4 hour forex trading strategy

The forex market is the largest and most liquid financial market globally, attracting diverse participants, from individual retail traders to institutional investors.

Timeframes play a crucial role in forex trading, as they determine the duration of each trading session's data and influence the interpretation of price movements. Traders often use various timeframes to identify trends, gauge market sentiment, and effectively time their entries and exit.

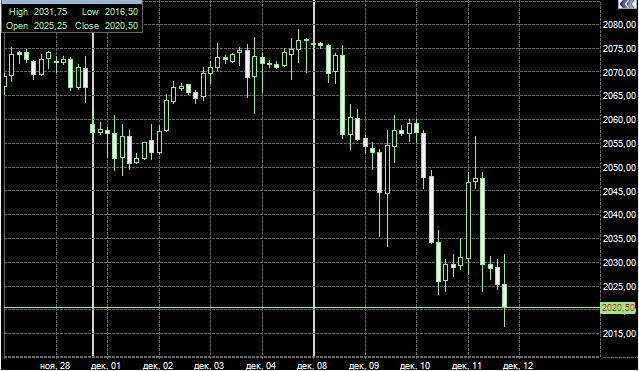

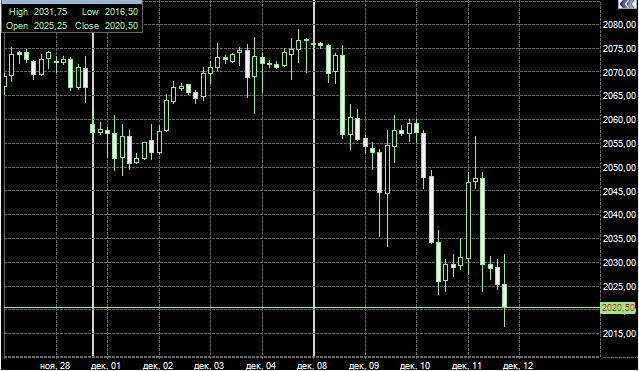

The 4-Hour Forex Trading Strategy centres around the 4-hour time frame, providing a balanced perspective that is less noisy than shorter timeframes while offering more trading opportunities than longer ones. This approach hinges on identifying significant candlestick breakouts, which signal potential trend reversals or continuations, and making strategic trading decisions based on these patterns.

Understanding the forex 4 hour time frame

In forex trading, timeframes refer to the intervals used to plot price data on charts. Traders can choose from various timeframes, such as the 1-minute, 15-minute, 1-hour, daily, and, notably, the 4-hour timeframe. Each timeframe provides a unique perspective on market movements, catering to different trading styles and objectives. The 4-hour time frame strikes a balance between capturing significant price movements and reducing market noise, making it a popular choice for many traders.

The 4-hour time frame offers several advantages that attract traders seeking medium-term positions. It provides a broader view of the market, allowing traders to spot trends and major support and resistance levels more effectively. Additionally, the 4-hour candles can reveal essential price patterns with higher reliability, making it easier to identify breakout opportunities.

However, this timeframe also has some drawbacks. Due to the extended duration of each candle, the 4-hour time frame may not be suitable for traders seeking quick profits or scalping strategies. Moreover, significant news events can influence the market during the 4-hour period, leading to unexpected volatility.

Given the global nature of the forex market, it operates 24 hours a day, five days a week. When trading on the 4-hour timeframe, understanding the key trading sessions can be beneficial. The overlap between major trading sessions, such as the European and U.S. sessions, often leads to increased liquidity and higher price movements, presenting more trading opportunities.

To effectively use the 4-hour timeframe, traders need to set up 4-hour candlestick charts on their trading platforms. This involves selecting the desired currency pair and choosing the 4-hour timeframe as the chart period. Each candle represents four hours of price action, and traders can apply various technical indicators and drawing tools to analyze market trends and potential breakout signals.

Mastering the 4 hour candle breakout strategy

The 4-hour candle breakout strategy revolves around identifying significant price movements that break beyond established support and resistance levels. Candlestick breakouts occur when the price breaches these key levels, indicating a potential shift in market sentiment and the initiation of a new trend. Traders who master this concept can capitalize on these breakout signals to enter trades with favorable risk-reward ratios and enhance profitability.

Volatility plays a crucial role in the 4-hour candle breakout strategy. Traders must assess market volatility to determine the validity of breakout signals and manage risk effectively. A sudden surge in volatility may lead to false breakouts, underscoring the need for additional confirmation before entering a trade. Additionally, analyzing market sentiment through tools like technical indicators and chart patterns can further enhance the precision of breakout trading decisions.

To execute the 4-hour candle breakout strategy successfully, traders must identify key support and resistance levels accurately. These levels are essential reference points where the price has historically reversed or stalled. By recognizing these areas on the chart, traders can anticipate potential breakout opportunities and position themselves to take advantage of price movements.

Confirmation is vital in breakout trading to reduce false signals and minimize risks. Traders often look for specific candlestick patterns, such as the engulfing pattern, the harami pattern, and the morning or evening star, to validate breakout signals. These patterns provide additional insight into the strength of the breakout and the potential duration of the ensuing trend, guiding traders towards making more informed trading decisions.

Implementing the 4 hour candle breakout strategy

When implementing the 4-hour candle breakout strategy, selecting appropriate currency pairs and market conditions is vital. Not all currency pairs behave similarly, and certain pairs may exhibit stronger breakout tendencies within the 4-hour timeframe. Traders should conduct thorough research and analyze historical price data to identify pairs that align with their trading goals and risk tolerance. Additionally, monitoring the overall market conditions, such as trending or ranging environments, can provide valuable insights for successful breakout trading.

Timing is crucial in breakout trading to maximize profitability and minimize risks. Traders must wait for a confirmed breakout above resistance or below support before entering a position. Entering too early may lead to false breakouts, while entering too late may result in missed opportunities. Employing technical indicators and trend analysis can aid in fine-tuning entry points and increasing the probability of profitable trades.

Setting appropriate stop-loss and take-profit levels is essential to protect capital and manage risk. Stop-loss orders should be placed just beyond the breakout level to limit potential losses if the market reverses. Take-profit levels can be determined based on previous price movements or key support and resistance levels. Traders should aim for a favorable risk-to-reward ratio to ensure that winning trades outweigh losing ones.

Sound risk management practices are paramount in 4-hour trading. Traders should always avoid a significant portion of their capital on a single trade, as forex markets can be unpredictable. Implementing position sizing techniques, such as the percentage risk model or fixed dollar amount, can help ensure that no single trade jeopardizes the overall trading account. By managing risk effectively, traders can maintain a sustainable and profitable trading approach.

Enhancing the 4 hour forex trading strategy

To strengthen the effectiveness of the 4-hour forex trading strategy, traders can incorporate technical indicators for additional confirmation. Indicators such as the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands can complement the breakout signals generated by candlestick patterns. These tools provide insights into market momentum, overbought or oversold conditions, and potential trend reversals, adding layers of analysis to support trading decisions.

While the 4-hour timeframe primarily focuses on technical analysis, incorporating fundamental analysis can offer a more comprehensive market view. Economic indicators, geopolitical events, and central bank decisions can significantly impact currency pairs. By aligning the 4-hour trading strategy with fundamental factors, traders can gauge the broader market sentiment and avoid potential conflicts between technical signals and fundamental developments.

Staying informed about upcoming news events and economic releases is crucial for traders employing the 4-hour forex strategy. Major news announcements, such as Non-Farm Payrolls or interest rate decisions, can cause substantial market volatility and affect breakout setups. Utilizing an economic calendar to be aware of scheduled events can help traders adjust their trading approach accordingly, either by temporarily exiting positions or refraining from entering new trades during high-impact news periods.

Common pitfalls and challenges

One of the most common pitfalls in applying the 4-hour forex trading strategy is falling into the trap of overtrading. The allure of multiple trading opportunities within the 4-hour timeframe can lead traders to enter positions impulsively, deviating from their carefully planned strategies. Overtrading often results in increased transaction costs and reduced overall profitability. To overcome this challenge, traders must exercise patience and discipline, waiting for high-probability setups that align with their trading plan.

Emotional discipline plays a crucial role in successful 4-hour trading. The forex market can be unpredictable, and managing emotions during drawdowns or winning streaks is essential to avoid impulsive decisions driven by fear or greed. Developing a strong psychological mindset and adhering to pre-established risk management rules can help traders stay focused and avoid emotional biases that may interfere with objective decision-making.

False breakouts, including the 4-hour candle breakout strategy, are inherent risks in breakout trading. Traders may encounter situations where a breakout signal appears valid, but the market quickly reverses, leading to losses. To address false breakouts, traders should employ additional confirmation techniques, such as using technical indicators or waiting for multiple candle closes beyond the breakout level before entering a trade. Flexibility and adaptability are also essential when dealing with false breakouts, as they are an inherent part of forex trading.

Advantages and disadvantages of the 4 hour forex trading strategy

The 4-hour forex trading strategy offers several compelling advantages that attract traders seeking medium-term positions. Firstly, this timeframe provides a balanced market view, offering a clearer picture of price trends and significant support and resistance levels. The extended duration of 4-hour candles helps filter out market noise, reducing the impact of minor price fluctuations on trading decisions. Moreover, traders can find ample trading opportunities within the 4-hour timeframe, enabling them to actively participate in the market without being overwhelmed by constant monitoring. Additionally, the 4-hour trading approach allows traders to combine both technical and fundamental analysis effectively, providing a more comprehensive understanding of the market.

While the 4-hour forex trading strategy offers attractive benefits, it also has certain drawbacks. One of the notable cons is the potential for missed intraday opportunities. Traders focusing on the 4-hour timeframe might not capture quick price movements within shorter timeframes. Additionally, false breakouts can occur due to the extended duration of each candle, leading to occasional losses and challenges in determining genuine breakout signals. Furthermore, the 4-hour strategy may not suit traders who prefer frequent trading or those seeking to capitalize on high-frequency price fluctuations. Finally, the reliance on historical price data in this strategy might only sometimes fully reflect rapidly changing market conditions, potentially affecting the accuracy of trading decisions.

Conclusion

In conclusion, the 4-hour forex trading strategy presents a valuable approach for traders seeking a balanced and medium-term perspective on the market. By focusing on candlestick breakouts within the 4-hour timeframe, traders can capitalize on significant price movements while filtering out unnecessary market noise. The strategy's advantages lie in its ability to provide a comprehensive view of price trends, ample trading opportunities, and the potential to integrate both technical and fundamental analysis effectively.

However, traders must also be mindful of the challenges associated with the 4-hour strategy, such as the risk of false breakouts and the possibility of missing intraday opportunities. Emphasizing patience, emotional discipline, and risk management is crucial to overcoming these pitfalls.

As with any trading strategy, continuous learning and practice are key to mastering the 4-hour forex trading approach. Traders should dedicate time to refine their skills, deepen their understanding of technical indicators and chart patterns, and stay updated on relevant news and economic events.