Menene dabarun MACD

Kalmar "MACD" ita ce gajarta don alamar oscillator-nau'in alama wanda aka sani da Matsakaicin Matsakaicin Matsala. Gerald Appel ne ya ƙirƙira shi a cikin 1979 kuma tun lokacin yana ɗaya daga cikin manyan alamun fasaha da 'yan kasuwa ke amfani da su don gano ƙimar farashi da damar haɓaka a cikin kasuwannin kuɗi.

Don kasuwanci da dabarun MACD yadda ya kamata, 'yan kasuwa dole ne su fahimci alamar MACD, yadda yake aiki kuma suna da jagora mai amfani kan yadda ake amfani da alamar MACD mai kyau don yanke shawarar kasuwanci daban-daban.

TAKAITACCEN BAYANI NA MALAMAI MACD

Sunan 'Matsakaicin Motsawa' 'Haɗuwa' 'Bambance-bambance' yana ba da labari da yawa game da mai nuna alama. Yana nuna ra'ayi na matsakaita masu motsi guda biyu da aka yi amfani da su don samun haɗin kai da bambance-bambancen karatun fasaha na motsin farashi wanda a zahiri gaskiya ne!

Karatun fasaha yana ba da labari da yawa game da ƙarfin motsin farashi, jagorar yanayin da yanayin juyawa na kasuwa.

Ƙididdigar fasaha na alamar MACD abu ne mai matukar amfani ga 'yan kasuwa na tushen masu nuna alama, don haka yana da mahimmanci cewa sassan, saitunan, ayyuka, da sauran abubuwan da ke da tasiri akan alamar MACD su fahimci yadda ya kamata don ingantaccen aikace-aikacen kayan aiki da riba ciniki sakamakon.

MENENE BAYANIN FASAHA NA ALAMOMIN MACD

Abubuwan fasaha na alamar MACD sun ƙunshi

1-Layi guda biyu, daya ana kiransa “layin MACD” dayan kuma “Layin Sigina”.

2- Histogram.

3- Wurin nunin layin sifiri.

Waɗannan duk abubuwan da aka samo asali ne na sigogin shigarwar mai nuna alama waɗanda suka ƙunshi matsakaicin matsakaicin motsi na fasikanci biyu (EMA) da matsakaicin matsakaicin motsi mai sauƙi (SMA) tare da ƙimar tsoho na 12, 26, 9. Ana iya canza waɗannan ƙimar don dacewa da tsarin ciniki da ake so ko dabarun.

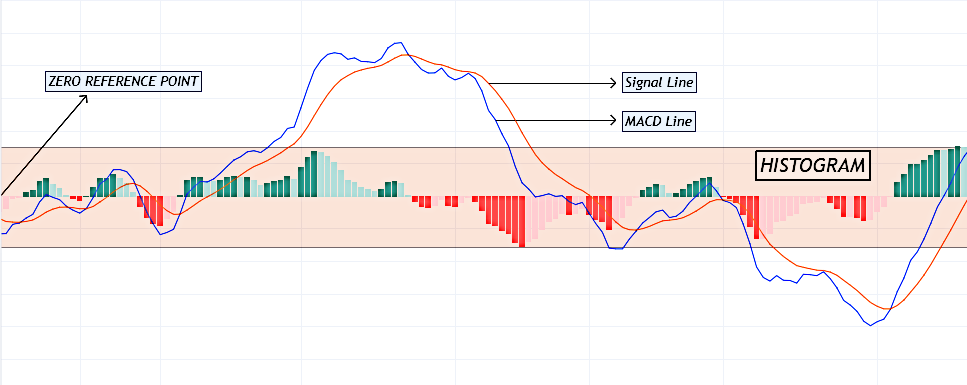

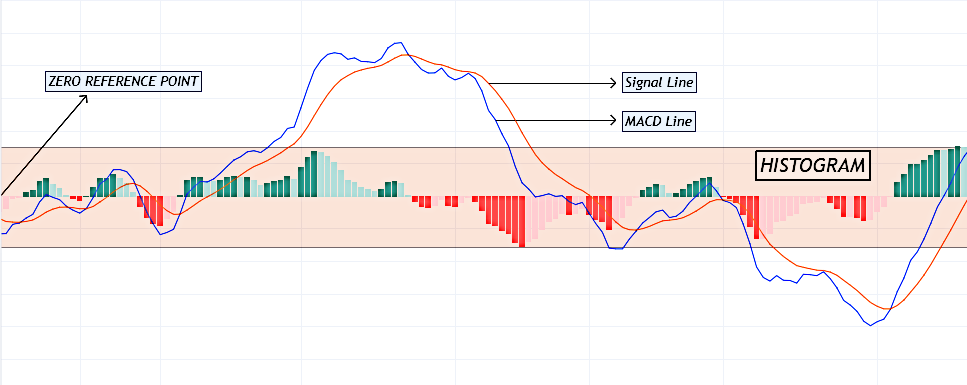

Hoto 1: Samfurin duban alamar MACD yana nuna abubuwan da suka haɗa

"MACD Line" shine layin santsi mai launin shuɗi wanda ya samo asali ne na bambanci tsakanin sigogin EMA guda biyu na mai nuna alama (EMA 12 da EMA 26).

"Layin Sigina" (launi ja) matsakaicin motsi ne mai sauƙi na tsawon lokaci 9 na "layin MACD" watau matsakaicin ƙididdiga na matsakaici.

Su (MACD da Siginar sigina) an ƙirƙira su biyu don fassara motsin farashi ta nisan su da kuma tsallake-tsallake.

MACD histogram a cikin hanyar oscillator shine wakilcin hoto na nisa tsakanin layin MACD da Layin Sigina.

Wurin nunin layin sifili maki ne kawai don karanta jagorar kasuwa mai mahimmanci da tace duka siginar crossover da histogram.

YAYA MUKE FASSARAR DUKKAN FASSARAR FASSARAR MALAMAI MACD KAMAR YADDA SUKE DANGANTA DA MATSALAR FARASHI.

Tabbas, karatun fasaha da aka samo daga mai nuna alama sun dace da juna amma suna nufin abubuwa daban-daban.

- Yana da mahimmanci a fahimci cewa sigina da layin MACD siginar sigina ce mai lalacewa saboda ya dogara da motsin farashi ko da yake ita ce mafi mahimmancin siginar mai nuna alama.

- A duk lokacin da aka sami siginar giciye sama da ma'aunin nunin sifili, yana nuna yanayin kasuwa mai girman gaske kuma idan siginar giciye tana ƙasa da ma'aunin nunin sifili, yana nufin kasuwa tana cikin yanayi mara kyau.

- Bugu da ƙari kuma, mafi girman nisa tsakanin layin layi, alama ce ta ƙarfi a cikin motsin farashi zuwa wata hanya ta musamman.

- Mafi girman nisa tsakanin layin layi (MACD da siginar sigina) sama ko ƙasa da layin nunin sifili yawanci ana gani tare da daidaitaccen haɓakar nisa tsakanin EMA akan ginshiƙi farashin.

- Lokacin da lokacin 12 na EMA ya kasance sama da lokacin EMA na 26, ana ɗaukar siginar giciye na layi mai kyau; in ba haka ba, ana ɗaukar crossover a matsayin mara kyau.

- Ana iya rage yawan siginar giciye ta hanyar haɓaka ƙimar shigarwa don layin siginar, wannan zai taimaka don guje wa tarin siginar ƙarya.

- Histogram koyaushe yana karanta tabbatacce lokacin da layin MACD ke sama da layin sigina kuma akasin haka yana karanta korau lokacin da layin MACD ke ƙasa da layin siginar. Wannan yana ba MACD halaye na oscillator.

- A ƙarshe, 'convergence' shine kalmar da aka yi amfani da ita don tabbatar da yanayin da ake ciki lokacin da farashin farashin, layin MACD da kuma tarihin suna kan hanya ɗaya. Sabanin haka, 'banbanci' shine kalmar da aka yi amfani da ita don tabbatar da cewa yanayin yana raguwa lokacin da farashin farashin ya kasance a cikin kishiyar hanyar zuwa layin MACD da kuma tarihin tarihi.

Hoto 2: Misalin haɗin kai na MACD da rarrabuwa

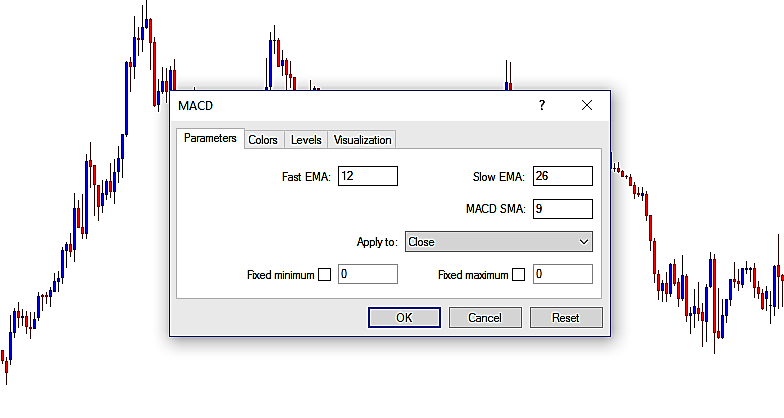

KAFA ALAMOMIN MACD

'Yan kasuwa dole ne su bi tsari na asali yayin kafa alamar MACD:

- Zaɓi firam ɗin lokacin da aka fi so.

- Shigar da ma'auni na EMA masu dacewa don wannan lokacin.

- Shigar da madaidaicin MACD SMA don wannan lokacin.

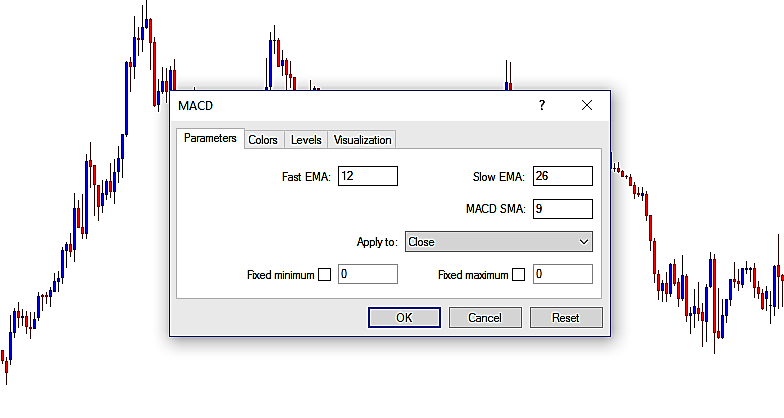

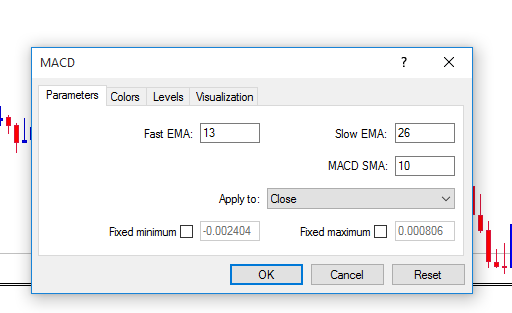

Hoto 3: Saitin Nuni na MACD

Alamar MACD tana da ƙimar tsoho na 12 da 26 madaidaitan motsi masu ƙarfi (EMA) da matsakaicin motsi mai sauƙi na tsawon lokaci (SMA).

Za a iya tweaked saitin tsoho don dacewa da dabarun ciniki daban-daban, salon ciniki da lokutan lokaci.

Misali, matsayi, dogon lokaci ko mai siyar da juzu'i na iya fifita ƙimar shigarwa mai mahimmanci kamar (5, 35, 5) akan ginshiƙi na wata da mako.

Rage ko dai daga cikin EMA guda biyu ko SMA zai ƙara yawan siginar ciniki yayin da karuwa a cikin SMA yana rage adadin siginar giciye ta yadda za ta kawar da tarin siginar ƙarya kuma, yana taimakawa wajen sa ido kan abubuwan da ke faruwa na dogon lokaci.

SAURAN CINIKI NA MACD

Anan akwai hanyoyi daban-daban da dabarun ciniki waɗanda za a iya aiwatar da su tare da alamar MACD.

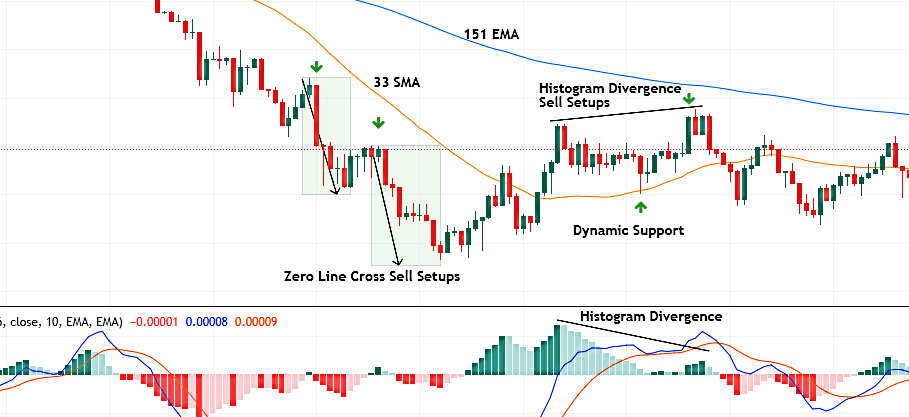

Dabarar 1: Dabarar CROSS EZRA

Wannan shine mafi sauƙi kuma dabarun ciniki na farko don aiwatar da alamar MACD kafin motsawa zuwa hanyoyin hadaddun. Duk lokacin da layin biyu (layin MACD & Layin Sigina) ya ketare ta wurin ma'anar layin sifili daga sama. Yana tabbatar da yanayin bearish don haka saboda haka ana iya aiwatar da odar sayar da kasuwa don riba daga yanayin bearish.

Kuma duk lokacin da layin biyu (layin MACD & Layin Sigina) ya ketare ta wurin ma'anar layin sifiri daga ƙasa. Yana tabbatar da yanayin haɓaka don haka sabili da haka ana iya aiwatar da odar kasuwa don samun riba daga yanayin haɓaka.

Daga cikin duk dabarun ciniki na MACD, wannan shine mafi girman. Don haka, saboda haka, Zai fi kyau a yi amfani da shi azaman haɗaka ko abin tallafi don saitin ciniki.

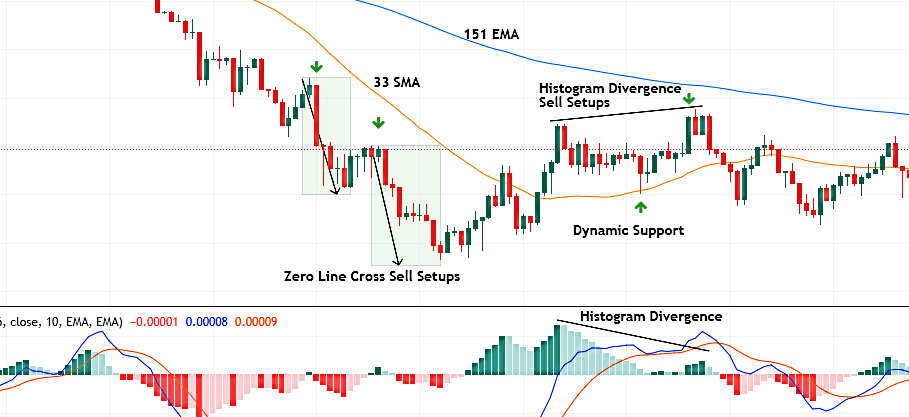

Hoto 4: Misali na MACD Zero Line Cross dabarun ciniki dabarun

Dabarun 2: MACD & SIGNAL LINE CROSSover STRATEGY

Mai nuna alama yawanci yana ba da sigina masu yawa da yawa amma gungun su karya ne. Ta yaya za mu tace daidaitattun saitin da za a iya yiwuwa?

- Da farko, dole ne mu tabbatar da halin da ake ciki don tace siginar da ya dace daidai da ketare da ke aiki tare da son zuciya. Za a iya amfani da dabara ta farko ko wasu fitattun alamomi don tantance alkiblar yanayi.

- Na biyu, za a iya amfani da layin nunin sifili na alamar MACD azaman ginanniyar tacewa don giciye na ƙarya akan sigina. yaya?

Ƙarƙashin layin nunin sifili, la'akari da kowane dogon/saya siginar giciye don zama ƙarya kuma sama da layin nunin sifili, la'akari da kowane gajere ko siyar da siginar giciye ya zama ƙarya.

- Na uku shine tace histogram. Ba kamar madaidaicin 'dabarun giciye' sifili ba, siginar histogram yawanci suna da tasiri sosai kuma suna gaba da motsin farashi. Wannan shine abin da ya sa ya zama muhimmin sashi na alamar MACD.

Ƙaruwa na histogram a tsayi yayi daidai da ƙarfin farashi zuwa wani shugabanci kuma raguwar histogram daga tsayin daka yana nufin canji a farashin farashin yana nan kusa.

Hoto 5 5: Layin MACD & Siginar siginar siginar siginar siyan saitin saitin

Anan ga taƙaitaccen tsarin ciniki na dabarun ciniki na MACD da Layin Sigina

- Ƙayyade idan farashin yana tasowa da kuma alkiblar Trend.

- Don dogon saitin, layin siginar dole ne ya haye sama da layin MACD a saman ma'aunin nunin sifili.

- Don ɗan gajeren saitin, layin siginar dole ne ya haye ƙasa da layin MACD a ƙarƙashin ma'anar sifili.

- Idan (2) ya tabbata. Yi matsayi mai tsawo lokacin da histogram ya fara raguwa daga kololuwar da ke ƙasa da layin sifili.

- Idan (3) ya tabbata. Yi ɗan gajeren matsayi lokacin da histogram ya fara raguwa daga kololuwar da ke sama da layin sifili.

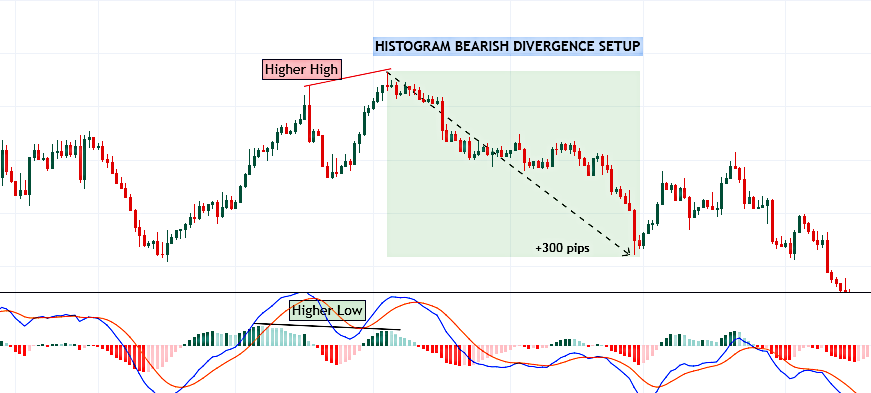

DABARA 3. SABABBIN BANBANCIN HISTOGRAM

Mun yi magana kawai game da histogram kasancewa muhimmin sashi na alamar MACD. Hakanan ana amfani da ita don gano rarrabuwar kawuna watau lokacin da farashin kadari ko nau'in kuɗi ya yi daidai da na alamar fasaha.

A cikin yanayin MACD, ana ganin saitin bambance-bambancen bullish lokacin da farashin ke yin sabon jujjuya ƙasa (ƙananan ƙasa) kuma tarihin ya kasa yin ƙarancin ƙasa daidai. Wannan misali ne na babban saitin bullish mai yiwuwa.

Hoto na 6 6: Misalin saitin sayan bambancin MACD

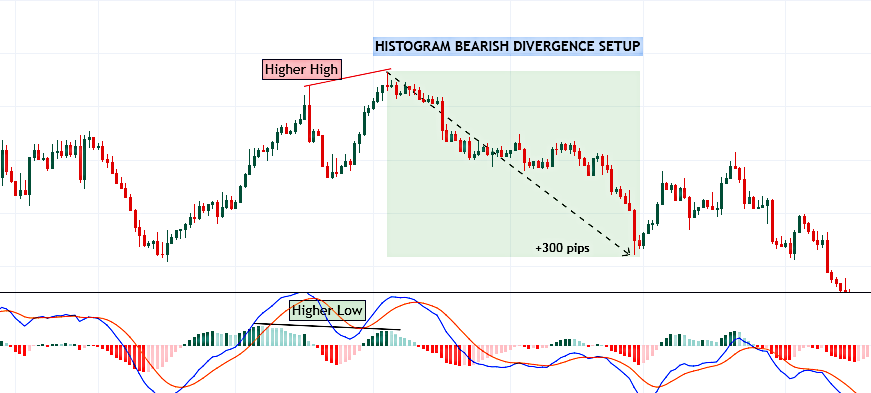

Ana ganin saitin bambance-bambancen bearish lokacin da farashin ke yin sabon girma (ƙananan ƙasa) kuma histogram ya kasa yin tsayi mai tsayi daidai. Wannan misali ne na babban saitin bearish mai yuwuwa.

Hoto 7 7: Misalin saitin siyar da bambancin MACD

Saitin rarrabuwar kawuna dangane da yanayin da ake ciki ba shi yiwuwa kuma ba abin dogaro ba saboda rarrabuwar kawuna ba zai haifar da juye-juye nan take ba duk da cewa ana amfani da dabarar wani lokaci don nuna alamar canji a cikin dogon lokaci.

Dabarar ta 4: WUCE SOYAYYA DA WUYA

Wannan dabara ce mai ma'ana don sarrafa riba da saitin juyawa.

Babban bambance-bambancen tsakanin layin MACD da layin siginar yana nufin cewa farashin yana cikin yanayin da aka yi sama da ƙasa ko kuma an sayar da shi, don haka akwai babban damar gyara farashin. Don haka, duk wani ciniki mai gudana a cikin yanayin da aka yi fiye da kima ko aka sayar da shi ya kamata a rushe shi.

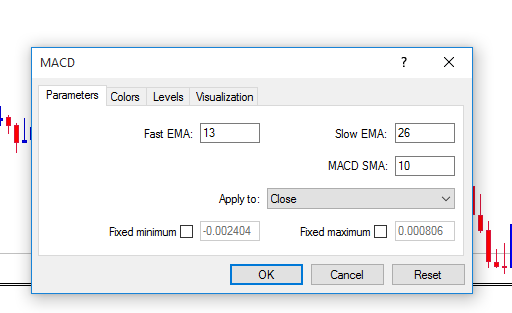

Dabarar 5: MACD MINTI 1 SCALPING HANYAN CINIKI

Scalping a cikin forex salon ciniki ne na ɗan gajeren lokaci wanda ke da nufin haɓaka ƙananan ribar da aka samu daga ƙananan motsin farashi. Dabarar ƙetare layin sifili, MACD & Siginar Siginar dabarun crossover, histogram, rarrabuwa, oversold da dabarun oversold za a iya amfani da su don fatarar kasuwancin forex da riba akan ƙananan firam ɗin lokaci.

Ko da yake dabarun ba su dace da ɓata lokaci ba, ana iya keɓance tsoffin sigogi don haɓaka riba lokacin da ake yin tsinkaya akan ƙananan lokutan lokaci. Hakanan za'a iya aiwatar da wasu kayan aikin tallafi don dalilai masu haɗawa.

Scalper yakamata ya keɓance tsoffin sigogin shigarwar MACD zuwa 13, 26, 10.

Sauran abubuwan tallafi da aka aiwatar a cikin wannan dabarun shine babban yanki mai yuwuwar lokaci da matsakaicin motsi 2. Yankunan lokaci masu yuwuwa: Don rage lokacin da aka kashe akan ginshiƙi don neman ingantaccen saitin siginar giciye, mafi dacewa don cinikin wannan saitin shine zaman London (2 - 5am EST) da zaman New York (7 - 11am EST).

Matsakaicin motsi guda 2: Matsakaicin motsi na 2 da aka yi amfani da su shine 151 EMA da 33 SMA, duka biyun suna aiki azaman tallafi mai ƙarfi da juriya.

Hoto 9: Misalin haɗin MACD da rarrabuwa

Hoto 9: Scalping damar a kan ƙaramin lokaci: 1 min MACD dabarun tsinkewa

Ana tsammanin kasuwar za ta kasance mai girma a duk lokacin da farashin ya kasance sama da 151 EMA a matsayin tallafi kuma ya kamata a yi la'akari da dogon saiti. Ana tsammanin kasuwar za ta kasance mai rauni a duk lokacin da farashin ke ƙasa da 151 EMA azaman juriya kuma kawai siyar da saitin ya kamata a yi la'akari.

KALUBALES NA HANYOYIN CININ MACD BANBANCIN

Tabbas, akwai fa'idodi da yawa na ciniki tare da MACD amma kamar sauran alamomin, ba cikakke bane. Akwai ƴan rashin amfani ga yin amfani da MACD.

- MACD yana da tasiri sosai a matsayin mai nuna alama da haɓaka don haka amfanin sa yana iyakance ga kasuwanni masu tasowa.

- Ɗaya daga cikin manyan lahani na MACD shine cewa yana ba da sigina daga baya fiye da motsin farashin. Wannan saboda matsakaita masu motsi sun dogara ne akan bayanan farashin baya.

- Bugu da ƙari, MACD ba ya samar da asarar tsayawa da aka shirya don amfani ko ɗaukar matakan riba.

- Alamun juyar da bambance-bambance ba koyaushe suke aiki ba kuma baya hasashen duk juyowa.

KAMMALAWA

Yana da mahimmanci cewa yan kasuwa suyi amfani da alamar MACD da dabarun sa cikin nasara akan asusun demo kafin cinikin kuɗi na gaske. Mahimman fahimtar matsakaita motsi zai taimaka wa mai ciniki ya yi amfani da alamar MACD don kyakkyawan sakamako.

Danna maɓallin da ke ƙasa don Zazzage mu "Mene ne dabarun MACD" Jagora a cikin PDF