What is a Pip in Forex?

If you are interested in forex and read analytical and news articles, you probably came across the term point or pip. This is because pip is a common term in forex trading. But what is pip and point in Forex?

In this article, we will answer the question of what is a pip in forex market and how this concept is used in Forex trading. So, just read this article to find out what are pips in forex.

What are pips in Forex Trading?

Pips are a minimal change in price movement. Simply, this is the standard unit for measuring how much the exchange rate has changed in value.

Initially, the pip showed the minimum change in which the Forex price moves. Although, with the advent of more accurate pricing methods, this initial definition is no longer relevant.

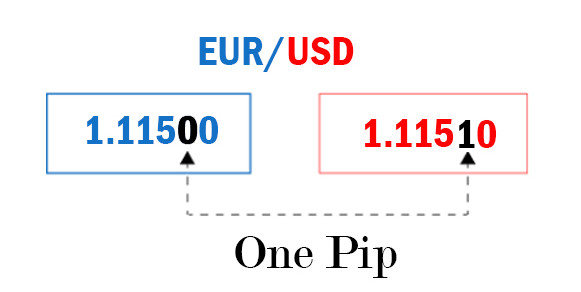

Traditionally, Forex prices were quoted for four decimal places. Initially, the minimum change in price by the fourth decimal place was called pip.

It remains a standardized value for all brokers and platforms, which makes it very useful as a measure that allows traders to communicate without confusion. Without such a specific definition, there is a risk of incorrect comparisons when it comes to general terms such as points or ticks.

How much is one Pip in Forex?

A lot of traders ask the following question:

How much is one pip and how to count it correctly?

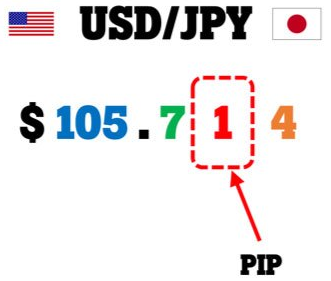

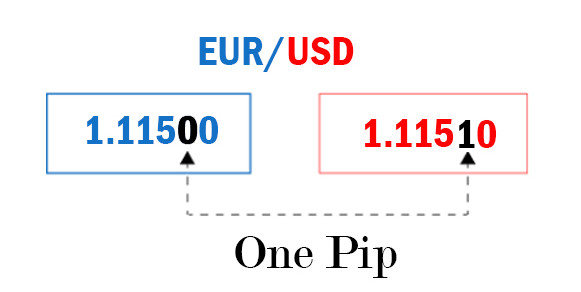

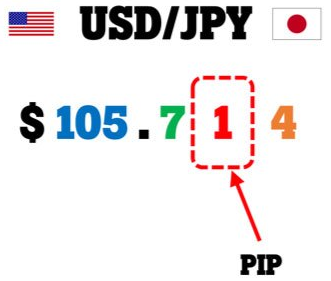

For most currency pairs, one pip is the movement of the fourth decimal place. The most notable exceptions are the forex pairs associated with the Japanese Yen. For JPY pairs, one pip is the movement in the second decimal place.

The following table shows the forex values for some common currency pairs to understand what on Forex is equal to:

Forex pairs

One pip

Price

Lot size

Forex pip value (1 lot)

EUR/USD

0.0001

1.1250

EUR 100,000

USD 10

GBP/USD

0.0001

1.2550

GBP 100,000

USD 10

USD/JPY

0.01

109.114

USD 100,000

JPY 1000

USD/CAD

0.0001

1.37326

USD 100,000

CAD 10

USD/CHF

0.0001

0.94543

USD 100,000

CHF 10

AUD/USD

0.0001

0.69260

AUD 100,000

USD 10

NZD/USD

0.0001

0.66008

NZD 100,000

USD 10

Comparison of pip value of forex pairs

By a change of one pip in your position, you can answer the question of how much the pip costs. Suppose you want to trade EUR/USD, and you decide to buy one lot. One lot cost 100,000 euros. One pip is 0.0001 for EUR/USD.

Thus, the cost of one pip for one lot is 100,000 x 0.0001 = 10 US Dollars.

Suppose you buy EUR/USD at 1.12250 and then close your position at 1.12260. The difference between the two:

1.12260 - 1.12250 = 0.00010

In other words, the difference is one pip. Hence, you will make $10.

What is a Forex contract?

Suppose you opened your position of EUR/USD at 1.11550. It means that you bought one contract. This purchase cost of one contract will be 100,000 Euros. You sell Dollars to buy Euros. The value of the Dollar you sell is naturally reflected by the exchange rate.

EUR 100,000 x 1.11550 USD/EUR = USD 111,550

You closed your position by selling one contract at 1.11600. It is clear that you sell Euros and buy Dollars.

EUR 100,000 x 1.11560 USD/EUR = USD 111,560

This means that you initially sold $111,550 and ultimately received $111,560 for a profit of $10. From this, we see that a one pip move in your favor has made you $10.

This value of pips corresponds to all pairs of forex that are quoted up to four decimal places.

What about currencies that are not quoted up to four decimal places?

The most noticeable such currency is the Japanese Yen. Money pairs associated with the Yen have traditionally been indicated by two decimal places, and the forex pips for such pairs are regulated by the second decimal place. So, let's see how to calculate pips with USD/JPY.

If you sell one lot of USD/JPY, change of one pip in price will cost you 1,000 Yens. Let's look at an example to understand.

Let's say you sell two lots of USD/JPY at a price of 112.600. One lot of USD/JPY is 100,000 US Dollars. Therefore, you sell 2 x 100,000 US Dollars = 200,000 US Dollars to buy 2 x 100,000 x 112.600 = 22,520,000 Japanese Yen.

The price moves against you, and you decide to reduce your losses. You close at 113.000. One pip for USD/JPY is the movement in the second decimal place. The price has moved 0.40 against you, which is 40 pips.

You have closed your position by purchasing two lots of USD/JPY at 113.000. To redeem $200,000 at this rate, you need 2 x 100,000 x 113.000 = 22,600,000 Japanese Yen.

This is 100,000 Yen more than your initial sale of Dollars, so you have a deficit of 100,000 Yen.

Losing 100,000 Yen in 40 pips move means that you lost 80,000/40 = 2,000 Yen for every pip. Since you sold two lots, this pip value is 1000 Yen per lot.

If your account is replenished in a currency other than the quote currency, it will affect the value of the pip. You can use any pip value calculator online to quickly determine the actual pip values.

How to use pips in Forex trading?

Some say that the term "pips" originally means "Percentage-In-Point," but this may be a case of false etymology. Others claim it means Price Interest Point.

What is a pip in forex? Whatever the origin of this term is, pips allow currency traders to talk about small changes in exchange rates. This is similar to how its relative term the base point (or bip) makes it easier to discuss minor changes in interest rates. It is much easier to say that the cable rose, for example, by 50 points, than to say that it increased by 0.0050.

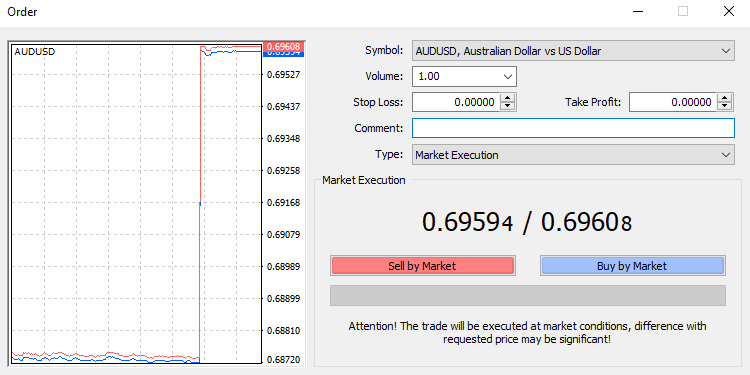

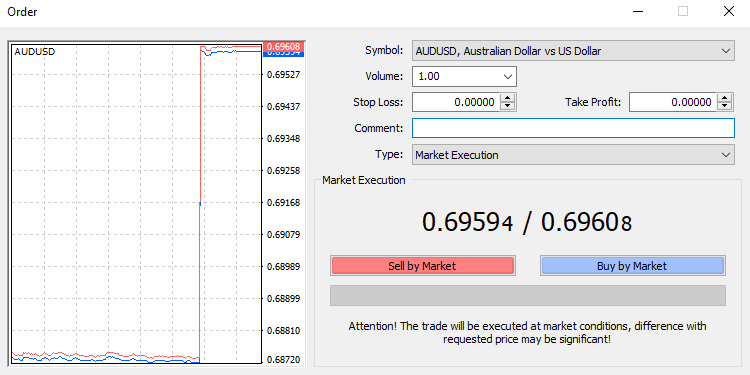

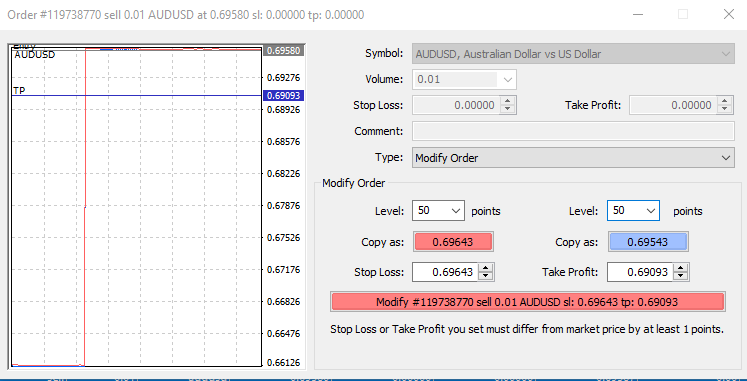

Let's see how forex prices appear in MetaTrader to illustrate a pip in forex once again. The figure below shows the order screen for AUD/USD in MetaTrader:

The quote shown in the image is 0.69594 / 0.69608. We can see that the digits of the last decimal place are smaller than the other numbers. This indicates that these are fraction of a pip. The difference between the bid price and the offer price is 1.4 pips. If you instantly bought and sold at this price, the contract cost will be 1.8.

Difference between pips and points

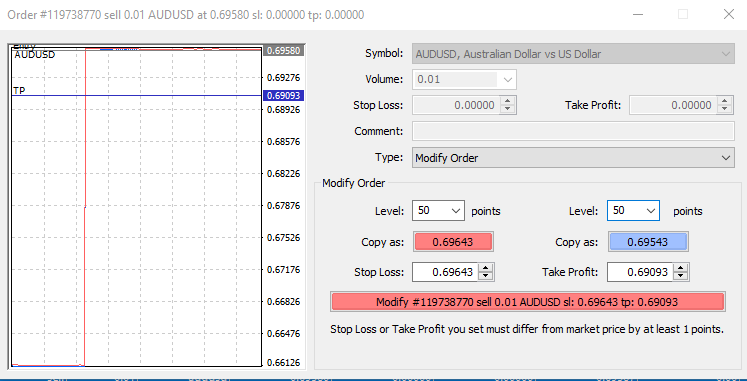

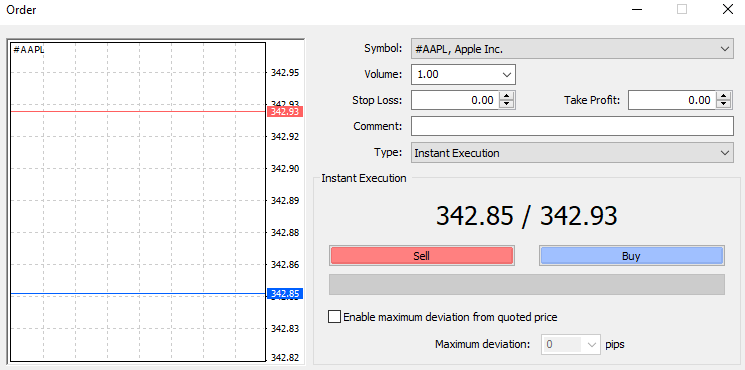

If you look at the screenshot below another order window, you will see a "Modify Order" window:

Note that in the part of the Modify Order window, there is a drop-down menu that allows you to select certain number of points as stop loss or take profit. Therefore, there is an essential difference between points and pips. The points in these drop-down lists refer to the fifth decimal place. In other words, the fractional pips making up one-tenth of the value of a pip. If you select 50 points here, you will be actually choosing 5 pips.

An excellent way to familiarize yourself with pips in forex prices is to use a demo account in the MetaTrader platform. This allows you to view and trade at market priceswith zero risk, because you only use virtual funds in a demo account.

CFD Pips

If you are interested in trading stocks, you may be wondering if there is such a thing like pip in stock trading. Indeed, there is no use of pips when it comes to stock trading, as there are already preset conditions for exchanging price changes like pence and cents.

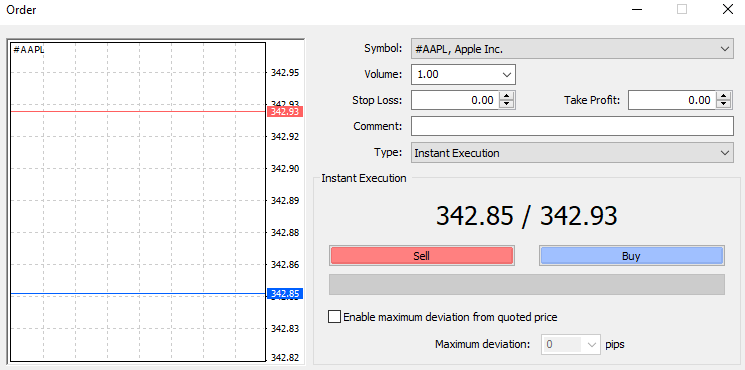

For example, the image below shows an order for Apple stocks:

The integer numbers in the quote represent the price in US Dollars, and the decimal numbers represent cents. The above image shows that the cost of trading is 8 cents. This is easy to understand, so there is no need to introduce another term like pips. Although sometimes market jargon may include the general term like "tick" to represent the movement of the smallest change of price equivalent to a cent.

The value of a pip in indices and commodities may significantly vary. For example, gold and crude oil contracts or DXY may not be the same as in case of currencies or stock CFDs. Hence, it is important to calculate value of a pip before opening a trade in particular instrument.

Conclusion

Now you should know the answer to the question “what is a pip in forex trading?”. Familiarity with the unit of measurement for change in exchange rates is an essential step towards becoming a professional trader. As a trader, you must know how the value of pips are calculated. This can help you to realize the potential risk in a trade. Therefore, we hope that this guide has provided you the basic knowledge to start your trading career.

Related articles

How to read Forex charts

What is spread in Forex Trading?

Learn Forex Trading step by step

Click on the button below to Download our "What is a Pip in Forex?" article in PDF