Equity in forex trading

The basics of forex trading are an essential part of any forex trading education. Forex traders of all kinds must understand the basics of forex trading to ensure effective risk management of real live funds when trading. The aspect of these forex trading basics that has more to do with real live funds is the concept of equity.

To grasp the concept of equity in forex trading you must understand the following; margin, free margin, account balance, equity and floating open positions because they are usually linked to each other and they give a clearer and more in-depth understanding about equity in forex.

First, we will begin with the account balance.

Account balance: A traders’ portfolio account balance simply refers to the total amount of money present in the traders’ account at the moment without taking into consideration any opened position. Opened positions and margins are not accounted for in a portfolio account balance but the balance is a reflection of the previous history of profits and losses from closed trade positions.

Equity: To get a broader perspective of what equity means let's look at the case of investment in traditional finance. Equity represents the value of money that would be returned to a company’s shareholder (an individual shareholder) if all of the company’s assets and debts were paid off. In addition to this, equity can also represent the amount of money (profit or loss) returned to a company shareholder if he or she decides to exit from his or her shares of ownership by selling off his owned shares of the company. The profit or loss from the shareholder exit depends on the health and performance of the company throughout his or her investment.

The same idea applies to forex trading. Equity is not just the current balance of a trader account. It takes into account the unrealised profits or losses of all the floating positions on any financial asset or forex pairs.

In brief, the equity of a forex trading account reflects the overall balance at the moment, that is, the sum total of the portfolio account balance, current unrealised profits and losses and the spread.

Margin: It is for the retail forex trader (or traders) to utilize the leverage made available by their preferred broker, to execute market orders and open trade positions that their money usually can’t. This is where margin comes into play. Margin is simply a portion of a trader’s equity set aside from the actual account equity to keep floating trades open and to ensure that potential losses can be covered. It is required that the trader put up a specific sum of money (known as margin) as a form of collateral required to keep leveraged positions open. The remaining uncollateralized balance that the trader has left is what is referred to as the available equity and can be used to calculate the margin level.

Margin level (expressed as a percentage) is the ratio of equity in the account to the used margin.

Margin Level = (Equity / Used Margin) * 100

Floating open positions: These is the unrealised profits and/or losses from all opened positions, that is steadily accrued on the trading account balance. These unrealised profits and losses are exposed to fluctuations in price movements which depends on economic impacts, news events and the ever-changing cycle of the market.

Without any opened position, the portfolio account balance does not see any fluctuation in its price movement. Therefore traders need to ensure that if open positions are floating on profit, the traders must manage their profits effectively with strategies like percentage partial profits, trailing stop or break even, in the advent of negative market factors or news events that can reverse a profitable trade into losses. On the other hand, in the advent of negative market factors or high impact news events. If a trader doesn’t manage his or her losses effectively with the appropriate stop loss or hedging strategies, the whole equity of the trader may be wiped out and then the losing positions will be forced closed to balance the equation by the broker and also to protect its (the broker) trading capital. Brokers usually have an established rule of percentage margin limit in case of certain events like this.

Assume the free margin limit of a broker is set to 10%. The broker will automatically close out positions when the free margin approaches the 10% threshold; beginning from the position with the highest floating loss and as much as is needed to be closed to protect the broker’s capital.

What is the difference and relationship between a portfolio or trading account balance and its equity.

It’s always important to distinguish between equity and account balance when trading forex. This can help to prevent and avoid petty mistakes that can cost a whole lot. Oftentimes when there are open floating positions, novice traders might focus their attention only on the trading account balance neglecting the equity of the trading account. This is not right because it does not show the current status of the opened trades relative to the account balance.

Now that we have had a clear understanding of equity and trading account balance. We can clearly state that the difference between equity and trading account balance is; the trading account balance does not take into account the unrealised profits and losses of opened positions but the equity of the trading account does take into account the unrealised profits and losses thus reflecting the present and floating value of the trading account based on its investments and open trades.

Next is the basic relationship between a trading account balance and its equity. The equity gets lower than the actual account balance if the current open trades are negative (floating in losses) or if the profit from the trade is not more than the spread and broker commission. Conversely, the equity will be higher than the actual account balance of the trading account if the open trades are positive (floating in profits) or if the profits from the trade is more than the spread and brokers commission.

Why a trader should pay close attention to his equity

Just like in traditional investing as discussed earlier whereby an individual owns a share of a particular company. The equity of the company, analysed by its balance sheet reveals the company’s financial health, so does the equity of a trader's account reveals the health and current value of all floating open positions of the trading account.

The health and current value of the trader's account is also reflected in the free margin which represents the amount of equity that is still available to open new positions.

This is very important. Why?

- Not only does it help traders see if they can open a new position or not.

- It helps the trader to determine the right size of trade position that can be opened based on the available equity.

- It also helps the trader to determine the right risk management to apply to minimize losses or secure tangible profits.

Take for instance you as a forex trader have some floating open positions in good profit. After having applied the right profit management to secure your profits. You are aware that there is enough gained equity to open a new trade. If the new trade is profitable, it adds up to the equity making it larger.

Conversely, if your floating open positions are on losses, the equity reduces correspondingly and the trader is left with the option to either open trades of lesser sizes, open no new trade at all or close the losing trades.

In addition, If the floating open positions are on huge losses such that the free margin is not sufficient enough to cover for the losing positions, the broker will send a notification known as a margin call to top up your account balance but nowadays most brokers will just close out all the opened position, this is known as ‘Stop out’.

Note that equity, account balance and free margin is usually displayed accordingly at the top of the trade section of any mobile trading application.

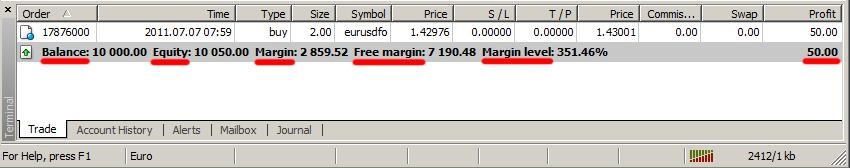

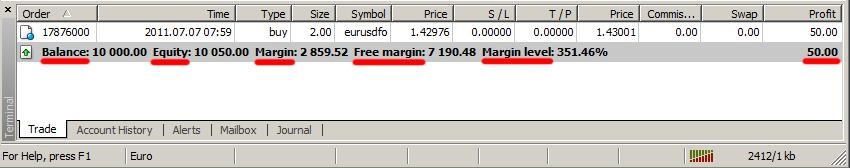

Likewise, on a PC trading terminal, they are displayed at the bottom left corner in the trade section of the terminal.

Conclusion

Equity is one of the most important aspects of forex trading and risk management therefore having a good comprehension of the role of equity in Forex can undoubtedly help traders in terms of observing their free margin level by maintaining discipline of trading activity which entails avoiding too much risk and ensuring that there is sufficient amount of equity, enough to not get stopped out of losing positions. This can be achieved by adding up to the trading account balance or using the most minimal lot sizes relative to the account size.

Traders of all kinds can open a free demo trading account to trade completely risk-free and get accustomed to this basic concept in order to effectively manage trading capital in a live market.

Click on the button below to Download our "Equity in forex trading" Guide in PDF