How institutional traders move the forex market

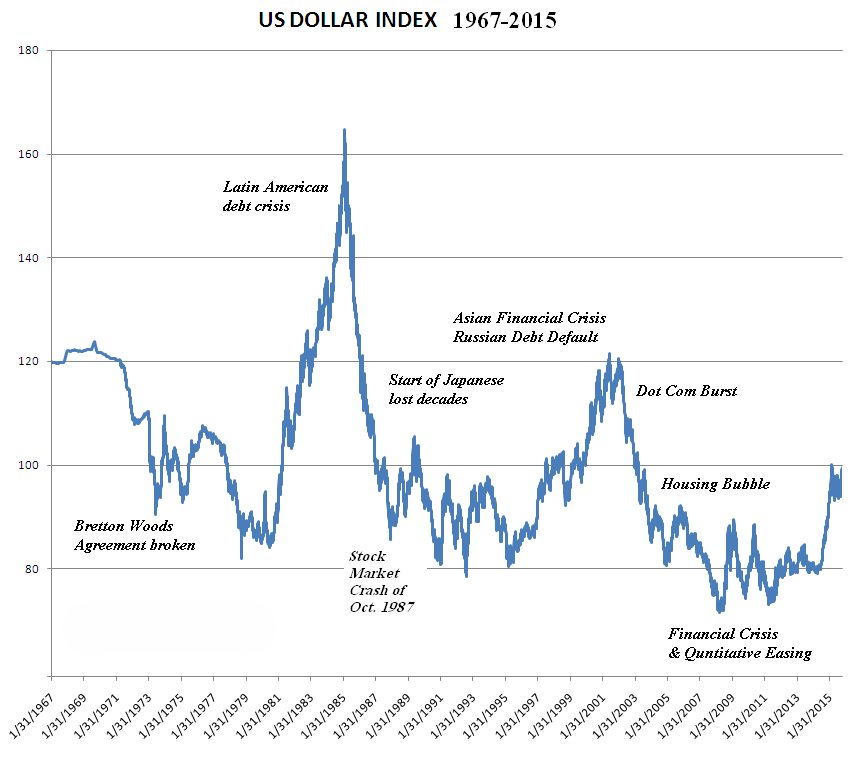

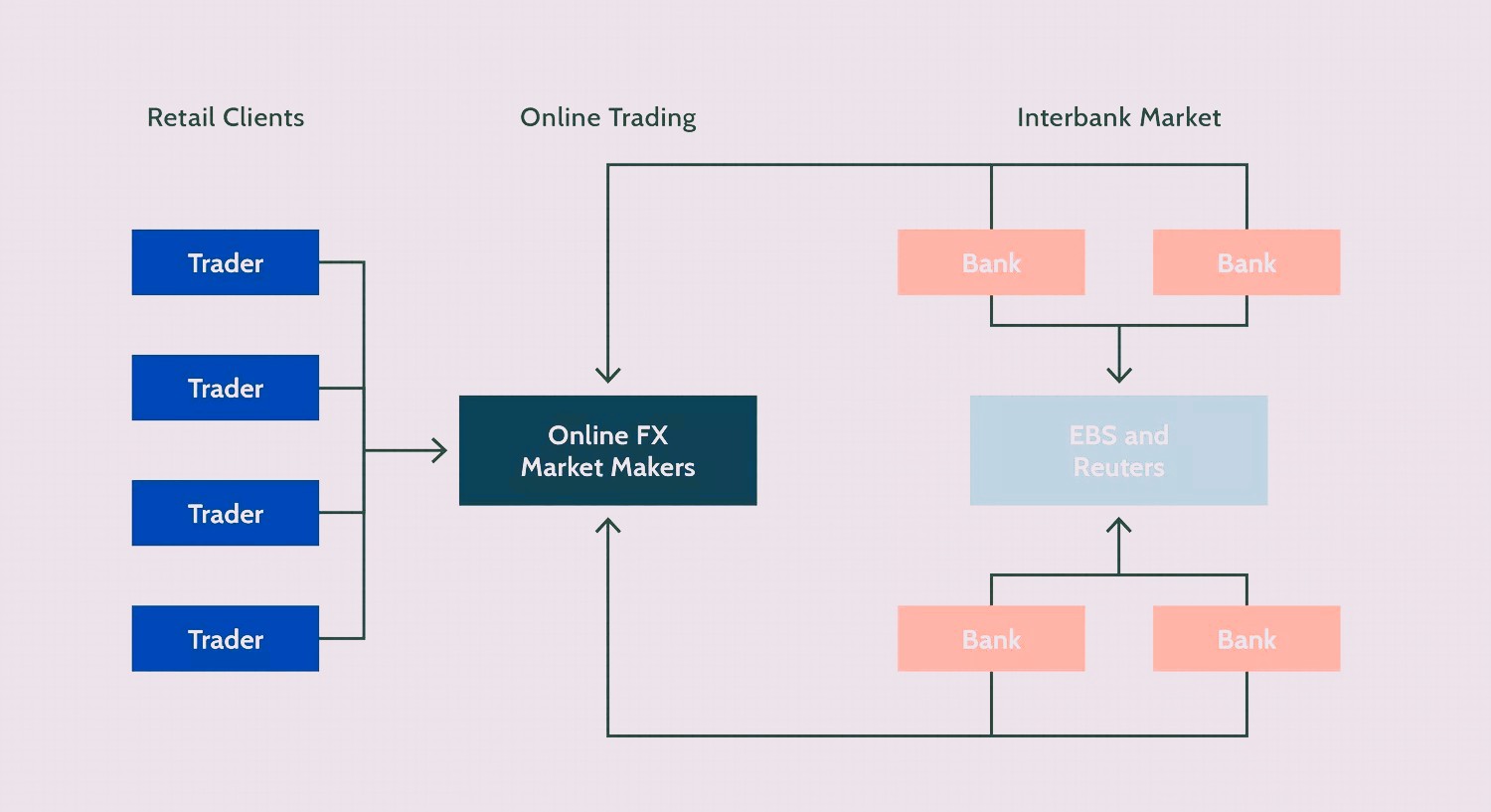

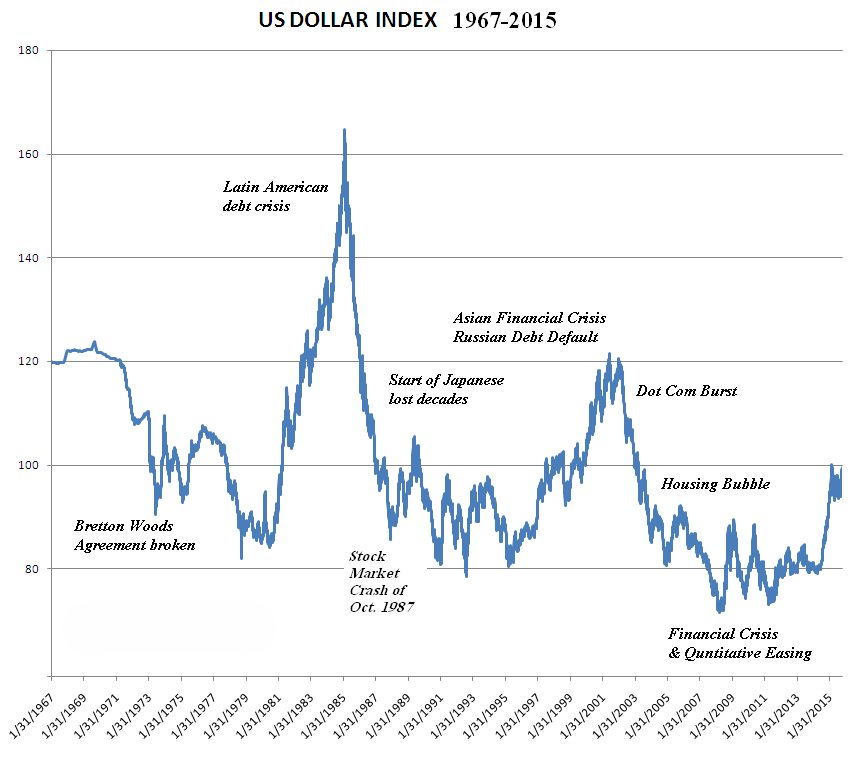

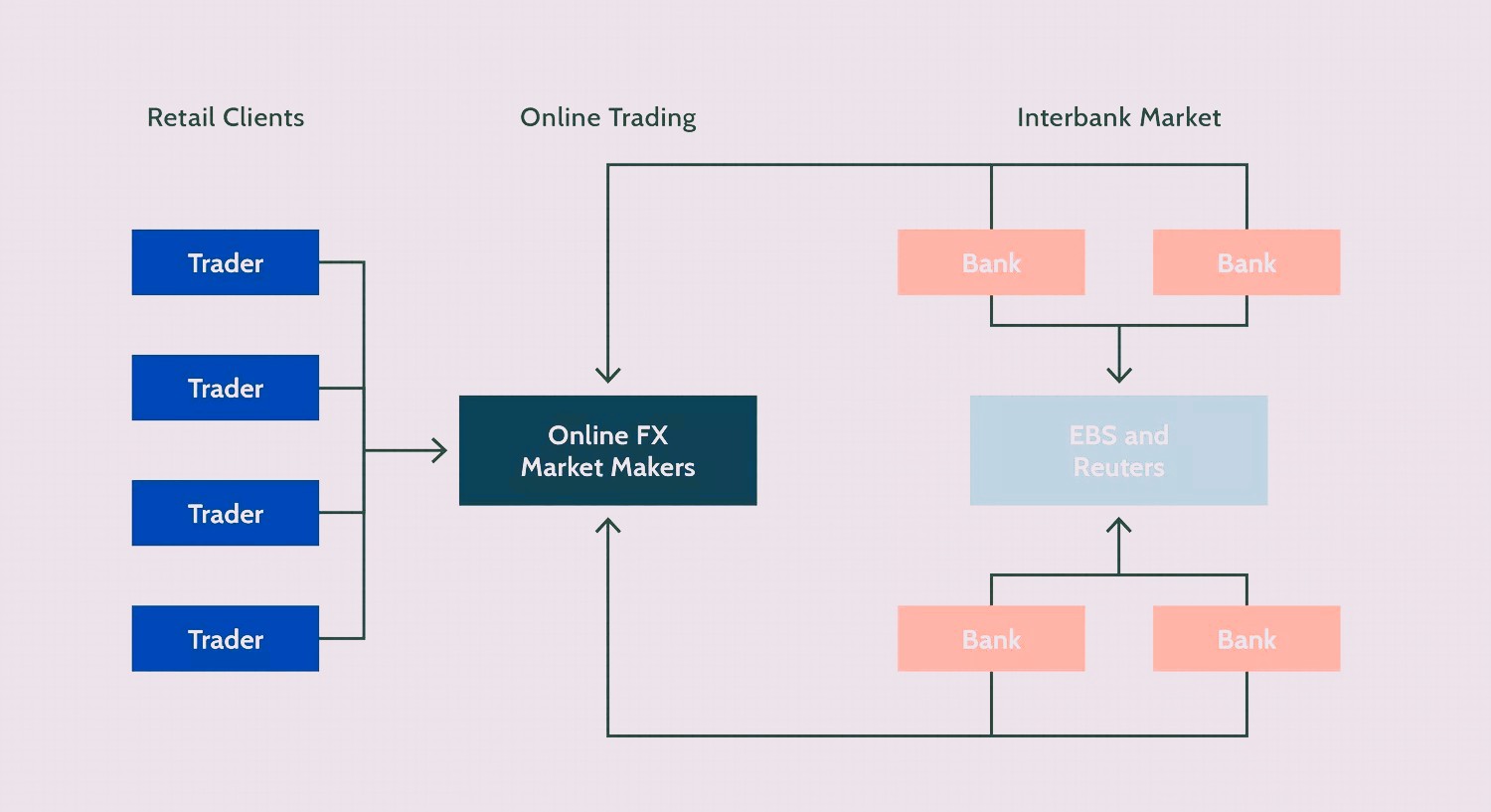

The foreign exchange market is the largest financial market in the world, with daily turnover exceeding trillions of dollars, as reported by the Bank for International Settlements. A significant share of this volume is generated by institutional traders rather than individual participants. These institutions operate with large capital, advanced trading systems, and direct access to interbank liquidity. For example, when a global investment bank executes a large currency order, the transaction is often routed through multiple liquidity providers at once to avoid excessive price disruption. Unlike retail trading, where position size is measured in micro or standard lots, institutional orders are commonly measured in tens or hundreds of millions of base currency units. Leverage, margin, and pip value still apply, but their scale is magnified by order size and execution speed. Price movements observed on platforms connected to the CME Group or reflected in Federal Reserve data often originate from institutional flows.

Who institutional traders are and why they matter

The institutional trader segment includes big market participants who run their operations through organized structures with big money and strict rules for risk control. The market includes investment banks and hedge funds and asset managers and pension funds and multinational corporations and central banks. A multinational company needs to exchange hundreds of standard lots of euros into U.S. dollars for operating expense payment. The big trading activity produces thousands of dollars in profit or loss for every pip price change. The nominal exposure of institutional trading accounts already reaches high levels so they use reduced leverage in their trading operations. The European Central Bank along with other central banks actively participate in currency stabilization and monetary policy implementation through direct market intervention. Their large trading activities affect market liquidity and spread widths and create brief periods of market volatility. A major fund adjusts its currency investments following FRED data-based inflation information which leads to price movements across different trading platforms.

How institutional trading differs from retail trading

Institutional trading operates on a very different scale compared to retail activity, both in terms of volume and execution. Retail traders typically place orders measured in micro, mini, or standard lots, where one standard lot equals 100,000 units of the base currency. For example, a one-lot EUR/USD trade means each pip is usually worth about 10 USD. Institutional participants, by contrast, often trade the equivalent of hundreds or even thousands of standard lots in a single session, which means a single pip can represent tens or hundreds of thousands in currency value. Leverage is also structured differently. Retail accounts may access high leverage with relatively small margin requirements, while institutional desks usually apply lower leverage but commit far larger capital. Execution speed and liquidity access also differ. Retail orders are filled through brokers on platforms such as MetaTrader, while institutions transact directly in interbank markets or through prime brokers with access to deep liquidity. These structural differences explain why institutional flows often shape market direction, while retail activity typically reacts to existing price movement.

Key institutions that influence currency markets

The foreign exchange market experiences continuous activity from major institutional groups because of their large transactions and their ability to control market timing and achieve strategic goals. Commercial banks lead daily currency turnover because they maintain market liquidity and set exchange rates and execute big trades for their clients. Asset managers together with pension funds direct long-term investment patterns through their portfolio adjustments between different geographic areas and currency markets. The transfer of global fund capital from U.S. stock markets to European bond markets results in major EUR/USD currency exchange operations. A standard lot equals 100,000 units so trading 500 lots results in 50 million base currency exposure. Multinational corporations create market activity through their normal business operations which involve importing goods and exporting products and using financial hedging techniques for upcoming cash obligations. Central banks continue to lead market participation because they conduct transactions for non-financial purposes. The Federal Reserve and European Central Bank and Bank of Japan implement policy changes which lead to fast changes in interest rate predictions and currency market activity.

Liquidity, order flow, and market impact

The definition of foreign exchange market liquidity exists when traders can execute currency pair transactions without facing major price changes. The EUR/USD pair maintains high liquidity because institutional investors can perform big trades without market price changes because many market participants actively trade at the same time. The market order flow demonstrates the current market balance between buyers and sellers who participate in the market. An asset manager places a 300 standard lot EUR/USD buy order which amounts to 30 million base currency units. The price will increase by multiple pips until the complete order execution occurs because the market lacks sufficient sell-side liquidity. The transaction cost and profit/loss potential become measurable through all price changes which occur during market transactions. The large transactions that move through trading venues connected to CME Group and TradingView pricing feeds create market impact which appears as visible price changes. Your market sensitivity will increase when you place larger orders because your leverage and margin levels remain unchanged.

Institutional Trading Strategies and Market Positioning

The main goal of institutional trading strategy development focuses on protecting investments through risk management during big market transactions. The main trading methods used by institutions include trend-following and carry trading and hedging and macroeconomic position management. Funds implement carry trading by acquiring high-yielding currencies while selling low-yielding currencies to earn interest rate differences from overnight swaps. The fund maintains 200 standard lots of a high-yield currency pair in its investment portfolio. The daily swap earnings from trading large volumes of currency pairs generate substantial returns throughout the year. The market positioning system shows how institutional investors stand in relation to current market trends and economic projections. The CME Group connected futures data shows whether big traders maintain long or short positions in currencies. The execution of big trades happens through automated systems which reduce market impact by spreading orders across multiple time periods and price levels. Institutional traders use position size adjustments as their main method to manage market exposure instead of working with high leverage levels.

How institutions use macroeconomic data and policy signals

Institutional traders base many currency decisions on macroeconomic indicators and central bank policy signals that shape interest rate expectations and capital flows. Key data sets include inflation, employment, economic growth, and trade balances. These figures are closely tracked through releases linked to feeds such as FRED. For example, let’s say U.S. inflation prints above forecast. Higher expected interest rates increase the appeal of U.S. dollar assets, often leading to immediate buying pressure in USD pairs. When institutions position for this move, order size is expressed in large blocks of standard lots, which amplifies the pip impact compared with retail trades. Central bank communication from the Federal Reserve, the European Central Bank, and the Bank of Japan further guides expectations about future borrowing costs, liquidity conditions, and currency supply. Margin and leverage remain part of execution, but institutional risk models prioritize volatility projections tied to economic data.

How institutional activity shapes short-term and long-term price movement

Currency prices experience changes from institutional activities which depend on transaction sizes and execution times and investment capital movements. The short-term market response to large transactions during data releases and policy announcements leads to multiple pips of price movement which occurs within short time frames. A group of funds buys 800 standard lots of currency after the employment report shows better-than-expected results. The total demand of 80 million units will rapidly increase the price because the market lacks sufficient liquidity. The number of transactions executed determines how much pip value exists and what margin requirements become necessary and what execution costs will be incurred. The direction of price change emerges from three main factors which include portfolio adjustments and foreign investment movements and market rate predictions. The market trend of a higher-yield currency will continue after institutions finish their systematic investments which span multiple weeks. The CME Group venues and TradingView platform show how institutional investors control futures market positions which affect currency price movements.

Conclusion

Currency prices receive their direction from institutional traders because they operate through their large trading volumes and organized market systems and their ability to execute trades with precision. The market experiences price fluctuations because institutional traders execute large orders of 100+ standard lots while using margin and controlling their leverage levels. The market experiences short-term price fluctuations because institutional investors react to economic data and policy announcements but long-term market trends form through continuous capital movements and investment portfolio adjustments. The market shows rising demand for high-yield currencies because rate expectations change throughout multiple months. The total price movement from these transactions amounts to more than 1000 pips even though the market shows no immediate large price changes. The price movement forces of the market become visible through trading platform. Investors can better understand price movements through research of institutional market dynamics which connects liquidity and order flow to interest rates and risk management practices.