How Economic News affects Forex Markets

Currency markets demonstrate rapid responses to modifications in economic data. The announcements of interest rates and employment statistics and inflation numbers lead to immediate market price fluctuations. The market volatility creates both potential gains and potential dangers for traders. The management of both opportunities and risks requires traders to understand the mechanisms through which economic news affects currency values.

The Forex market operates mainly through expectations. Economic indicators serve as clues for markets to determine the correct direction of economies. Currency prices tend to adjust after actual figures show differences from forecasted numbers in either direction. Major news releases create periods of increased market volatility because of this phenomenon.

Traders expect central banks to implement tighter monetary policies after inflation data exceeds market predictions. The expectation of higher interest rates typically leads to currency strength because foreign capital flows into the market. The currency value weakens when inflation data shows lower-than-expected numbers because investors expect monetary policy to become less strict.

Why economic news drives forex markets

The Forex market responds to economic news because such data influences the way people expect national economies to perform in the future. The economic power and stability of each nation determines currency value because traders make their investment decisions based on their predictions of future economic conditions. The measurable data from economic indicators helps investors predict changes in interest rates and inflation rates and economic growth which affect currency values.

A central bank of a nation plans to increase interest rates as an example. Market participants begin to expect stronger policy measures when inflation data exceeds its target level. The anticipation of future central bank actions leads to currency appreciation even though the bank has not yet taken any steps. Market participants initiate a sell-off when economic data fails to meet expectations because they lower their forecasts.

Market participants evaluate the extent to which actual results differ from predicted values. A country's currency tends to rise in value when its job report surpasses projections because traders believe monetary policy will become more restrictive. The market reaction remains minimal when actual results match predicted values.

The central banks track the same economic indicators which traders follow. Consumer price indexes (CPI) together with gross domestic product (GDP) and unemployment rates serve as both economic indicators and monetary policy decision inputs.

Key types of economic news that impact currencies

The impact of economic reports on currency movements varies based on their significance level. These high-impact releases often reflect inflation trends, employment health, economic growth, and interest rate direction. Traders monitor these reports because they need to detect policy changes and economic momentum shifts.

Interest rate decisions serve as the starting point for this discussion. The Federal Reserve and European Central Bank and Bank of Japan employ interest rates to control inflation and achieve economic stimulation or reduction. Rate increases strengthen the local currency because investors seek higher returns from its market. Rate cuts lead to currency weakening because investments connected to that region generate reduced returns.

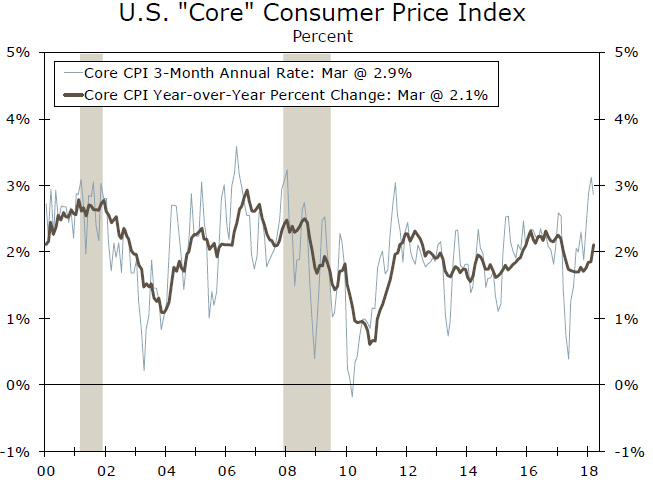

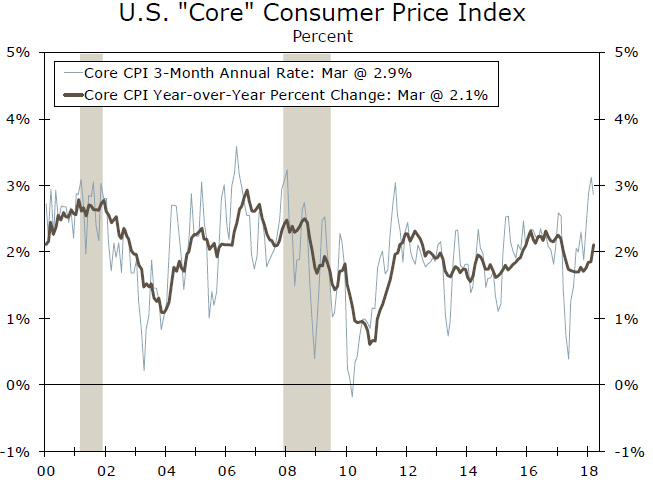

The Consumer Price Index (CPI) stands as the main indicator for measuring inflation data which shows price increase speed. Higher-than-target inflation rates lead to increased expectations of rate hikes which can boost currency value. The U.S. dollar experienced a price increase during early 2022 when U.S. CPI data exceeded market predictions because investors expected faster monetary policy actions.

The U.S. Non-Farm Payrolls (NFP) employment reports together with other employment data demonstrate economic performance. Better-than-expected job gain results in currency appreciation but weak employment data leads to market sell-offs.

The assessment of GDP growth stands as a fundamental indicator. Strong growth supports a currency because it signals a healthy economy which tends to align with rising rates.

How traders react: volatility, spikes, and spreads

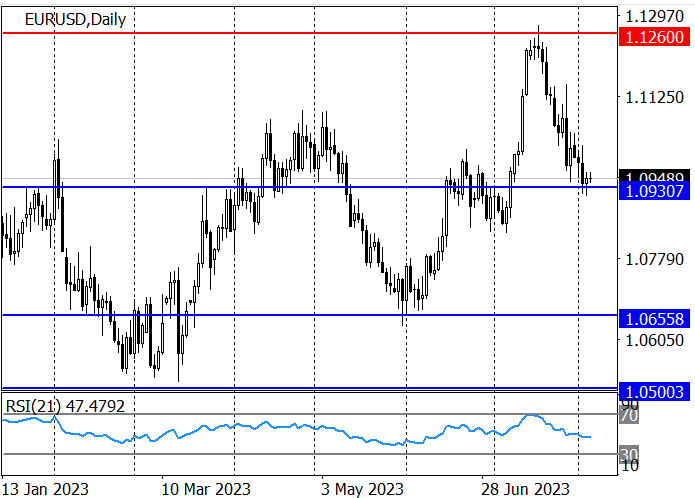

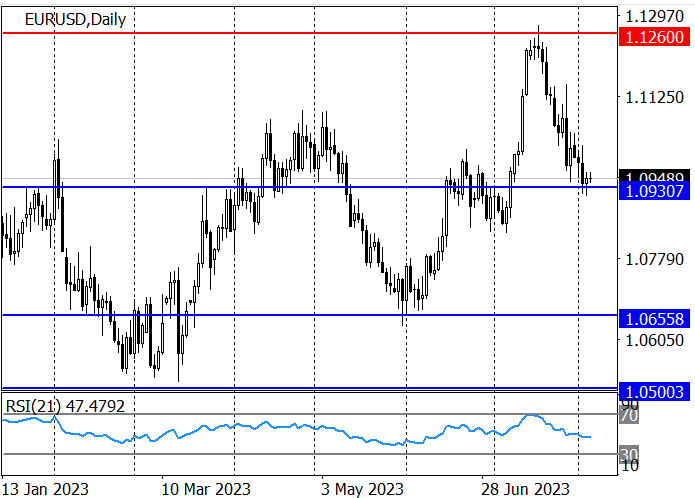

Major economic news releases create sudden price movements in forex markets which results in higher market volatility. The price changes happen because traders make immediate position adjustments following new data releases which occur within seconds of the announcement. A central bank decision to unexpectedly increase interest rates serves as an example. The market participants start buying the currency intensely which results in a fast price increase.

Spreads between bid and ask prices tend to expand during these periods. Liquidity providers decrease their market exposure through unfavorable price quotations during these moments. Retail traders face higher transaction costs because they must execute trades at unfavorable prices during these periods.

The short-term market volatility creates conditions for slippage to occur when trades execute at different prices than the original target. The market experiences frequent price movements during major announcements including U.S. Non-Farm Payrolls and inflation data releases. Traders who want to control their exposure will either decrease their position sizes or stay out of the market during news release times.

The volume of orders surges dramatically when news events occur. The immediate trading activities of algorithms together with institutional players result in price spikes or reversals because they execute large trade volumes. The understanding of these market dynamics becomes essential for traders who use pending orders together with tight stop-loss levels.

Tools and calendars to track economic news

Economic data tracking serves as a vital tool for risk management while helping investors predict market direction. Economic calendars serve as a precise guide to upcoming data releases which enables traders to develop their strategies during times of anticipated market volatility. These tools show the date and time of the event alongside the event name and expected result (consensus) and previous figure and actual value after release.

A trader who plans to prepare for an upcoming interest rate decision needs this information. The announcement time and current interest rate and forecast and expected central bank remarks are all listed in a reliable economic calendar. Traders can evaluate price reactions by comparing the forecasted data to the actual release numbers.

The impact ratings (low, medium, high) enable users to determine which events will most affect currency pairs. The price reactions from currency pairs tend to be stronger when U.S. CPI or ECB rate decisions occur as high-impact red-flagged events compared to lower-impact surveys or reports.

Trading strategies around news events

Economic news events create both trading possibilities and obstacles for forex traders. Multiple trading approaches exist to handle the typical market volatility which occurs following major news events. The success of each trading method depends on market timing and trader risk tolerance and their ability to interpret market movements.

The news breakout strategy requires traders to set pending orders at current price levels before major reports to buy or sell. The trader expects the U.S. Non-Farm Payrolls release to create strong market movement. A trader can use two stop orders to buy above resistance or sell below support for a breakout in either direction based on the report's outcome. This trading approach seeks to benefit from the first market movement but traders need to maintain strict risk control to prevent losses from false breakouts and whipsaws.

The news fading strategy requires traders to establish positions against the first market reaction. A reversal strategy should focus on retracement after a currency experiences a strong rally due to better-than-expected inflation data and shows signs of overextension. The approach predicts that initial market reactions will either be overdone or get reversed.

Risk management stands as a vital element in both trading approaches. Stop-loss orders together with predefined take-profit levels function as protective measures against extreme market volatility. Traders choose to delay their market entries following data releases to observe price structure and volume before making trading decisions.

Common mistakes traders make

Trading economic news requires traders to maintain discipline while being prepared for market conditions. Traders who lack a defined strategy tend to make frequent errors that boost their risk exposure while diminishing their long-term financial gains. The main errors in trading stem from excessive market reactions and poor timing along with insufficient knowledge of market dynamics.

The most common error occurs when traders execute multiple trades during major events. The U.S. Federal Reserve interest rate decision triggers multiple trades to be opened in a brief time period. The fast-paced attempt to profit from market volatility creates unplanned exposure because stop-loss levels are either too wide or mismatched with account size.

The failure to consider economic factors as a whole represents another major problem. Analyzing only a single data point such as better-than-expected GDP results without considering other indicators and central bank commentary and geopolitical risks produces inaccurate market conclusions. Currency market reactions depend on various factors which extend beyond the headline number.

Revenge trading represents a widespread practice among traders who experience losses. The attempt to quickly recover through aggressive or impulsive trading during volatile times usually results in additional losses. Emotional responses create judgment impairment while simultaneously decreasing trading consistency.

Conclusion

The forex market experiences volatility primarily because of economic news. Currency values adjust according to new data performance relative to forecasted values while traders base their reactions on monetary policy expectations and economic conditions. The identification of these patterns enables better decision-making while minimizing exposure to avoidable risks.

When major economic inflation data exceeds market predictions it leads to significant market adjustments. The market adjusts its interest rate hike expectations which subsequently affects capital movements and currency exchange rates. The structured trading approach emerges from monitoring key indicators which include CPI and GDP alongside employment reports and central bank decisions.

Economic calendars combined with volatility risk assessment and breakout or fade trading strategies enable traders to handle news events more effectively. The most successful trading method unites fundamental macroeconomic analysis with technical pattern recognition and risk management tools.