Forex arbitrage strategy

Forex arbitrage is a trading strategy that aims to take advantage of pricing inefficiencies across various currency markets. It involves the simultaneous buying and selling of currency pairs in different markets to profit from temporary imbalances in prices. The fundamental principle behind arbitrage is the law of one price, which states that identical goods (in this case, currencies) should have the same price across different locations.

Understanding forex arbitrage

Arbitrage, a cornerstone of financial markets, is a strategy employed to exploit price discrepancies across different markets. In its essence, arbitrage seeks to capitalize on temporary market inefficiencies, aiming to achieve risk-free profits. The concept of arbitrage is rooted in the principle that market prices should align, reflecting the true underlying value of an asset.

Within the Forex market, arbitrage serves as a means to leverage price differentials among various currency pairs and exchanges. Traders analyze exchange rates across different platforms or geographical regions, seeking instances where disparities emerge. By swiftly executing trades to buy at a lower price and sell at a higher price, arbitrageurs attempt to profit from these imbalances before they dissipate.

Forex arbitrage strategies encompass several approaches, each designed to exploit specific market conditions. The most common types include:

Spot Arbitrage: Capitalizing on pricing discrepancies between different currency pairs in the spot market.

Interest Rate Arbitrage: Leveraging interest rate differentials between countries to benefit from variations in currency values.

Triangular Arbitrage: Identifying inconsistencies in cross-rates among three currency pairs to generate profitable trades.

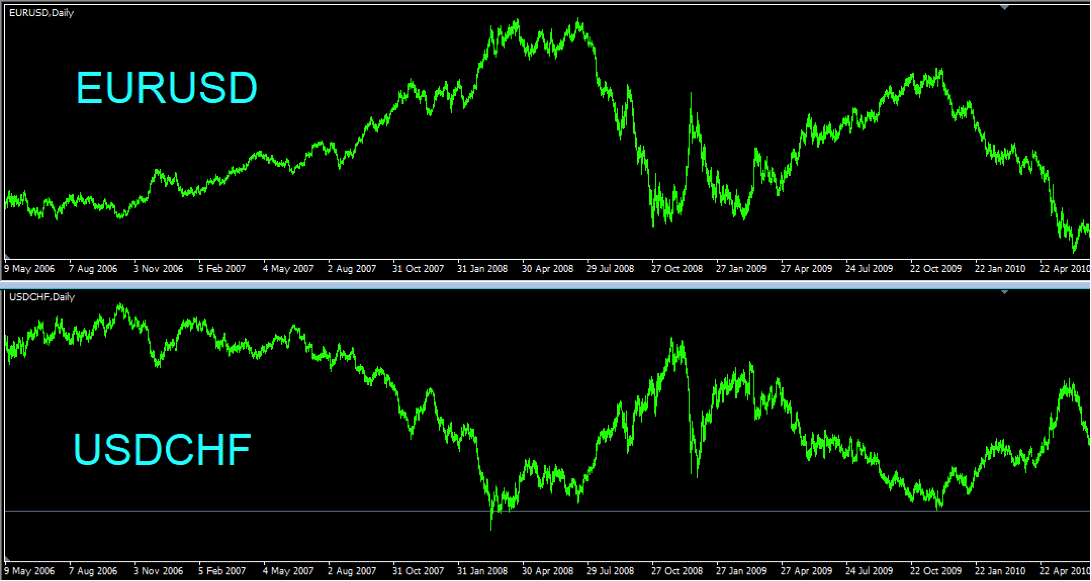

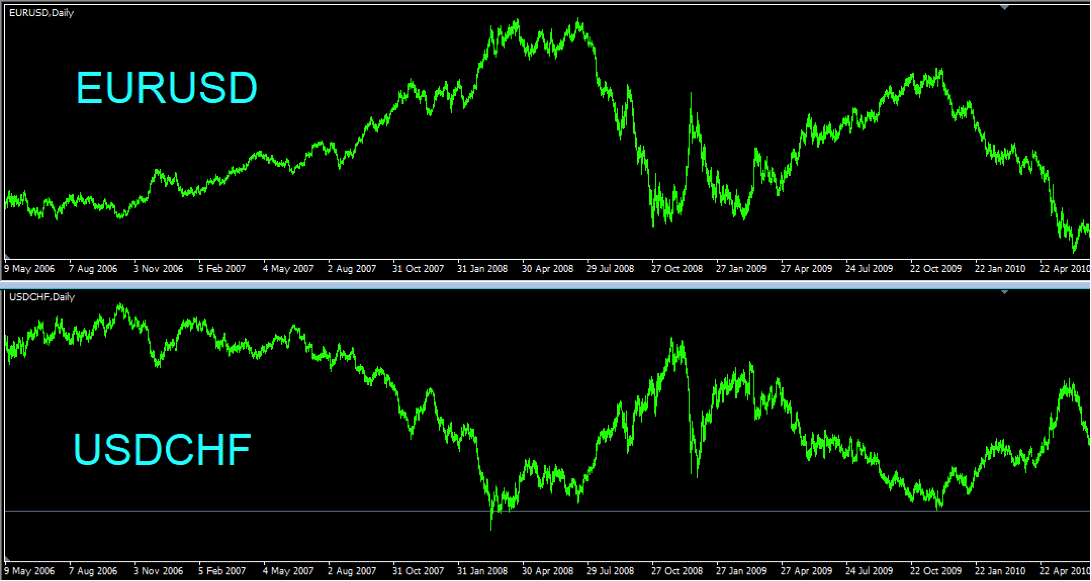

Statistical Arbitrage: Utilizing quantitative analysis and statistical models to identify pricing anomalies and execute profitable trades.

The mechanics of forex arbitrage

At the core of Forex arbitrage lies the ability to identify and exploit price discrepancies across different currency markets. Traders employ sophisticated tools and technologies to monitor exchange rates, seeking instances where disparities emerge. These disparities can be caused by variations in liquidity, market inefficiencies, or delays in information dissemination. Successful arbitrageurs must act swiftly to capitalize on these temporary discrepancies, executing trades that buy at a lower price and sell at a higher price, thus locking in risk-free profits.

Triangular arbitrage is a widely utilized strategy in the Forex market. It involves exploiting price inconsistencies among three currency pairs to generate profits. By carefully analyzing the exchange rates between these currency pairs, traders can identify triangular relationships that deviate from their equilibrium values. Leveraging these deviations, traders execute a series of rapid trades to capture profits without exposing themselves to market risk.

Statistical arbitrage is a sophisticated approach that leverages quantitative analysis and statistical models to identify and exploit pricing anomalies in the Forex market. Traders employ advanced algorithms to process vast amounts of historical and real-time data, searching for patterns and deviations from expected values. By utilizing statistical techniques, traders can identify opportunities where the observed market prices differ significantly from the predicted values, allowing them to execute profitable trades.

While Forex arbitrage offers the potential for risk-free profits, it is not without its own set of risks and considerations. Market participants must carefully consider factors such as transaction costs, execution speed, market liquidity, and regulatory constraints. Moreover, technological failures or connectivity issues can disrupt the execution of arbitrage trades, potentially leading to missed opportunities or financial losses. Effective risk management, thorough research, and constant monitoring are essential to navigate the challenges inherent in Forex arbitrage.

Real-world examples

Example 1: Spot forex arbitrage

Spot Forex arbitrage involves taking advantage of pricing discrepancies in the spot market, where currencies are traded for immediate delivery. For instance, let's consider a scenario where the exchange rate for USD/EUR is 1.2000 in one market and 1.2100 in another market. A trader could simultaneously buy 1,000 USD at a lower rate and sell them at a higher rate, resulting in a risk-free profit of 100 EUR.

Example 2: Interest rate arbitrage

Interest rate arbitrage exploits differences in interest rates between countries to profit from currency fluctuations. Suppose the interest rate in Country A is 2% and in Country B is 3%. A trader could borrow 1,000 units of currency from Country A at a lower interest rate, convert it into the currency of Country B, and invest it at a higher interest rate. By the end of the investment period, the trader can convert the investment back to the original currency, repaying the loan and generating a profit from the interest rate differential.

Example 3: Cross-currency arbitrage

Cross-currency arbitrage takes advantage of pricing inconsistencies between currency pairs involving three different currencies. For instance, consider three currency pairs: USD/EUR, EUR/GBP, and GBP/USD. If the exchange rates in these pairs do not align with the market's implied cross-rate, an arbitrage opportunity arises. Traders can execute a series of transactions across the three pairs to capitalize on the price disparities and secure risk-free profits.

Implementing an effective forex arbitrage strategy

Successful implementation of a Forex arbitrage strategy requires thorough preparation. Traders should establish accounts with reputable brokers, ensuring access to multiple markets and competitive pricing. It is crucial to have sufficient capital to execute trades swiftly and efficiently. Additionally, traders must stay informed about market events, economic indicators, and geopolitical developments that can impact exchange rates.

Choosing the right currency pairs and markets is vital for Forex arbitrage. Traders should focus on pairs with high liquidity and actively traded markets to minimize execution risks. Analyzing historical price data and market behaviour can provide insights into which pairs are prone to pricing inefficiencies, increasing the likelihood of finding profitable opportunities.

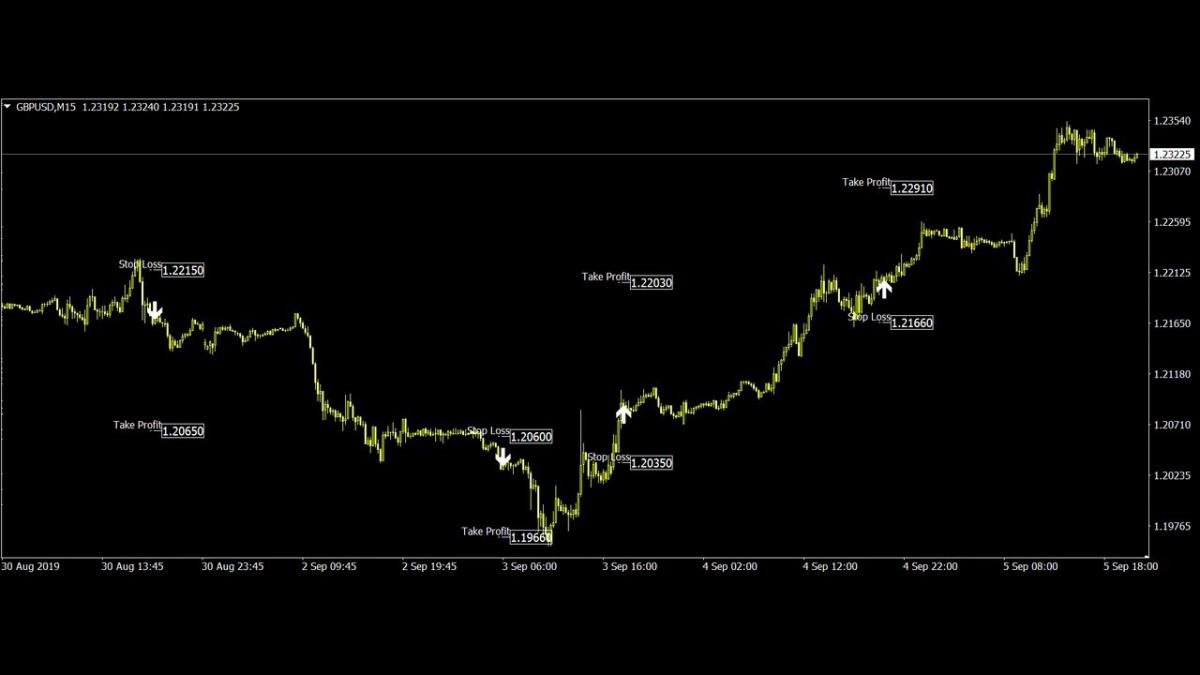

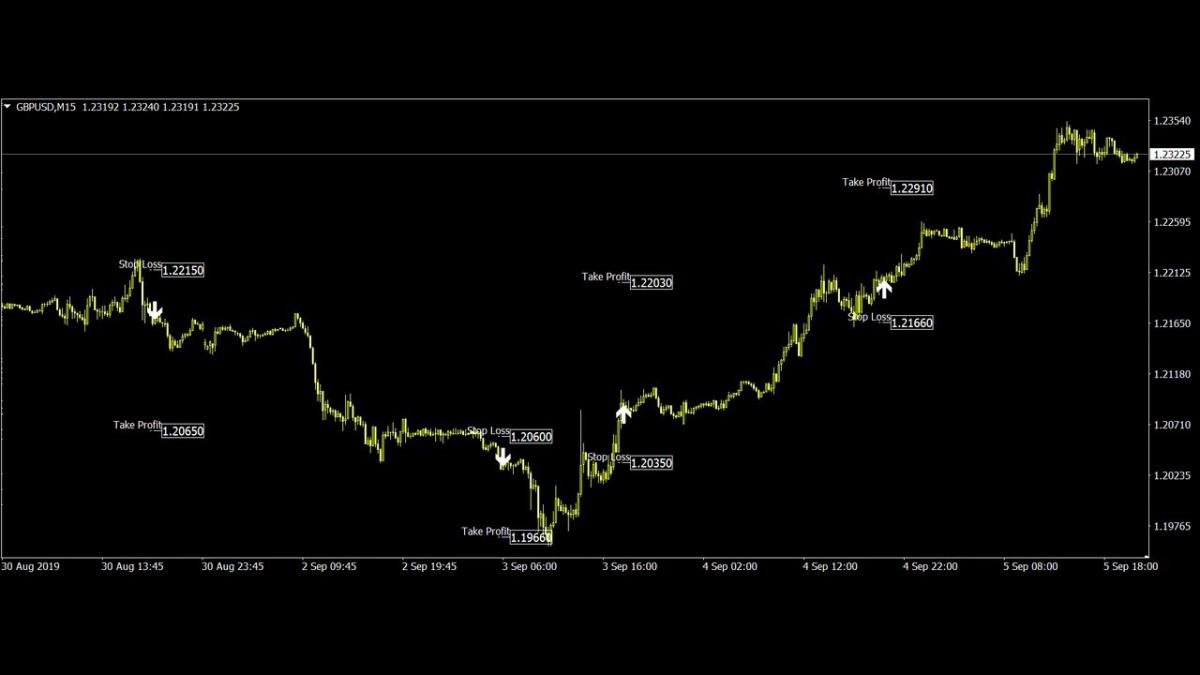

Real-time monitoring of exchange rates and market data is essential for identifying arbitrage opportunities. Traders utilize advanced tools, such as trading platforms, news feeds, and price aggregators, to stay updated on price movements and spot discrepancies swiftly. Implementing automated algorithms and custom indicators can enhance the efficiency of opportunity identification.

Executing arbitrage trades requires speed and precision. Traders employ cutting-edge technology to execute trades instantaneously and ensure accurate order placement across multiple platforms. Risk management is crucial in arbitrage trading. Hedging strategies, stop-loss orders, and position-sizing techniques are employed to mitigate potential risks and protect capital.

Challenges and limitations

One of the key challenges in Forex arbitrage is market efficiency and competition. As markets become increasingly sophisticated and technology-driven, pricing inefficiencies tend to be short-lived. High-frequency trading and automated algorithms enable market participants to swiftly identify and exploit arbitrage opportunities, minimizing the profitability window for traders. Moreover, as more traders engage in arbitrage strategies, competition intensifies, further reducing profit margins and increasing the difficulty of finding suitable opportunities.

Forex arbitrage heavily relies on advanced technology for rapid trade execution and real-time market monitoring. Technological constraints, such as network latency, system outages, or data inaccuracies, can impede the effectiveness of arbitrage strategies. Even slight delays in trade execution can result in missed opportunities or diminished profits. Traders must continually invest in robust technology infrastructure and employ reliable connectivity to overcome these challenges.

Regulatory considerations pose another set of challenges in Forex arbitrage. Different jurisdictions have varying rules and regulations regarding market access, trading practices, and transaction costs. Traders must navigate complex legal frameworks and ensure compliance with applicable laws. Additionally, regulatory changes or interventions aimed at maintaining market stability can impact arbitrage opportunities, requiring traders to stay abreast of regulatory developments and adapt their strategies accordingly.

Future trends and innovations in forex arbitrage

The future of Forex arbitrage lies in advancements in algorithmic trading and automation. As technology continues to evolve, traders are leveraging sophisticated algorithms to execute trades with remarkable speed and accuracy. These algorithms analyze vast amounts of data, identify arbitrage opportunities, and execute trades instantaneously, minimizing human intervention.

Blockchain technology and decentralized finance (DeFi) have the potential to revolutionize Forex arbitrage. Blockchain's transparent and immutable nature can enhance trust and security in cross-border transactions, simplifying settlement processes and reducing counterparty risks. Decentralized exchanges and smart contracts enable seamless peer-to-peer trading, eliminating intermediaries and reducing trading costs. These innovations may open up new avenues for arbitrageurs, enabling them to explore alternative trading platforms and access liquidity in previously untapped markets.

The machine learning (ML) holds great promise for the future of Forex arbitrage. ML algorithms can analyze vast amounts of historical and real-time market data, detect patterns, and make predictions with remarkable accuracy. By leveraging these technologies, traders can enhance their ability to identify pricing anomalies, adapt to changing market conditions, and optimize their arbitrage strategies. Furthermore, AI-powered risk management systems can help traders better assess and manage the inherent risks associated with arbitrage trading.

Conclusion

Forex arbitrage presents a unique opportunity for traders to capitalize on pricing discrepancies and secure risk-free profits. By taking advantage of temporary imbalances in exchange rates, arbitrageurs can achieve consistent returns. The potential of Forex arbitrage lies in its ability to leverage technological advancements, such as algorithmic trading, artificial intelligence, and blockchain technology. These innovations enhance the efficiency, speed, and accuracy of arbitrage strategies, opening up new avenues for profit generation.

As the Forex market continues to evolve, the future of arbitrage holds exciting prospects. Advancements in technology and the integration of AI and blockchain are expected to shape the landscape of Forex arbitrage. While challenges such as market efficiency, technological constraints, and regulatory considerations persist, traders who adapt to these changes and embrace innovation will be well-positioned to thrive in the dynamic currency market.