Mene ne mafi kyau Trend bin nuna alama

Kasuwannin kuɗi suna da alamomin ciniki iri-iri waɗanda ke ba da dalilai daban-daban. Waɗannan alamomin suna taimakawa don yin nazari, ciniki da riba daga yanayin motsin farashin da ke canzawa koyaushe.

Yana da matukar muhimmanci a rarraba waɗannan alamun bisa ga manufar da suke aiki da kuma yanayin kasuwa wanda suke da amfani duka biyu don nazarin motsi na farashi da alamun kasuwanci.

A cikin wannan labarin, za mu sake nazarin manyan biyar mafi kyawun abubuwan da ke biyo baya waɗanda kowane ɗan kasuwa na yau da kullun zai iya aiwatar da kansa da kansa kuma ya haɓaka cikin dabarun bin dabarun zamani.

Kasuwancin Trend tare da halin yanzu na motsin farashi ya tabbatar da zama mafi kyawun fasaha na ciniki saboda kawai cinikai da aka yi la'akari da su sosai shine saitin ciniki a cikin jagorancin yanayin.

Don haka yin amfani da dabarar da ta dace tare da saitin ciniki mai kyau a cikin yanayin yanayin koyaushe zai kasance yana da motsi mai fashewa kuma ba a ma maganar ba, yanayin kuma zai iya ba da belin ɗan kasuwa daga saitin ciniki mara kyau.

Ta hanyar ma'anar, ana iya siffanta ciniki na zamani azaman nazari da ciniki da ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun lokaci a cikin hanya ɗaya don kama manyan riba mai yuwuwa.

Gabaɗayan jagorar motsin farashi ko dai sama ko ƙasa akan kowane lokaci ana magana da shi azaman yanayi sannan kuma 'yan kasuwa masu tasowa, suna nazarin kadara a cikin haɓaka don mafi girman saitin ciniki mai yuwuwa sannan kuma bincikar kadari a cikin ƙasan ƙasa don mafi girman yuwuwar bearish. saitin ciniki.

Don yin ciniki da kyau da kuma riba daga haɓakawa ko raguwa tare da cikakkiyar shigarwar ciniki da fita, yana da mahimmanci cewa 'yan kasuwa masu cin kasuwa suyi amfani da amfani da yanayin da ke biyo bayan alamun saboda suna da amfani ga 'yan kasuwa masu tasowa ta hanyoyi da dama.

- Suna faɗakar da manazarcin fasaha game da yanayin da ke tafe ko koma baya da ke tafe.

- Sun gano kololuwar motsin farashi mai tasowa.

- Bayar da saitunan ciniki mai yiwuwa mai yiwuwa.

- Suna ƙoƙari su hango gajeriyar jagorar farashi na gajere da na dogon lokaci.

- Suna ba da ƙarin tabbaci ga siginar kasuwanci daga tsarin farashi da sauran alamun fasaha.

Ciniki styles da ciniki mutane yi bambanta don haka, kowane nuna alama tushen mai ciniki zai fi son daban-daban irin Trend bin nuna alama.

Amma don haɓaka dabarun da ke biyo baya na ƙarshe, yana da matuƙar mahimmanci cewa ƴan kasuwa na yau da kullun su haɗu da alamu biyu ko fiye masu zuwa don ƙarin tabbatarwa da dalilai masu haɗuwa.

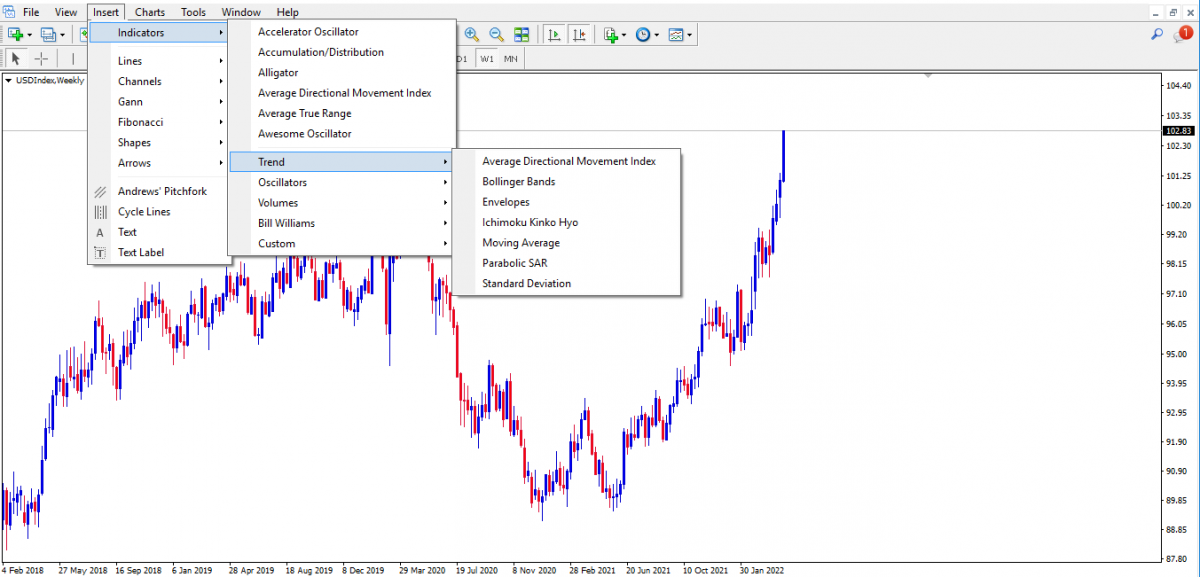

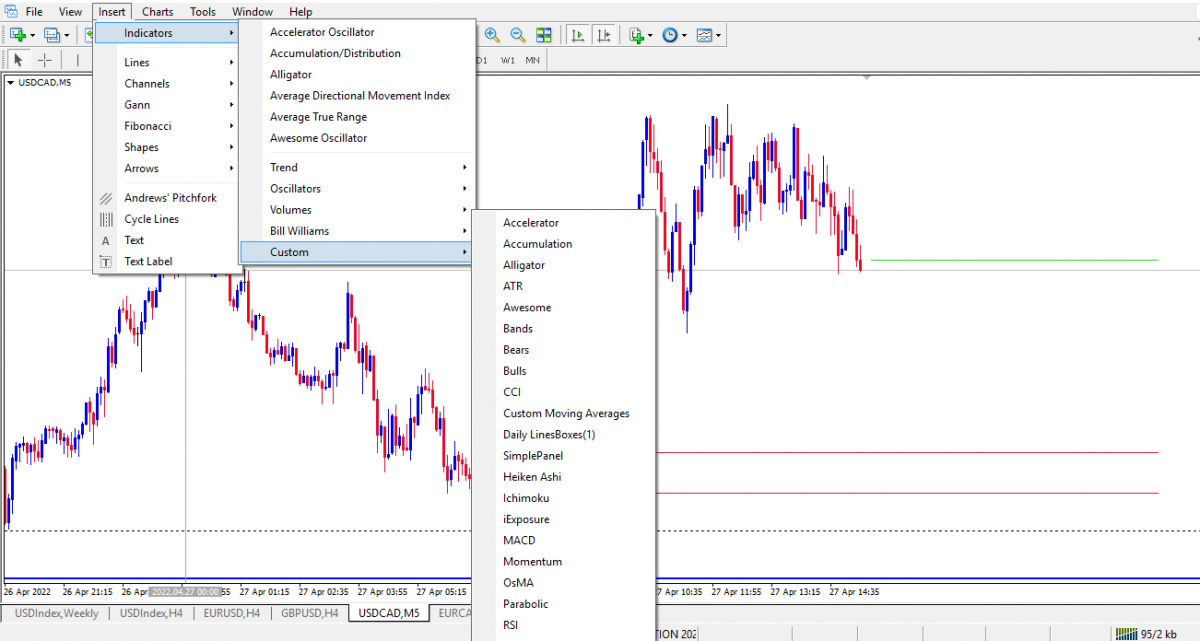

Yadda za a gano mafi kyawun yanayin ku bin nuna alama akan MetaTrader (MT4)

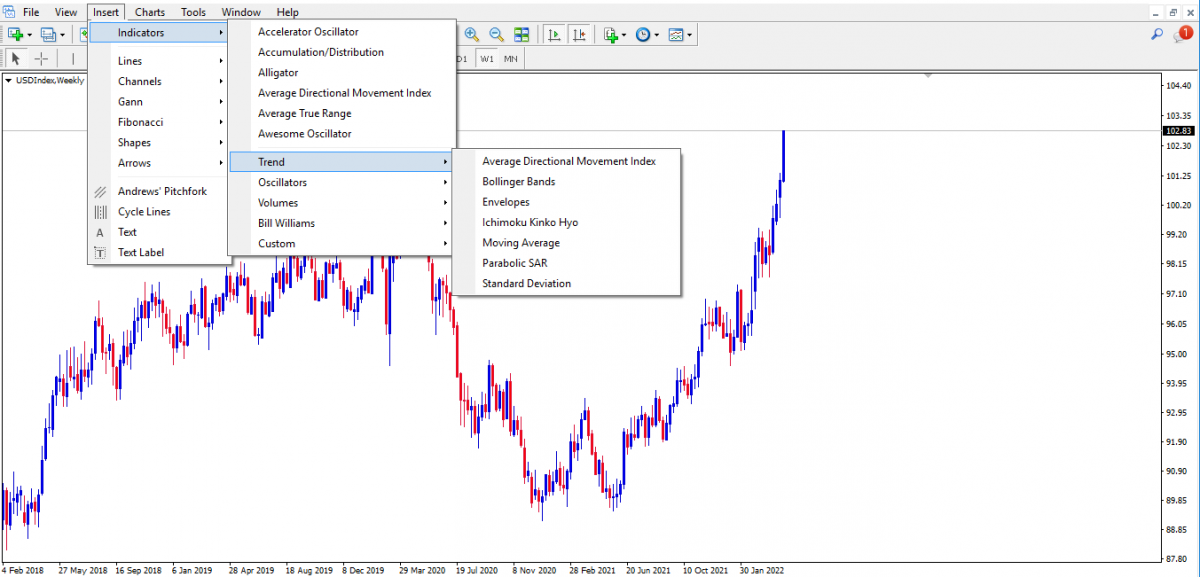

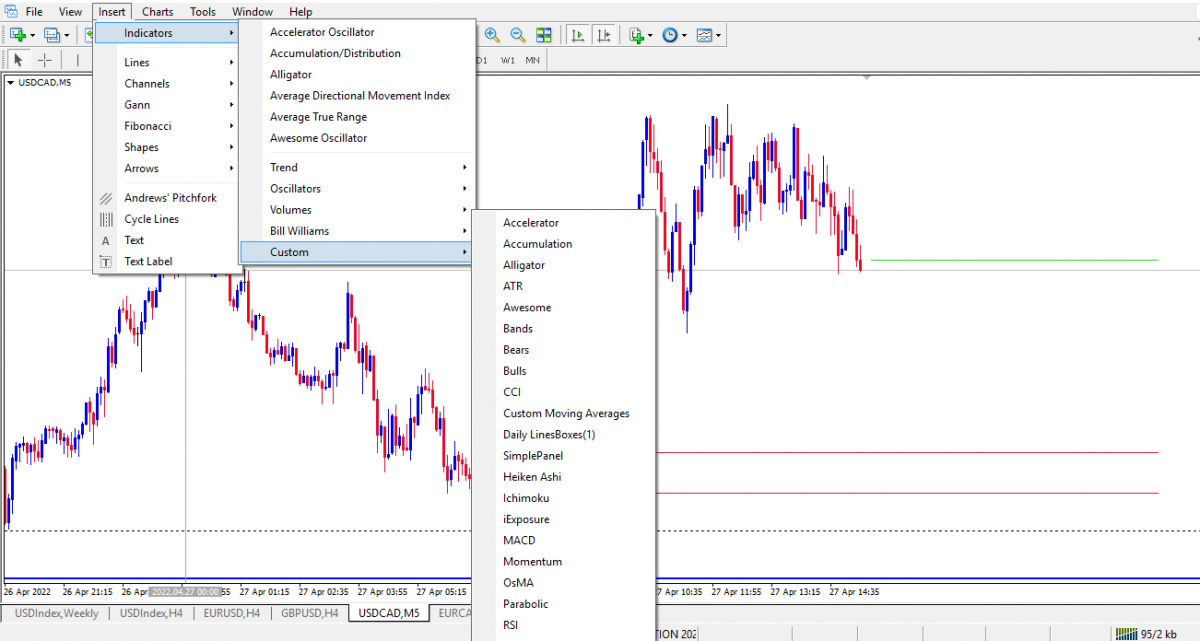

Nemo kuma danna kan 'saka' a saman kusurwar hagu na allonku.

Na gaba, danna kan 'indicator'. Za a nuna ƴan alamomi da wasu nau'ikan masu nuni.

Baya ga ƙayyadaddun alamomin yanayi, akwai alamomi a cikin sauran nau'ikan da ke aiki mafi kyau a matsayin alamun masu biyo baya.

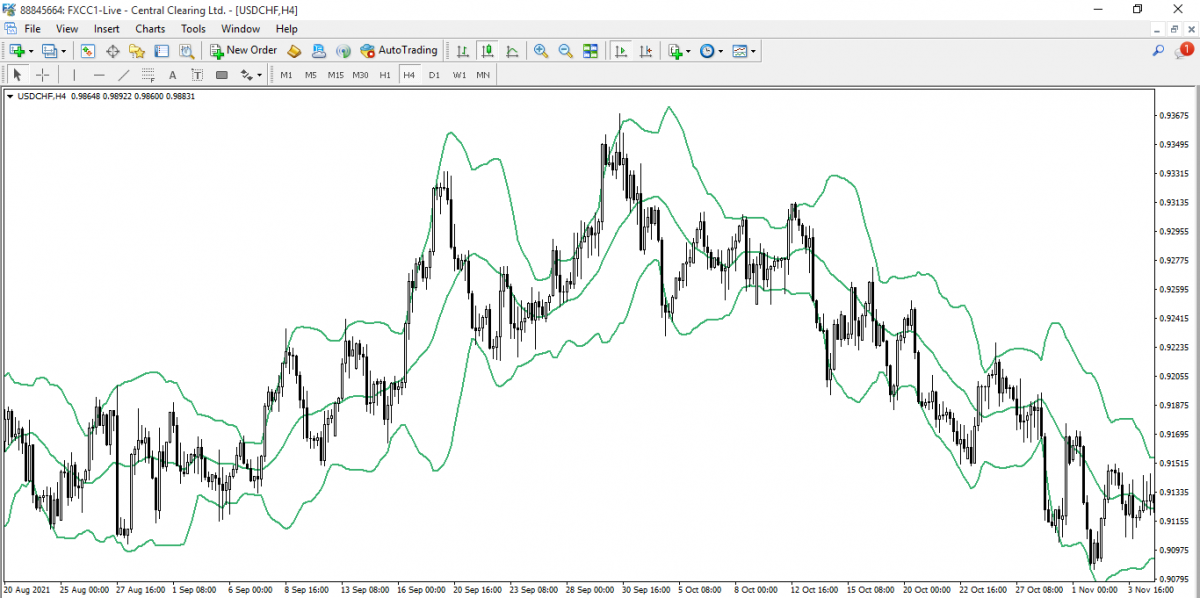

Hoton alamu masu biyo baya

Wasu daga cikin waɗannan alamu masu biyowa an ƙirƙira su akan motsin farashi don haka suna nuna sigina na siyarwa sama da motsin farashi da siyan sigina ƙasa motsi farashin. Ana nuna wasu alamu masu biyowa a ƙasan ginshiƙi farashin, auna ƙarfin motsin farashin yawanci tsakanin ma'aunin 0 zuwa 100 ko a tsakiyar layin 'sifili', don haka samar da sigina, bearish da divergences.

Mafari da masu sha'awar 'yan kasuwa dole ne su fara zaɓar mafi kyawun alamar su mai biyowa sannan su ƙara alamomi ɗaya ko biyu don fito da dabarun ciniki na ƙarshe.

Don wannan dalili, dole ne mu sake duba duk yanayin da ake da shi na bin alamomi kuma mu bambanta tsakanin raguwa da manyan alamomi.

Ko da yake mafi yawan abubuwan da ke biyo baya suna raguwa kuma wasu daga cikinsu suna aiki azaman duka lagging da manyan alamomi.

Anan akwai jerin manyan 5 mafi kyawun abubuwan da ke biyo baya

- motsi Averages

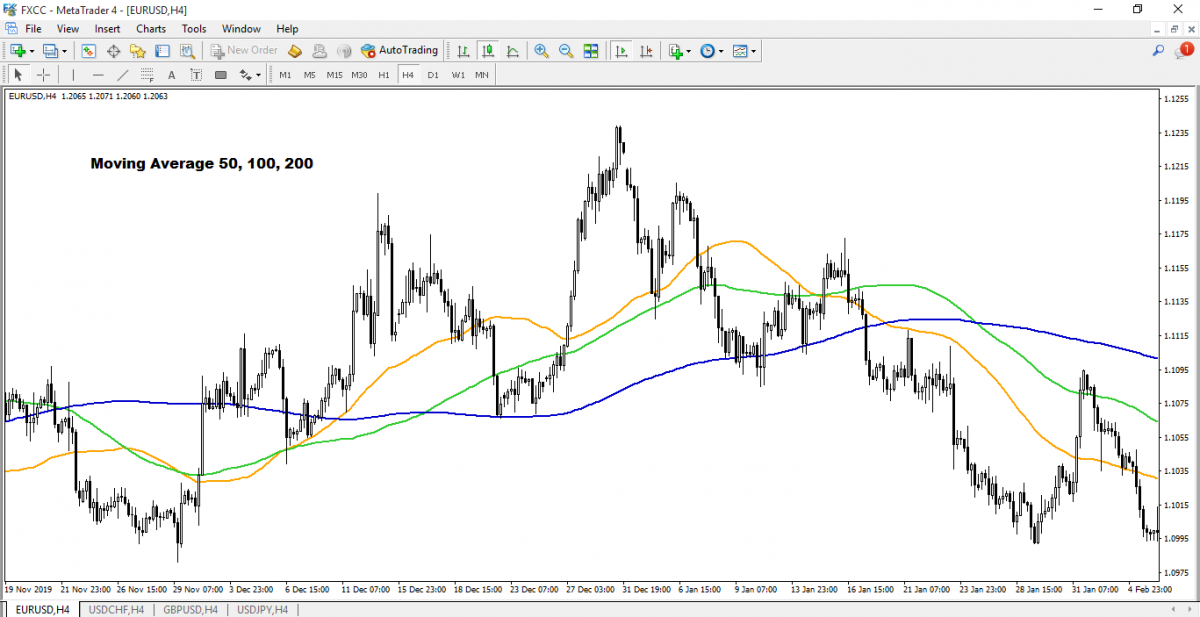

Matsakaicin matsakaita shine tabbas mafi mashahuri kayan aikin bincike na fasaha don gano abubuwan da ke faruwa a cikin motsin farashi. Suna zuwa ta hanyoyi daban-daban kamar yadda aka lissafa a ƙasa

- sauƙi mai sauƙi a matsakaici

- ƙarancin ƙaƙƙarfan motsi

- Matsakaicin motsi mai laushi

- madaidaicin ma'aunin nauyi mai motsi

Waɗannan hanyoyi daban-daban na matsakaita motsi duk suna bin ka'ida ɗaya akan ginshiƙi farashin.

Lokacin da aka ƙirƙira su akan ginshiƙi farashin, yawanci layi ɗaya ne ke wakilta su wanda ke sassaukar da ma'anar motsin farashi akan ƙayyadaddun lokaci yadda ya kamata yana kawar da bambance-bambancen hauhawar farashin bazuwar a kowane tsarin lokaci.

Matsakaicin matsakaicin motsi mai sauƙi da matsakaicin motsi mai faɗi shine mafi yawan amfani da matsakaicin hanyoyin motsi. Bambanci tsakanin hanyoyin matsakaita masu motsi guda biyu shine cewa matsakaicin matsakaicin motsi wanda kuma ake magana da shi a matsayin 'matsakaicin matsakaicin nauyi' yana amsawa da sauri ga canje-canjen farashin don haka samar da sigina da siyayya da wuri saboda yana mai da hankali kan bayanan farashin kwanan nan fiye da jerin bayanai masu tsayi. maki a matsayin matsakaicin motsi mai sauƙi yana buƙata.

Anan akwai ainihin ayyuka na matsakaicin matsakaicin motsi

- Suna gano yanayin ta hanyar gangara na matsakaita mai motsi akan motsin farashi.

- Suna ba da tallafi mai ƙarfi da matakan juriya sama da ƙasa motsin farashi don sigina da siyarwa.

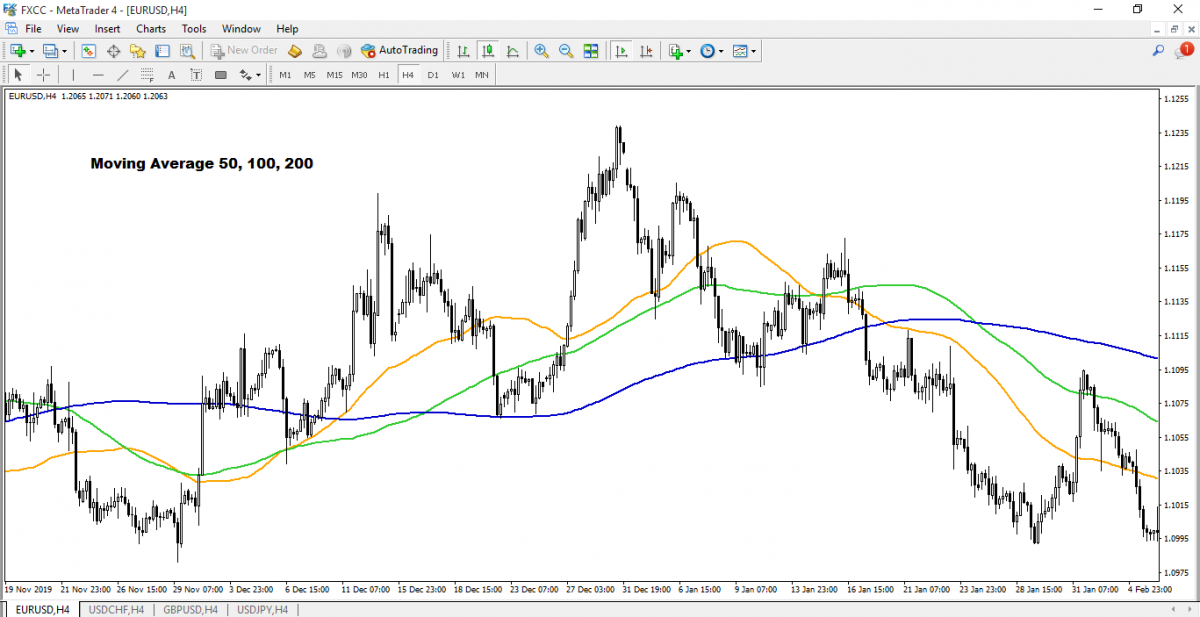

- 'Yan kasuwa da masu nazarin fasaha kuma za su iya haɗa 2 zuwa 3 matsakaita masu motsi a kan farashin farashin don samar da sigina na sigina tare da matsakaicin matsakaicin matsakaici da kuma sayar da sigina tare da matsakaicin matsakaicin matsakaici.

'Yan kasuwa na dogon lokaci sun fi son amfani ko haɗa ko dai 50, 100, ko 200 matsakaita masu motsi

'Yan kasuwa na ɗan gajeren lokaci da masu saɓo sun fi son amfani ko haɗa ko dai 10, 20 ko 33 matsakaita masu motsi

Haɗin madaidaicin motsi biyu ko fiye da duk ayyuka don samar da ingantaccen saitin ciniki na iya yin mafi kyawun yanayin bin dabarun.

- Dangi Ƙarfin Index

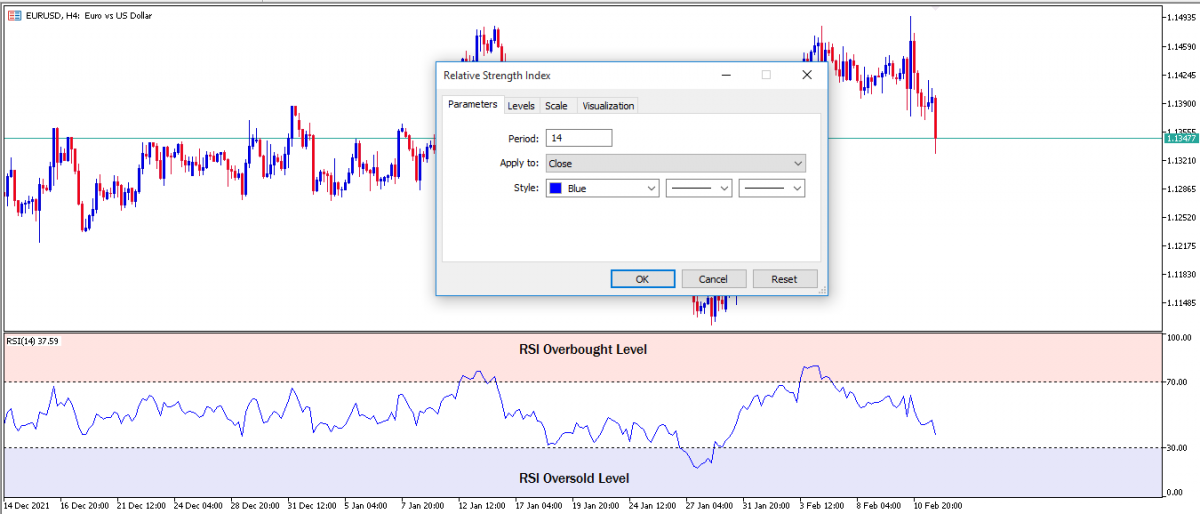

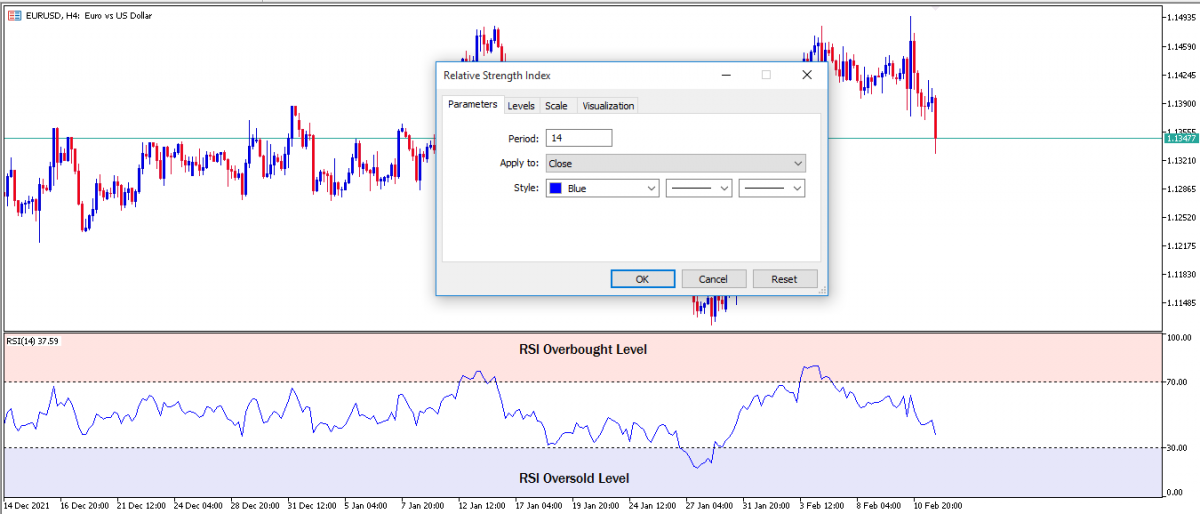

RSI alama ce ta musamman wacce ke ba da labari da yawa game da haɓakawa da yanayin motsin farashi ta hanyar auna ƙarfin sauye-sauye na kwanan nan a cikin motsin farashin.

Ana fassara RSI ta hanyar layi mai motsi guda ɗaya a cikin ma'auni na 0 zuwa 100 wanda aka fassara azaman wanda aka yi sama da matakin 70 kuma an yi sama da ƙasa da matakin 30.

An ƙididdige layin da ke wakiltar ƙarfin ƙarfin ƙarfin motsi na farashi tare da tsoho lokacin duba baya na 14. Za'a iya daidaita saitin shigarwa na lokacin duba baya don samar da sigina kaɗan ko fiye.

Siginar da aka yi fiye da kima da sigina na alamar RSI tana hidima iri-iri a kasuwa mai tasowa.

A cikin haɓakawa, RSI yana karanta oversold lokacin da retracement na bearish ya ƙare kuma babban yuwuwar haɓakar haɓaka yana nan gabatowa.

A lokaci guda kuma, RSI na iya karanta abin da aka yi fiye da kima, alamar da ke nuna yuwuwar sake dawowa ko juyewa daga yunƙurin farashi mai tasowa.

A cikin raguwar yanayin ƙasa, RSI yana karanta abin da aka siyo da yawa lokacin da ɗimbin yawa ya ƙare kuma babban yuwuwar faɗaɗa bearish yana nan kusa.

A lokaci guda kuma, RSI na iya karanta oversold, alama ce mai nuna yuwuwar ja da baya ko ja da baya daga hauhawar farashin farashi.

Siginar rarrabuwar kawuna kuma babban ra'ayi ne mai yuwuwa na RSI da aka yi amfani da shi don gano sauye-sauye na dabara tsakanin wadata da bukatar mahalarta kasuwa.

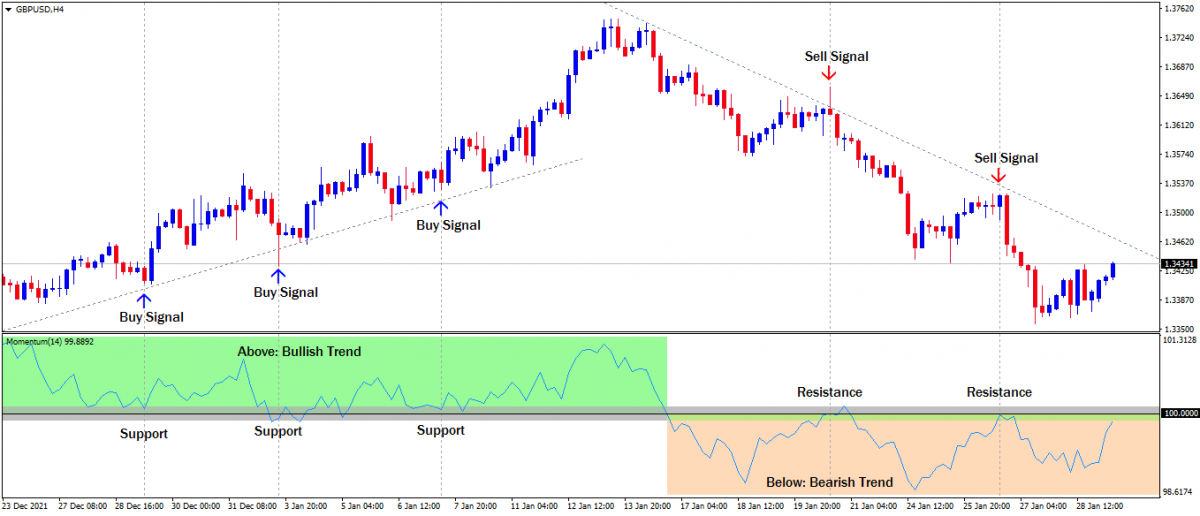

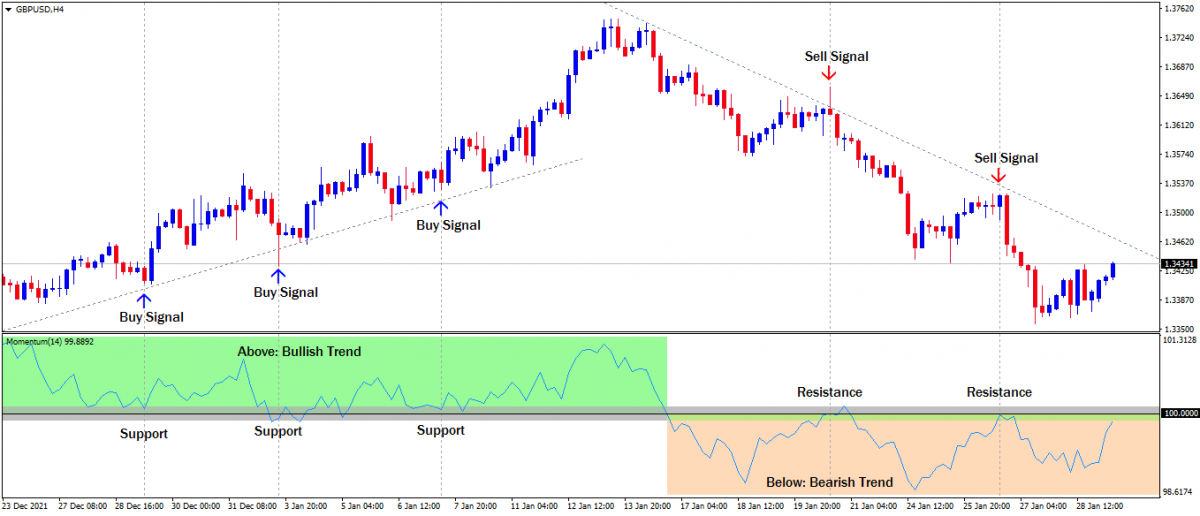

- Alamar lokaci

Wannan wata alamar girgiza ce ta musamman wacce ke auna ƙarfin motsin farashi ta hanyar kwatanta farashin rufewa na baya-bayan nan zuwa farashin rufewar baya daga kowane ƙayyadaddun lokaci.

Alamar ƙuri'a tana amfani da layin kwance na matakin matakin 100 (madaidaicin ma'anar magana) azaman tushe don siginar ƙaranci da bearish.

Idan layin ma'aunin motsi ya tashi sama da maki 100 matakin yana nuna haɓakawa. Idan layin ya faɗi ƙasa da maki 100 matakin yana nuna raguwa.

Idan ƙasa da madaidaicin matakin 100, layin nuna alama ya fara tashi. Wannan ba yana nufin jujjuyawar koma baya ba kai tsaye. Yana ba da shawarar cewa yanayin bearish na yanzu ko haɓakawa zuwa ƙasa yana raguwa.

Dabarun bin dabarun yin amfani da ma'anar motsi sun haɗa da masu zuwa

100 matakin tunani point crossover dabarun.

- Sayarwa a madaidaicin juzu'i da ke ƙasa da matakin matakin 100

- Sayi a babban giciye sama da matakin matakin 100

Dabarar da aka yi fiye da kima da kima

- A cikin haɓaka, saya lokacin da mai nuna alama ya karanta oversold

- A cikin yanayin ƙasa, siyarwa lokacin da mai nuna alama ya karanta abin da aka sayo

Dabarun ciniki na bambance-bambance

- Sayarwa a siginar rarrabuwar kawuna

- Saya a siginar rarrabuwar kawuna

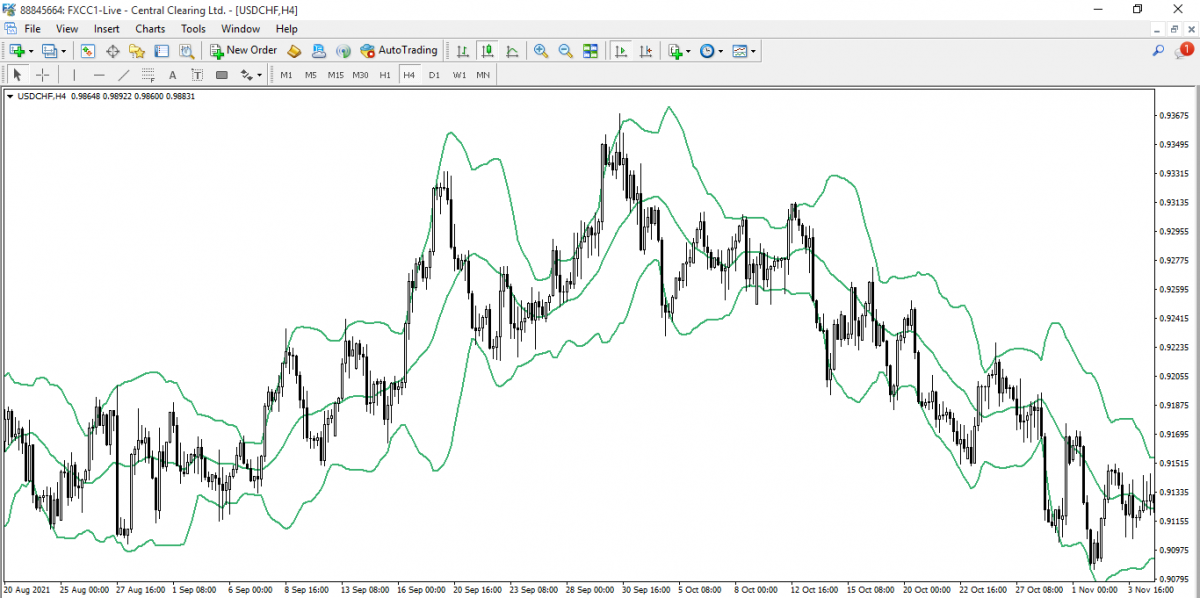

- Bollinger makada

Ƙungiyoyin Bollinger suna yin yanayi na musamman suna biye da nuna alama a cikin cewa yana aiki azaman duka jagora da mai nuna alama.

Mai nuna alama yana da tsarin ambulaf mai kama da tashoshi wanda ya ƙunshi ƙididdiga na sama da ƙananan matsakaitan motsi da matsakaicin motsi mai sauƙi a tsakiya.

Yana auna dangantakar dake tsakanin motsin farashi da rashin daidaituwar wani kadara ko biyu na forex na tsawon lokaci.

Bollinger Bands squeeze da breakout dabarun ciniki ne wanda za'a iya amfani dashi don hango ko hasashen alkiblar da ke tafe.

Mai nuna alama yana gano kasuwa mai tasowa ta hanyar haɓaka nisa tsakanin layi na sama da ƙasa na ƙungiyar.

'Yan kasuwa za su iya ƙara amfani da matsakaicin motsi mai sauƙi a tsakiyar tashar don ƙayyade mahimmin shugabanci na motsin farashi kuma idan kadara ko nau'in forex a zahiri yana tasowa ko a'a.

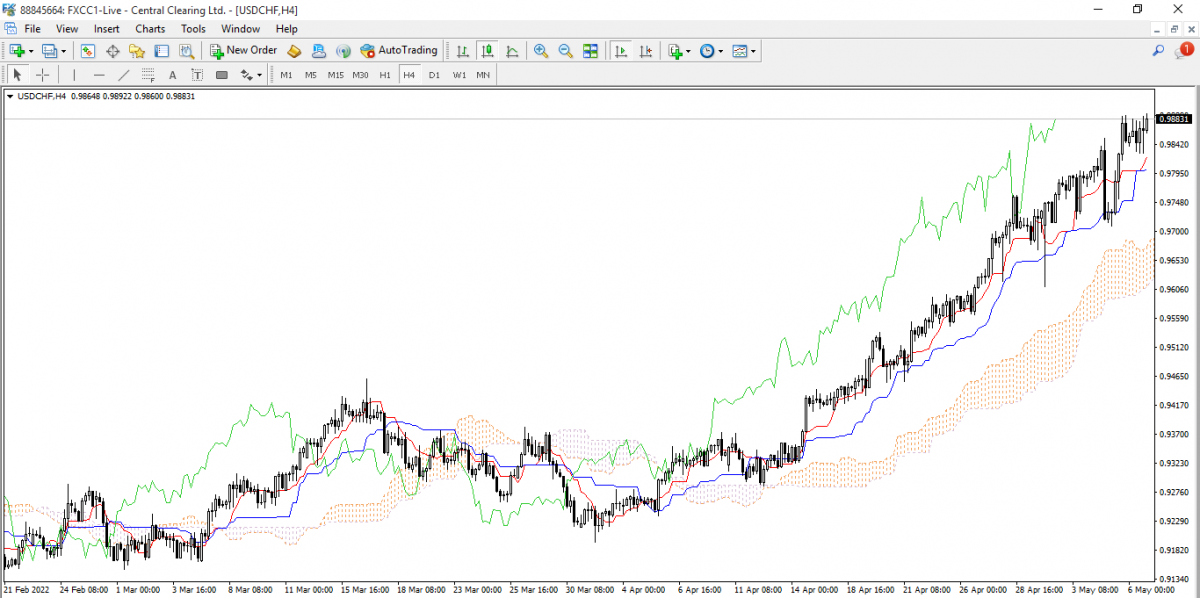

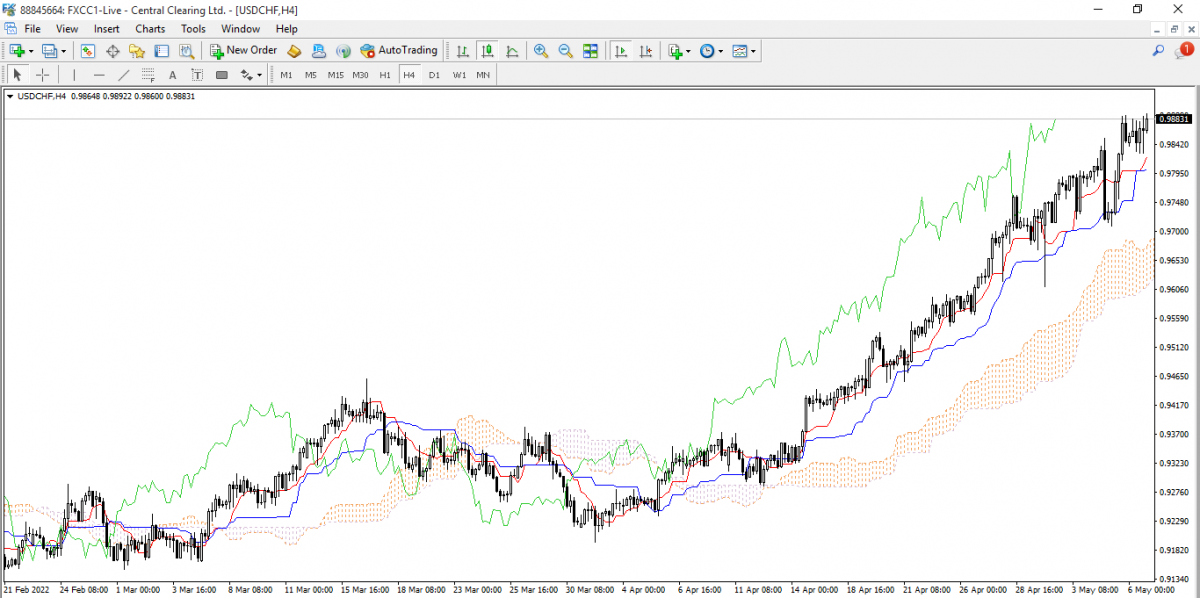

- Alamar girgije Ichimoku:

Har ila yau, an san shi da "Ichimoku Kinko Hyo", yana da halaye masu kama da Bollinger Bands.

Gajimare na Ichimoku yana aiki azaman mai nuna alama mai biye da ƙwaƙƙwaran da aka yi amfani da shi don gano babban damar kasuwanci a cikin ƙaƙƙarfan kasuwa mai tasowa ta hanyar nuna matakan farashi na tallafi da juriya.

Mai nuna alama yana da wasu abubuwan fasaha masu ban sha'awa waɗanda ke sanya shi tsarin ciniki da kansa. Abubuwan fasaha sun haɗa da Cloud, layin juyawa da aka sani da Tenkan Sen, tushen tushe da aka sani da Kijun Sun, da kuma layin launin kore wanda aka sani da Chikou Span.

Ana la'akari da ɗayan mafi kyawun yanayin bin alamomi.

Kammalawa

Kamar yadda sanannen magana ke faɗi, babu Mai Tsarki Grail a cikin ciniki na forex. Wannan ya ce alhakin ɗan kasuwa ne don haɓaka dabarun kasuwancinsa na ƙarshe wanda ya haɗa mafi kyawun alamu masu biyowa kamar yadda aka bayyana a sama tare da ɗaya ko biyu wasu alamomi masu zuwa.

Danna maɓallin da ke ƙasa don Zazzage mu "Mene ne mafi kyawun yanayin bin alamar" Jagora a cikin PDF