Building and backtesting custom forex indicators

The custom forex indicators function as analytical tools which convert market information into structured trading alerts which users can use to select their investment decisions. Custom indicators enable users to create their own calculations which duplicate the exact position sizing rules and margin limits and execution conditions which traders implement in their actual trading accounts. The indicators maintain their functionality because they function within predetermined limits.

Custom indicators function to minimize the difference between trading signals and actual market execution through their design which matches trading operations. The indicator development process enables researchers to acquire vital information which they can use to build better risk management systems and decision-making frameworks.

Why traders build their own indicators

Traders create their own indicators because they need to link their trading signals to their position size rules and their margin restrictions and risk tolerance settings. Standard indicators apply fixed formulas that may not reflect how a trader calculates lots or manages leverage. Through custom indicators traders can link their trading signals to particular performance indicators which measure their trades.

The account contains USD 5,000 which the trader uses to establish a 2 percent risk limit for each trade at USD 100. A trade setup which needs a 20-pip stop loss requires traders to use 0.5 mini lots for their position because one pip equals USD 1. The custom indicator will automatically determine this value while showing the signal when it stays inside the defined risk area. Without this adjustment, a default indicator may generate a signal without accounting for pip value, leading to an oversized position.

The application of leverage reduces margin requirements but it does not affect the existing price exposure. The combination of margin usage tracking with lot size monitoring serves as an indicator which stops traders from placing multiple trades that would use up most of their available funds.

Core concepts behind forex indicator design

The main objective of Forex indicator development involves transforming market price fluctuations into useful data which traders can apply to determine their trading positions and manage their risk exposure. The fundamental connection between pips and lot size and monetary exposure exists at the center of this process. The effectiveness of indicators for price change detection depends on their ability to show how these price changes affect business profitability and loss rates and margin consumption.

The EUR/USD exchange rate experienced a 12 pip price change during this short time span. The trading of one standard lot results in a USD 120 price change because each pip movement equals USD 10. The same 12-pip move on a mini lot equals about USD 12. An indicator that highlights price momentum must be interpreted alongside lot size to understand its financial impact. The physical environment of signals creates them into entities which exceed their theoretical nature.

Stop-loss distance becomes affected by volatility indicators which serve as tracking tools. Stop losses need to be set at different levels when market volatility increases. The risk level remains stable when lot size decreases in proportion to maintain it at the same level. The use of leverage adds a new risk factor because market price fluctuations do not affect the required minimum margin amounts. The design of effective indicators needs to show these connections because it helps maintain signal consistency with established account boundaries.

Choosing the right data and market inputs

The selection of suitable data serves as the essential beginning for creating dependable forex indicators. Indicators are only as accurate as the inputs used to calculate them. Most custom indicators use price data which includes open high low and close values together with time-based intervals that span from minutes to hours and days. These inputs directly affect pip calculations, lot sizing, and margin exposure.

The indicator uses five-minute price data instead of hourly data for its development. The smaller timeframe captures short-term price fluctuations, which may generate more signals but also increases sensitivity to noise. The five-minute chart shows a 10-pip price change which seems important but it translates to USD 100 when trading with one standard lot. The lack of margin requirement analysis allows traders to build up excessive leverage positions because they follow multiple trading signals.

The market provides two types of information which include volatility measures and session-specific data. Traders need to increase their stop-loss distances when markets become volatile because this practice forces them to decrease their trading position amounts for risk protection. The indicator input alignment with these relationships maintains signal consistency with actual trading limitations.

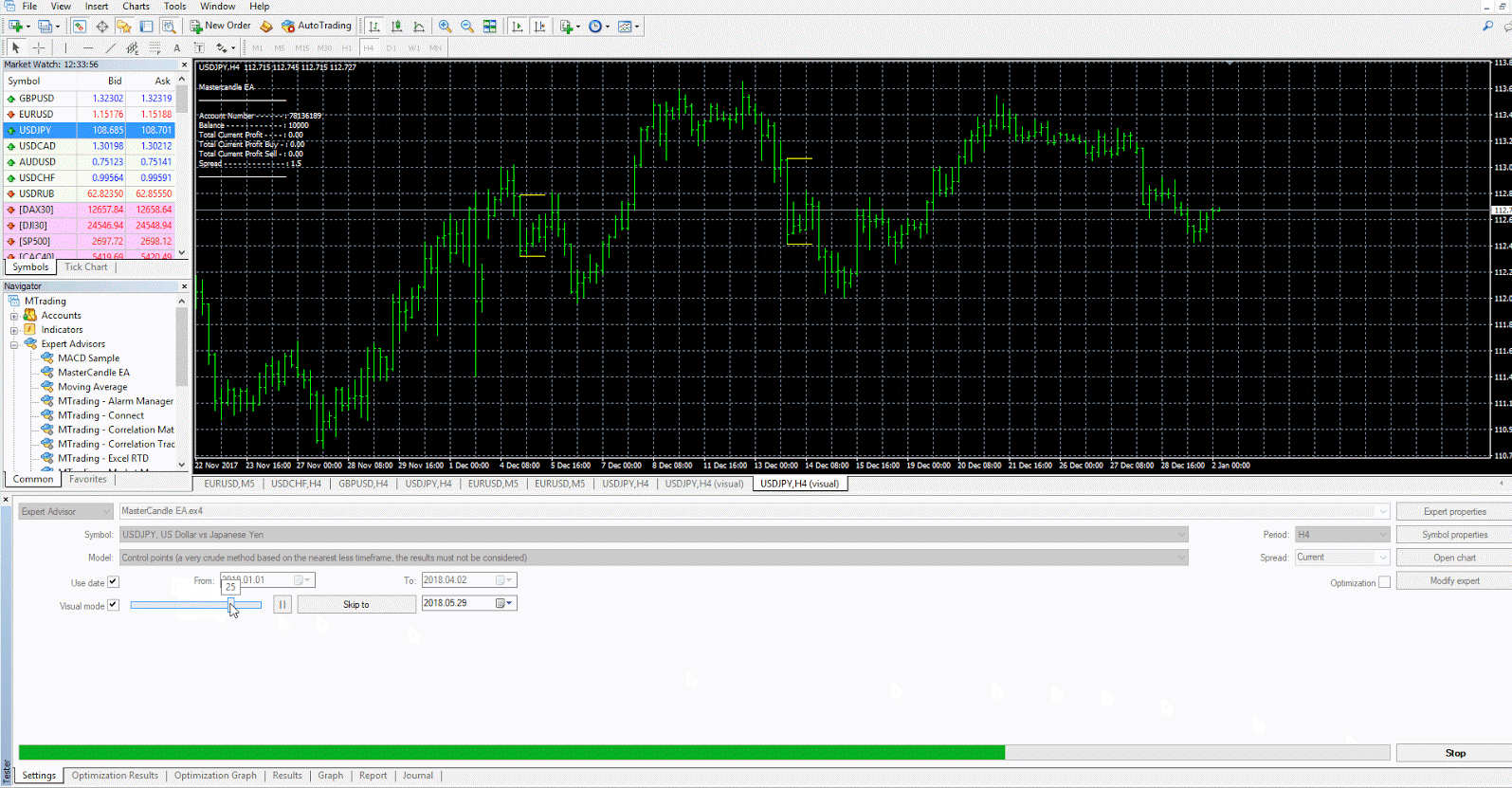

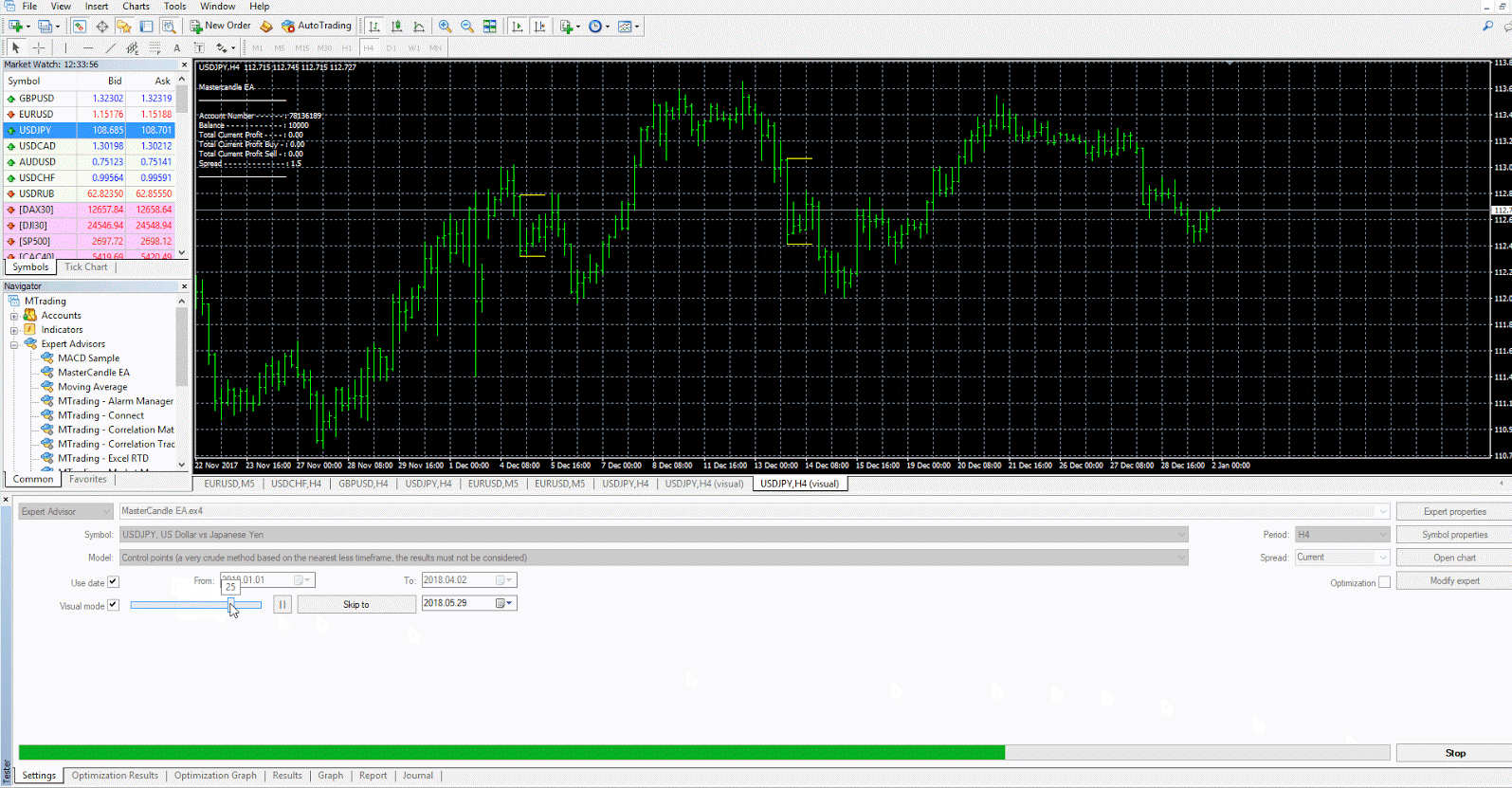

Programming custom indicators on trading platforms

The process of programming a custom indicator requires developers to transform their indicator logic into executable code which trading platforms use for real-time calculations. Most retail platforms process price data tick by tick and update indicator values on each new candle. This ensures that pip movements, lot exposure, and margin impact are reflected immediately as market prices change.

Let’s say an indicator is programmed to measure a 14-period price range and convert that range into pips. The indicator shows a price movement of approximately USD 300 because the calculated range equals 30 pips when trading with one standard lot. The data allows traders to adjust their stop-loss distances and reduce their trading position sizes before beginning their market entries. The indicator logic will determine the appropriate trading size based on account rules which establish a maximum loss of USD 150.

The programmer needs to establish the rules which determine how leverage impacts the process of calculating margin. The correct coding of indicators takes into account both contract size and leverage ratio and current market price to stop generating trading signals which exceed the available trading capital.

Principles of indicator backtesting

The process of indicator backtesting involves using historical price data to test how indicator signals would have performed as trading signals under actual market conditions. The research investigates how trading signals influence the connection between lot size and pip value and margin restrictions which traders encounter when they trade in the market. Tests which evaluate price direction alone without these elements will produce incorrect results about risk and performance.

Let’s say a strategy generates a buy signal every time price moves 15 pips in one direction. The backtesting process requires the use of the chosen lot size to generate its results. The value of one standard lot allows traders to earn USD 10 for each pip they make on EUR/USD which results in USD 150 from a 15-pip gain before paying transaction fees. The same move on a mini lot equals about USD 15. The implementation of backtesting must show how it distinguishes between these two elements.

Margin usage also matters. Users can maintain their market position through 1:30 leverage which allows them to work with reduced margin requirements. The assessment of total margin usage needs to compare it with available equity when multiple market signals emerge during a brief time period. The failure to execute this step results in unrealistic projections about what can be accomplished.

Avoiding overfitting and data bias in indicator testing

The indicator becomes overfit when it receives excessive adjustments from past price data which results in testing success but fails to deliver reliable market performance. The process of optimizing multiple parameters results in trading performance which does not effectively translate into real market execution. A indicator which shows excellent results on one particular dataset will not work when market patterns shift.

The indicator has been optimized to detect exact 12-pip market movements while using a 6-pip stop loss. The model generates precise predictions by processing historical data which it has already analyzed. The results will experience significant changes when trading with one standard lot because each pip value equals approximately USD 10. A backtest that ignores these costs may overstate profitability by hundreds of dollars over a short sample.

The use of indicators for bias testing with the same historical data set creates a potential bias problem. The process of adjusting parameters to achieve better results does not ensure that future results will be positive. The analysis becomes more reliable because it uses data from multiple time periods together with data from various market conditions.

Interpreting backtest results correctly

Backtest result interpretation requires traders to transform performance metrics into usable data which they can use for their trading activities. The raw profit numbers do not demonstrate if the indicator fulfills the defined risk parameters together with position management criteria. The evaluation process for results needs to check both the size of each lot and its pip value as well as the amount of drawdowns and the amount of margin used.

Let’s say a backtest shows a total gain of 500 pips over six months. The execution of trades through one standard lot results in a gross profit of USD 5,000 before costs because one pip equals approximately USD 10. The same pip gain using a mini lot equals about USD 500. Without this context, conclusions about performance can be misleading. The strategy demonstrates potential profit potential but it produces drawdowns which exceed the safe account risk threshold when traders execute trades with their actual trading capital.

Conclusion

The development of personal forex indicators becomes useful only when traders use them with proper trading methods and proper management of their market exposure. The trading results from price data indicators depend on how traders use trading signals through lot sizing and pip value calculation and margin management. Without this connection, even well-designed indicators can lead to unstable results.

The indicator shows excellent performance during testing because it produces distinct market entry points. The following stage requires uniting these signals with risk boundaries that exist in the market and operational conditions which impact trading activities.