Forex 1-hour trading strategy

Forex trading is a dynamic, fast-paced financial market where currencies are bought and sold. As with any trading endeavour, having a well-thought-out strategy is essential for success. Strategies help traders navigate the complexities of the Forex market and make informed decisions to maximise profits while managing risks.

One such strategy that has gained popularity is the "Forex 1-Hour Trading Strategy." This approach revolves around the 1-hour time frame, where traders analyze price movements and execute trades within each hourly candlestick. The 1-hour time frame offers a balanced perspective, providing enough data to capture significant price movements while preventing traders from being overwhelmed by minute-to-minute fluctuations.

Understanding the basics

The Forex 1-hour time frame is a critical component of the 1-hour trading strategy, and its significance lies in striking a balance between capturing meaningful price movements and avoiding the noise of shorter time frames. In the Forex market, currency prices constantly fluctuate, influenced by various factors ranging from economic indicators to geopolitical events. The 1-hour time frame aggregates price data over hourly intervals, providing traders with a more comprehensive view of market trends and reducing the impact of random price spikes that can occur in smaller time frames.

Central to the 1-hour trading strategy is scalping, a trading technique where traders seek to profit from small price movements over short periods. Scalpers aim to enter and exit positions swiftly, capitalizing on even the slightest price differentials. The 1-hour time frame is particularly conducive to scalping as it allows traders to identify intraday trends and capitalize on them within each hourly candlestick.

Scalping within the 1-hour time frame demands precision and quick decision-making. Traders must analyze charts, identify potential entry and exit points, and execute trades promptly. The goal is to accumulate multiple small gains that, when combined, result in significant profits. However, it is important to note that scalping also comes with increased risk due to the higher frequency of trades, making risk management and discipline crucial aspects of this strategy.

The 1 hour forex strategy

The 1 Hour Forex Strategy is a well-crafted approach designed to harness the potential of the 1-hour time frame for profitable trading. This strategy offers several benefits that attract traders seeking dynamic and timely opportunities in the Forex market. One of the primary advantages of this strategy is its ability to capture meaningful price movements while filtering out the market noise prevalent in smaller time frames. By focusing on hourly candlesticks, traders can identify trends and make informed decisions based on more reliable data.

Central to the 1 Hour Forex Strategy is the one-hour candle strategy, a cornerstone technique that plays a crucial role in the overall approach. Each one-hour candlestick represents a snapshot of price action during that specific hour, providing essential information about price opening, closing, high, and low within the given time frame. Traders analyze these candlesticks to identify patterns, trends, and potential trade entry and exit points.

The one hour candle strategy lets traders spot short-term price fluctuations and capitalize on intraday trends. By combining this approach with proper risk management and discipline, traders can aim for consistent profits. However, it is vital to acknowledge that no strategy is without risks. The 1 Hour Forex Strategy demands diligent monitoring of trades, as the dynamic nature of the Forex market can result in sudden reversals or unexpected volatility.

The 1 hour scalping strategy

Scalping within the 1-hour time frame demands a keen understanding of market dynamics and technical indicators. Traders analyze price charts, searching for patterns and trends that can lead to quick profits. The strategy's appeal lies in its potential to accumulate numerous small gains, which can add up significantly over time. However, it is crucial to remain mindful of the associated risks, as the rapid pace of scalping can amplify the impact of losses.

Timing and precision are paramount when executing the 1 Hour Scalping Strategy. Traders must be well-versed in using tools like moving averages, support and resistance levels, and other technical indicators to identify optimal entry and exit points. Additionally, staying up-to-date with economic events and news releases can provide valuable insights into potential market movements.

While the 1 Hour Scalping Strategy offers enticing prospects, it requires discipline and a firm grasp of risk management. The fast-paced nature of scalping can be emotionally challenging, as trades unfold quickly and may demand split-second decisions. Traders must approach this strategy with a well-defined plan and adhere to it to mitigate impulsive actions.

Implementing the 1 hour forex scalping strategy

Implementing the 1 Hour Forex Scalping Strategy requires a systematic approach and a keen eye for market dynamics. In this step-by-step guide, we will walk you through the process of effectively utilizing this strategy to seize short-term trading opportunities and navigate the dynamic Forex market.

Step 1: Set up your trading platform

Begin by selecting a reliable trading platform that offers the necessary technical analysis tools. Ensure that your platform provides real-time price data and allows for swift execution of trades within the 1-hour time frame.

Step 2: Identify currency pairs and market hours

Choose currency pairs that exhibit sufficient liquidity and volatility for scalping. Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY are popular choices. Additionally, be mindful of the market hours, as the 1-hour scalping strategy is most effective during peak trading sessions when liquidity is high.

Step 3: Analyze price charts

Utilize technical indicators and chart patterns to identify potential entry and exit points. Moving averages, Bollinger Bands, and RSI (Relative Strength Index) are commonly employed tools for this strategy. Look for price patterns and trends that align with your trading objectives.

Step 4: Set stop loss and take profit levels

Determine your risk tolerance and set appropriate stop-loss and take-profit levels for each trade. Scalping involves quick trades, so ensure that your stop-loss levels are tight enough to limit potential losses, while take-profit levels capture profits before market conditions change.

Tips and tricks for maximizing profits and minimizing losses:

Maintain discipline: stick to your trading plan and avoid impulsive decisions.

Manage risk: never risk more than a small percentage of your trading capital on any single trade.

Use shorter time frames for confirmation: consider using shorter time frames (e.g., 5 or 15 minutes) to fine-tune your entry and exit points based on the 1-hour strategy signals.

Stay informed: keep abreast of economic events and news releases that can impact the Forex market.

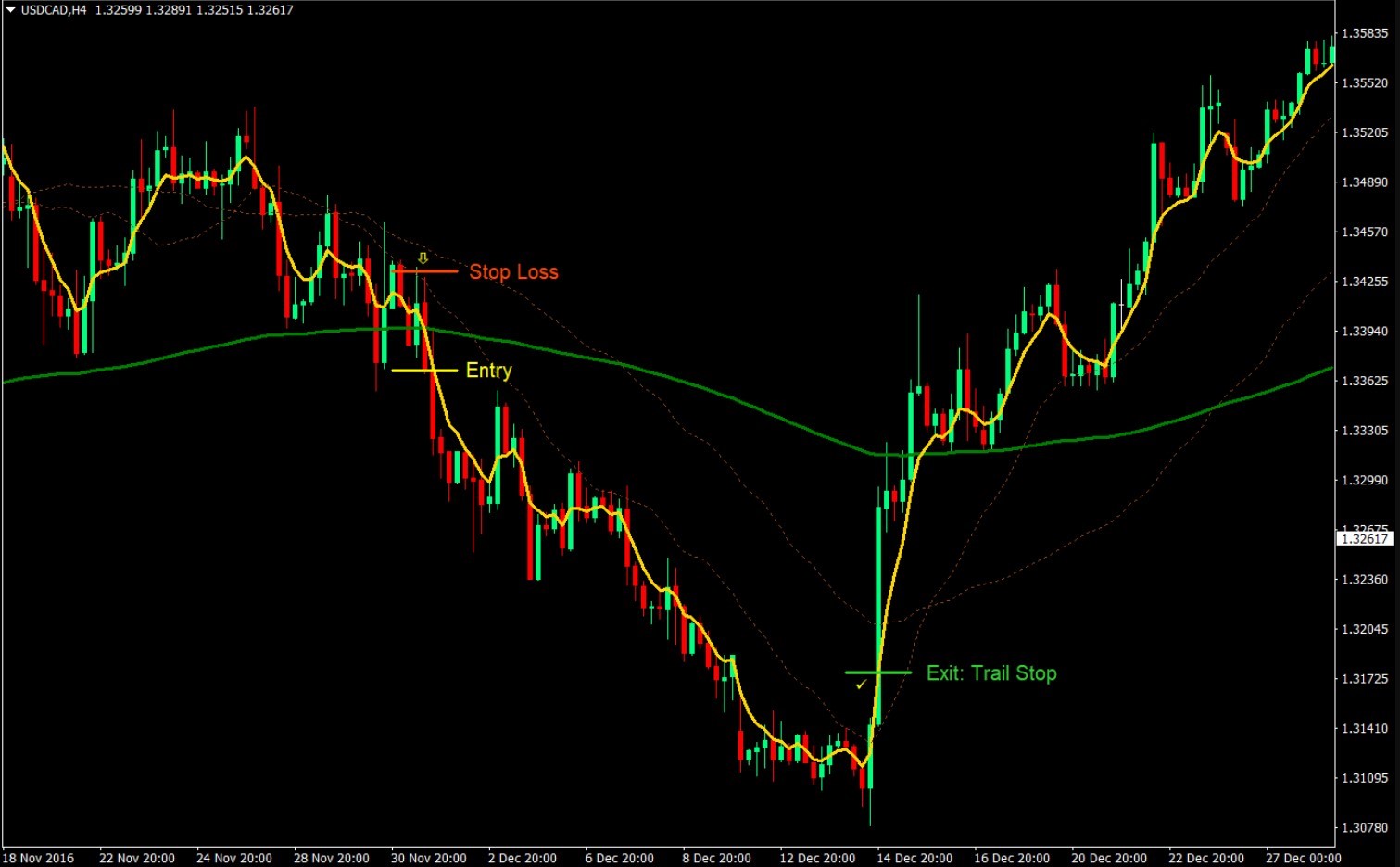

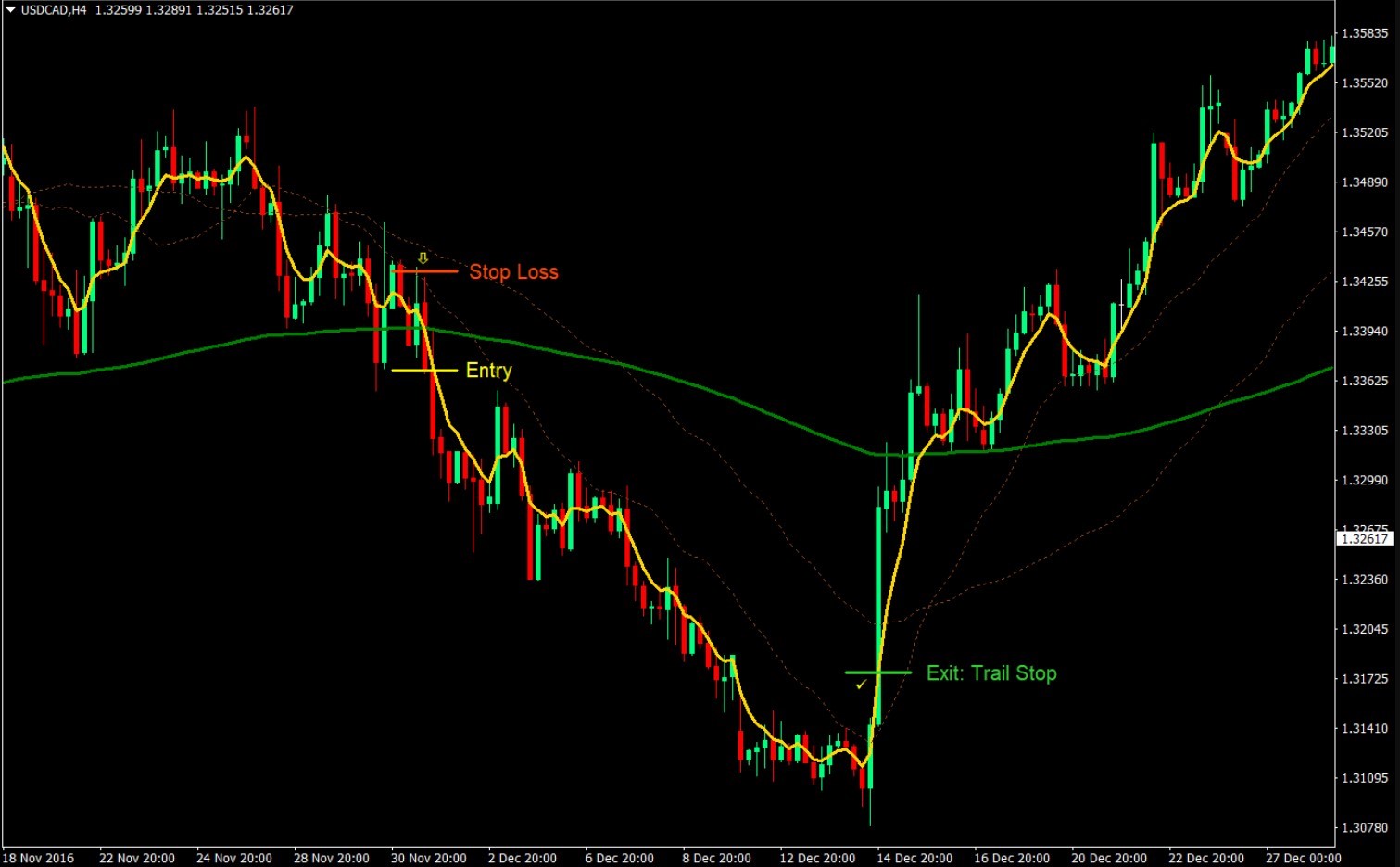

Case Studies

To bring the 1 Hour Forex Trading Strategy to life, let's explore real-world examples of successful trades executed within one 1-hour. These case studies will provide valuable insights into the strategy's application and the outcomes traders achieve.

Case study 1: EUR/USD Scalping Trade

A trader identified a clear upward trend in the EUR/USD currency pair using moving averages and RSI indicators in this case. Observing a series of higher highs and higher lows within the 1-hour candlesticks, the trader entered a long position at a breakout point. With a tight stop-loss and a modest take-profit level, the trader aimed to capitalize on the ongoing bullish momentum. The trade reached the take-profit level within the hour, yielding a respectable profit.

Case study 2: GBP/JPY Reversal Trade

During a volatile market session, another trader spotted a potential reversal in the GBP/JPY pair. Utilizing Bollinger Bands and candlestick patterns, the trader identified overbought conditions followed by a sharp bearish candle. Sensing an opportunity, the trader entered a short position, setting a nearby stop-loss to manage risks. The trade swiftly moved in the desired direction, hitting the take-profit level within the hour.

Analysis and insights:

These case studies highlight key learning points for traders implementing the 1 Hour Forex Trading Strategy. First and foremost, technical analysis tools play a crucial role in identifying entry and exit points. Moving averages, RSI, Bollinger Bands, and candlestick patterns can provide valuable signals.

Furthermore, the importance of risk management is evident in both case studies. Each trader carefully set stop-loss levels to limit potential losses, recognizing that the 1-hour time frame demands quick decisions and risk control.

Flexibility is also key. While the strategy emphasizes the 1-hour time frame, traders can complement it with shorter time frames to fine-tune their entries and confirm signals.

Conclusion

In conclusion, the "Forex 1 Hour Trading Strategy" offers traders a dynamic and powerful approach to navigate the Forex market. The 1 Hour Forex Trading Strategy capitalizes on the 1-hour time frame, providing a balanced perspective of market trends while filtering out noise. Scalping, the central technique within this approach, allows traders to profit from short-term price movements, making timely decisions and executing trades with precision.

To implement this strategy successfully, traders should follow a systematic approach. Setting up a reliable trading platform, choosing suitable currency pairs, analyzing price charts, and employing risk management techniques are all crucial steps to maximize profits and minimize losses.

We must remember that while the 1 Hour Forex Trading Strategy presents enticing opportunities, it is not without risks. Scalping demands discipline and emotional control, given the fast-paced nature of trades. Risk management should always be a top priority to safeguard trading capital.

As we conclude, we encourage readers to explore the 1 Hour Forex Trading Strategy with an open mind. By diligently applying the insights gained from real-world case studies and the step-by-step guide, traders can develop their skills in the ever-changing Forex market.