Yazi konke mayelana ne-margin call ekuhwebeni kwe-forex

Imakethe yokushintshiselana kwamanye amazwe (i-forex), evame ukubizwa ngokuthi imakethe yezimali enkulu kunazo zonke futhi ewuketshezi kakhulu emhlabeni idlala indima ebalulekile emhlabeni wezezimali zamazwe ngamazwe. Kulapho kuthengwa futhi kudayiswe khona izimali, okuyenza ibe yingxenye ebalulekile yohwebo nokutshalwa kwezimali komhlaba. Kodwa-ke, amandla amakhulu emakethe ye-forex okwenza inzuzo ahambisana nezinga elikhulu lobungozi. Yilapho ukubaluleka kokulawulwa kobungozi ekuhwebeni kwe-forex kuba sobala.

Ukulawulwa kobungozi kungenye yezinto ezibalulekile zesu lokuhweba le-forex eliphumelelayo. Ngaphandle kwakho, ngisho nabahwebi abanolwazi kakhulu bangazithola besengozini yokulahlekelwa okukhulu kwezezimali. Omunye wemiqondo ebalulekile yokulawula ubungozi ekuhwebeni kwe-forex "ucingo lwe-margin." Ucingo lwe-margin lusebenza njengesivikelo, umugqa wokugcina wokuzivikela, ekulahlekelweni okudlulele kokuhweba. Kuyindlela eqinisekisa ukuthi abathengisi bagcina imali eyanele kuma-akhawunti abo okuhweba ukuze bahlanganise izikhundla zabo kanye nokulahlekelwa okungase kube khona.

Iyini ikholi ye-margin ekuhwebeni kwe-forex?

Emhlabeni wokuhweba kwe-forex, ikholi ye-margin iyithuluzi lokulawula ubungozi elisetshenziswa abadayisi ukuvikela bobabili abadayisi kanye ne-brokerage uqobo. Kwenzeka lapho ibhalansi ye-akhawunti yomthengisi iwela ngaphansi kwezinga elincane lemajini elidingekayo, okuyinani lemali edingekayo ukuze kugcinwe izikhundla ezivulekile. Uma lokhu kwenzeka, umthengisi uzokhipha ikholi ye-margin, egqugquzela umthengisi ukuthi afake imali eyengeziwe noma avale ezinye zezikhundla zakhe ukuze abuyisele i-akhawunti ezingeni lemajini eliphephile.

I-Leverage iyinkemba esika nhlangothi zombili ekuhwebeni kwe forex. Nakuba kuvumela abahwebi ukuthi balawule izikhundla ezinkulu ngemali encane uma kuqhathaniswa, kwandisa ingozi yokulahlekelwa okukhulu. Ukusetshenziswa kwe-average kungakhulisa izinzuzo, kodwa futhi kungaholela ekwehlisweni kwe-akhawunti ngokushesha uma kungaphathwa ngobuhlakani. Izingcingo ze-margin zivame ukungena lapho abathengisi bedlula izikhundla zabo, njengoba kukhulisa umthelela wokunyakaza kwentengo okungekuhle.

Izingcingo ze-margin zenzeka lapho imakethe ihamba ngokumelene nesimo somthengisi, futhi ibhalansi ye-akhawunti yabo ayikwazi ukumboza ukulahlekelwa noma ukuhlangabezana nezinga elidingekayo lemajini. Lokhu kungenzeka ngenxa yokuguquguquka okungekuhle kwemakethe, izehlakalo zezindaba ezingalindelekile, noma imikhuba engemihle yokulawula ubungozi njengokusebenzisa amandla ngokweqile.

Ukuziba noma ukuphatha kabi ucingo lwe-margin kungaba nemiphumela emibi kakhulu. Abahwebi basengozini yokuvalwa kwezikhundla zabo ngumthengisi, ngokuvamile ngamanani angesihle, okuholela ekulahlekelweni okukhulu. Ngaphezu kwalokho, ikholi ye-margin ingalimaza ukuzethemba komthengisi kanye nesu lonke lokuhweba.

I-Margin call meaning in forex

Ekuhwebeni kwe-forex, igama elithi "margin" libhekisela esibambiso noma idiphozithi edingwa umthengisi ukuze avule futhi agcine isikhundla sokuhweba. Akuyona inkokhiso noma izindleko zomsebenzi kodwa ingxenye yokulingana kwe-akhawunti yakho ebekwe eceleni njengesibambiso. Imajini ivezwa njengephesenti, okubonisa ingxenye yenani likasayizi wendawo okufanele unikezwe njengesibambiso. Isibonelo, uma umdayisi wakho edinga imajini engu-2%, uzodinga ukuba no-2% wesamba sikasayizi wesikhundla ku-akhawunti yakho ukuze uvule ukuhweba.

I-Margin iyithuluzi elinamandla elivumela abathengisi ukuthi balawule izikhundla ezinkulu kunebhalansi ye-akhawunti yabo. Lokhu kwaziwa ngokuthi yi-leverage. I-Leverage ikhulisa kokubili inzuzo nokulahlekelwa okungenzeka. Nakuba ingakhulisa izinzuzo lapho izimakethe zivuna wena, iphinde ikhulise ingcuphe yokulahlekelwa okukhulu uma imakethe iphikisana nesimo sakho.

Ukushaya kwe-margin ku-forex kwenzeka lapho ibhalansi ye-akhawunti yomthengisi iwela ngaphansi kwezinga elidingekayo lemajini ngenxa yokulahlekelwa kokuhweba. Uma lokhu kwenzeka, umthengisi ucela umthengisi ukuthi afake izimali ezengeziwe noma avale izikhundla ezithile ukuze abuyisele ileveli yemajini ye-akhawunti kumkhawulo ophephile. Ukwehluleka ukuhlangabezana nekholi yemajini kungase kuholele ekuvaleni indawo ngempoqo ngumthengisi, okuholela ekulahlekelweni okukhona.

Ukugcina izinga lemajini elanele kubalulekile kubathengisi ukuze bagweme izingcingo ze-margin futhi balawule ubungozi ngempumelelo. Imajini eyanele isebenza njengesivimbeli ngokumelene nomnyakazo wentengo ongemuhle, okuvumela abahwebi ukuthi babhekane nokuntengantenga kwezimakethe zesikhashana ngaphandle kokufaka ingozi yocingo. Abahwebi kufanele bahlale beqaphile mayelana namazinga abo e-margin futhi basebenzise amasu okulawula ubungozi ukuze baqinisekise ukuthi ama-akhawunti abo okuhweba ahlala enempilo futhi eqinile lapho bebhekene nokuguquguquka kwezimakethe.

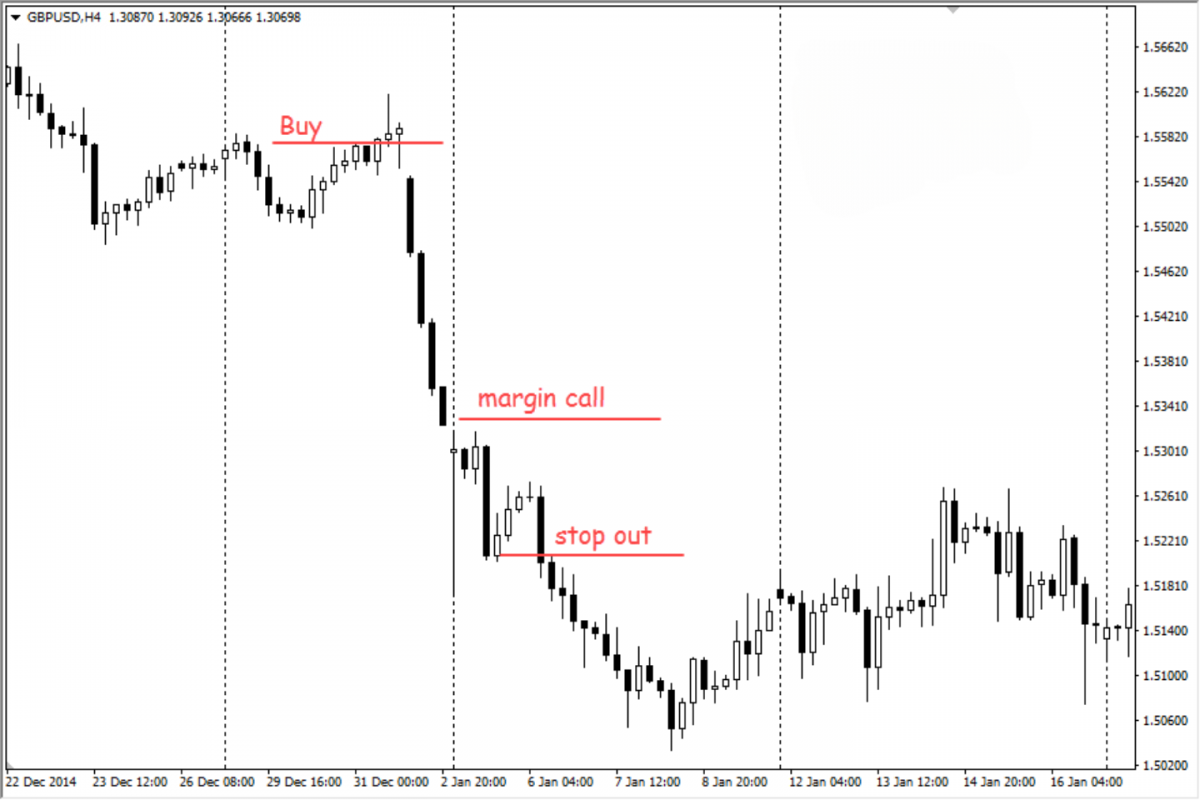

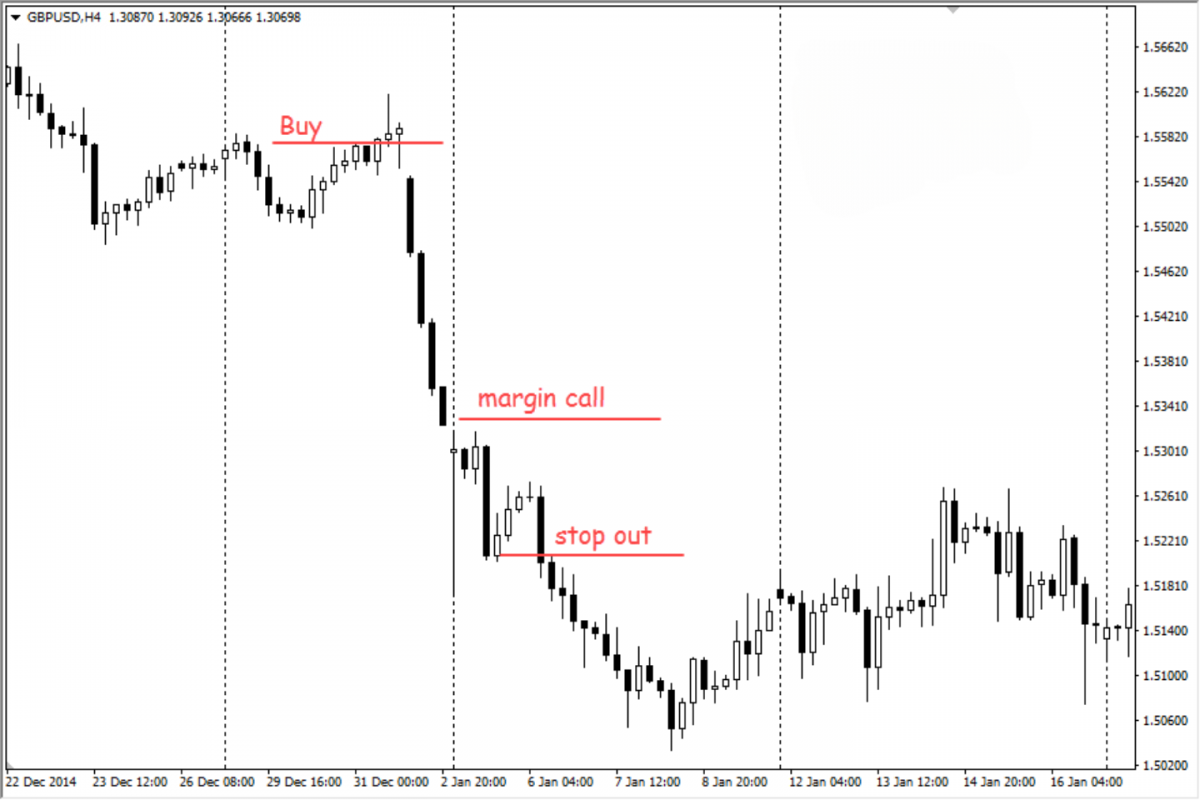

Isibonelo se-Margin call forex

Ake singene esimeni esisebenzayo ukuze sibonise umqondo wocingo lwe-margin ekuhwebeni kwe-forex. Ake ucabange ngomhwebi ovula isikhundla esilinganiselwe kubhangqa lemali enkulu, i-EUR/USD, enebhalansi ye-akhawunti yokuhweba engu-$5,000. Umthengisi udinga i-margin engu-2% kulokhu kuhweba, okusho ukuthi umhwebi angakwazi ukulawula usayizi wesikhundla se-$ 250,000. Kodwa-ke, ngenxa yokunyakaza kwezimakethe okungekuhle, ukuhweba kuqala ukungenisa ukulahlekelwa.

Njengoba izinga lokushintshaniswa kwe-EUR/USD lihamba ngokumelene nesimo somthengisi, ukulahlekelwa okungafezeki kuqala ukudla kubhalansi ye-akhawunti. Uma ibhalansi ye-akhawunti iwela ku-$2,500, isigamu sediphozithi yokuqala, izinga le-margin lehla ngaphansi kwe-2%. Lokhu kuvula ikholi yemajini evela kumdayiseli.

Lesi sibonelo sigcizelela ukubaluleka kokuqapha ileveli yemajini ye-akhawunti yakho eduze. Uma ucingo lwe-margin lwenzeka, umhwebi ubhekana nesinqumo esibucayi: noma faka imali eyengeziwe ku-akhawunti ukuze ahlangabezane nemfuneko ye-margin noma avale isikhundla sokulahlekelwa. Kuphinde kugcizelele ubungozi obuhambisana nokusetshenziswa kwamandla, njengoba kungakhulisa kokubili ukuzuza nokulahlekelwa.

Ukuze ugweme izingcingo ze-margin, abadayisi kufanele:

Sebenzisa i-average ngokuqapha futhi ngokulingana nokubekezelela kwabo ubungozi.

Misa ama-stop-loss orders afanelekile ukuze ukhawulele ukulahlekelwa okungaba khona.

Bahlukanise iphothifoliyo yabo yokuhweba ukusabalalisa ubungozi.

Buyekeza njalo futhi ulungise isu labo lokuhweba njengoba izimo zemakethe zishintsha.

Ukuphatha izingcingo zemajini ngempumelelo

Ukusetha ama-stop-loss orders afanelekile:

Ukusebenzisa ama-stop-loss orders kuyindlela eyisisekelo yokulawula ubungozi. Le miyalo ivumela abathengisi ukuthi bachaze inani eliphakeme lokulahlekelwa abazimisele ukulibekezelela ekuhwebeni. Ngokusetha amaleveli okulahlekelwa kokuyeka ngokwecebo, abahwebi bangakhawulela ukulahlekelwa okungaba khona futhi banciphise amathuba okushaya ucingo. Kubalulekile ukusekela amazinga okulahlekelwa kokuma ekuhlaziyweni kobuchwepheshe, izimo zemakethe, kanye nokubekezelela kwakho ubungozi.

Ukuhlukanisa iphothifoliyo yakho yokuhweba:

Ukwehlukahlukana kuhilela ukusabalalisa ukutshalwa kwezimali kwakho kuzo zonke izinhlobo zemali ehlukene noma izigaba zempahla. Leli su lingasiza ekunciphiseni ubungozi obuphelele bephothifoliyo yakho ngoba izimpahla ezihlukene zingase zihambelane ngokuzimele. Iphothifoliyo ehluke kakhulu ayinakwenzeka kalula ekulahlekelweni okukhulu ekuhwebeni okukodwa, okungaba nomthelela ezingeni lemajini elizinzile.

Ukusebenzisa izilinganiso zomvuzo wobungozi:

Ukubala nokubambelela ezilinganisoni zomvuzo wobungozi kungenye ingxenye ebalulekile yokulawulwa kobungozi. Umthetho ovamile wesithupha uwumgomo wokuzuza isilinganiso somvuzo engcuphe okungenani esingu-1:2, okusho ukuthi uqondise inzuzo okungenani ewusayizi ophindwe kabili wokulahlekelwa okungaba khona. Ngokusebenzisa njalo lesi silinganiso emisebenzini yakho yohwebo, ungathuthukisa amathuba emiphumela enenzuzo futhi wehlise umthelela wokulahlekelwa emaphethelweni akho.

Ungalubamba kanjani ucingo lwemajini uma kwenzeka:

Ukwazisa umdayisi wakho:

Uma ubhekene nekholi yemajini, kubalulekile ukuxhumana ngokushesha nomthengisi wakho. Bazise ngenhloso yakho yokufaka imali eyengeziwe noma ukuvala izikhundla ukuze uhlangabezane nemfuneko yemajini. Ukuxhumana okuphumelelayo kungaholela ekuxazululeni okushelelayo kwesimo.

Ukuqedwa kwezikhundla ngokwesu:

Uma unquma ukuvala izikhundla ukuze uhlangabezane nekholi ye-margin, yenza kanjalo ngamasu. Beka kuqala izikhundla zokuvala ngokulahlekelwa okubaluleke kakhulu noma lezo ezingahambisani namasu akho okuhweba. Le ndlela ingasiza ekwehliseni omunye umonakalo kubhalansi ye-akhawunti yakho.

Ukuhlola kabusha isu lakho lokuhweba:

Ucingo lwemajini kufanele lusebenze njengocingo lokuvuka ukuze ubuyekeze kabusha isu lakho lokuhweba. Hlaziya ukuthi yini eholele ekushayelweni kwe-margin futhi ucabange ukulungisa, njengokunciphisa amandla, ukulungisa amasu akho okulawula ubungozi, noma ukubuyekeza uhlelo lwakho lonke lokuhweba. Ukufunda kokuhlangenwe nakho kungakusiza ube umthengisi oqinile futhi onolwazi.

Isiphetho

Kulokhu kuhlola okuphelele kwezingcingo ze-margin ekuhwebeni kwe-forex, sithole imininingwane ebalulekile kulesi sici esibalulekile sokulawula ubungozi. Nazi izinto ezibalulekile ongazithatha:

Izingcingo ze-margin zenzeka uma ibhalansi ye-akhawunti yakho iwela ngaphansi kwezinga lemajini elidingekayo ngenxa yokulahlekelwa ukuhweba.

Ukuqonda i-margin, amandla, kanye nokuthi izingcingo ze-margin zisebenza kanjani kubalulekile ekuhwebeni okuthembekile.

Amasu asebenzayo okulawula ubungozi, njengokusetha ama-oda okulahlekelwa kokuyeka, ukuhlukanisa iphothifoliyo yakho, nokusebenzisa izilinganiso zomvuzo wengcuphe, kungasiza ukuvimbela izingcingo ze-margin.

Uma ucingo lwe-margin lwenzeka, ukuxhumana okufika ngesikhathi nomthengisi wakho kanye nokuqedwa kwesikhundla sakho kubalulekile.

Sebenzisa izingcingo zemajini njengethuba lokuhlola kabusha futhi wenze ngcono isu lakho lokuhweba ukuze uphumelele isikhathi eside.

Izingcingo eziseceleni akufanele zithathwe kalula; bamele uphawu oluyisixwayiso ohambweni lwakho lokuhweba. Ukungazinaki noma ukungaziphathi kahle kungaholela ekulahlekelweni okukhulu kwezimali futhi kuqede ukuzethemba kwakho njengomhwebi. Kubaluleke kakhulu ukubamba umqondo wezingcingo ze-margin kahle futhi ufake ukulawulwa kwezinhlekelele ezindleleni zakho zokuhweba.

Sengiphetha, ukuhweba nge-Forex akuyona i-sprint kodwa i-marathon. Kubalulekile ukugcina umbono wesikhathi eside futhi ungadunyazwa izingcingo noma ukulahlekelwa ngezikhathi ezithile. Ngisho nabadayisi abanolwazi olunzulu babhekana nezinselelo. Okubalulekile wukufunda kulokhu okuhlangenwe nakho, ukuzivumelanisa, futhi uqhubeke nokucwenga amakhono akho.