How do gold reserves affect currency?

Gold has long been esteemed not only for its allure and craftsmanship into jewelry and artifacts but also for its significant role in shaping economic landscapes globally. Traditionally, gold's inherent value has established it as a foundation for financial systems, often dictating the strength and stability of national currencies. Today, gold continues to influence the global economy through its integration in the monetary policies of nations, particularly through gold reserves maintained by central banks.

Gold reserves refer to the quantity of gold held by a central bank or a nation, intended primarily to support the currency and serve as a hedge against economic crises. The valuation and stability of a nation's currency can be directly influenced by these reserves, especially during periods of market volatility. Currency valuation, on the other hand, represents the worth of a country's currency in terms of another. This valuation fluctuates based on various economic factors, including the status of a nation's gold reserves.

Historical context

The gold standard was a pivotal system in international finance, wherein the value of a country's currency was directly linked to a specific amount of gold. This system aimed to provide a stable basis for global trade, as currencies were backed by the tangible value of gold, ensuring their reliability and stability. From the 1870s until 1914, the gold standard primarily dominated monetary policies across major economies, contributing to a period of remarkable economic stability and growth known as the Classical Gold Standard period.

However, the pressures of the World Wars and the Great Depression tested the gold standard's viability, revealing its limitations in a modern economic framework. The rigidity in the supply of gold restricted the ability of central banks to adjust monetary policy in response to economic conditions, often exacerbating economic downturns. Consequently, beginning in the 1930s, nations began to detach their currencies from gold, a transition that was solidified by the Bretton Woods Agreement in 1944. This agreement marked a shift towards fiat currency systems, where the value of money is not based on physical commodities but rather on the trust and authority of the government that issues it.

Mechanics of how gold reserves affect currency

Central banks play a crucial role in shaping monetary policy, and one of their strategic assets are gold reserves. These reserves serve multiple functions, primarily acting as a tool for financial security and as a means to instill confidence in the nation's currency. By holding substantial amounts of gold, central banks can support their currency's value, offering a tangible assurance of their ability to meet international payment obligations.

The relationship between gold reserves and currency valuation is intricate. When a central bank purchases more gold, it often leads to a perception of increased economic stability and strength. This perception can boost the value of the national currency as investors see the country as a safer investment. Conversely, selling gold can signal economic distress, potentially depreciating the currency’s value as confidence diminishes.

Furthermore, fluctuations in the price of gold can significantly impact the currency market. An increase in gold prices generally strengthens the currencies of countries with substantial gold reserves, as the intrinsic value of these reserves grows. However, a decline in gold prices can weaken these currencies, reflecting a decrease in the overall asset value held by the central bank. Thus, gold price movements are closely watched by forex traders, as they can be indicative of broader economic trends and currency fluctuations.

Case studies

Exploring the impact of significant gold reserves in countries like the United States, India, China, and Russia provides valuable insights into how these assets influence national currencies over time. The United States, holding the largest gold reserves globally, supports the dollar's dominance as a global reserve currency. This vast reserve has historically buffered the currency against volatility, enhancing investor confidence.

In India, where cultural and economic factors drive gold accumulation, increases in gold reserves often correlate with a strengthened rupee, reflecting robust economic health. Conversely, market reactions to reductions in reserves can weaken the currency, highlighting gold's critical role in economic perception.

China has strategically increased its gold reserves to diversify away from the U.S. dollar, strengthening the yuan and asserting greater economic independence. This approach has periodically enhanced the yuan's international standing as China positions itself as a global economic leader.

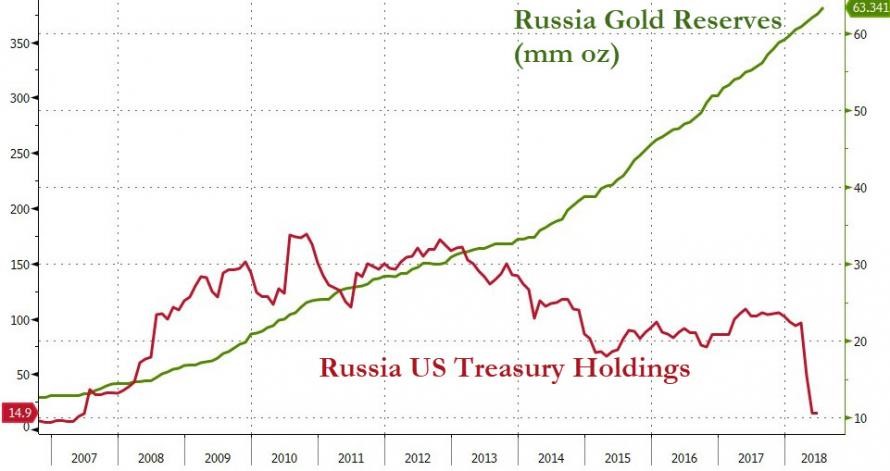

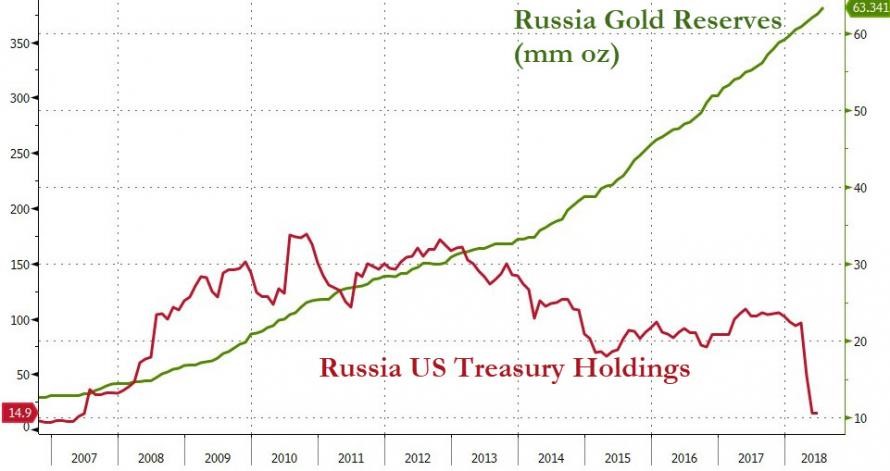

Russia, too, has significantly augmented its gold reserves as part of its broader strategy to fortify its economy against geopolitical tensions and sanctions. This accumulation has occasionally led to a more resilient ruble, showcasing gold's utility in reinforcing currency stability amidst international uncertainty.

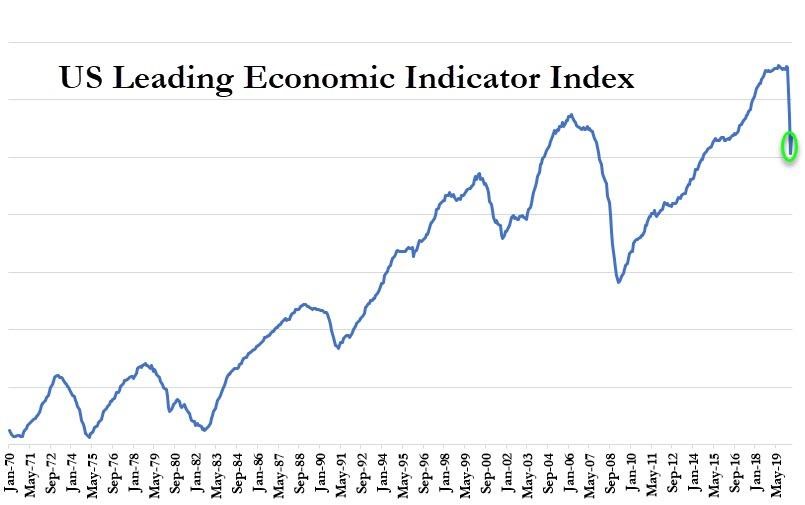

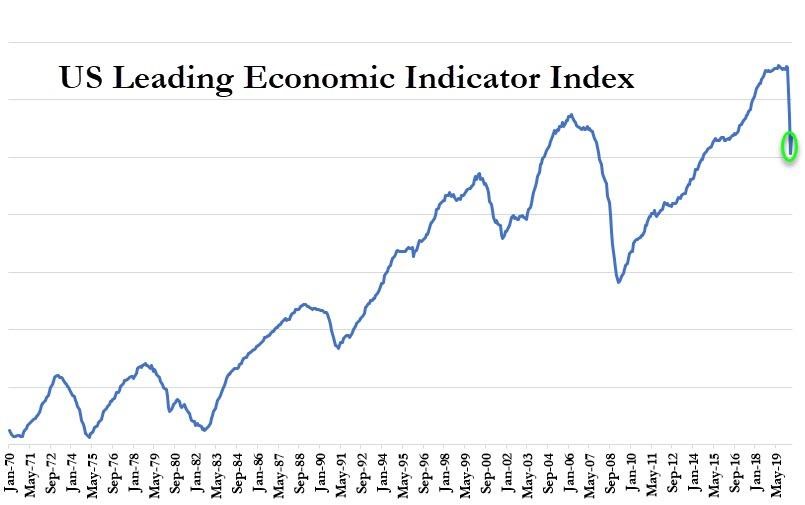

Gold reserves and economic indicators

Gold reserves are not only pivotal in currency valuation but also correlate strongly with broader economic indicators such as inflation, interest rates, and overall economic stability. These reserves often act as a hedge against inflation; as the cost of living increases, the value of gold typically rises, preserving the purchasing power of a nation’s currency. Conversely, during periods of low inflation or deflation, the appeal of holding gold may diminish, impacting its price and the related economic strategies.

Interest rates also interact with gold reserves in a significant manner. Low interest rates generally decrease the opportunity cost of holding non-yielding assets like gold, making gold more attractive to investors and central banks. This increased demand can lead to higher gold prices, which in turn supports stronger currency valuations.

In terms of economic stability, gold reserves provide a cushion against economic shocks. During times of financial crisis or geopolitical instability, gold is often seen as a 'safe haven' asset. Investors and central banks alike tend to increase their gold holdings as a safeguard against uncertainty, leading to a rise in gold prices and a potential stabilization effect on the national currency.

Implications for traders

For forex traders, understanding the dynamics of gold reserves and their influence on currency values is a crucial aspect of crafting effective trading strategies. Gold pricing and reserve data can serve as significant indicators for predicting currency movements, particularly in nations with substantial gold holdings. Traders can leverage this information to anticipate shifts in currency strength, which often correlate with changes in gold prices or reserve levels.

When central banks increase their gold reserves, this is typically seen as a sign of strength and stability, suggesting potential appreciation of the nation’s currency. Conversely, selling off gold reserves might indicate economic challenges, potentially leading to currency depreciation. Forex traders monitoring these trends can adjust their positions accordingly to capitalize on these movements.

Additionally, global economic indicators such as inflation rates, geopolitical stability, and monetary policy changes are also influenced by movements in gold prices. Traders can use this interconnected data to predict broader market trends. For example, during times of economic uncertainty, an increase in gold prices often precedes a shift towards lower-risk assets, including stable currencies backed by significant gold reserves.

Current trends and future qutlook

In recent years, several countries have actively managed their gold reserves, reflecting broader economic strategies and responses to global financial uncertainties. For instance, central banks in emerging markets have been notable for increasing their gold holdings, seeking to diversify their reserves and reduce reliance on the US dollar. This trend suggests a shift towards what many see as a 'safer' asset amid fluctuating global economic conditions.

Looking ahead, the valuation of gold is likely to continue influencing global currencies, particularly if economic volatility persists. As geopolitical tensions and economic policies evolve, gold may experience variable demand, which in turn could lead to fluctuations in its price. Such changes are crucial for currency valuation, especially for countries heavily invested in gold or those whose currencies are perceived as less stable.

For forex traders, staying informed about these trends is vital. They should monitor central bank activities and global economic indicators that impact gold prices. Utilizing financial news, government reports, and market analysis will be key in anticipating shifts in gold valuation. By adapting their trading strategies to incorporate these insights, traders can better manage risks and capitalize on opportunities presented by gold-related currency fluctuations.

Conclusion

A multifaceted relationship exists between gold reserves and currency values, illuminating gold's historical significance and its continued impact on the modern economic landscape. The gold reserves serve not only as a hedge against economic instability but also play a crucial role in shaping the valuation of currencies on the global stage. Countries with substantial gold reserves often enjoy a perception of increased economic stability and stronger currencies.

The interplay between gold prices and currency values is especially significant for forex traders. Fluctuations in gold reserves can signal broader economic shifts that impact currency markets. As such, gold remains a critical component of national economic strategies and a key indicator for forex trading strategies.

Staying updated with changes in gold reserve policies, global economic trends, and geopolitical events can provide essential insights. Traders are encouraged to deepen their understanding of these dynamics and integrate this knowledge into their trading decisions. Regular monitoring of gold-related economic indicators will not only enhance strategic planning but also better equip traders to respond to market changes effectively and opportunistically.