What is ECN Forex Trading?

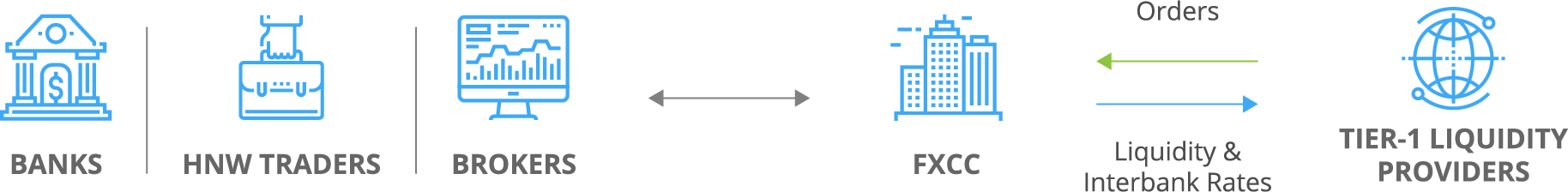

ECN, which stands for Electronic Communication Network, really is the way of the future for the Foreign Exchange Markets. ECN can best be described as a bridge linking smaller market participants with its liquidity providers through a FOREX ECN Broker.

ECN serves as a bridge between smaller participants of the market and their liquidity providers. Also known as alternative trading systems (ATS), ECN is essentially a computerized network enabling trading of currencies and stocks outside traditional exchanges.

It is pertinent to note that all transactions were done manually prior to the 1970s, with a restricted amount of e-trading existing in the 80s. At that time, almost all electronic trading was done through an advanced communication system developed by Reuters, called Reuters Dealing.

The modern electronic trading systems first surfaced in the early 90s when they began to match buyers and sellers to soon become the currency price benchmark. It isn’t that these Electronic Communications Networks didn’t exist earlier; in fact they have existed since the late 1960s but weren’t used for currency trading until late 90s.

First Things First – Know Your Broker

The Forex market is said to be one of the most popular markets for smaller traders. Here, gains are made from the tiniest price fluctuations on currency pairs. And unlike the trading of shares or assets, the foreign exchange trading doesn’t take place on a regulated exchange.

Instead, it happens between buyers and sellers from different parts of the globe, through an over-the-counter (OTC) market. And, it goes without saying that you need to use a broker to access this market.

Due to its decentralized status, choosing the right broker could mean the difference between success and failure in your Forex trading endeavour. While there exist many brokers in the market offering similar products and services, you must be able to identify the different kinds of brokers before embarking on Forex trading.

Predominantly, there are two kinds of brokers in the Forex trading market: Market Makers and ECN Brokers. As the name suggests, the Market Makers are the type of brokers that set the bid and ask prices using their own systems thus ‘making the market’. The prices they set are shown on their platforms to the potential investors who can open and close trading positions.

ECN – The ‘Purest’ Kind of Forex Broker Out There

As opposed to the Market Makers, the Electronic Communication Network (ECN) brokers do not make a profit on spread difference, but charge a commission on positions instead. As a result, their clients’ win is their own win or else they wouldn’t be able to make any profits.

ECN brokers are financial experts that use their sophisticated electronic networks to link their clients with other market participants. Consolidating quotes from different participants, ECN brokers are able to offer tighter bid/ask spreads.

Besides serving big financial institutions and market traders, ECN brokers also cater to individual trading clients. ECNs enable their clients to trade against each other by sending bids and offers onto the system platform.

One of the attractions of ECN is that both buyers and sellers remain anonymous in the trade execution reports. Trading on ECNs is more like a live exchange that offers the best bid/ask rates from all currency quotes.

Through ECNs, traders get better prices and cheaper trading conditions as an ECN broker is able to allow prices from different liquidity providers. Plus, the trading environment provided by an ECN broker is more efficient and transparent, adding further to the appeal of e-trading.

The ECN Advantage - Why You Should Trade With an ECN Broker

Using an ECN broker has several advantages; in fact, a large number of traders are looking forward to ECN brokers, and for a viable reason. ECN brokers offer a range of major benefits, which may help them get ahead of their leading counterparts. Here are some of the key advantages of using an ECN broker.

Anonymity, Confidentiality, and Secrecy

You are often an open book when you are dealing with typical Forex trading. Nevertheless, privacy and confidentiality assume high importance when you opt to go down the path of an ECN broker. The high level of confidentiality and secrecy indeed has to do with the fact that the broker would only serve as a middleman in the market instead of a market maker.

Variable Spreads

Traders are granted unhindered access to market prices through an ECN agent and a dedicated account. Since the prices vary upon supply, demand, instability, and other market environments, through the correct ECN broker, one can trade on very low bid/offer spreads.

Instant Trade Execution

This feature is something that Forex dealers usually can’t afford to make compromises on. ECN brokers guarantee that efficient trade performance is very much certain at every go. This specific technique of trading does not need the client to trade with the broker, but instead uses its network to place orders. This different method really does let anyone enjoy improved trade execution.

Access to Customers and Liquidity

ECN agents operate on a model that lets any and all the opportunity to trade within an international liquidity pool of viable, controlled, and competent financial institutions. Additionally, due to how connected information is transmitted, transparency is yet another key benefit of an ECN broker. All ECN agents are granted access to the same market data and trade; therefore, transparency of fundamental market prices from numerous liquidity providers is guaranteed.

Trade Consistency

One of the major benefits of an ECN broker and a connected Forex trading account is trading consistency. Given the nature of Forex trading, a break is not essential, nor does it ever occur between trades. When you take advantage of an ECN broker, you can amenably trade during events and news, with it being likely to create a real flow of activity. This also creates an opportunity for any trader to benefit from Forex price volatility.