Isu le-Bollinger band Breakout

Ama-Bollinger Bands avele njengethuluzi elivelele lokuhlaziya lobuchwepheshe emhlabeni wokuhweba we-forex, enikeza abadayisi imininingwane ebalulekile mayelana nokuguquguquka kwezimakethe kanye namathuba okuhweba angaba khona. Ithuthukiswe ngumhwebi odumile u-John Bollinger, lawa mabhendi ahlinzeka ngokubonakala kokuguquguquka kwentengo futhi asize abahwebi ukuhlonza amazinga entengo abalulekile okwenza izinqumo zokuhweba ezinolwazi.

Emakethe ye-forex esheshayo futhi eshintsha njalo, abadayisi bahlala befuna amasu anikeza umkhawulo. Yilapho isu le-Bollinger Band Breakout lifakazela khona ukubaluleka kwalo. Ngokwenza imali ekwehleni kwentengo ngale kwamabhendi amisiwe, leli su lenza abathengisi bakwazi ukuzuza ngokunyuka kwamanani abalulekile futhi bathwebule namathuba okuhweba abalulekile.

Ukuqonda amabhendi e-Bollinger

Amabhendi e-Bollinger aqukethe izingxenye ezintathu ezihlinzeka ngemininingwane ebalulekile ekuguquguqukeni kwentengo namathuba okuhweba angaba khona. Ingxenye yokuqala ibhendi emaphakathi, okuyisilinganiso esihambayo esilula (i-SMA) esimela inani lentengo esikhathini esibekiwe. Ibhendi ephezulu nephansi zimi enanini elithile lokuchezuka okujwayelekile ngenhla nangaphansi kwebhendi emaphakathi, ngokulandelana. Lawa mabhendi akhula futhi enze inkontileka njengoba ukuntengantenga kwemakethe kushintshashintsha.

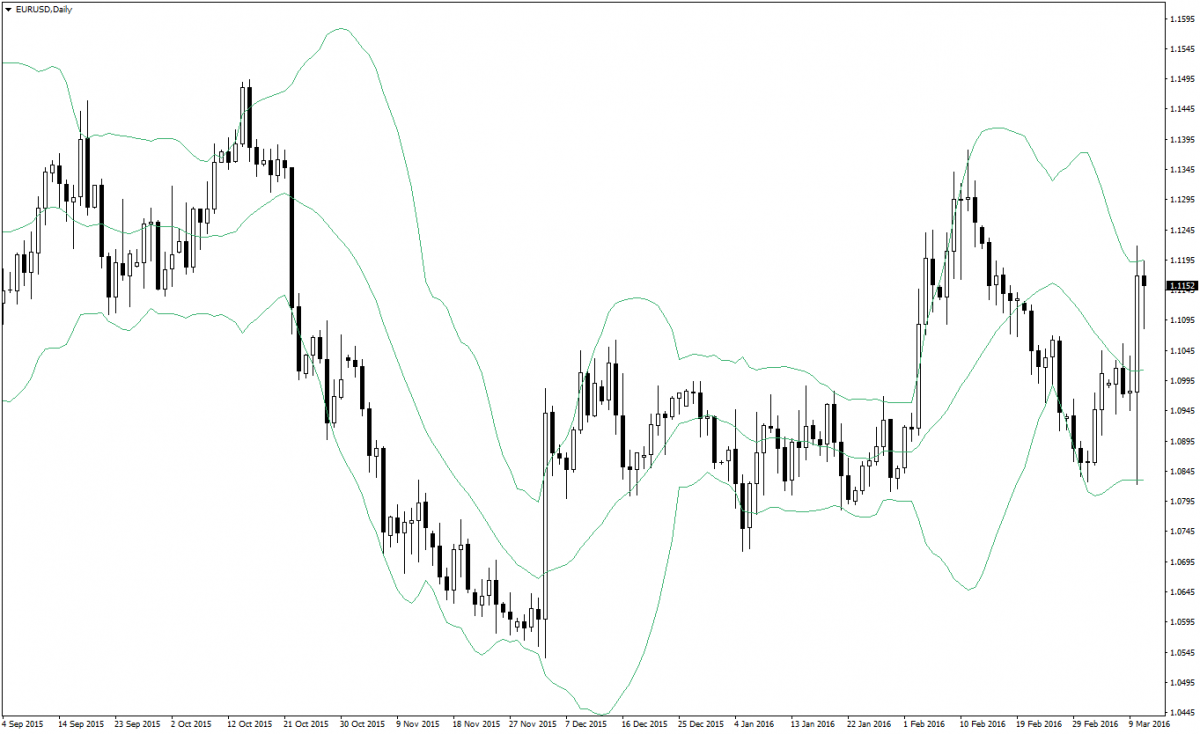

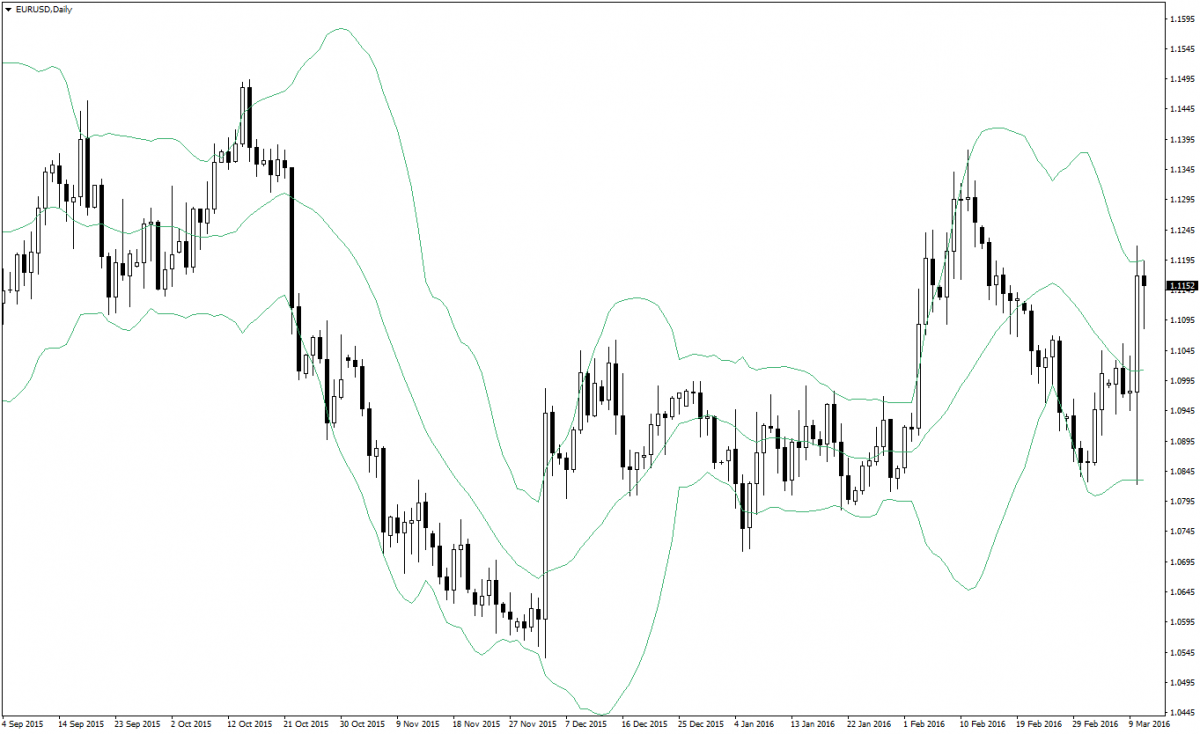

Amabhendi e-Bollinger asebenza njengethuluzi elinamandla lokuhlaziya ukuguquguquka. Uma imakethe iguquguquka kakhulu, amabhendi ayaba banzi, abonise ukuguquguquka okukhulu kwentengo. Ngokuphambene, ngezikhathi zokuguquguquka okuphansi, amabhendi ayaba mincane, okubonisa ukunyakaza kwentengo okwehlisiwe. Abahwebi bangasebenzisa lolu lwazi ukukala isimo samanje semakethe futhi balungise amasu abo okuhweba ngendlela efanele.

Ukuchezuka okujwayelekile kudlala indima ebalulekile ekubalweni kwama-Bollinger Bands. Ikala ukusakazeka kwedatha yentengo kusuka kubhendi ephakathi. Ukuchezuka okukhudlwana okujwayelekile kubonisa ukuguquguquka okuphezulu, okuholela kumabhendi ababanzi, kuyilapho ukuchezuka okujwayelekile okuncane kuhambisana nokuguquguquka okuphansi, okuholela kumabhendi amancane. Ngokuqonda ukuchezuka okujwayelekile, abathengisi bangahlola ububanzi bentengo yemakethe futhi bakhombe ukunqamuka okungaba khona noma ukuguqulwa.

Amabhendi e-Bollinger amelelwa ngokubonakalayo kumashadi amanani, okuvumela abahwebi ukuthi babheke ukunyakaza kwentengo okuhlobene namabhendi. Uma izintengo zithinta noma zingena ebhandeni eliphezulu, libonisa izimo ezingaba khona zokuthengwa kakhulu, okubonisa ukuguqulwa noma ukulungiswa okungenzeka. Ngokuphambene, izintengo ezifika noma eziwela ngaphansi kwebhendi ephansi ziphakamisa izimo ezingaba khona zokudayiswa ngokweqile, okubonisa ukuguqulwa kwentengo okungaba khona kuya phezulu.

Ukuqonda izingxenye kanye nokuchazwa kwamabhendi e-Bollinger kubalulekile kubahwebi abafuna ukusebenzisa amandla esu le-Bollinger Band Breakout. Ngokuhlaziya ubudlelwano obuguqukayo phakathi kwentengo, ukuguquguquka, namabhendi, abahwebi bangenza izinqumo zokuhweba ezinolwazi futhi basebenzise amathuba okungenzeka ukuthi aphule.

Isu lokuphuma kwebhendi ye-Bollinger

Isu lokuphuma kwe-Bollinger Band lizungeza ekuhlonzeni izikhathi ezibalulekile lapho intengo iphuma kuma-Bollinger Bands amisiwe, okubonisa amathuba okuhweba angaba khona. Lapho intengo yephula ibhendi ephezulu, iphakamisa ukuphuma kwe-bullish, okubonisa ukuthi kungenzeka ukuthi intengo ikhuphuke. Ngokuphambene, lapho intengo iwela ngaphansi kwebhendi ephansi, ikhombisa ukuphuma kwe-bearish, okusho ukunyakaza kwentengo okungenzeka kwehle. Abahwebi bangakwazi ukwenza imali kulokhu kuqubuka ngokufaka izindawo eziya lapho kuphuma khona.

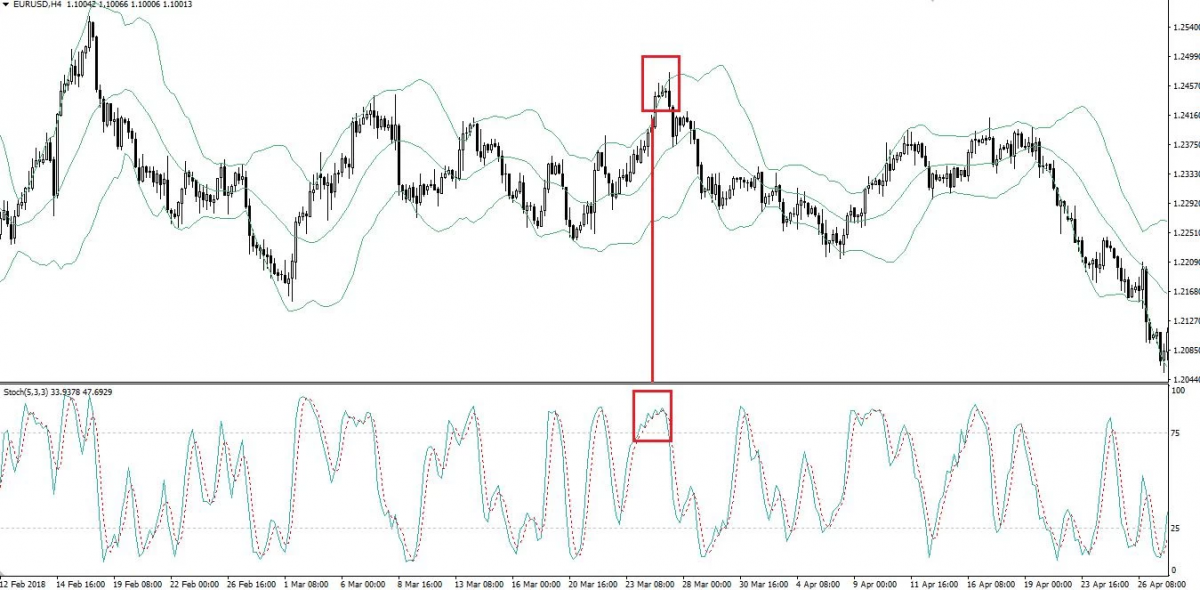

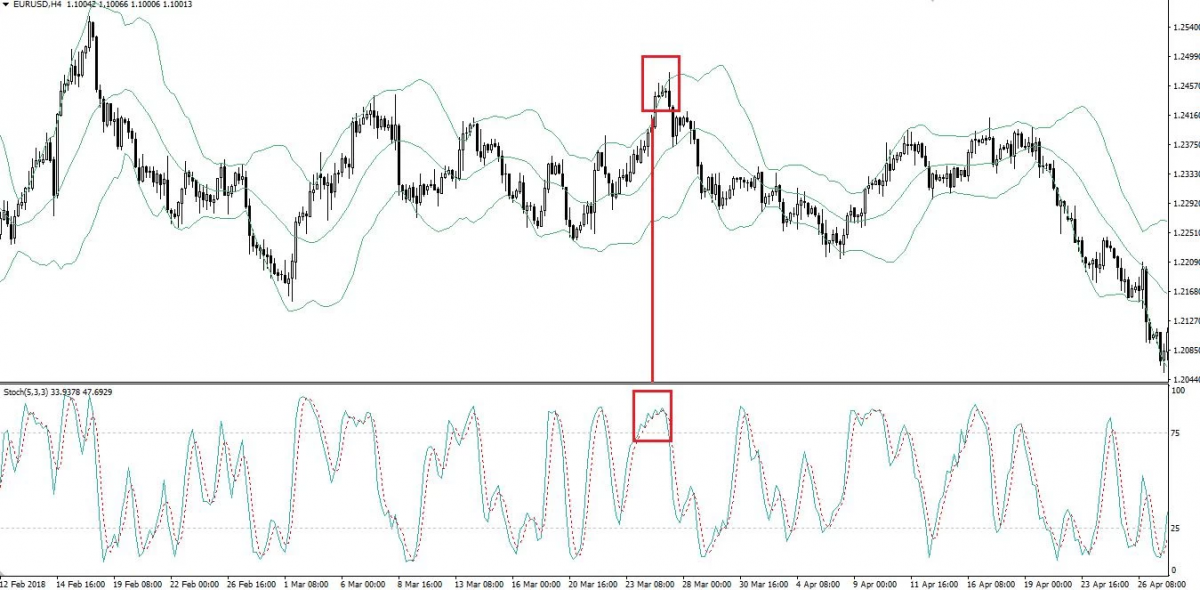

Ukuze uhlonze amasiginali aphumayo usebenzisa ama-Bollinger Bands, abathengisi baqapha ngokucophelela isenzo samanani maqondana namabhendi. Ama-breakouts ngokuvamile aqinisekiswa uma intengo ivala ngaphandle kwamabhendi. Isibonelo, ukuqhuma okuqinile kwe-bullish kwenzeka lapho intengo ivala ngaphezu kwebhande eliphezulu, kuyilapho ukuqhuma okuqinile kwe-bearish kuqinisekiswa ukuvala ngaphansi kwebhendi ephansi. Abahwebi bangase futhi bacabangele ezinye izinkomba zobuchwepheshe noma amaphethini ukuze baqinisekise amasiginali aphumayo futhi bakhulise amathuba okuhweba okuphumelelayo.

Ukwehlukanisa phakathi kwezimakethe ezihlanganisa uhla kanye namathuba okuphuma

Enye yezinselelo ekusebenziseni isu le-Bollinger Band ukuhlukanisa phakathi kwezimakethe eziboshelwe ezinhlobonhlobo namathuba angempela okuqalisa. Izimakethe eziboshelwe kububanzi zibonisa izintengo ezishintshashintshayo ngaphakathi kwemingcele yamabhendi, okubonisa ukuntuleka komfutho wokuqondisa. Abahwebi kufanele baqaphe futhi bagweme ukuqubuka kokuhweba ezimweni ezinjalo. Ngokuhlaziya ithrendi yemakethe iyonke kanye nokubheka amaphethini wevolumu, abathengisi bangakwazi ukubona ukuthi imakethe isesigabeni esiboshelwe kububanzi noma ihloselwe ukuqala kokuphuma.

Ukuqaliswa ngempumelelo kwesu le-Bollinger Band kudinga ukucabangela izici ezimbalwa ezibalulekile. Okokuqala, abahwebi kufanele bakhethe izilungiselelo ezifanele zamabhendi e-Bollinger, okuhlanganisa isikhathi namanani okuchezuka ajwayelekile, ukuze avumelane nokubhanqwa kwemali ethile kanye nesikhathi esibekelwe sona. Ukwengeza, abahwebi kufanele basebenzise amasu afanele okulawula ubungozi, okuhlanganisa ukusetha ama-oda okulahlekelwa kokuyeka kanye nokunquma izilinganiso ezivumayo zengozi yomvuzo. Okokugcina, abadayisi kufanele bahlanganise isu le-Bollinger Band breakout namanye amathuluzi okuhlaziya ezobuchwepheshe kanye nokuhlaziya okuyisisekelo ukuze bathole ukuqonda okuphelele kwemakethe futhi baqinisekise izimpawu zokuphumula.

Izinzuzo kanye nemikhawulo ye-Bollinger band scalping

Izinzuzo ze-Bollinger band scalping ekuhwebeni kwe forex

I-Bollinger band scalping inikeza izinzuzo ezimbalwa kubadayisi be-forex abafuna amathuba okuhweba esikhashana. Okokuqala, leli su livumela abahwebi ukuthi basebenzise ngokunenzuzo ukunyakaza kwamanani okusheshayo ngaphakathi kwamabhendi, okungase kukhiqize amathuba okuhweba avamile. I-Scalpers ihlose ukuzuza ngokuguquguquka okuncane kwamanani, futhi ama-Bollinger Bands ahlinzeka ngesiqondiso esibalulekile ekuhlonzeni lezi zindlela zesikhathi esifushane. Ngaphezu kwalokho, i-Bollinger band scalping ingasetshenziswa kumapheya emali ahlukahlukene kanye nezikhathi ezimisiwe, enikeza ukuguquguquka kokuvumelana nezimo zemakethe.

Izinselelo ezingaba khona kanye nemikhawulo yesu

Naphezu kwezinzuzo zayo, i-Bollinger band scalping iveza izinselelo ezithile. Omunye wemikhawulo eyinhloko amandla okuphuka okungamanga noma ama-whipsaws, lapho amanani edlula kancane amabhendi kodwa ahlehle ngokushesha. Abahwebi kudingeka baqaphe futhi basebenzise izinkomba ezengeziwe zokuqinisekisa ukuze banciphise ubungozi bezimpawu ezingamanga. Ukwengeza, i-scalping idinga ukuthathwa kwezinqumo ngokushesha kanye nokubulawa, okungase kudinge abadayisi abanenkinga yokuphathwa kwesikhathi noma isiyalo somzwelo.

Ukucatshangelwa kokulawulwa kobungozi ukuze kusetshenziswe ngempumelelo

Ukusebenzisa ukuphathwa kobungozi okufanele kubalulekile uma usebenzisa isu le-Bollinger band scalping. Abahwebi kufanele bachaze izindawo zokungena nokuphuma ezicacile, babeke ama-oda afanele okulahlekelwa kokuyeka, futhi banqume izinhloso zenzuzo ezingokoqobo. Kubalulekile ukugcina ukuziphatha nokuhambisana nezilinganiso zomvuzo wobungozi ukuze uqinisekise inzuzo engaguquki. Ukwengeza, abathengisi kufanele bacabangele umthelela wezindleko zokuthengiselana, njengokusabalala namakhomishana, njengoba ukuhweba okuvamile kungaqongelela izimali.

Imihlahlandlela esebenzayo yokusebenzisa isu le-Bollinger band breakout

Ukuze kusetshenziswe ngempumelelo isu lokuphuma kwe-Bollinger Band, abadayisi kufanele banqume izilungiselelo ezifanele zamabhendi e-Bollinger ngokusekelwe ekubhanqweni kwemali ethile kanye nesikhathi esibekelwe sona. Isikhathi esifushane, esifana nama-20 noma angu-30, singanikeza amasiginali asabelayo kakhudlwana, kuyilapho isikhathi eside, njengama-50 noma angu-100, singase sihlunge umsindo futhi sinikeze ukugqashuka okuthembeke kakhudlwana. Abahwebi kufanele bazame ngezilungiselelo ezahlukahlukene futhi bahlole amasu abo ukuze bathole ukucushwa okufanele kakhulu.

Amaphoyinti okungena nawokuphuma ohwebo asuselwa ekuphumeni kwebhendi ye-Bollinger

Lapho usebenzisa isu le-Bollinger Band Breakout, abathengisi kufanele basungule amaphuzu acacile okungena nokuphuma. Ngokuphuma kwe-bullish, indawo yokungena ingaba lapho intengo ivala ngaphezu kwebhendi ephezulu, ephelezelwa izinkomba eziqinisekisa njengokukhuphuka kwevolumu noma amaphethini ekhandlela le-bullish. Ngokuphambene, ukuze kuqhume i-bearish, iphuzu lokungena lingase libe lapho intengo ivala ngaphansi kwebhendi ephansi, esekelwa amasignali engeziwe ezobuchwepheshe. Abahwebi kufanele futhi banqume izindawo zokuphuma ezifanele, njengezinhloso zenzuzo noma ama-oda alandelayo okulahlekelwa kokuyeka.

Ukufaka izinkomba ezengeziwe zobuchwepheshe ukuze kuqinisekiswe amasiginali wokuphuma

Ngenkathi ama-Bollinger Bands ehlinzeka ngemininingwane ebalulekile ekuguquguqukeni kwentengo kanye nokuphuma, ukufaka izinkomba ezengeziwe zobuchwepheshe kungathuthukisa ukunemba kwezimpawu. Abahwebi bangase bacabange ukusebenzisa ama-oscillator afana ne-Relative Strength Index (RSI) noma i-Stochastic Oscillator ukuze bakhombe izimo ezithengiwe kakhulu noma ezidayiswe kakhulu. Amaphethini eshadi, afana nonxantathu noma amafulegi, angahambisana nokuphuma kwe-Bollinger Band. Ngokuhlanganisa izinkomba eziningi, abadayisi bangaqinisa ukuqinisekiswa kwezimpawu zokuphumula futhi bakhulise ukuzethemba kwabo ekusebenzeni kwezohwebo.

Ukushuna kahle isu le-Bollinger band scalping

Isu le-Bollinger Band scalping lingalungiswa kahle ngokulivumelanisa nezikhathi ezihlukene kanye namapheya emali. Izikhathi ezimfishane, ezifana neshadi lomzuzu ongu-1 noma iminithi emi-5, zinikeza amathuba okuhweba avamile kodwa zidinga ukuthathwa kwezinqumo okusheshayo nokwenza. Ngakolunye uhlangothi, izikhathi ezibekelwe isikhathi ezinde, njengamashadi emizuzu engu-15 noma ihora eli-1, zinganikeza amasignali athembekile kodwa ngamathuba ambalwa. Abahwebi kufanele bacabangele isitayela sabo sokuhweba abasithandayo, ukutholakala, nezici zamapheya emali abawadayisayo ukuze banqume isikhathi esifaneleka kakhulu.

Abahwebi bangaqhubeka nokucwenga isu le-Bollinger Band scalping ngokulungisa izilungiselelo ze-Bollinger Bands. Ukwandisa inani lokuchezuka okujwayelekile, isibonelo, ukusuka ku-2 kuye ku-3, kungaholela kumabhendi abanzi, kunikeze ukuzwela okukhulayo ekunyakazeni kwentengo. Lokhu kulungiswa kungase kukhiqize amasignali amaningi kodwa kungase kuhlanganise nenani eliphezulu lokuphuka okungamanga. Ngokuphambene, ukwehlisa inani lokuchezuka okujwayelekile kunganciphisa amabhendi, kunikeze ukucaciswa okukhulu kodwa okungenzeka kunciphise inani lamathuba okuhweba. Abahwebi kufanele bahlole izilungiselelo ezihlukene futhi bahlole umthelela emiphumeleni yabo yokuhweba.

Kucatshangelwa izimo zemakethe kanye nezimo lapho usebenzisa isu

Lapho usebenzisa isu le-Bollinger Band scalping, kubalulekile ukucabangela izimo zemakethe kanye nokuthambekela okuphelele. Ezimakethe ezithrendayo, lapho izintengo zibonisa ukunyakaza okucacile okuya phezulu noma okuya phansi, abahwebi bangase bagxile ekuhwebeni bebheke kuthrendi, bahlose ukunqamuka okuhambisana nomfutho okhona. Ezimakethe ezibophezelekile kububanzi, lapho izintengo zihlangana phakathi kwebanga elithile, abahwebi bangase babheke ukuphuma kumazinga osekelo noma okumelana. Ukuqonda umongo wemakethe nokuvumelanisa isu nezimo ezikhona kungakhuphula ukusebenza kwe-Bollinger Band scalping.

Ngokulungisa kahle isu le-Bollinger Band scalping ngokulivumelanisa nezikhathi ezihlukene kanye namapheya emali, ukulungisa izilungiselelo ze-Bollinger Band, futhi ucabangele izimo zemakethe namathrendi, abadayisi bangathuthukisa ukusebenza kanye nenzuzo yemizamo yabo ye-scalping. Ukuvumelana nezimo, ukuhlola okuqhubekayo, nokuzivumelanisa nezimo kuyisihluthulelo sokukhulisa amandla aleli su emakethe ye-forex eguquguqukayo.

Isiphetho

Sengiphetha, isu le-Bollinger Band Breakout iyithuluzi elinamandla labathengisi be-forex ukuhlonza amathuba okuhweba angaba khona. Ngokusebenzisa amabhendi aphezulu naphansi njengamaleveli okusekela okuguquguqukayo kanye namazinga okumelana, abathengisi bangakwazi ukuhlonza ukuphuma futhi basebenzise ukunyakaza kwentengo. Isu livumela abahwebi ukuthi basebenzise izikhathi zokuntengantenga okukhuphukayo kanye nenzuzo kusuka ekushintsheni kwamanani okubalulekile.

Nakuba isu lokuphuma kwe-Bollinger Band linikeza amathuba abalulekile enzuzo, kubalulekile ukugcizelela indima ebalulekile yokulawulwa kobungozi okufanele ekuhwebeni kwe-forex. Abahwebi kufanele basebenzise ukulinganisa isikhundla esifanele, babeke ama-oda okulahlekelwa kokuyeka ukuze bakhawulele ukulahlekelwa okungase kube khona, futhi bacabangele isilinganiso somvuzo wengozi wohwebo ngalunye. Ngokulawula ngempumelelo ubungozi, abathengisi bangakwazi ukuvikela imali yabo futhi baqinisekise impilo ende ezimakethe.

Wonke umhwebi uhlukile, futhi kubalulekile ukukhuthaza abantu ngabanye ukuthi bahlole isu le-Bollinger Band breakout futhi balivumelanise nezitayela zabo zokuhweba ngazinye. Abahwebi bangahlola izikhathi ezimisiwe ezihlukene, balungise izilungiselelo ze-Bollinger Bands, futhi bafake izinkomba ezengeziwe ukuze balungise kahle isu ngokuvumelana nalokho abakuthandayo kanye nokubekezelela ubungozi. Ngokuqhubeka nokufunda, ukuzijwayeza, nokuzivumelanisa nezimo, abahwebi bangakwazi ukuthuthukisa ukusebenza kwesu futhi bafinyelele izinjongo zabo zokuhweba.

Sengiphetha, isu le-Bollinger Band Breakout linikeza abathengisi indlela ehlelekile yokuhlonza amathuba angahle aqubuke emakethe ye-forex. Ngokusebenzisa amandla ama-Bollinger Bands futhi uwahlanganise nokulawulwa kwengozi okuphumelelayo, abahwebi bangandisa amathuba abo okuphumelela. Ngokuhlola okufanele nokuzivumelanisa nezimo, abahwebi bangenza isu libe ngelakho ukuze lihambisane nezitayela zabo zokuhweba ezihlukile kanye nezintandokazi zabo.