EMA crossover strategy

In the fast-paced world of Forex trading, market participants rely on various tools and techniques to gain insights into price movements and make informed decisions. Technical analysis, one of the pillars of trading strategies, encompasses a wide array of indicators and patterns that help traders interpret historical price data and predict future trends. Among these tools, moving averages hold a significant position due to their simplicity and effectiveness.

Moving averages, as versatile trend-following indicators, smooth out price fluctuations and reveal underlying trends. Their calculation involves averaging price data over a specific period, providing traders with a clearer picture of market dynamics. By identifying trend directions and potential support or resistance levels, moving averages serve as invaluable tools in devising trading strategies.

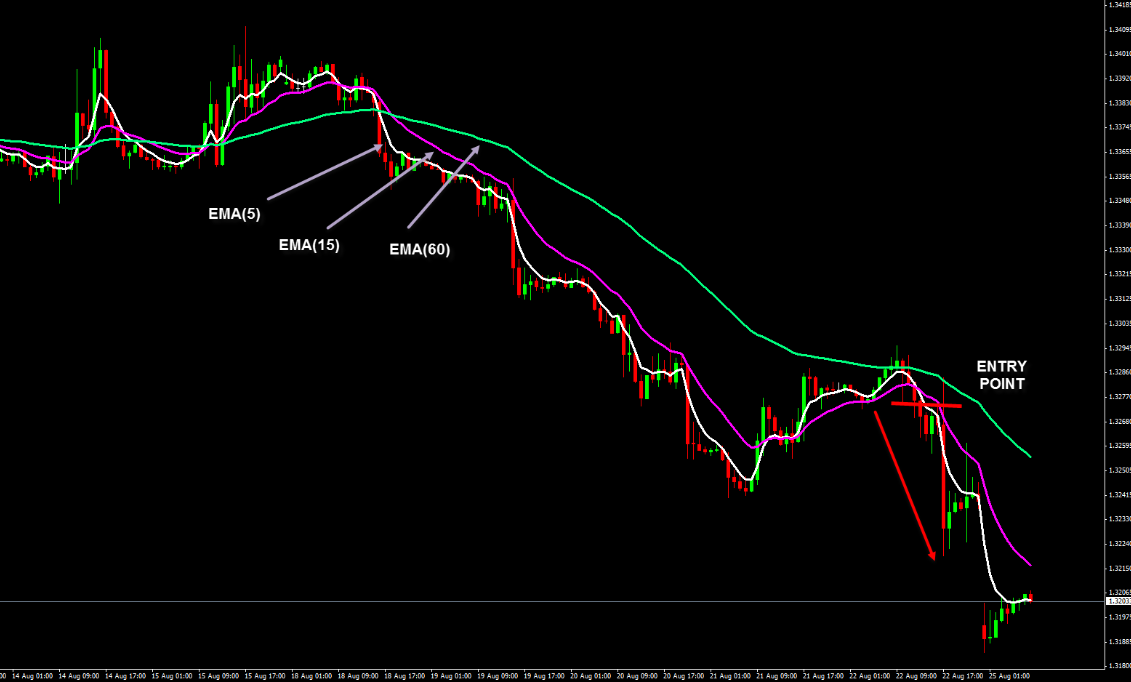

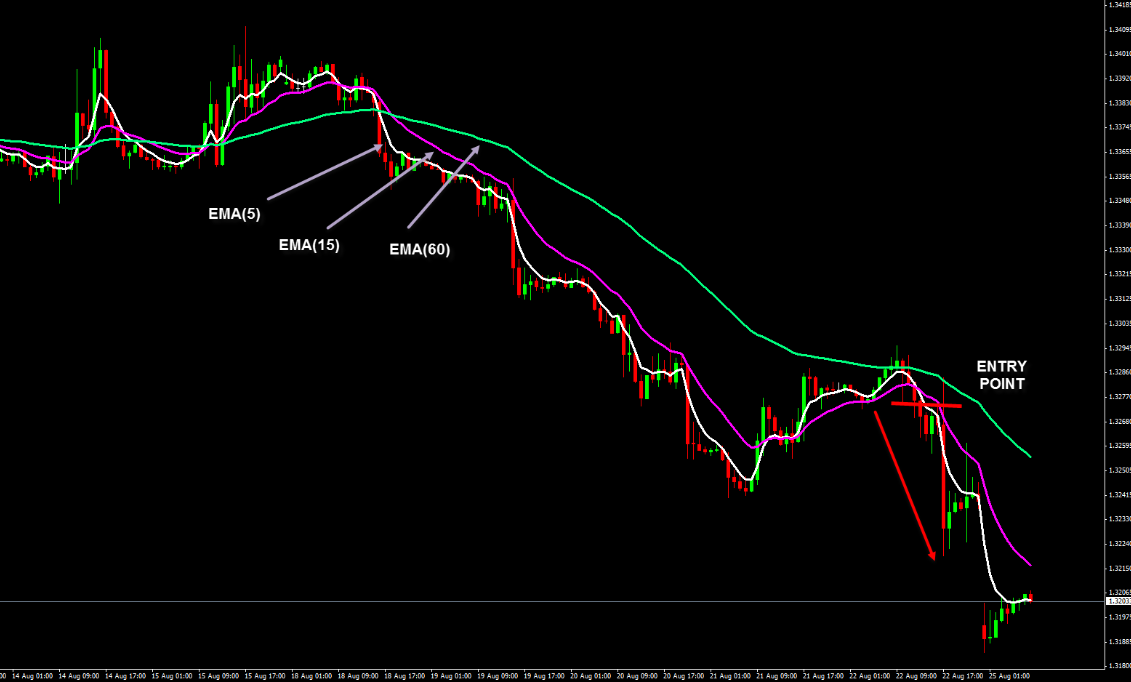

Within the realm of moving averages, the Exponential Moving Average (EMA) crossover strategy has gained notable popularity among traders. This strategy involves the intersection of two EMAs with different time periods, aiming to generate buy or sell signals when these lines cross each other. By capturing shifts in momentum, the EMA crossover strategy enables traders to enter and exit positions at opportune moments, potentially maximizing profits and minimizing risks.

As the Forex market operates 24/5 across different time zones, traders can benefit from the EMA crossover strategy's adaptability to various timeframes. Whether employed by short-term day traders or longer-term investors, this strategy offers a versatile approach to identifying trends and making well-timed trading decisions.

Understanding moving average crossover strategy

Moving averages are widely utilized technical indicators in financial markets, including Forex trading. These indicators smooth out price fluctuations and help traders identify trends by calculating the average price over a specific period. The primary purpose of moving averages is to reveal the underlying direction of price movements and filter out short-term noise, allowing traders to make informed decisions based on more reliable signals.

There are two common types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price by summing up the closing prices over a specific period and dividing it by the number of periods. On the other hand, the EMA places more weight on recent price data, making it more responsive to current market conditions.

Moving average crossovers occur when two different moving averages intersect on a price chart. This event is significant as it often signals a potential change in market direction. A bullish crossover happens when a shorter-term moving average crosses above a longer-term moving average, indicating a potential upward trend. Conversely, a bearish crossover occurs when the shorter-term moving average crosses below the longer-term moving average, suggesting a potential downward trend.

The EMA crossover strategy offers several advantages for traders. It provides a clear and systematic approach to identifying potential trend reversals and generating buy or sell signals. Moreover, the EMA's responsiveness to recent price changes allows traders to capture shifts in market momentum more swiftly.

However, it's essential to recognize the limitations of the EMA crossover strategy. During periods of low volatility or in ranging markets, false signals can occur, leading to suboptimal trading outcomes. Additionally, the strategy may experience whipsaws, where frequent crossovers result in repeated entry and exit signals without sustained price movements.

The EMA crossover strategy in forex

The EMA crossover strategy has gained significant popularity among Forex traders due to its adaptability and effectiveness in capturing trends. The dynamic nature of the Forex market, with its continuous fluctuations and various currency pairs, makes the EMA crossover strategy well-suited for identifying potential trading opportunities. By focusing on recent price movements, the EMA crossover strategy aims to generate timely signals that align with the market's changing conditions.

Before deploying the EMA crossover strategy in live trading, it is crucial to perform rigorous backtesting and optimization. By utilizing historical price data, traders can assess the strategy's performance under different market conditions and refine its parameters. Backtesting enables traders to gain insights into the strategy's profitability, win rate, and drawdowns, helping them determine the optimal settings and assess its suitability for their trading style.

Selecting the appropriate EMA parameters is essential for the EMA crossover strategy's effectiveness. The choice of EMA lengths depends on the trader's trading timeframe and market characteristics. Shorter EMA periods, such as 10 or 20, react quickly to price changes, making them suitable for short-term traders. Longer EMA periods, such as 50 or 200, offer a broader perspective and are favoured by longer-term traders. It is crucial to strike a balance between responsiveness and smoothness to avoid excessive noise or lag in the trading signals.

Best practices for EMA crossover strategy

The EMA crossover strategy excels at identifying potential trend reversals, allowing traders to enter or exit positions at optimal times. Bullish crossovers, where the shorter-term EMA rises above the longer-term EMA, indicate a potential shift to an upward trend, presenting buying opportunities. Conversely, bearish crossovers, when the shorter-term EMA falls below the longer-term EMA, suggest a potential downward trend and provide signals to sell or go short. Traders can combine these crossovers with additional confirmation techniques, such as price patterns or momentum indicators, to increase the accuracy of their trading signals.

To enhance the effectiveness of the EMA crossover strategy, traders often integrate it with other technical indicators. For example, combining the EMA crossover strategy with oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can help identify overbought or oversold conditions, confirming potential entry or exit points. By incorporating multiple indicators, traders gain a more comprehensive view of the market, reducing the likelihood of false signals and increasing the overall accuracy of their trading decisions.

The timeframe selection is a crucial consideration when implementing the EMA crossover strategy. Shorter timeframes, such as intraday or scalping, require shorter EMA periods, enabling traders to capture quick price movements. Conversely, longer-term traders or swing traders may prefer higher timeframes with longer EMA periods to identify broader trends and reduce noise. Selecting the appropriate timeframe ensures that the EMA crossover strategy aligns with the trader's preferred trading style and objectives.

Real-world case studies provide valuable insights into the successful applications of the EMA crossover strategy in Forex trading. These case studies showcase how traders effectively use the strategy in various market conditions, highlighting the importance of proper parameter selection, risk management, and adapting the strategy to different currency pairs and timeframes. By examining these examples, traders can gain inspiration and learn from the experiences of successful practitioners, further refining their own implementation of the EMA crossover strategy.

Evaluating the efficacy of EMA crossover indicators

EMA crossover indicators are technical tools that automate the identification of EMA crossovers and provide visual signals on price charts. These indicators help traders efficiently track and analyze EMA crossover signals, reducing the need for manual chart observation. EMA crossover indicators typically offer customization options, allowing traders to adjust the EMA periods, select the type of crossover (bullish or bearish), and incorporate additional features such as alerts and visual markers to enhance their trading experience.

Several EMA crossover indicators are available in the market, each with its own unique features and functionalities. It is crucial for traders to compare and evaluate these indicators to determine the most suitable option for their trading needs. Factors to consider include ease of use, accuracy of signals, compatibility with trading platforms, and the availability of additional tools for comprehensive technical analysis. Popular EMA crossover indicators include the Moving Average Convergence Divergence (MACD), the Exponential Moving Average Ribbon, and the Hull Moving Average.

When selecting an EMA crossover indicator, traders should consider several factors to ensure its effectiveness in their trading strategies. These factors include the trader's trading style, timeframes, and the specific currency pairs or markets being traded. Additionally, evaluating the indicator's historical performance through backtesting and reviewing user feedback can provide valuable insights into its reliability and accuracy. It is also essential to assess the indicator's compatibility with the trader's preferred trading platform and its user-friendly interface to facilitate seamless integration into the trading workflow.

Conclusion

In conclusion, the EMA crossover strategy has established itself as a valuable tool for Forex traders seeking to identify and capitalize on market trends. By utilizing the dynamic nature of moving averages, this strategy offers timely signals for potential trend reversals, enabling traders to enter or exit positions with enhanced precision. The EMA crossover strategy's ability to adapt to different market conditions and timeframes makes it a versatile approach suitable for traders of varying styles and objectives.

For traders considering the implementation of the EMA crossover strategy, several key takeaways can guide their approach. First, thorough backtesting and optimization are essential to determine the optimal EMA parameters and validate the strategy's performance. Additionally, combining the EMA crossover strategy with other technical indicators can enhance its accuracy and provide additional confirmation signals. Effective risk management techniques, such as setting appropriate stop-loss orders and monitoring trade outcomes, are critical for long-term success with this strategy.

As the Forex market continues to evolve, traders should stay abreast of these future trends and developments, continually refining their understanding and application of the EMA crossover strategy to remain competitive and successful in their trading endeavours.

By leveraging the benefits of the EMA crossover strategy, employing sound risk management practices, and staying attuned to emerging trends, Forex traders can capitalize on market opportunities and navigate the complexities of the financial markets with confidence and proficiency.