don oversold da oversold karatun farashin motsi zuwa 20 da 80 don ƙara daidaito, aminci da rashin daidaituwa na sigina na juyewa da oversold.

Don cinikin lilo akan jadawalin mako-mako da na yau da kullun, mafi kyawun daidaitawa da aka yi akan RSI shine canza ƙimar shigar da lokaci daga 14 zuwa 20.

Don dabarun gyaran fuska na RSI akan ginshiƙi na 1Hr zuwa 15minute, mai nuna alama yana buƙatar kulawa da motsin farashin intraday don haka mafi kyawun daidaitawa ga alamar RSI shine rage ƙimar shigarwar lokaci daga 14 zuwa tsakanin 9 da 5 dangane da ɗan kasuwa. ta'aziyya tare da yawan saitin.

Yadda ake fassara siginar ƙarfin ƙarfin dangi da amfani da siginoni yadda ya kamata azaman dabarun ciniki na RSI na forex

Akwai sigina na asali guda 3 waɗanda alamar RSI ke samarwa wanda aka fi sani da oversold, oversold da bambance-bambancen motsin farashi.

RSI nuna alama forex dabarun za a iya ɓullo da a kusa da wadannan sigina saboda suna ba yan kasuwa muhimman alamu na da asali yanayin farashin motsi a confluence na lokaci da farashin da kuma Bugu da kari, siginar ba yan kasuwa wani ra'ayi na jira nan da nan canje-canje a cikin shugabanci na farashin motsi.

- Alamomin ciniki da aka yi fiye da kima da siyan fihirisar ƙarfin dangi:

A kan alamar RSI idan layin RSI ya haye sama da daidaitaccen matakin kofa 70 akan ma'aunin motsin farashi mai girman gaske. Wannan sigina alama ce ta cewa motsin farashin yana cikin yanayin kasuwa da aka wuce gona da iri. watau yunƙurin farashi na halin yanzu yana kan iyakarsa, matsananci ko ɓarna.

Ma'anar wannan ita ce duk wani babban tasiri na kasuwa kamar fitowar labarai, matakin juriya ko canjin buƙata don samarwa zai iya canza yanayin motsin farashi cikin sauƙi ko dai zuwa jujjuyawar juzu'i ko zuwa motsi na haɓaka farashin farashi.

Sabanin haka, idan akan alamar RSI, layin RSI ya ketare ƙasa da kishiyar madaidaicin madaidaicin matakin 30 akan ma'aunin motsin farashin bera. Wannan sigina alama ce ta cewa motsin farashin yana cikin yanayin kasuwa da aka sayar. Ie Matsayin farashin bearish na yanzu yana kan iyakar sa, matsananci akan ƙasa.

Ma'anar wannan ita ce duk wani babban tasiri na kasuwa kamar fitowar labarai, matakin tallafi ko sauyawar samarwa don buƙata na iya canza alkiblar motsi cikin sauƙi ko dai zuwa jujjuyawar ƙima ko kuma motsin haɓakar farashin gefe dangane da ƙarfin tasirin kasuwa.

Tare da taimakon alamu da sauran dabarun ciniki, 'yan kasuwa na iya yin tsinkaya daidai kan ɗayan waɗannan ƙungiyoyin farashin jagora na gaba kuma su gane idan ra'ayin ciniki ne mai yuwuwar samun riba daga gare ta.

Misalin hoton da ke sama misali ne na yau da kullun na sigina da aka yi sama da fadi da sigina na motsin farashi akan jigon USDJPY 4hr gami da sigina masu fa'ida da mara riba.

Akwai siginonin kasuwanci guda 8 da aka yi sama da fadi da su da aka gani da launuka uku; launin toka, orange da blue.

Akwatin launin toka yana wakiltar ƙananan sigina mai yuwuwar sama da ƙasa da sigina waɗanda ba sa iya samun riba kuma yana iya haifar da asara.

Akwatunan lemu suna wakiltar siginar siyarwar da aka yi sama da fadi da yawa.

Akwatunan shuɗi suna wakiltar sigina mai yuwuwa da riba mai yawa.

- Alamun rarrabuwar kawuna na ƙarfin dangi:

Bambance-bambancen ra'ayi ne mai mahimmanci a cikin kasuwancin forex da aka yi amfani da shi don gano sauye-sauye masu sauƙi tsakanin wadata da buƙatun mahalarta kasuwa. Bambance-bambancen yana faruwa ne lokacin da aka sami tsatsauran ra'ayi tsakanin motsin farashi na ma'auni na forex da kuma jagorar mai nuna fasaha.

Siginar rarrabuwar kawuna na RSI yana aiki iri ɗaya ne saboda ana amfani da shi don gano tarin dogayen oda ko gajerun umarni daga manyan mahalarta kasuwa a cikin forex ko kuɗin kuɗi.

Ana iya gano siginar rarrabuwar kawuna ta mai nuna RSI lokacin da motsin farashin ma'auni na forex ba ya cikin daidaitawa (wanda baya daidaitawa) tare da motsin layi ɗaya na alamar RSI.

Misali, ana iya gano siginar rarrabuwar kawuna lokacin da motsin farashin ke yin sabon swing low (ƙananan ƙasa) kuma alamar RSI ta kasa yin ƙarancin ƙasa daidai kuma a maimakon haka yana yin ƙasa kaɗan.

A gefe guda, ana iya gano siginar bambance-bambancen bearish lokacin da motsin farashin ke yin sabon haɓaka mai girma (mafi girma) kuma alamar RSI ta kasa yin tsayin daka daidai kuma a maimakon haka yana yin ƙasa kaɗan.

Hoton da ke sama tabbataccen misali ne na saitin ciniki na rarrabuwar kawuna da bearish akan ginshiƙi USDJPY 4Hr. Yi la'akari da cewa yawancin siginonin rarrabuwar kawuna suna da babban saitin kasuwanci mai yuwuwa kuma dukkansu suna faruwa ne a matakan RSI da aka yi sama da su.

Alamun rarrabuwar kawuna na farko da na biyar sune saitin rarrabuwar kawuna inda farashin farashin USDJPY ya yi ƙasa da ƙasa kuma layin nuna RSI ya saba ma mafi girma. Wannan tsaga cikin daidaituwa a matakin oversold na RSI ya saita sautin don USDJPY bullish rally a cikin saitin kasuwanci na farko da na biyar.

Sigina na rarrabuwar kawuna na biyu, na uku da na huɗu sune rarrabuwar kawuna suna siyar da saitin saiti tare da alaƙa mara daidaituwa tsakanin farashin motsi na USDJPY biyu da layin siginar RSI. USDJPY yana yin mafi girma kuma layin nuna alama na RSI yana yin fa'ida mafi girma a matakin da aka wuce gona da iri sau uku a jere ya saita sautin don motsin farashin bearish USDJPY.

Kalubale na alamar RSI

Ko da yake RSI babbar alama ce, wannan yana nufin siginar da mai nuna ke samarwa ya rigaya motsi farashin. Wannan fasalin yana sa siginar RSI ta zama na musamman, bambanta kuma suna da amfani sosai ga yan kasuwa a cikin nazarin fasaha na nau'ikan nau'ikan da suka fi so da ɗaukar manyan saitunan kasuwanci mai yuwuwa amma akwai wasu fa'idodi don amfani da alamar RSI.

Na farko shine, farashin ba koyaushe yana juyawa nan da nan ba a duk lokacin da alamar RSI ta karanta abin da aka yi fiye da kima. Sau da yawa a waɗannan matakan da aka yi fiye da kima da kima, motsin farashi yakan wuce gaba.

Wannan yana nufin cewa bai kamata a yi amfani da siginonin da aka yi fiye da kima da siyayyar RSI azaman ra'ayoyin kasuwanci na tsaye ba, wato, bai wadatar ba don tabbatar da ra'ayin kasuwanci mai juyawa ko saitin ciniki. Don haka dole ne a tabbatar da waɗannan sigina tare da wasu mahimman bayanai ko abubuwan da aka fi so, yanayin halin yanzu da tsarin shigarwar fitila kafin aiwatar da odar siye ko siyar da kasuwa akan saitin ciniki.

Idan motsin farashin zai iya kara gaba yayin da aka riga aka nuna alamar RSI an sayar da shi ko kuma an sayar da shi, wannan yana nuna cewa ana iya amfani da fassarar RSI na ƙungiyoyin farashi azaman mahimmin mafari na bincike na fasaha ko shirin ciniki don zazzagewa don fa'idar oversold da oversold juye. saitin ciniki.

Danna maɓallin da ke ƙasa don Zazzage "Dabarun RSI na forex" Jagora a cikin PDF