Mafi kyawun Alamar canjin Forex da Yadda ake amfani da shi

'Yan kasuwa na Forex suna buƙatar yin la'akari da wasu ra'ayoyi yayin cinikin kudaden waje. Fahimtar rashin daidaituwa da kuma yadda yake shafar motsin farashin agogo na ɗaya daga cikin mahimman mahimman abubuwan kasuwancin forex.

Tunanin abin da ake nufi da rashin ƙarfi ya bambanta daga mai ciniki zuwa mai ciniki. Misali, ’yan kasuwa da suka ƙware a cinikin ɗan gajeren lokaci na iya auna rashin daidaituwa ta saurin da ciniki zai iya samun riba kuma ya kai ga riba. Ga wasu, rashin ƙarfi shine ma'auni na ribar kasuwa da saurin canjin farashin farashin.

Volatility yana da ban takaici ga ƴan kasuwa masu ƙin haɗari, amma ga wasu, yana ba da dama da yawa don cin riba daga hauhawar farashin da ke da sauri da kuma akai-akai.

Hanya mafi kyau don guje wa kamawa ta hanyar rashin daidaituwar kasuwa da canje-canje a cikin alkiblar motsin farashi shine yin ciniki cikin daidaituwa tare da mafi kyawun fahimtar yanayin kasuwa.

Amfanin amfani da alamun rashin daidaituwa na forex?

Idan kana son yin amfani da rashin daidaituwa na kasuwar forex, yana da taimako don dogara ga shahararrun alamun rashin daidaituwa wanda zai iya taimaka maka fahimtar hargitsi na motsin farashi. Akwai Alamar rashin daidaituwa ta Forex waɗanda ke taimakawa don auna ƙimar kuɗin kuɗi da kuma yin hukunci ko nau'ikan forex sun dace da farautar mai ciniki don riba. Dangane da wane nau'in dan kasuwa ku ne, idan kuna neman tsayayye, tafiya mai shuru sannan kuɗaɗen kuɗi tare da ƙarancin rashin ƙarfi na iya dacewa da ku mafi kyau amma idan kun kasance ɗan kasuwa na ɗan gajeren lokaci ko mai saɓani, ya kamata ku nemi kasuwa mai canzawa. .

Bayan ƙayyadaddun ingancin sauyin kasuwa, alamun rashin daidaituwa na forex suna da ƙarin takamaiman amfani, kamar:

- Hasashen juye-juye

- Aunawa ƙarfin hali da kuzari

- Gano yiwuwar fashewa daga jeri da ƙarfafa motsin farashi.

Idan kuna mamakin waɗanne alamomin canji na Forex suna samuwa akan dandamalin ciniki na MetaTrader (MT4 da MT5), amsar ita ce akwai da yawa. Sabili da haka, yana da mahimmanci a lura cewa ba duk alamun rashin daidaituwa na Forex suna da ikon yin takamaiman buƙatun ku ba saboda ma'auni daban-daban na ma'auni na canzawa ta hanyoyi daban-daban saboda haka sun fi dacewa da manufa ɗaya fiye da ɗayan.

An jera alamomin kamar haka:

- SARAR KYAUTA

- Matsakaicin Matsakaicin Matsayi na Gaskiya

- Alamar alama

- Tashoshin Volatility

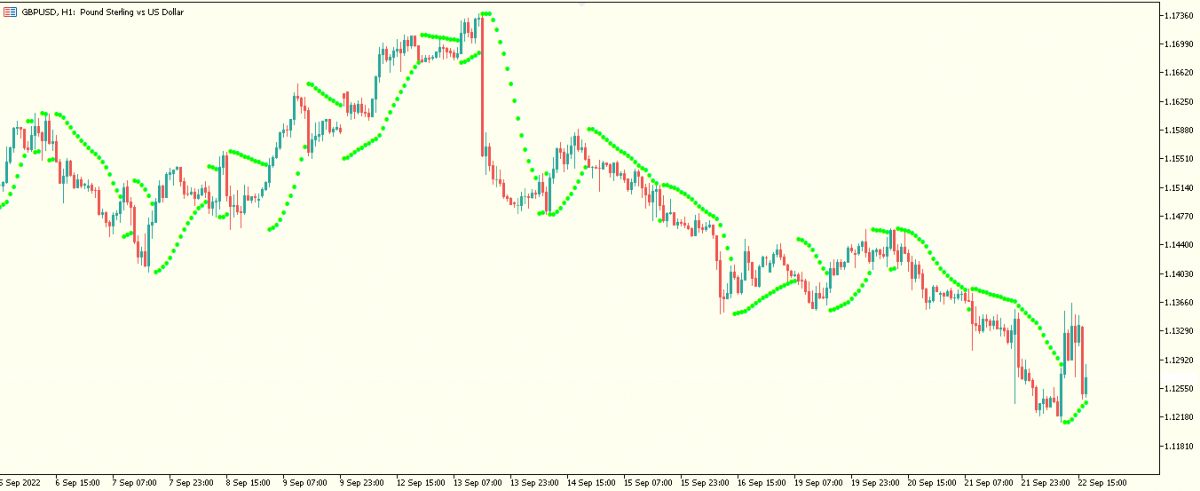

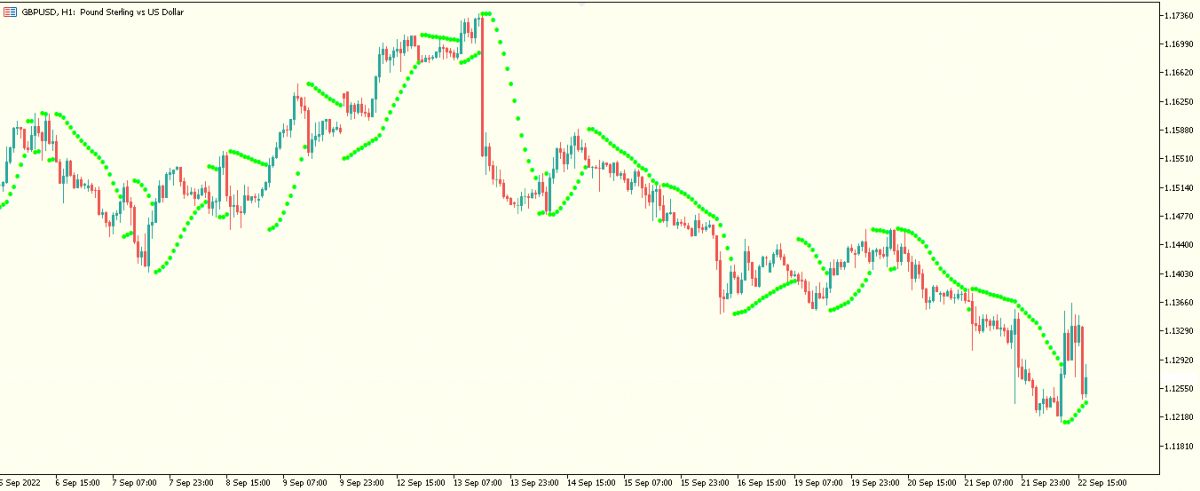

- Parabolic SAR: An rage shi a matsayin Parabolic Stop and Reverse, J. Welles Wilder ya tsara shi don gano matakan shigarwa mai kyau da fita don saitin kasuwanci. An ƙirƙira shi ne kawai don kasuwanni masu tasowa kuma, saboda haka, ba shi da tasiri a cikin motsin farashi ko haɗin kai. A wannan yanayin, don samar da siginar ciniki mai yuwuwa, ana iya haɗa Parabolic SAR tare da mai nuna alama mai zuwa.

GBPUSD ginshiƙi na sama, mai nuna alama yana yin maƙalli, ko parabolas akan motsin farashi.

Menene dabara don lissafin Parabolic SAR?

Ta amfani da Parabolic SAR, 'yan kasuwa za su iya kewaya yanayi maras tabbas da gano abubuwan da ke faruwa. A cikin kasuwanni masu tasowa, motsin farashin zai iya motsawa a cikin maƙallan ƙirƙira na mai nuna alama in ba haka ba yana yiwuwa yanayin ya ƙare idan farashin ya wuce fiye da kullun.

Ƙididdigar ƙididdiga ta Parabolic SAR na rana mai zuwa:

(EP - SAR yau) x SAR yau + AF = SAR gobe

An taƙaita 'Acceleration factor' a matsayin AF.

EP an rage shi azaman matsananciyar ma'ana, wanda shine bambanci tsakanin matakin farashi mafi girma na haɓakawa da mafi ƙarancin farashin matakin ƙasa.

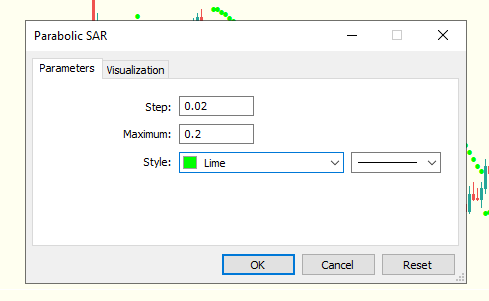

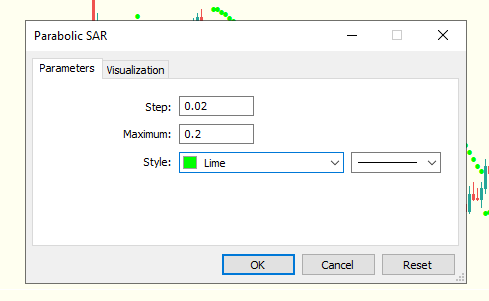

An saita ƙimar haɓakawa a ƙimar farko ta 0.02 ta tsohuwa amma kuna iya samun wata ƙima ta daban wacce ke aiki mafi kyau. Dole ne a gudanar da waɗannan binciken kawai akan asusun ciniki mara haɗari da demo.

Darajar ma'aunin haɓaka tana canzawa koyaushe ta 'mataki' (ƙimar farko na AF) yayin da motsin farashin ke yin sabon haɓaka da sabbin fa'ida.

Dangane da hoton da ke sama, ƙimar tsoho na wannan matsakaicin a cikin dandamali na MetaTrader shine 0.20.

Gabaɗaya jagororin yin amfani da wannan alamar ana iya taƙaita su cikin maki biyu:

- A yayin da ɗigon SAR suka bayyana ƙasa da motsin farashi na yanzu, wannan yana nuna haɓakawa amma idan ya bayyana sama da motsin farashin na yanzu, yana nuna yanayin ƙasa mai kusa.

- Lokacin da ɗigon ke haye daga sama zuwa ƙasa, yana nuna siginar siye amma idan ɗigon sun haye daga ƙasa zuwa sama, yana nuna siginar siyarwa.

- Alamar ATR (Matsakaici na Gaskiya).

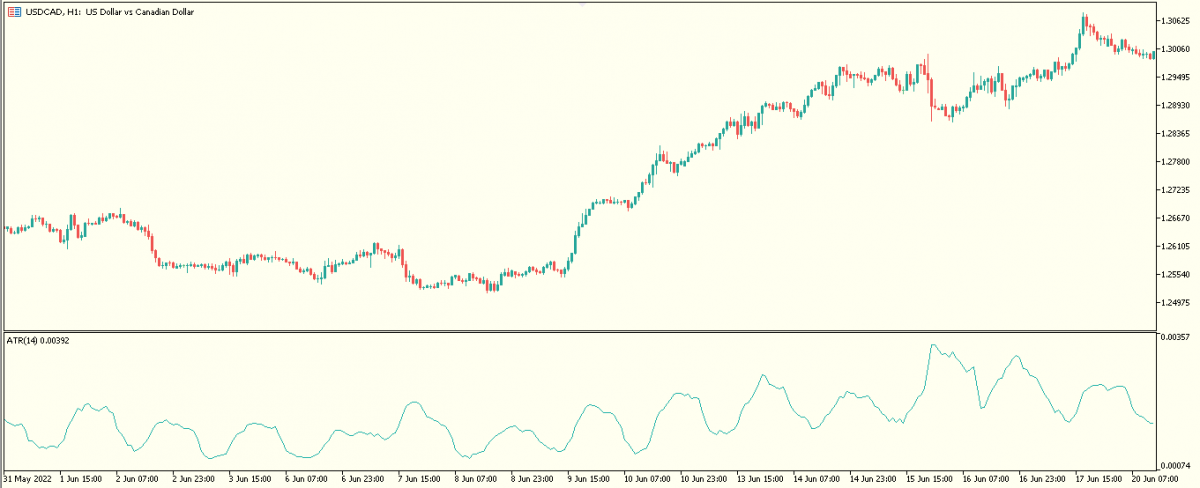

ATR alamar bincike ce ta fasaha wanda J. Welles Wilder Jr ya haɓaka don auna motsin farashin kasuwa. An ƙera shi don amfani a kasuwannin kayayyaki amma tun daga lokacin an ƙaddamar da shi zuwa duk sauran kayan kasuwancin kuɗi.

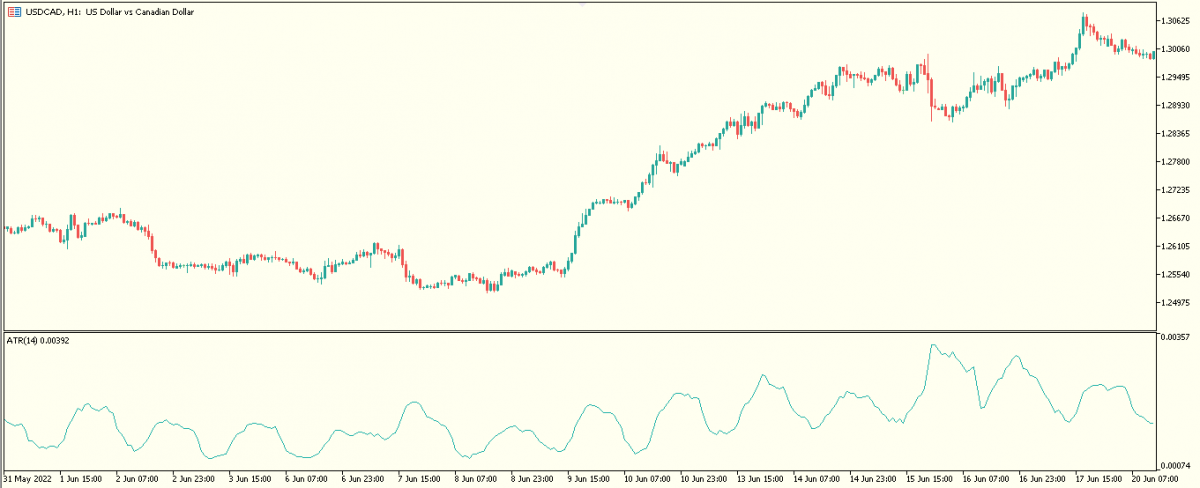

Ana ƙididdige shi ta hanyar ɗaukar matsakaicin motsi mai sauƙi na jeri na gaskiya na tsawon kwanaki 14. Alamar ATR da ke auna ɗan gajeren lokaci fiye da kwanaki 14 yana yiwuwa ya samar da ƙarin sigina, yayin da lokaci mai tsawo zai iya haifar da ƙananan sigina.

Matsakaicin kewayon gaskiya (ATR) na ƙungiyoyin farashin USDCAD

Yin amfani da alamar ATR yana da lahani na kasancewa ma'auni na ƙididdiga wanda za'a iya fassara ta hanyoyi daban-daban amma kawai an bayyana shi, farashin farashi tare da babban matakin rashin daidaituwa yana da ATR mafi girma kuma farashin farashi tare da ƙananan ƙarancin yana da ƙananan ATR. Bugu da ƙari, babu darajar ATR da za ta gaya muku ko motsi farashin ko yanayin zai canza shugabanci.

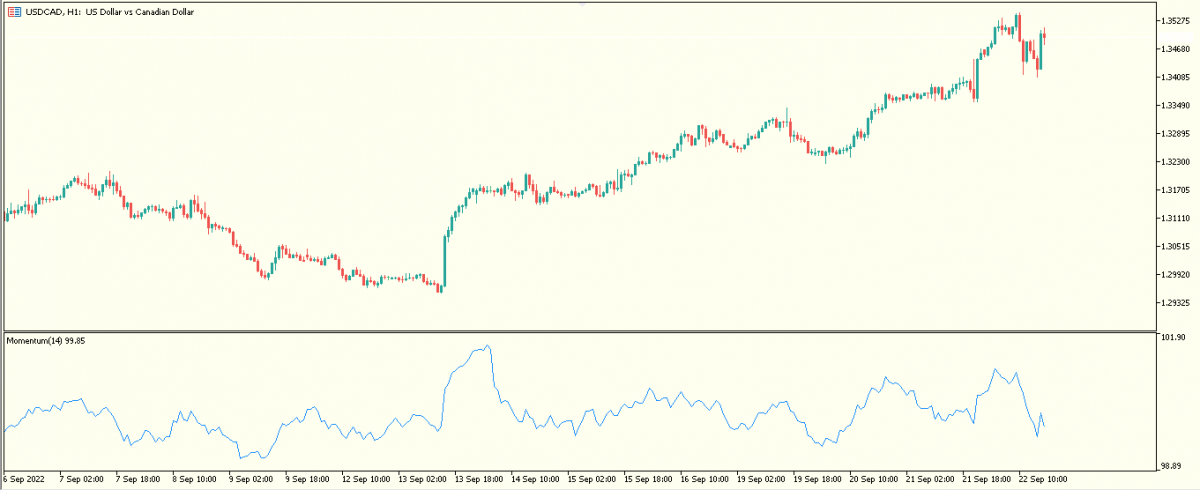

- Alamar Motsi na Forex

Alamar ƙuri'a, wani lokaci ana kiranta Rate of Change nuna alama (ROC), yana auna yadda saurin motsin farashin ke canzawa. Moreso, mai nuna alama yana auna ƙarfin bayan kowane faɗaɗa farashin. Hakanan yana taimakawa wajen gano yuwuwar koma bayan kasuwa ta hanyar auna ƙarfi da rauni na motsin farashi.

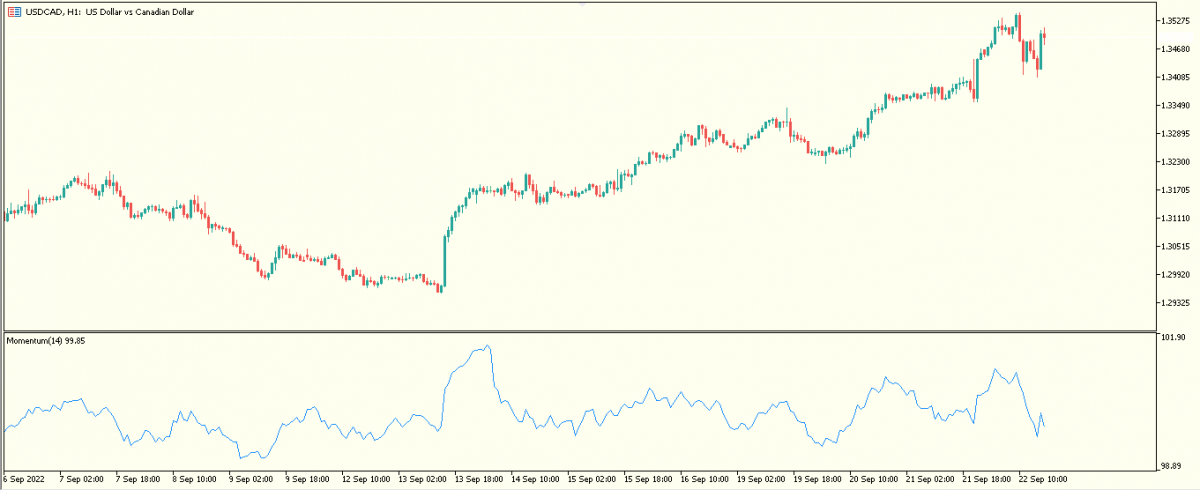

ginshiƙi USDCAD tare da nuna alama mai ƙarfi da aka tsara a ƙasa motsin farashi.

Ƙimar mai nuna alama tana faɗi game da yawan adadin canjin motsin farashi tare da wannan dabarar,

Momentum = (kusan halin yanzu - kusa da lokacin N) / (kusa da lokacin N x 100)

Inda 'N' ke da ƙayyadaddun lokaci tare da tsayayyen ƙimar 20.

Mafi ingancin ƙimar ƙarfin ƙarfi, ƙarfin motsin farashi zuwa sama. Sabanin haka, mafi girman ƙimar ƙimar haɓakawa, mafi ƙarfin motsin farashin ƙasa zai kasance.

Don haka, muna iya yin zato kamar haka; Yana da ma'ana a sa ran yanayin zai ci gaba muddin ƙimar ƙimar ta kasance babba. Koyaya, idan darajar motsi ta fara faɗuwa zuwa 0, wannan alama ce cewa yanayin yana raguwa.

Bisa ga wannan, za mu iya yanke shawara mai zuwa cewa

- Alamar ƙuri'a ta ƙetare daga mara kyau zuwa ƙima mai kyau shine siginar siye

- Alamar ƙuri'a ta ƙetare daga tabbataccen ƙima zuwa mummunan ƙima shine siginar siyarwa.

- Tashoshi masu canzawa

Tashoshin haɓakawa nau'in nuni ne mai rufi wanda ke tsara layin rashin ƙarfi sama da ƙasa motsin farashi. Waɗannan layukan nau'i ne na tashoshi, ambulaf ko makaɗa waɗanda ke faɗaɗa yayin da rashin ƙarfi ya ƙaru da kwangila yayin da rashin ƙarfi ke raguwa.

Shahararriyar tashar mai nuna juzu'i shine Bollinger Band, amma Alamar Tashar Keltner ta kasance wani.

Daga cikin dukkan alamomin tashoshi masu canzawa waɗanda aka haɓaka kuma ana samun su a kan dandamali na kasuwanci, ƙungiyar Bollinger da John Bollinger ya kirkira a farkon 1980s sun zama mafi shahara kuma sanannen alamar rashin ƙarfi a kasuwar kuɗi.

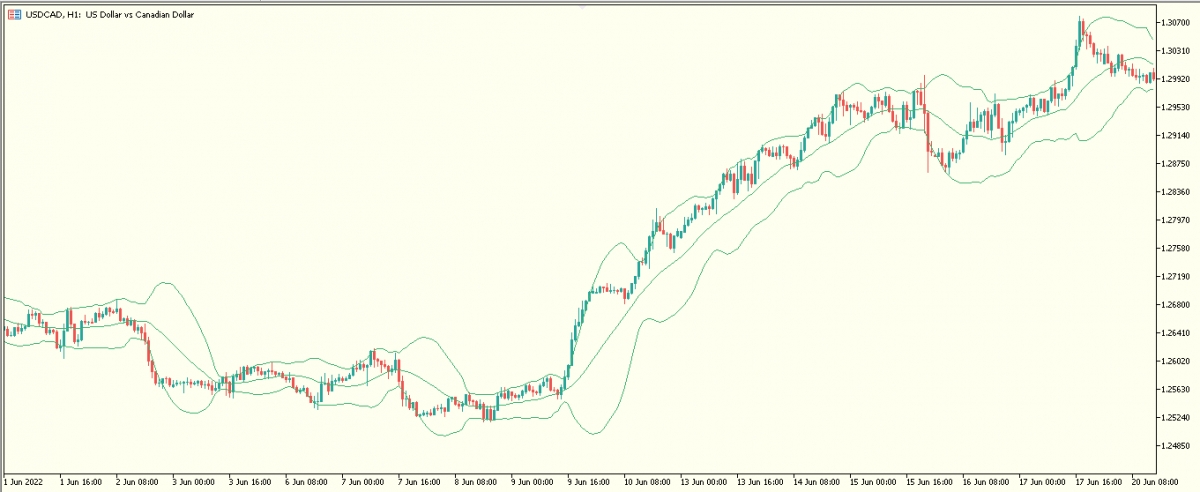

Mai nuna alama yana tsara layi uku a kusa da motsin farashi tare da

- Matsakaicin motsi mai sauƙi (tare da ƙimar tsoho na 20) azaman layin tsakiya wanda wasu layi biyu ke kewaye.

- Sauran layukan guda biyu suna samar da iyakoki na band kuma suna da nisa daidai, tare da layi na sama da ƙasa wanda ke faɗaɗawa da kwangila don amsa canje-canje a kasuwa. Lokacin da rashin daidaituwar kasuwa ya karu, band ɗin yana faɗaɗa sosai amma ƙarancin kasuwa yana sa ƙungiyar ta takura.

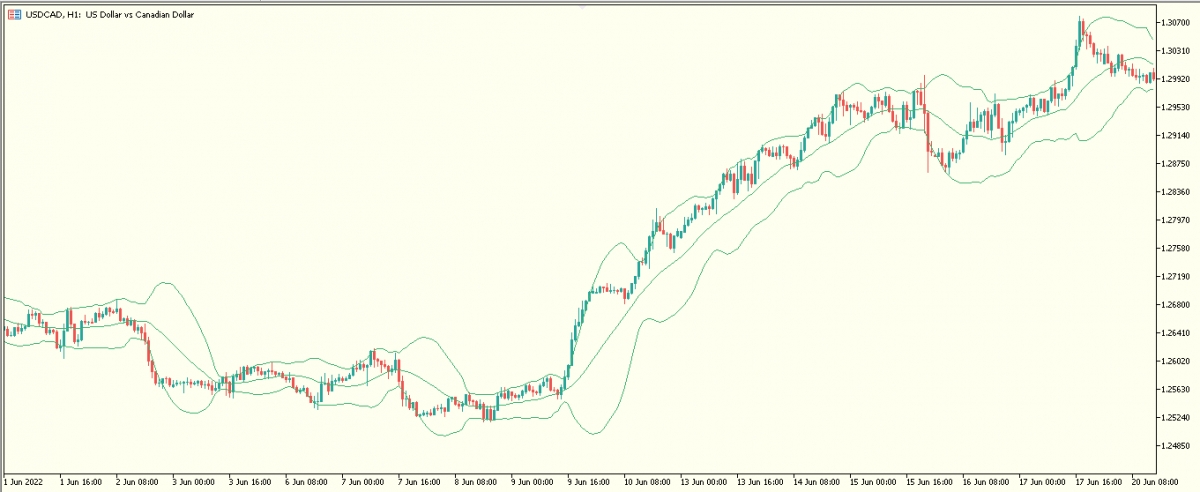

Ƙungiyar Bollinger kewaye da motsin farashi na USDCAD

'Yan kasuwa za su iya daidaita tsoffin ƙimar ƙungiyar bisa ga abubuwan da suke so. Lokacin da motsin farashi yana kusa da layin sama na ƙungiyar a cikin haɓakawa, ana ɗaukar kasuwa an cika siyayya. Sabanin haka, a cikin raguwa, lokacin da farashin farashin ya kasance a ƙananan layi na band, kasuwa ana la'akari da oversold.

Wanne daga cikin waɗannan alamun rashin daidaituwa na Forex shine mafi kyau?

Babu yarjejeniya tsakanin forex volatility Manuniya game da wanda shi ne mafi kyau, kuma ya dogara da abin da kowane mai ciniki sami dadi da kuma dace da su ciniki style.

Gabaɗaya, alamun suna aiki mafi kyau idan aka yi amfani da su tare da wani. Misali na dabara mai ƙarfi shine haɗa alamomi guda biyu, ƙungiyar Bollinger a matsayin alama ta farko don nuna yawan siyayyar da ake samu a cikin motsin farashi, sannan alamar motsi a matsayin alama ta biyu don tabbatar da jujjuyawar bullish ko bearish.

Godiya ga wannan jagorar nuna rashin ƙarfi, ana iya amfani da shi don nemo mafi kyawun alamar rashin ƙarfi na forex (a cikin 4 na sama) wanda ya dace da salon kasuwancin ku. Dole ne ku yi aiki tare da waɗannan alamomi akan asusun demo ba tare da haɗari ba da gwajin damuwa wanne daga cikin waɗannan alamun shine mafi inganci da riba don salon kasuwancin ku.

Ta hanyar aiki kawai, za ku iya fara yin ƙarin bayani game da yanke shawara na kasuwanci da kuma ayyukan sarrafa haɗari.

Danna maballin da ke ƙasa don Zazzage mu "Mafi kyawun alamar canji na Forex da Yadda ake amfani da shi" Jagora a cikin PDF