Isilinganiso sebanga langempela ku forex

Ukuhweba nge-Forex kuwumsebenzi oyinkimbinkimbi odinga abahwebi ukuthi bahlaziye izici ezihlukahlukene zemakethe ukuze benze izinqumo ezinolwazi. Enye yezinto ezinjalo ezingasiza abathengisi baqonde ukuntengantenga kwezimakethe futhi balawule ubungozi I-Average True Range (ATR). I-ATR inkomba yobuchwepheshe esetshenziswa ukukala izinga lokuguquguquka kwentengo emakethe. Yathuthukiswa ngu-J. Welles Wilder Jr. ngeminyaka yawo-1970 futhi isibe yithuluzi elidumile labadayisi.

I-ATR iyithuluzi elibalulekile labahwebi njengoba ibasiza ukukhomba amathuba emakethe angenzeka kanye nezingozi. Ngokulinganisa ukuntengantenga kwemakethe, abahwebi bangakwazi ukunquma izinga lengozi elihlobene nohwebo oluthile. Lolu lwazi lungase lusetshenziselwe ukusetha amazinga okulahlekelwa nokuthatha inzuzo, ukusiza abahwebi ukuthi balawule ubungozi babo ngempumelelo. Ukwengeza, i-ATR ingasetshenziswa ukukhomba izitayela emakethe nokudala amasu okuhweba asizakala ngalezi zindlela.

U-J. Welles Wilder Jr. uthuthukise inkomba ye-ATR njengengxenye yochungechunge lwakhe lwamathuluzi okuhlaziya lobuchwepheshe, okuhlanganisa i-Relative Strength Index (RSI) kanye ne-Parabolic SAR. I-ATR yakhelwe ukusiza abahwebi ukuthi balinganise ukuntengantenga kwemakethe futhi benze izinqumo ezinolwazi ngokusekelwe kulolu lwazi. Kusukela ekuthuthukisweni kwayo, i-ATR isiphenduke ithuluzi elidumile labadayisi ezimakethe ezihlukahlukene, kuhlanganise nokuhweba kwangaphambili. Ngokukhula kobuchwepheshe kanye nokutholakala kwesofthiwe yokuhweba, i-ATR isifinyeleleke kakhulu kunanini ngaphambili, okwenza kube lula kubathengisi ukusebenzisa le nkomba kumasu abo okuhweba.

Incazelo yefomula ye-ATR.

Ukuze ubale i-ATR, abathengisi basebenzisa ifomula ethile ecabangela ububanzi bokunyakaza kwentengo esikhathini esimisiwe. Ifomula ye-ATR ithi:

ATR = [(I-ATR x 13 edlule) + Ububanzi Bamanje Bangempela] / 14

Ububanzi beqiniso bukhulu kakhulu kulokhu okulandelayo:

Umehluko phakathi kokuphezulu kwamanje nokuphansi kwamanje

Inani eliphelele lomehluko phakathi kokuvala kwangaphambilini nokuphakama kwamanje

Inani eliphelele lomehluko phakathi kokuvala kwangaphambilini nokuphansi kwamanje.

Isibonelo sokubala kwe-ATR.

Ake sithathe isibonelo ukuze siqonde indlela yokubala i-ATR. Cabanga ukuthi sisebenzisa i-ATR yezikhathi eziyi-14 kanti i-ATR yangaphambilini ibingu-1.5. Umnyakazo wamanje wamanani umi kanje:

Ukuphakama kwamanje: 1.345

Okuphansi kwamanje: 1.322

Ngaphambilini kuvalwe: 1.330

Sisebenzisa ifomula, singabala ububanzi bangempela bamanje ngale ndlela elandelayo:

Umehluko phakathi kokuphakama kwamanje nokuphansi kwamanje: 1.345 - 1.322 = 0.023

Inani eliphelele lomehluko phakathi kokuvala kwangaphambilini nokuphakama kwamanje: |1.345 - 1.330| = 0.015

Inani eliphelele lomehluko phakathi kokuvala kwangaphambilini nokuphansi kwamanje: |1.322 - 1.330| = 0.008

Inani elikhulu lalezi ngu-0.023, okuwububanzi bangempela bamanje. Ukuxhuma leli nani kufomula ye-ATR, sithola:

I-ATR = [(1.5 x 13) + 0.023] / 14 = 1.45

Ngakho-ke, inani lamanje le-ATR lingu-1.45.

Ukubaluleka Kokuqonda Ukubalwa kwe-ATR.

Ukuqonda indlela yokubala i-ATR kubalulekile kubahwebi njengoba kubasiza ukuthi bahumushe amanani ale nkomba ngendlela efanele. Ngokwazi ukuthi i-ATR ibalwa kanjani, abahwebi bangenza izinqumo ezinolwazi ngokusekelwe ekuguquguqukeni kwamanje kwemakethe. Isibonelo, uma inani le-ATR liphezulu, libonisa ukuthi imakethe ibhekene nokuntengantenga okuphezulu, futhi abathengisi bangase badinge ukulungisa amazinga abo okulahlekelwa kokuyeka kanye nokwenza inzuzo ngokufanele. Ngakolunye uhlangothi, inani eliphansi le-ATR liphakamisa ukuthi imakethe izinzile, futhi abadayisi bangase badinge ukulungisa amasu abo ngokufanele. Ngakho-ke, ukuqonda ukubala kwe-ATR kubalulekile kubathengisi abafuna ukusebenzisa le nkomba ngokuphumelelayo kumasu abo okuhweba.

Ukuhlonza Ukuguquguquka Kwemakethe Ngokusebenzisa i-ATR.

Ukusetshenziswa okuyinhloko kwe-ATR ekuhwebeni kwe-forex ukukhomba izinga lokuguquguquka kwemakethe. Amanani aphezulu e-ATR akhombisa ukuthi imakethe ihlangabezana nokuguquguquka okukhulayo, kanti amanani aphansi e-ATR aphakamisa ukuthi imakethe izinzile. Ngokuqapha amanani e-ATR, abathengisi bangalungisa amasu abo okuhweba ngokufanele. Isibonelo, uma inani le-ATR liphezulu, abathengisi bangase bacabange ukunweba amazinga abo okulahlekelwa kokuyeka ukuze bagweme ukumiswa ukunyakaza kwemakethe yesikhashana.

Ukunquma Ukuyeka Ukulahlekelwa Futhi Thatha Amazinga Enzuzo Usebenzisa i-ATR.

Okunye ukusetshenziswa okubalulekile kwe-ATR ekuhwebeni kwe-forex ukucacisa amazinga okulahlekelwa nokuthatha inzuzo. Abahwebi bangasebenzisa inani le-ATR ukubala ibanga elifanelekile lokusetha amazinga abo okulahlekelwa kokuyeka kanye nokwenza inzuzo. Indlela evamile iwukusetha ileveli yokulahlekelwa kokuma kuphindaphinda yenani le-ATR. Isibonelo, umthengisi angasetha izinga labo lokulahlekelwa kokuma libe ngu-2x inani le-ATR, okusho ukuthi izinga labo lokulahlekelwa kokuma lizojwayela ukuntengantenga kwemakethe kwamanje. Ngokufanayo, abathengisi bangasetha amazinga abo okwenza inzuzo ngenani eliphindaphindiwe le-ATR ukuze babambe inzuzo kuyilapho bevumela ukuguquguquka okuthile ekunyakazeni kwemakethe.

Amasu Okuhweba Ngokusebenzisa i-ATR.

I-ATR ingasetshenziswa kumasu ahlukahlukene okuhweba ukuthuthukisa ukusebenza kokuhweba. Nazi izibonelo:

Amasu alandelayo: Abahwebi bangasebenzisa i-ATR ukuze baqinisekise amandla ethrendi. Uma inani le-ATR liphezulu, libonisa ukuthi ukuthambekela kunamandla, futhi abadayisi bangase bacabangele ukungena endaweni ende noma emfushane, kuye ngokuthi isiqondiso sini.

Amasu okukhishwa kwe-Volatility: Abahwebi bangasebenzisa i-ATR ukuze bakhombe ukwephulwa kwentengo okwenzeka lapho imakethe ihlangabezana nokuntengantenga okuphezulu. Kuleli su, abathengisi bangena endaweni ende noma emfushane lapho intengo iphuma ebangeni, futhi inani le-ATR liqinisekisa ukuthi imakethe ibhekene nokunyuka kokushintshashintsha.

Amasu okubekwa kokulahlekelwa kokuyeka: Abahwebi bangasebenzisa i-ATR ukuze balungise amazinga abo okulahlekelwa kokuyeka ngokusekelwe ekuguquguqukeni kwamanje kwemakethe. Isibonelo, uma inani le-ATR liphezulu, abathengisi bangase banwebe amazinga abo okulahlekelwa kokuyeka ukuze bagweme ukumiswa ukunyakaza kwemakethe yesikhashana.

Sengiphetha, i-ATR iyinkomba eguquguqukayo engasetshenziswa kumasu ahlukahlukene okuhweba ukuthuthukisa ukusebenza kokuhweba. Ngokuqapha amanani e-ATR, abathengisi bangalungisa amasu abo okuhweba ezimweni zamanje zemakethe futhi benze izinqumo ezinolwazi mayelana namazinga abo okulahlekelwa nokuthatha inzuzo.

Ukuqhathaniswa kwe-ATR nama-Bollinger Bands.

Amabhendi e-Bollinger iyinkomba ethandwayo yokuguquguquka equkethe imigqa emithathu: umugqa ophakathi, okuyisilinganiso esihambayo esilula, nemigqa emibili yangaphandle emele ukuchezuka okubili okujwayelekile ngenhla nangaphansi kwesilinganiso esinyakazayo. Amabhendi e-Bollinger angasetshenziswa ukukhomba izikhathi zokuguquguquka okuphansi nokuguquguquka okuphezulu.

Ngenkathi ama-ATR nama-Bollinger Bands womabili esetshenziselwa ukukala ukuguquguquka, ayahluka endleleni yawo. I-ATR ikala uhla lwangempela lokunyakaza kwamanani esikhathini esithile, kuyilapho ama-Bollinger Bands ekala ukuguquguquka ngokusekelwe ekuchezukeni okujwayelekile kusukela kusilinganiso esinyakazayo.

Enye yezinzuzo ze-ATR ngaphezu kwe-Bollinger Bands ukuthi izwela kakhulu ekushintsheni kwentengo. Lokhu kusho ukuthi i-ATR ingabona izinguquko eziguquguqukayo ngokushesha kunama-Bollinger Bands. Kodwa-ke, ama-Bollinger Bands ahlinzeka abathengisi ngolwazi olwengeziwe mayelana nesiqondiso sokunyakaza kwamanani, okunganikezwa yi-ATR.

Ukuqhathaniswa kwe-ATR kuya ku-Moving Average Convergence Divergence (MACD).

I-Moving Average Convergence Divergence (MACD) iyinkomba yomfutho elandela imfashini ekala ubudlelwano phakathi kwama-avareji amabili anyakazayo. I-MACD iqukethe imigqa emibili: umugqa we-MACD nomugqa wesiginali. Ulayini we-MACD ungumehluko phakathi kwezilinganiso ezimbili ezihambayo ezihambayo, kuyilapho umugqa wesignali uyisilinganiso esihambayo somugqa we-MACD.

Nakuba kokubili i-ATR ne-MACD ingasetshenziswa ukukhomba izitayela zokunyakaza kwamanani, ziyahluka endleleni yazo. I-ATR ikala ububanzi bokunyakaza kwentengo, kuyilapho i-MACD ikala ubudlelwano phakathi kwezilinganiso ezimbili ezihambayo.

Enye yezinzuzo ze-ATR ngaphezu kwe-MACD ukuthi inikeza abahwebi isithombe esicacile sokuntengantenga kwemakethe. I-ATR ingasiza abathengisi ukuthi babone izinguquko ezingaba khona ekuguquguqukeni ngaphambi kokuba zenzeke, okungaba usizo lapho kusetha amazinga okulahlekelwa kokuyeka kanye nokuthatha inzuzo. Ukwengeza, i-ATR ingasetshenziswa kumasu ahlukene okuhweba, kuyilapho i-MACD isetshenziswa ngokuyinhloko njengenkomba yokulandela izitayela.

Izinzuzo kanye nokubi kwe-ATR ngaphezu kwezinye izinkomba zokuguquguquka.

I-ATR inezinzuzo ezimbalwa ngaphezu kwezinye izinkomba zokuguquguquka. Okokuqala, i-ATR izwela kakhulu ekushintsheni kwentengo kunezinye izinkomba, okusho ukuthi ingakwazi ukubona izinguquko zokuguquguquka ngokushesha. Ukwengeza, i-ATR ingasetshenziswa kumasu anhlobonhlobo okuhweba, okuhlanganisa namasu okulandela izitayela kanye namasu okubuyisela emuva.

Nokho, i-ATR nayo inemikhawulo ethile. Okunye okungalungile kwe-ATR ukuthi ayinikezi abadayisi ngolwazi mayelana nesiqondiso sokunyakaza kwamanani, okuhlinzekwa ngezinye izinkomba ezifana nama-Bollinger Bands. Ukwengeza, i-ATR ingaba nzima kakhulu ukuyihumusha kunezinye izinkomba, ikakhulukazi kubathengisi abasha.

Indaba eyisibonelo: Ukusebenzisa i-ATR Isu Lokuhweba Nge-Forex.

Ake sicabangele isu elilula lokuhweba elisebenzisa i-ATR ukusetha ukulahleka kokuyeka futhi sithathe amazinga enzuzo. Ake sithi sifuna ukuthenga ipheya yohlobo lwemali uma inani layo leqa ngaphezu kwesilinganiso sokuhamba sezinsuku ezingu-50 futhi i-ATR ingaphezu kuka-0.005. Sizobeka ukulahleka kokumisa phansi kwekhandlela langaphambilini, kanye nenzuzo yokuthatha izikhathi ezimbili i-ATR. Uma inzuzo yokuthatha ingashayi, sizophuma ekuhwebeni ekupheleni kosuku lokuhweba.

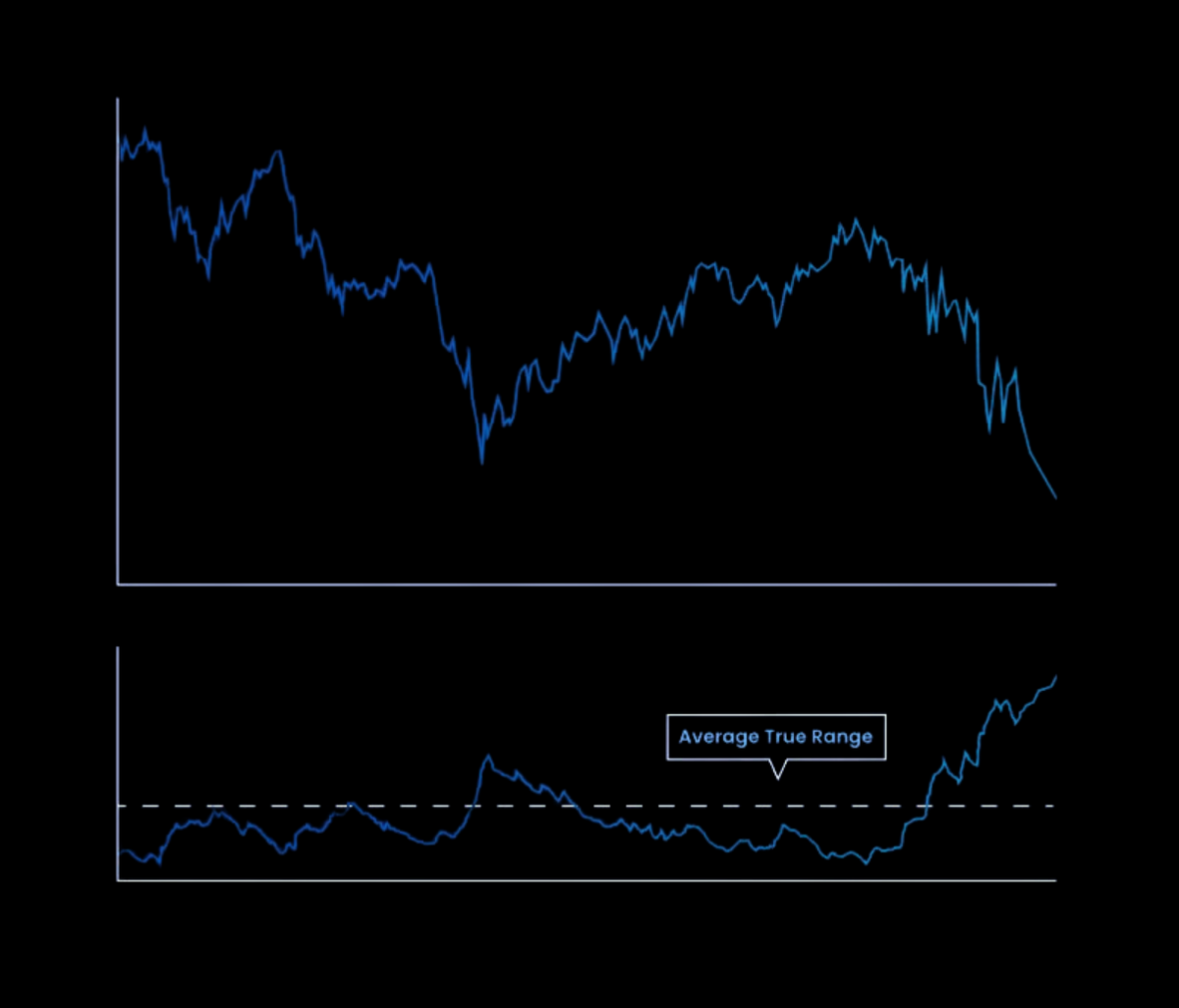

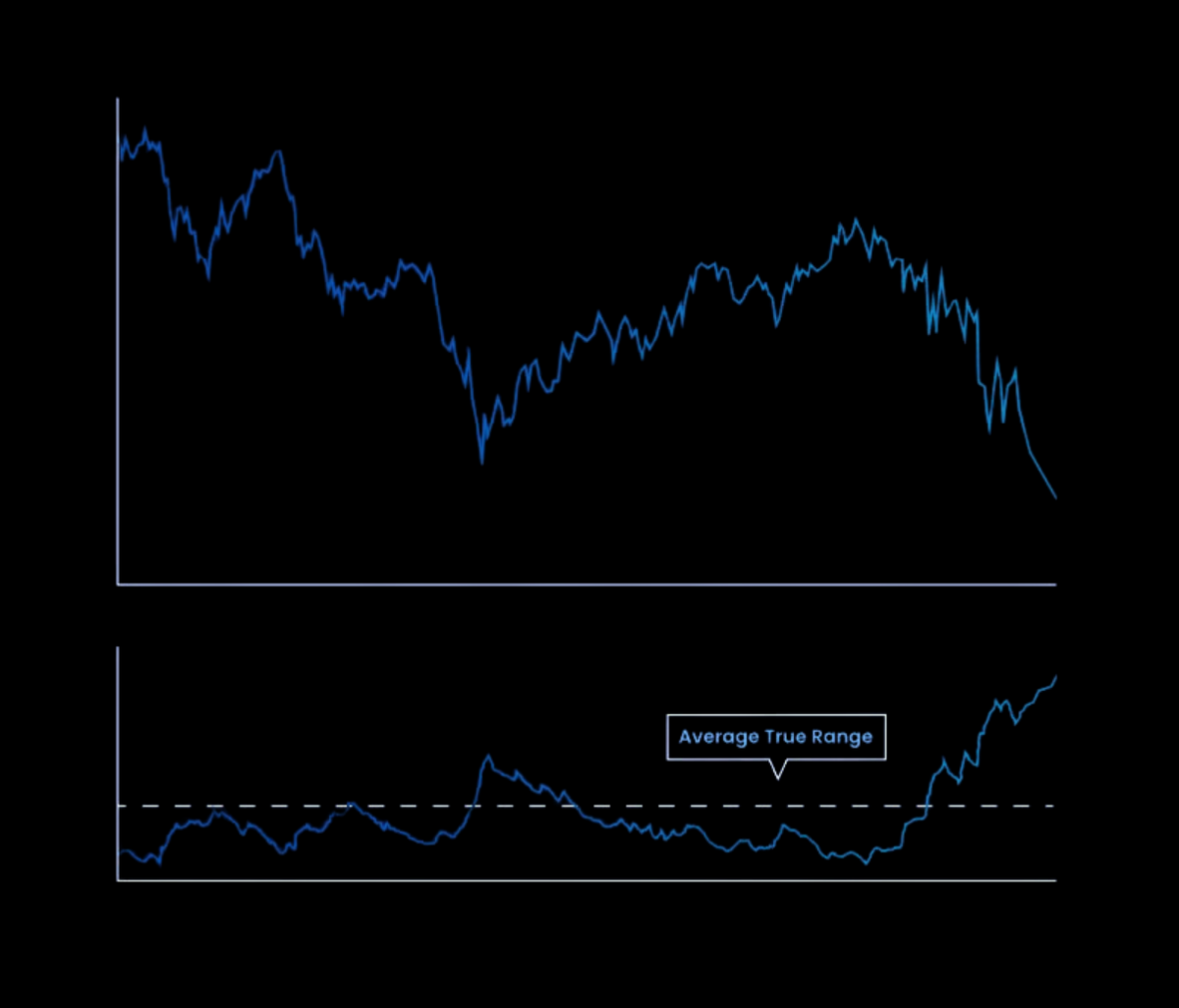

Ukubonisa leli su, ake sicabangele ipheya yemali ye-EUR/USD kusukela ngoJanuwari 2022 kuya kuMashi 2022. Sizosebenzisa inkomba ye-ATR kuplathifomu ye-MetaTrader 4 ukuze sibale inani le-ATR.

Ishadi libonisa amasiginali okuthenga akhiqizwe isu, elimakwe ngemicibisholo eluhlaza. Siyabona ukuthi leli qhinga likhiqize isamba sezohwebo eziyisithupha, ezine zazo ezinenzuzo, okuholele enzuzweni ephelele ye-1.35%.

Ukusekela amasu asekelwe ku-ATR.

I-Backtesting inqubo yokuhlola isu lokuhweba kusetshenziswa idatha yomlando ukuze ubone ukuthi ngabe lenze kanjani esikhathini esidlule. Leli ithuluzi eliwusizo lokuhlola ukusebenza kwesu nokuhlonza noma yibuphi ubuthakathaka.

Ukuze sivikele isu elisekelwe ku-ATR, sidinga kuqala sichaze imithetho yesu, njengoba senzile esigabeni sangaphambilini. Khona-ke sidinga ukusebenzisa le mithetho kudatha yomlando ukuze sikhiqize amasignali okuthenga nokuthengisa, nokubala inzuzo nokulahlekelwa kwezohwebo.

Kunamathuluzi amaningi atholakalayo okubuyisela emuva, okuhlanganisa amapulatifomu okuhweba afana ne-MetaTrader 4 kanye nesofthiwe ekhethekile efana ne-TradingView. Lawa mathuluzi asivumela ukuthi sihlole isu sisebenzisa idatha yomlando futhi sihlole ukusebenza kwayo.

I-Fine-Tuning ATR-based Strategies.

Uma sesihlole isu elisuselwa ku-ATR sisebenzisa idatha yomlando, singayishuna kahle ukuze sithuthukise ukusebenza kwayo. Lokhu kuhlanganisa ukulungisa amapharamitha esu, njenge-ATR threshold, ukumisa ukulahlekelwa futhi uthathe amaleveli enzuzo, kanye nobude besilinganiso esinyakazayo.

Ukushuna isu, sidinga ukusebenzisa ukuhlaziya izibalo kanye namasu okuthuthukisa ukuze sihlonze amanani alungile wamapharamitha. Lokhu kungaba inqubo edla isikhathi, kodwa kungaholela ekuthuthukisweni okuphawulekayo ekusebenzeni kwesu.

Indlela eyodwa edumile yamasu okushuna kahle ibizwa ngokuthi i-genetic algorithm. Le algorithm isebenzisa inqwaba yezixazululo ezingaba khona futhi iziguqule ngokuhamba kwesikhathi ngokusebenzisa ukukhetha, ukuphambana, kanye nemisebenzi yokuguqula ukukhiqiza izixazululo ezintsha.

Isiphetho.

Sengiphetha, ibanga leqiniso elimaphakathi (ATR) liyithuluzi elibalulekile labadayisi be-forex abafuna ukulinganisa nokuhlaziya ukuntengantenga kwezimakethe. Ngokusebenzisa i-ATR, abadayisi bangakwazi ukubona usayizi ongaba khona womnyakazo wemakethe, babeke ukulahleka kokuma okufanele futhi bathathe amazinga enzuzo, futhi bathuthukise amasu okuhweba asebenzayo.

I-ATR ingasetshenziswa ngokuhlanganiswa nezinye izinkomba zobuchwepheshe ezifana nama-Bollinger Bands kanye ne-Moving Average Convergence Divergence (MACD), kodwa futhi inezinzuzo zayo eziyingqayizivele. I-ATR kulula ukuyisebenzisa futhi ivumelana nezitayela ezahlukene zokuhweba kanye nezikhathi ezimisiwe. Kungasiza abahwebi bagweme izingozi ezingadingekile futhi bandise inzuzo yabo.

Empeleni, abathengisi bangasebenzisa i-ATR ukuthuthukisa kanye nokubuyisela emuva amasu okuhweba. Ukulungisa kahle isu elisuselwe ku-ATR kuhilela ukulungisa imingcele ngokusekelwe ezimeni zemakethe zamanje kanye nokubekezelela ubungozi bomthengisi.

Umbono wesikhathi esizayo we-ATR ekuhwebeni kwe-forex uyathembisa, njengoba iqhubeka nokushintsha futhi ivumelane nezimo zemakethe ezishintshayo. Njengoba imakethe ye-forex iya ngokuya iguquguquka futhi iyinkimbinkimbi, i-ATR ihlala iyithuluzi elithembekile nelisebenzayo labathengisi ukuze bazulazule futhi baphumelele emakethe.