Mene ne tsarin ginshiƙi da aka fi amfani da shi a cikin Kasuwancin Forex

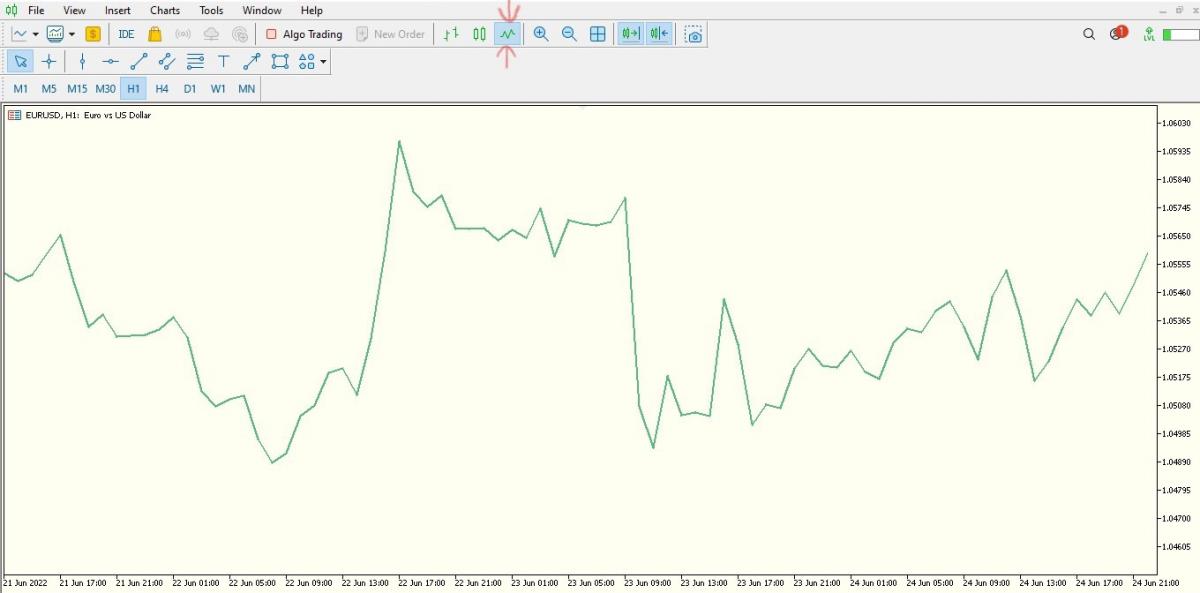

Don samun fahimtar farashin farashin nau'i-nau'i na forex, hannun jari da sauran kadarorin kuɗi, dole ne a gudanar da bincike mai zurfi akan sauye-sauyen farashi na tarihi da kuma maimaita tsarin da za a iya gani a kan farashin farashi. Jadawalin farashin Forex shine kayan aikin da kowane ɗan kasuwa da manazarta ke amfani da shi don yin nazarin motsin farashin nau'ikan forex. Ana wakilta su ta gani da nau'ikan ginshiƙi uku kuma ana iya saita su zuwa takamaiman lokaci wanda zai iya zama kowane wata, mako-mako, yau da kullun, sa'a har ma da daƙiƙa.

Menene nau'ikan 3 daban-daban na sigogin forex

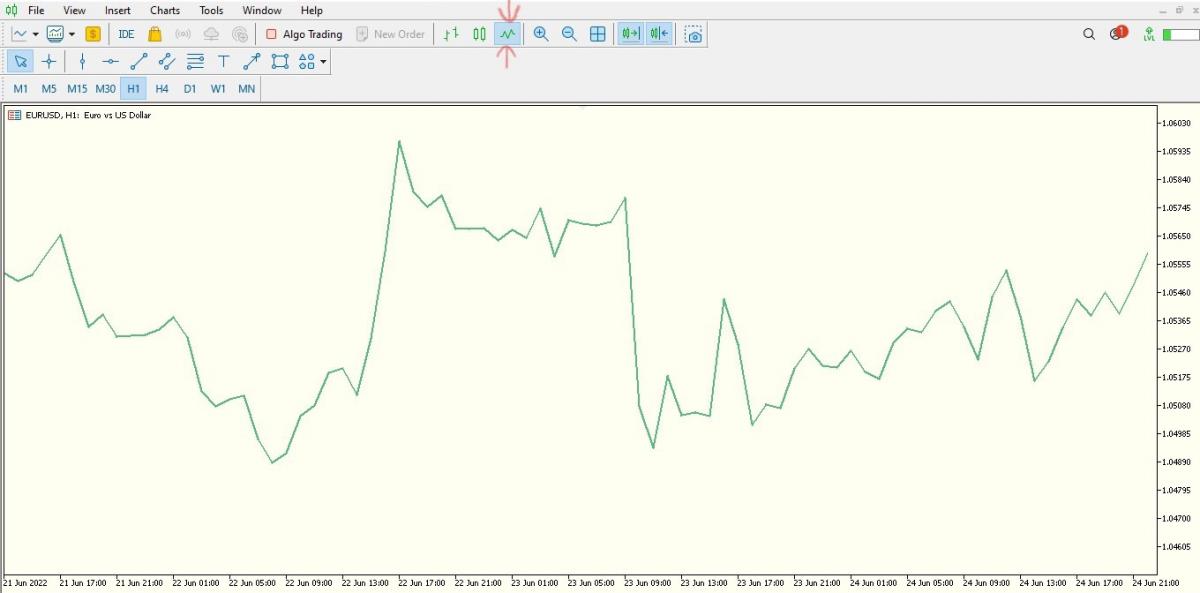

- Jadawalin layi: Wannan nau'in ginshiƙi yana da amfani don samun bayanin "babban hoto" na ƙungiyoyin farashin yawanci ta hanyar farashin rufe kowane lokacin ƙarewa na ƙayyadaddun lokaci don haka yana sauƙaƙa bin abubuwan da ke faruwa da kwatanta farashin rufewa daga lokaci ɗaya zuwa na gaba.

- Jadawalin Bar: Taswirar mashaya yana bayyana ƙarin daki-daki game da motsin farashi. Yana ba da ƙarin bayani game da jeri na farashin kowane lokacin ciniki ta hanyar nuna alamar buɗewa da rufe farashin, kazalika da haɓaka da ƙarancin kowane lokacin ciniki - akan sanduna masu girma dabam.

- Jadawalin Candlestick: Taswirar alkukin shine ƙarin bambance-bambancen hoto na ginshiƙi na mashaya wanda ke nuna bayanin farashin iri ɗaya amma a cikin tsari mai kama da kyandir. Tare da launuka daban-daban guda biyu don ganin girman girman kai da jin daɗi.

Akwai ɗimbin bayanai masu fa'ida waɗanda za'a iya tattara su daga motsin farashin agogo da sauran kadarorin kuɗi akan nau'ikan ginshiƙi farashin.

Za mu tattauna ɗaya daga cikin mahimman abubuwan motsin farashin da aka sani da 'tsararrun tsarin'.

Samfurin ginshiƙi iri-iri ne. Suna taka muhimmiyar rawa kuma suna kafa tushen dabarun ciniki iri-iri. Mafari da ƙwararru suna amfani da tsarin ginshiƙi don buɗe yanayin kasuwa da kuma tsinkayar kwatance motsin farashi na gaba. Baya ga nau'i-nau'i na forex, ana iya amfani da su don nazarin hannun jari, kayayyaki da sauran kayan aikin kuɗi.

Categories na ginshiƙi alamu

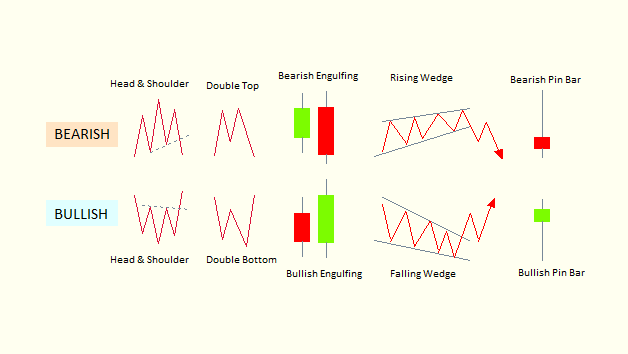

A cikin wannan sashe, za mu rarraba tsarin ginshiƙi bisa ga rawar da suke takawa wajen gano ra'ayin wasu alamu masu maimaitawa a cikin motsin farashi.

- Tsarin Juya Juyawa

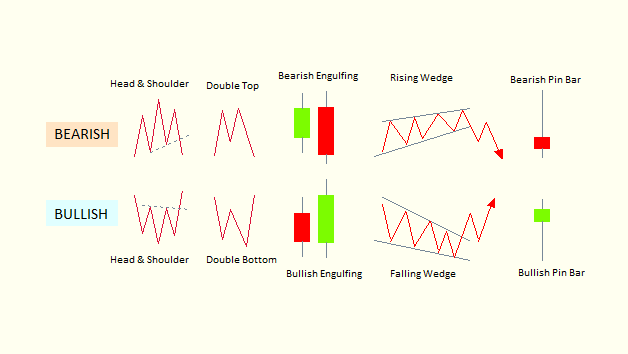

Waɗannan alamu ne na motsin farashi waɗanda ke bayyana juye-juye na kusa ko canji a alkiblar halin yanzu. Suna iya samuwa a saman wani haɓaka ko a kasan raguwa don haka suna ba da shawarar koli da yiwuwar canji a cikin yanayin motsin farashin.

A cikin wannan mahallin, ga wasu alamu masu yuwuwar ginshiƙi waɗanda za su iya nuna alamar juyowar yanayin da ke kusa.

- Biyu saman & ƙasa biyu

- Shugaban da Kwando

- Tashi & faɗuwar tudu

- Candle mai jan hankali

- Pin sanduna

Lokacin cinikin waɗannan alamu na ginshiƙi, yana da mahimmanci don saita maƙasudin riba wanda ya kai girman samuwar ƙirar. Misali, idan ka ga samuwar 'kai da kafada' a kasan yanayin kasa, sanya dogon tsari a saman wuyansa kuma ka yi niyyar samun riba mai girma kamar tsayin tsarin.

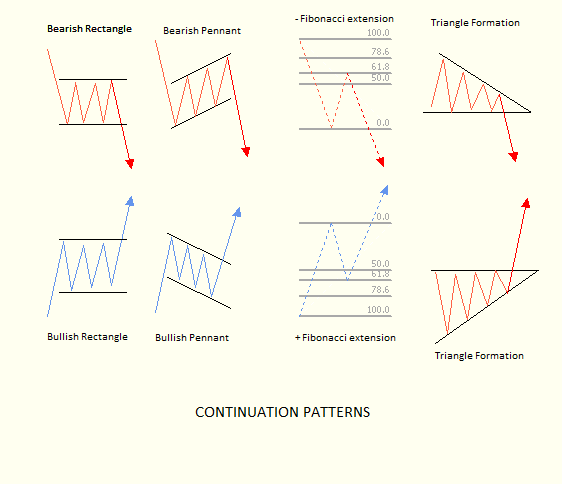

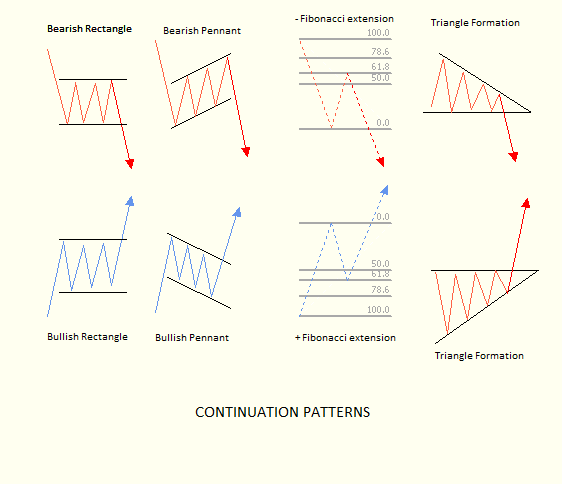

- Tsare-tsaren Ci gaba

Abubuwan da ke faruwa ba yawanci suna motsawa ba tare da fuskantar wasu juriya ba wanda zai iya haifar da ɗan dakata na ɗan lokaci (motsin farashin gefe) ko ja da baya na ɗan gajeren lokaci kafin a ci gaba da tafiya cikin al'amuran. Akwai alamu waɗanda ke nuna lokacin da wani abin da ya faru a baya zai yi yuwuwa ya sake dawowa kuma ya dawo da ƙarfi.

Daga cikin tsarin ci gaba da aka fi sani shine tutoci, alamu, da Fibonacci 61.2% mafi kyawun shigarwa. Wannan nau'in tsarin ginshiƙi shine mafi kyau kuma mafi riba saboda faɗaɗa farashin da ya gabata ya yi daidai da yanayin kuma don haka yana da fa'ida sosai.

- Alamomin ginshiƙi biyu

Kalmar 'bilateral' tana nufin ko dai hanya ko alkibla. Misalin wannan tsarin ginshiƙi shine samuwar 'triangle' - inda motsin farashi zai iya karye ko dai zuwa sama ko ƙasa na triangle. Ya kamata a yi ciniki da wannan nau'in sifofi na ginshiƙi tare da la'akari da yanayin yanayi biyu (na juye juye ko ɓarnawar ƙasa).

Samun irin waɗannan nau'ikan ginshiƙi na ginshiƙi don ciniki, yana da mahimmanci a san mafi yawan al'ada, mafi yawan maimaitawa kuma mafi yawan riba na duk waɗannan alamu na ginshiƙi sannan kuma tare da hanya mai sauƙi, za a iya samar da cikakken tsarin ciniki a kusa da waɗannan alamu.

Anan, za mu samar muku da saitin umarni don kasuwanci mafi yawan al'amuran ginshiƙi na Forex.

Mafi na kowa tsarin forex chart

Alamomin ginshiƙi na forex masu zuwa sune mafi yawan al'amuran ginshiƙi na fili waɗanda za'a iya gani akan kowane lokaci da kuma kan ginshiƙi na kowace kadarorin kuɗi.

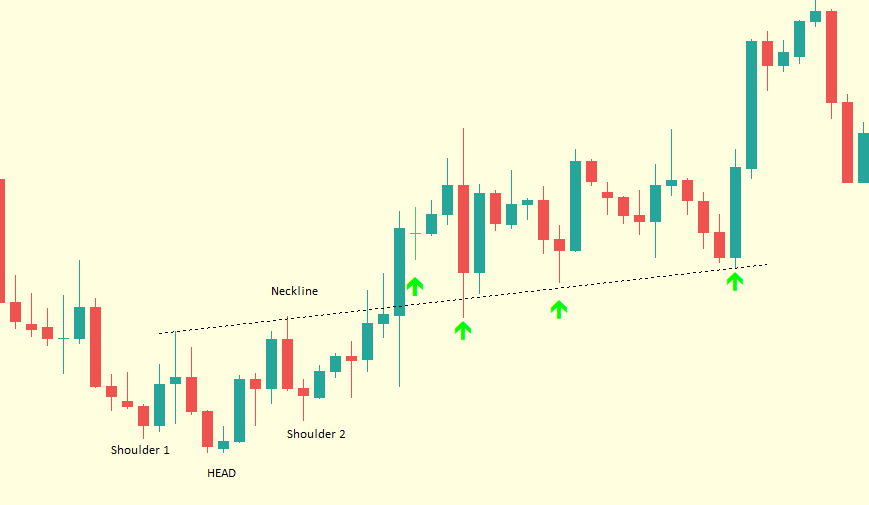

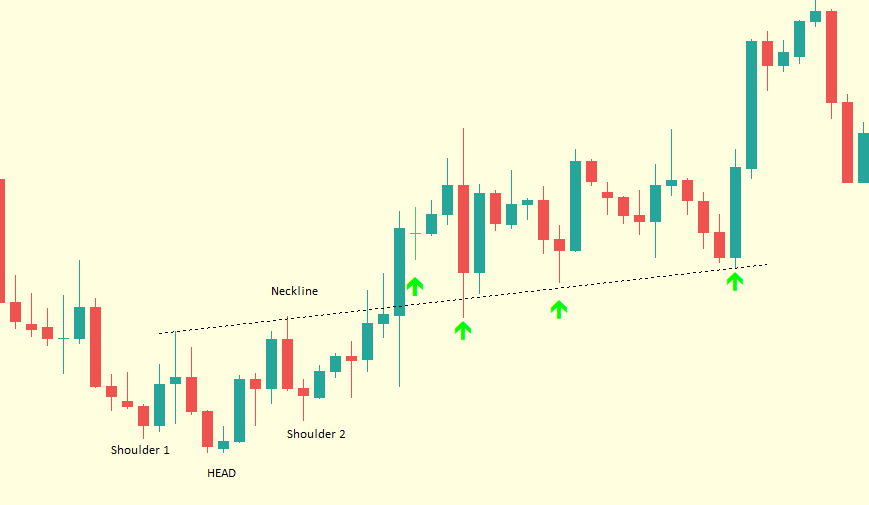

1. Kan da kafadu forex juna

Wannan tsari ne na musamman na musamman wanda aka samo shi ta hanyar kololuwa uku a saman motsin farashi ko mafi ƙarancin ƙasa uku a ƙasan motsin farashi, tare da mafi girma na biyu a tsakiya yawanci mafi girma.

Menene samuwar wannan ƙirar kololuwa uku (kai da kafadu) sama ko ƙasa motsin farashi?

Da fari dai, daga hagu, motsin farashi yana yin kololuwa (kafada ta farko) sannan wani kololuwa (kai) yawanci ya fi girma na farko da na uku (kafada ta biyu). Bayan da samfurin ya samo asali, dole ne a karya wuyan wuyansa kafin yin la'akari da dogon lokaci ko gajeren tsari na kasuwa dangane da wuri da jagorancin tsarin. Bugu da ƙari, manufar riba na iya zama babba kamar shugaban ƙirar.

Tsarin yana yin kyakkyawan tsarin ciniki tare da madaidaicin matakan shigarwa, dakatar da hasara kuma ɗaukar riba.

Misali na samuwar kai da kafada a kasan motsin farashi

2. Tsarin Chart na Forex Triangle

Za'a iya gano samfuran Forex Triangle ta hanyoyi guda biyu: a kwance da layin madaidaiciya (hawan hawa ko saukowa) tare da hauhawar farashin farashi a cikin ƙayyadaddun ma'auni na yanayin yanayin kafin ƙarshe ya fita.

Za'a iya rarrabewa da tsarin triangle a cikin nau'ikan daban-daban na tushen uku dangane da siffar samuwar su da kuma abubuwan fashewa na zamani na breakinsu. Gasu kamar haka

- Siffofin almara

- Hawan triangles

iii. Saukowar alwatika

Siffofin almara

Wannan tsari na triangle, wanda galibi ana la'akari da sifar ginshiƙi biyu, an ƙirƙira shi ta lokacin motsin farashi a cikin haɗin kai. Za'a iya gano tsarin ta hanyar saukowa da yanayin yanayin hawan da ke haɗuwa a wuri, wanda aka fi sani da koli. A cikin layukan yanayi guda biyu, motsin farashi zai billa zuwa koli, sannan kuma, ɓarkewar al'ada zai faru a kowane bangare na yanayin da ya gabata.

A cikin yanayin yanayin da ake gaba da shi a ƙasa, aikin ɗan kasuwa shine tsammani da kuma aiwatar da fashewa a ƙasan layin tallafi mai hawa. Duk da haka, idan tsarin ya riga ya wuce ta hanyar haɓakawa, mai ciniki ya kamata ya yi tsammani kuma ya yi aiki a kan raguwa a sama da layin juriya.

Hakanan yana da mahimmanci a lura cewa yayin da wannan ƙirar ta fi son ci gaba da yanayin, motsin farashi na iya faɗuwa sau da yawa ta wata hanya dabam kuma ya juya yanayin. An ba da misali a ƙasa.

Nazarin shari'ar biyu na madaidaicin alwatika

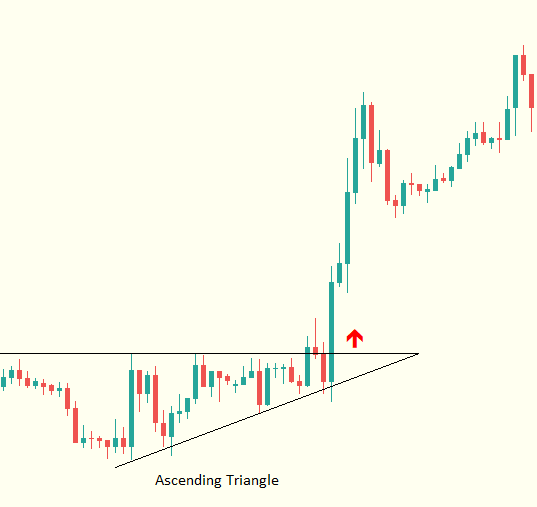

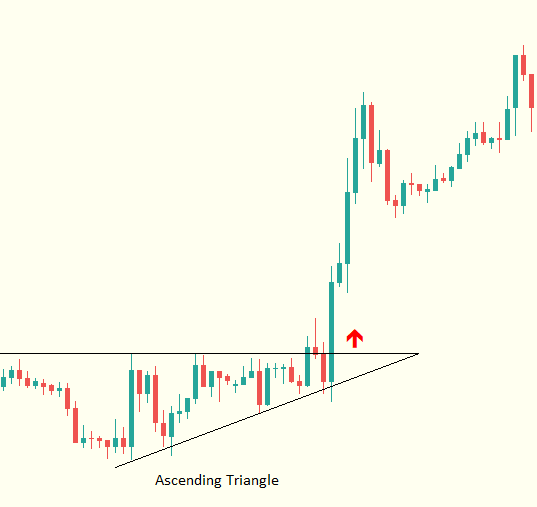

Triangle Mai Hawa

Triangle mai hawan hawa wani tsari ne na Forex wanda aka kirkira ta hanyar zato na layi biyu akan motsin farashi. Yanayin kwance a kwance yana aiki azaman juriya kuma yanayin hawan hawan yana ba da tallafi ga motsin farashi.

A cikin wannan yanayin, motsin farashin kadari na kuɗi yana billa kuma yana haɗuwa a cikin kewayen wannan alwatika har sai an sami fashewar sama a saman layin kwance mai juriya. Yunƙurin motsin farashi bayan ɓarnar tashin hankali yawanci yana da fashewa sosai, yana mai da shi tsari mai yuwuwa kuma mai fa'ida.

Triangle Mai Saukowa

Wannan shi ne akasin tsarin ginshiƙi mai hawa uku. Triangle mai saukowa yana samuwa ta hanyar zato na layi biyu akan motsin farashi. Yanayin kwance a kwance yana aiki azaman tallafi kuma yanayin saukowa yana ba da juriya mai ƙarfi ga motsin farashi.

Kamar triangle mai hawa, motsin farashin yana billa a cikin kewayen alwatika kuma ya haɗu zuwa koli amma tsarin ginshiƙi mai saukowa zai ga raguwa ƙasa ƙasa da layin kwance mai goyan baya.

Kamar yadda yake tare da kowane nau'in triangle, farashin ba koyaushe zai fashe a hanyar da ake tsammani ba saboda wannan ba ainihin kimiyya bane. Don haka yana da mahimmanci a aiwatar da kyakkyawan tsarin kula da haɗari don rage tasirin sakamakon da ba zato ba tsammani.

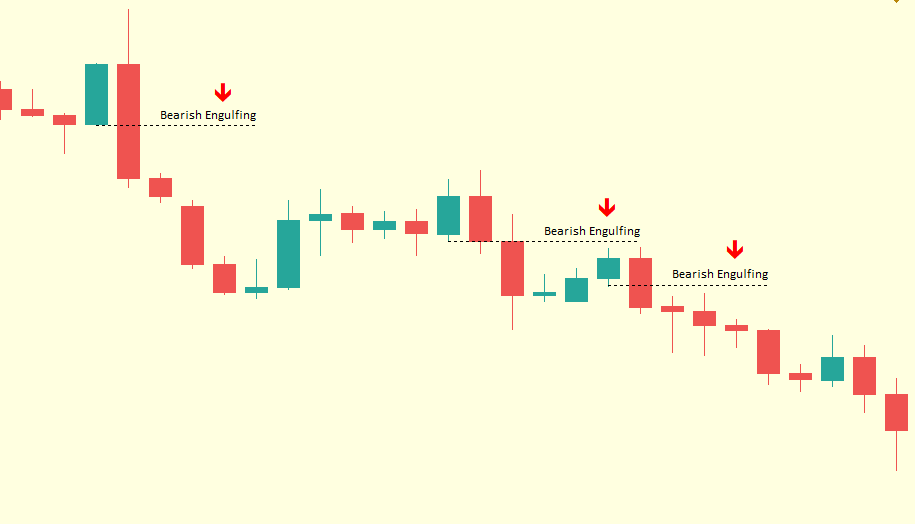

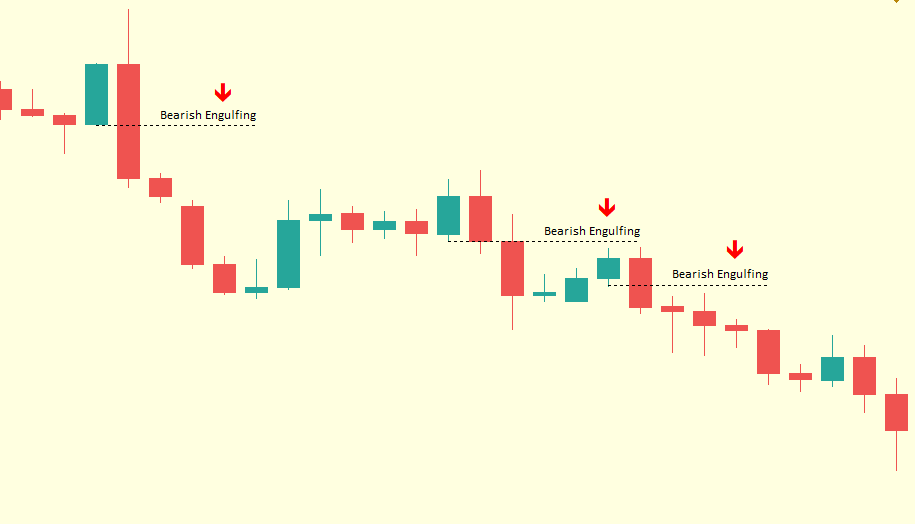

3. The Engulfing Candle Forex Chart Tsarin

Lokacin nazarin motsin farashi, ana iya samun ƙarin bayani da yawa daga sandunan ginshiƙi na farashi. Don haka, sandunan kyandir ɗin kayan aiki ne masu amfani don tantance makomar motsin farashi a kowane lokaci.

Akwai nau'ikan ginshiƙi da yawa don haka yana da kyau a kula da mafi kyawun, mafi girman yuwuwar kuma mafi sauƙi don tabo wanda shine alkuki mai mamayewa.

Wannan tsarin yana ba da kyakkyawar damar ciniki wacce ke daidai da takamaiman jagorar motsin farashin ko dai juyewa ko farkon sabon yanayin.

Yadda za a gano alamun ginshiƙi na kyandir

Lokacin da ake sa ran motsin farashin zai koma baya daga yanayin bearish ko fara haɓakar haɓaka. Kyandir ɗin da ya riga ya sauka zai samu gaba ɗaya jikin wata kyandir ɗin da ya mamaye ta don haka ya zama ƙirar kyandir ɗin da ta mamaye ta. Za'a iya buɗe odar kasuwa mai tsayi akan wannan ƙirar tare da asarar tasha da aka sanya ƴan pips a ƙasan jikin ƙirar kyandir ɗin da ke mamayewa.

Sabanin haka, lokacin da ake sa ran motsin farashin zai koma baya daga yanayin tashin hankali ko kuma fara yanayin haɓaka. Jikin fitilar bearish wanda ya rigaya ya mamaye shi gaba ɗaya don haka yana samar da ƙirar kyandir ɗin bearish. Za a iya buɗe ɗan gajeren oda na kasuwa akan wannan ƙirar tare da asarar tasha da aka sanya ƴan pips daidai sama da jikin ƙirar kyandir ɗin bearish.

ƙwararren ɗan kasuwa na iya amfani da duk waɗannan sanannun sifofi don gina dabarun ciniki na musamman na kansu.

Danna maɓallin da ke ƙasa don Zazzage mu "Mene ne tsarin tsarin da aka fi amfani da shi a cikin Kasuwancin Kasuwanci" Jagora a cikin PDF