Correlation between forex and other markets (Gold, oil, stocks)

Financial markets demonstrate their link through market correlation which tracks their synchronized price fluctuations. The forex market experiences price changes in currencies because of movements between commodities and stock indices and interest rate projections. Markets that show identical price movements have positive correlation between them. Market relationships become negative when their price movements oppose each other. The market demand for growth-oriented currencies rises when investors show rising optimism about worldwide investment opportunities. Market uncertainty growth causes investors to buy defensive assets which include gold and reserve currencies.

The release of inflation data leads investors to predict that major economies will increase their interest rates. The stock market initiates the price movement which then causes bond yields to change before currency pairs experience adjustments. The economic environment creates lasting changes in market interactions between different markets. Market correlation shifts enable traders to enhance their price analysis capabilities while they improve their ability to verify trading signals and control risks.

Correlation in financial markets

The measurement of correlation reveals how two assets move in sync throughout different periods of time. The correlation index ranges from +1 to –1. The correlation index shows +1 when assets track the same market patterns but it shows –1 when assets move in opposite market directions. The absence of any pattern between assets becomes evident when their correlation approaches zero. Through correlation analysis traders can evaluate position risk to understand how their investments affect their overall risk exposure.

Two currency pairs demonstrate a strong positive correlation of +0.85 according to our analysis. The market becomes more exposed when identical directional positions appear in the market instead of achieving diversification. The performance of two positions becomes more stable when their correlation shows negative values. The calculation of correlation requires historical price data which trading platforms and analytics tools make available to users. The stability of asset connections remains unstable because monetary policy changes and economic cycles progress and worldwide risk levels change.

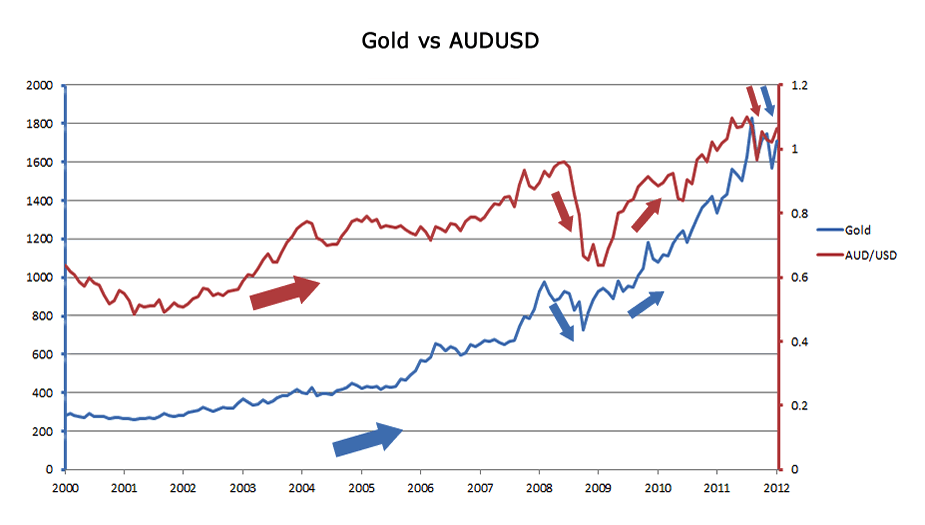

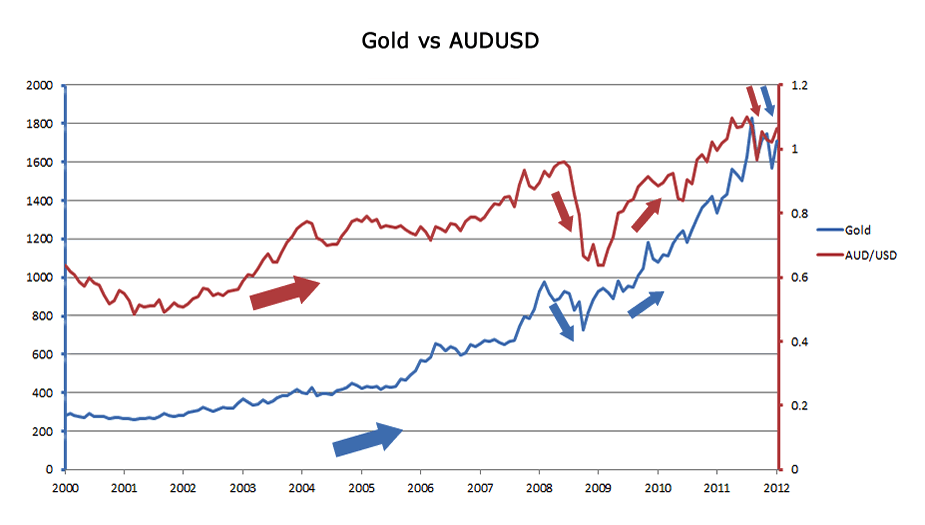

Relationship between forex and gold

The forex market maintains a historical connection with gold through its relationship with currencies that experience safe-haven demand and inflation expectation fluctuations. The worldwide pricing of gold in US dollars establishes a direct market opposition that occurs during various market scenarios. The strengthening of the US dollar makes gold more costly for investors who use different currencies which leads to decreased market interest. The dollar's decline in value leads to increased support for gold.

The market reaction to inflation data that leads to lower real interest rate expectations causes gold prices to increase while the US dollar value decreases against major currency pairs. During market stress investors shift their funds from risky currencies into defensive assets which causes gold market demand to increase. The market behavior of gold creates trading opportunities in USD and JPY and CHF currency pairs. The value of currencies from gold-producing nations will change when gold prices experience market fluctuations.

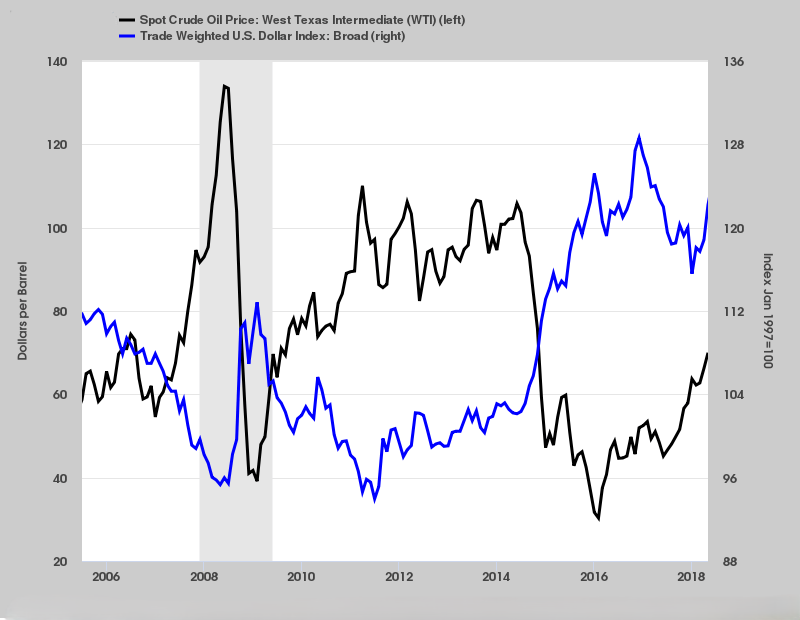

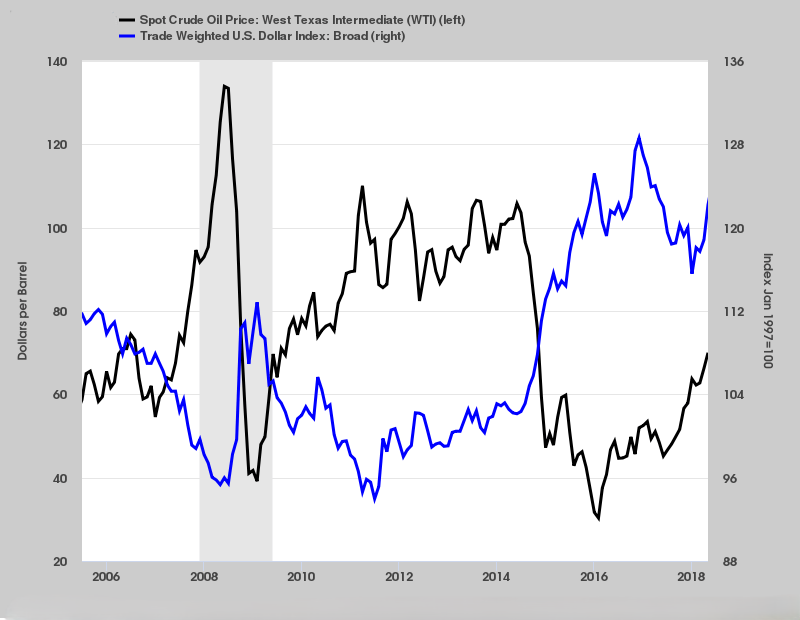

Relationship between forex and oil

The global economy depends heavily on oil as a fundamental component which directly affects multiple major currencies. The international market sets crude oil prices in US dollars which establishes a direct relationship between oil market values and dollar exchange rates. The value of domestic currencies in exporting nations increases when they receive more foreign currency from their oil exports during periods of rising oil prices. The value of currencies declines when oil prices decrease because export revenues decrease.

The global energy market demand increase leads to rising oil prices which affect both exporting and importing nations. The trade performance of export-driven economies improves when oil prices increase but these nations must pay more for their imported oil. The forex market experiences changes in inflation rates and interest rate predictions and capital movement because of these economic developments. The forex market reacts to oil price changes because traders use these fluctuations to predict economic growth or contraction. The analysis of oil prices with energy-related currency pairs helps traders understand market dynamics by showing how macroeconomic factors affect prices and allowing them to manage their market risk during times of high volatility.

Relationship between forex and stock markets

The stock market operates directly with the forex market because investors shift funds based on market emotions and their predictions about central bank actions. The performance of stock markets leads to higher demand for currencies that represent growing economies. The decrease in equity market values causes investors to select defensive currencies and secure investment choices. The worldwide capital movement between risky assets and protective investments determines this market relationship.

The stock market index experiences rising performance following economists' announcement of favorable economic statistics. International investors convert their foreign currency into local currency because they predict corporate earnings will increase and want to invest in equity markets. The rapid decline of equity markets because of recession fears leads investors to choose reserve currencies which causes stock-linked currencies to decrease in value. Central banks use their interest rate decisions to control both stock market value and currency market activity. Stock indices and forex markets share common elements which help investors verify market direction.

Key economic drivers behind market correlations

The main elements that influence market correlations emerge from macroeconomic indicators which control investment fund movements between different asset classes. The movement of interest rates functions as the main factor because rising yields attract foreign investors to buy currencies yet falling yields make currencies less attractive to investors. The way markets expect monetary policy decisions to unfold depends on inflation data which determines their correlation patterns. The market responds with synchronized movements between currencies and stocks and bonds and commodities when inflation rates show unexpected increases.

The market will respond to rising inflation rates which exceed the projected levels. The combination of rising bond yields and currency appreciation and stock market valuation decreases occurs when investors expect monetary policy to become more stringent. The same factors which affect currency correlations also impact economic growth indicators including GDP reports and employment statistics and industrial output data. The market performance of equities and growth-oriented currencies strengthens when economic growth remains robust yet investors select defensive assets during times of economic slowdown. All market forces pass through central bank communication because their policy statements determine how investors will position their assets and their risk tolerance and interest rate expectations.

How traders use correlation in forex analysis

The analysis of correlation enables traders to check their market entry points while managing their market exposure to stop taking on too much risk. Market participants who study currency pair movements relative to commodities and stock indices can identify the power of market price fluctuations. A positive stable relationship between two markets enables traders to use one market's movements for confirming direction in the other market. The natural hedge effect between two markets occurs when their relationship shows negative correlation.

The currency pair moves toward its essential technical point as the related asset shows a distinct breakout pattern. The trade confirmation process becomes more reliable because of this additional market validation. The practice of position sizing and diversification makes use of correlation data. The total risk exposure becomes larger when two highly correlated open trades have small lot sizes. Users of trading platforms have access to correlation tables and rolling correlation tools which help them monitor shifting market relationships.

Risks and Limitations of Correlation Analysis

The analytical value of correlation exists but traders need to understand its restrictions before using it for market decisions. The study of historical price patterns does not provide any insight about future market behavior during upcoming market activities. The market relationships between assets experience rapid changes because economic events and political developments and central bank decisions become active. Market relationships which seem stable during multiple months can experience sudden breakdowns without any prior indication.

The two markets maintain a positive relationship between them during times of economic expansion. The sudden introduction of new policies and geopolitical incidents will create instant market relationship shifts because capital begins to flow between different assets. The method reveals price relationships but does not explain what causes these connections to exist. The values of correlation between assets change based on the length of observation period which produces different trading signals when using different time frames. The use of correlation as a trading tool without understanding macroeconomic factors and market risks and structure will lead traders to make incorrect decisions.

Conclusion

The structured approach of correlation analysis enables investors to study how forex prices relate to gold and oil and stock market movements. The economic factors of interest rates and inflation expectations and global growth and risk sentiment establish the fundamental links between these financial instruments. The process of market trend verification and hidden market link detection becomes achievable through scheduled correlation monitoring which enables traders to better understand market behavior. The strength of asset relationships remains unstable because it responds to monetary policy adjustments and economic cycle phases and unexpected worldwide occurrences. The combination of price analysis with fundamental data and disciplined risk management produces the best results when using correlation as a supporting tool.