What is long-term trading in forex?

In the fast-paced and ever-evolving world of forex trading, a variety of strategies exist to capitalize on market movements. One such approach is long-term trading, a method that emphasizes patience and a broader perspective on price trends.

Long-term trading in forex refers to a strategy where traders hold positions for an extended period, typically ranging from weeks to months, to take advantage of significant market trends. Unlike short-term trading, which focuses on quick profits within smaller price fluctuations, long-term trading aims to capture larger price movements over extended timeframes.

Understanding long-term trading is crucial for forex investors seeking sustainable profitability. By adopting a long-term perspective, traders can avoid the noise and volatility associated with short-term fluctuations. Instead, they focus on capturing substantial trends driven by economic fundamentals, geopolitical events, and other macroeconomic factors. This approach allows for a more comprehensive analysis of market dynamics and reduces the impact of short-term market noise on investment decisions.

The concept of long-term trading in forex

Long-term trading in the forex market involves holding positions for an extended period, typically ranging from weeks to months, in order to capitalize on significant market trends. Unlike short-term trading styles such as day trading or swing trading, which focus on exploiting short-lived price fluctuations, long-term trading emphasizes a broader perspective on price movements and economic fundamentals.

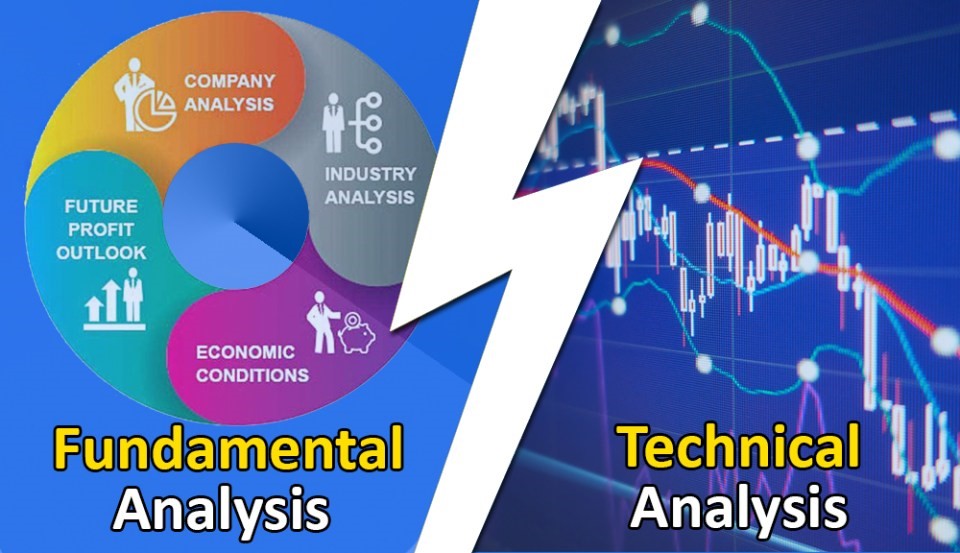

Long-term traders analyze and identify major trends by conducting comprehensive fundamental and technical analysis. They seek to identify currency pairs with strong long-term growth potential or decline, basing their decisions on factors such as economic indicators, central bank policies, geopolitical events, and long-term market cycles.

Compared to day trading and swing trading, long-term trading offers distinct advantages. Day traders aim to profit from short-term price fluctuations within a single trading day, while swing traders hold positions for a few days to a few weeks. In contrast, long-term traders benefit from reduced transaction costs, as they enter and exit trades less frequently. They also experience lower stress levels associated with constantly monitoring the market, making it an attractive option for investors with a more patient and strategic approach.

Factors influencing the suitability of long-term trading:

Several factors influence the suitability of long-term trading in forex. First, it requires a trader to have a long-term outlook and the ability to withstand interim price fluctuations without succumbing to emotional decision-making. Additionally, long-term trading is more suitable for investors with larger capital bases, as it may require greater margin requirements and tolerance for potential drawdowns.

Furthermore, the availability of reliable fundamental and technical analysis tools, access to historical data, and a robust understanding of economic indicators are crucial for successful long-term trading. Traders must also consider their risk tolerance and time commitment, as long-term trading requires patience and discipline to ride out prolonged market trends.

By understanding the concept of long-term trading in forex, traders can strategically position themselves to capture significant market movements over extended periods. The next sections will delve into specific strategies, benefits, and risks associated with long-term trading, providing valuable insights for investors seeking sustainable profitability.

Strategies for long-term trading in forex

Fundamental analysis and its role in long-term trading:

Fundamental analysis plays a vital role in long-term trading, helping traders identify currency pairs with strong growth or decline potential over extended periods. By analyzing economic indicators, geopolitical events, and central bank policies, traders gain insights into the underlying factors driving long-term currency trends. This analysis involves assessing macroeconomic data, such as GDP growth, inflation rates, employment figures, and trade balances, to understand the overall health and prospects of a country's economy. Fundamental analysis provides traders with a solid foundation for making informed long-term trading decisions.

Technical analysis approaches for identifying long-term trends:

In addition to fundamental analysis, long-term traders utilize various technical analysis approaches to identify and confirm long-term trends. Technical indicators, chart patterns, and trend analysis tools help traders spot potential entry and exit points for their trades. Popular technical indicators such as moving averages, trend lines, and the relative strength index (RSI) can provide insights into the strength and sustainability of a long-term trend. Combining fundamental and technical analysis allows traders to make more accurate predictions and increase their chances of success in long-term trading.

Risk management techniques specific to long-term trading:

Managing risk is crucial in long-term trading to protect capital and maintain sustainable profitability. Traders employ techniques such as setting stop-loss orders, implementing trailing stops, and diversifying their positions. Stop-loss orders are essential to limit potential losses if the market moves against the trader's expectations. Trailing stops are adjusted as the trade moves in the trader's favor, allowing them to secure profits while still giving the trade room to breathe. Diversifying positions across different currency pairs and asset classes helps mitigate the impact of adverse market movements on the overall portfolio.

Diversification and portfolio management considerations:

Long-term traders understand the importance of diversification and effective portfolio management. Diversifying across currency pairs, geographic regions, and asset classes helps spread risk and reduces exposure to individual currency fluctuations. Traders carefully allocate their capital, monitor portfolio performance, and make adjustments when necessary. Regular reviews of the portfolio's performance and ongoing analysis of market conditions enable traders to optimize their long-term trading strategies.

By employing a combination of fundamental and technical analysis, implementing effective risk management techniques, and practicing diversification and portfolio management, long-term traders can position themselves for success in the forex market.

Benefits of long-term trading in forex

One of the primary benefits of long-term trading in forex is the potential for higher profits. By holding positions for extended periods, traders can capture significant market trends and ride them for substantial gains. Long-term traders aim to identify currencies that exhibit clear long-term growth or decline patterns, allowing them to capitalize on large price movements. This patient approach enables traders to avoid being swayed by short-term market noise and focus on long-term market dynamics, potentially leading to more profitable trades.

Long-term trading offers the advantage of reduced transaction costs. Unlike short-term trading styles that involve frequent buying and selling, long-term traders enter and exit trades less frequently. This translates to lower transaction costs, as they incur fewer spreads and commission charges. Additionally, long-term traders often experience reduced emotional stress compared to their short-term trading counterparts. They are not exposed to the rapid price fluctuations and constant monitoring that can lead to heightened anxiety and emotional decision-making.

Long-term traders can benefit from interest rate differentials between currencies. By trading currencies with higher interest rates against those with lower rates, traders can potentially earn profits through carry trades. Carry trades involve borrowing in a low-interest-rate currency and investing in a higher-interest-rate currency, taking advantage of the interest rate differential. This strategy allows traders to generate income from the interest rate spread over the duration of the trade.

Long-term traders have the opportunity to align their positions with macroeconomic trends and geopolitical factors. By analyzing economic indicators, central bank policies, and geopolitical events, traders can position themselves in currencies that are likely to benefit from long-term economic growth or decline. Understanding these broader factors enables traders to make informed decisions based on fundamental analysis and align their trades with the underlying market dynamics.

Risks and challenges in long-term trading

Market volatility and unpredictable price fluctuations:

Long-term trading in forex is not without its risks. Market volatility and unpredictable price fluctuations can pose challenges to long-term traders. The forex market is influenced by various factors such as economic data releases, geopolitical events, and market sentiment, which can lead to significant price swings. Traders must be prepared to withstand interim price movements and remain committed to their long-term analysis, as short-term market noise can sometimes test their patience and conviction.

Exposure to economic, political, and regulatory risks:

Long-term traders are exposed to economic, political, and regulatory risks inherent in the forex market. Economic downturns, policy changes, and geopolitical tensions can have a profound impact on currency values and long-term trends. Traders need to stay informed about global economic developments and political events that may affect the countries they are trading. Additionally, changes in regulatory frameworks or interventions by central banks can introduce unforeseen challenges and affect the profitability of long-term trades.

The psychological aspect: patience, discipline, and managing expectations:

Successful long-term trading requires strong psychological attributes. Patience is key, as traders must wait for their positions to unfold and not be swayed by short-term market fluctuations. Discipline in adhering to their trading plan and risk management strategies is crucial for long-term success. Managing expectations is also important, as the forex market may not always move in a linear fashion, and there will be periods of drawdowns or sideways movements that require a steadfast mindset.

Long-term commitment and potential opportunity costs:

Long-term trading requires a significant time commitment. Traders need to monitor their positions periodically, stay updated on market developments, and make adjustments when necessary. This level of involvement may not be suitable for all individuals, as it can potentially impact other areas of life and incur opportunity costs. Traders must carefully consider their personal circumstances and commitments before embarking on long-term trading strategies.

Case studies and real-world examples

Numerous success stories exist among long-term forex traders, highlighting the potential rewards of this trading approach. For instance, Warren Buffett, one of the world's most renowned investors, employed a long-term perspective when trading currencies, aiming to profit from macroeconomic trends and fundamental analysis. Other successful long-term traders, such as George Soros and Paul Tudor Jones, have also demonstrated the effectiveness of their strategies over extended periods. These success stories serve as an inspiration and provide insights into the benefits of long-term trading when implemented with skill and discipline.

Analyzing notable long-term trading strategies can offer valuable insights into their effectiveness and outcomes. For example, trend-following strategies, which involve identifying and riding long-term market trends, have proven successful for many long-term traders. Breakout strategies, where traders enter positions when prices surpass key levels of support or resistance, have also yielded positive results. By examining these strategies and their outcomes, traders can gain a deeper understanding of the principles that underpin successful long-term trading.

Examining past market trends and events can provide valuable lessons for long-term traders. Historical episodes, such as the global financial crisis of 2008 or the European debt crisis, offer insights into how long-term trends can unfold and the impact of economic and political factors on currency values. By studying these events, traders can enhance their ability to anticipate and navigate future market developments. Additionally, analyzing the effects of central bank policies, interest rate changes, and geopolitical events on currency markets can further inform long-term trading strategies.

Conclusion

In conclusion, long-term trading in forex presents a compelling opportunity for investors willing to embrace its unique characteristics and challenges. By understanding the strategies, risks, and lessons learned from past market trends, traders can enhance their chances of success. We encourage readers to explore further and implement long-term trading strategies, considering their individual goals, risk tolerance, and dedication to ongoing market analysis.

By adopting a long-term perspective, forex investors can navigate the dynamic landscape of the currency market with greater confidence and potentially achieve their investment objectives.