How to improve your forex trading discipline

The ability to maintain discipline in Forex trading means following a trading plan without letting emotions or outside distractions interfere. The execution of trading plans under pressure depends on discipline rather than strategy which defines trading methods and procedures. Market concepts such as trend lines and lot sizes and leverage are well understood by traders yet they continue to lose money because of impulsive choices and inconsistent risk management and premature setup abandonment.

The absence of discipline leads traders to perform three common behaviors which include overtrading and revenge trading and ignoring risk parameters. The lack of predefined criteria when reacting to market moves results in unnecessary trading losses. Well-researched trades will fail when traders execute them without discipline. The majority of retail traders experience drawdowns because they fail to maintain their trading systems during times of market uncertainty and volatility according to industry data.

The foundation of trading discipline starts with recognizing personal behavioral patterns while making a promise to follow structured decision-making processes. The process of improving trading discipline requires traders to establish specific entry and exit rules and maintain proper risk-reward ratios and detailed trading journal entries for progress tracking. The ability to stay consistent during losing trades separates disciplined traders from emotional traders.

Understanding trading discipline

Trading discipline means following a pre-established trading plan without letting emotions or market surprises affect the process. The Forex market's continuous 24-hour operation and fast price movements make discipline essential for traders who want to protect their capital and minimize mistakes.

A disciplined trader depends on a well-organized system for making decisions. The framework includes specific rules for market entry and exit points and defined risk boundaries and scheduled performance assessment procedures. Trades that lack structure become susceptible to emotional influences which produce irrational choices.

The trader follows a system which limits each trade risk to 1% of their total capital. The trader's decision to increase their position after market movement breaks their initial trading plan. The short-term profit from this deviation weakens the trader's ability to maintain long-term consistency. Research indicates that emotional trading decisions made repeatedly produce larger drawdowns while increasing account volatility.

Trading discipline stands apart from strategy execution because it represents the ability to stick to a plan. A strategy outlines which trades to execute yet discipline ensures traders perform these trades with consistency. Technical indicators or fundamental data setups exist in detail among traders but lack discipline prevents them from executing these setups according to plan.

The development of discipline requires continuous learning from mistakes together with behavioral adjustments and performance review processes. The discipline enables traders to execute their strategies better while improving their analytical accuracy throughout time.

The most common discipline traps in forex

Even traders who possess effective trading strategies can develop discipline-related problems which ultimately damage their long-term achievement. The most widespread trading problem occurs when traders execute too many trades because they are either bored or want to recoup their previous losses. The behavior of excessive trading exposure and transaction costs does not lead to better performance.

The practice of straying from a trading plan represents a typical problem that traders face. A trader establishes a rule to enter trades only during London session hours when two technical indicators match. A trader who makes trades during the Asian session based on intuition breaks their trading discipline.

The practice of ignoring stop-loss levels creates problems with trading consistency. The purpose of stop-loss is risk management yet traders who modify or eliminate stop-loss during trades typically experience more significant losses. Traders lose their winners when they fail to set partial profits or adjust their targets. The main reason behind this behavior involves emotional attachment to trades rather than following systematic rules.

The practice of increasing position size to quickly recover losses proves to be the most harmful among all trading mistakes. The practice of increasing position size results in higher risk exposure which makes loss compounding more probable.

These traps emerge from psychological stress and overconfidence as well as the absence of structure. The first step to enhance discipline involves identifying and resolving these issues. Traders who understand the sources of their behavioral breakdowns can create tools and routines which strengthen their consistent trading practices.

Building a solid trading plan

A structured trading plan gives traders the essential structure needed for disciplined trading execution. The plan contains particular rules that direct trading choices while minimizing emotional impact and enhancing trading consistency. The absence of a trading plan leads traders to make spontaneous decisions when market prices fluctuate.

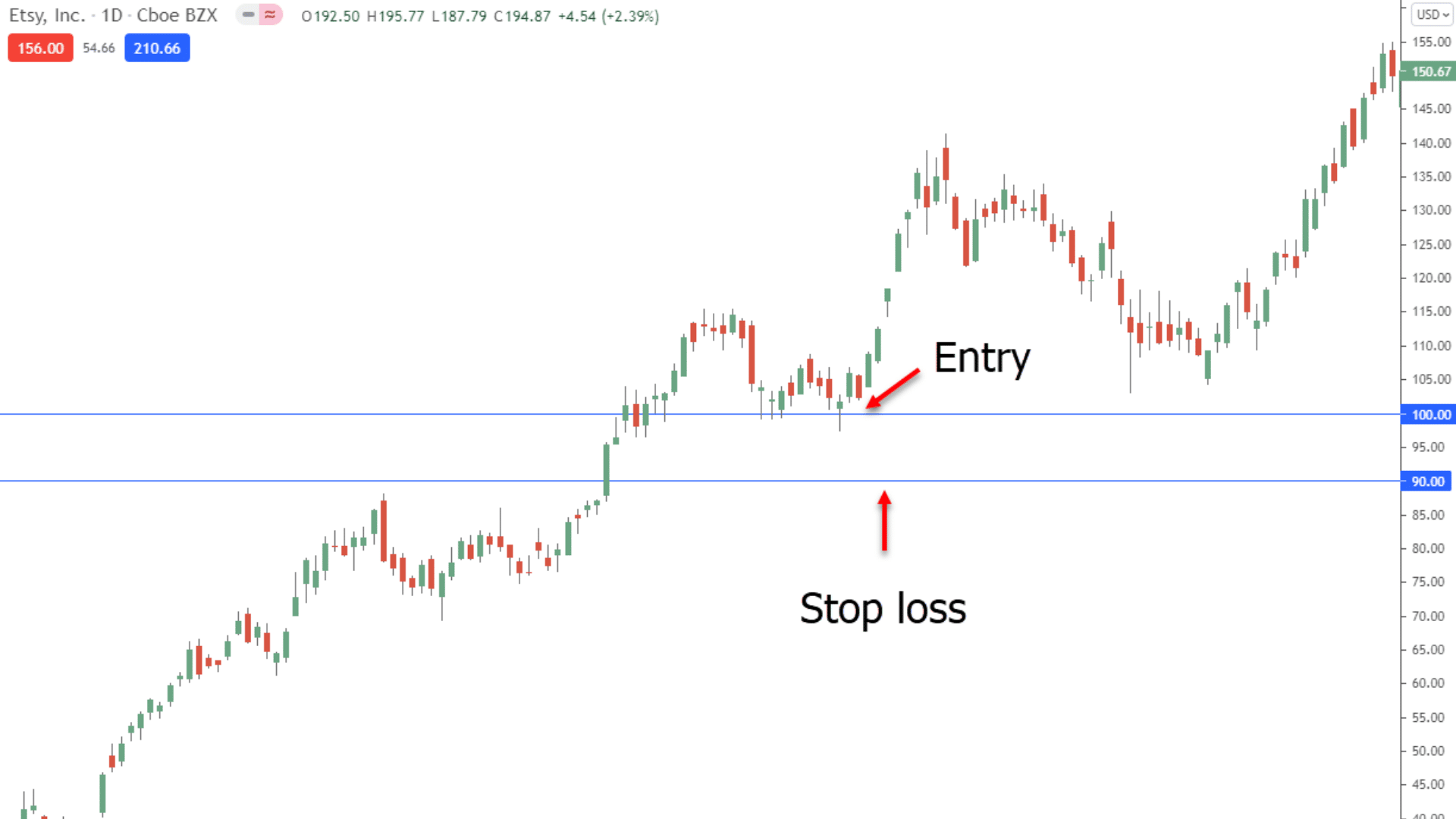

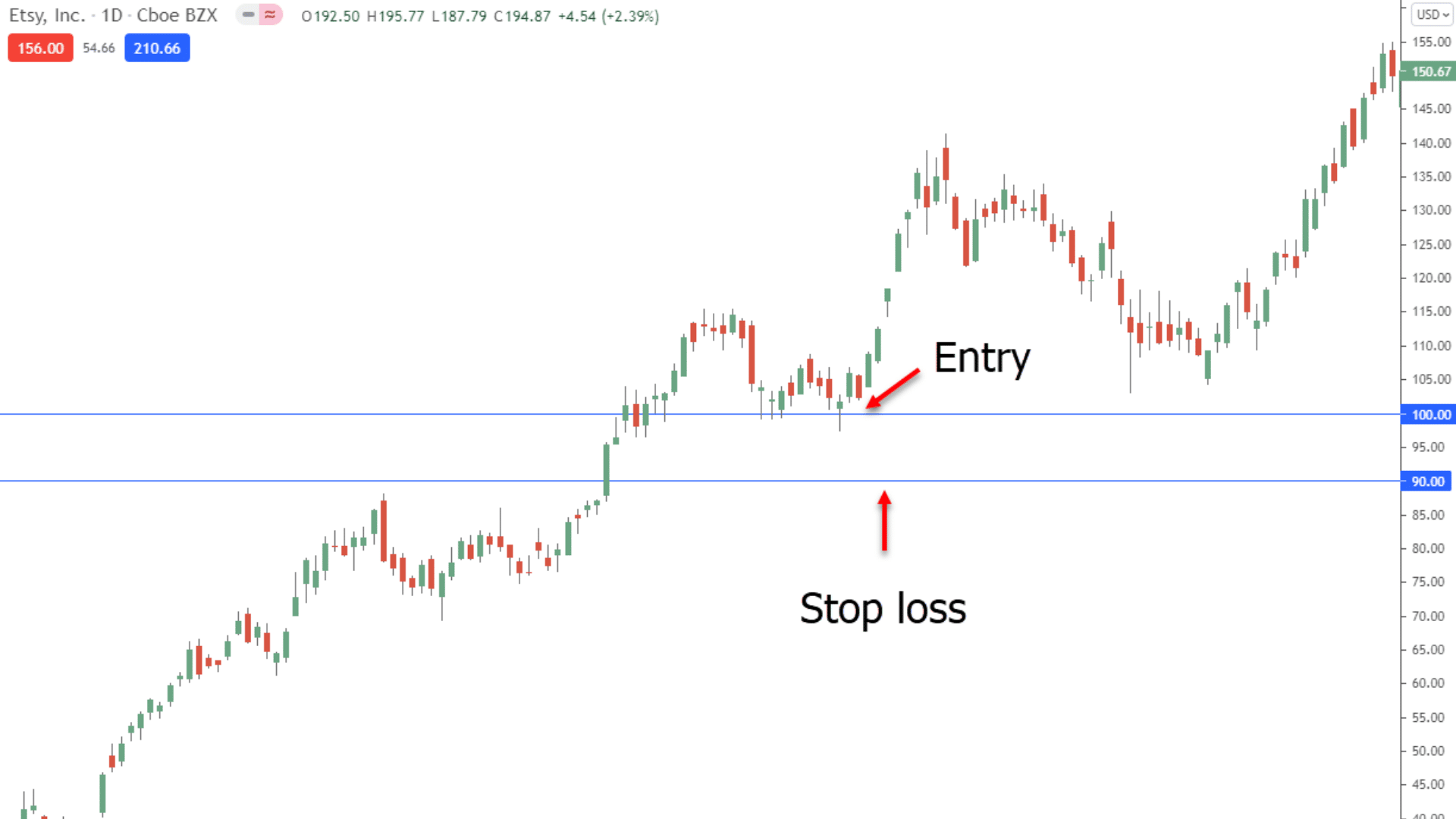

A reliable trading plan starts by establishing precise entry and exit rules. A trader establishes their long position entry rule through the 50-period moving average crossing above the 200-period moving average on a 4-hour chart. The exit rules in this system use technical levels and fixed risk percentages to determine profit targets and stop-loss levels.

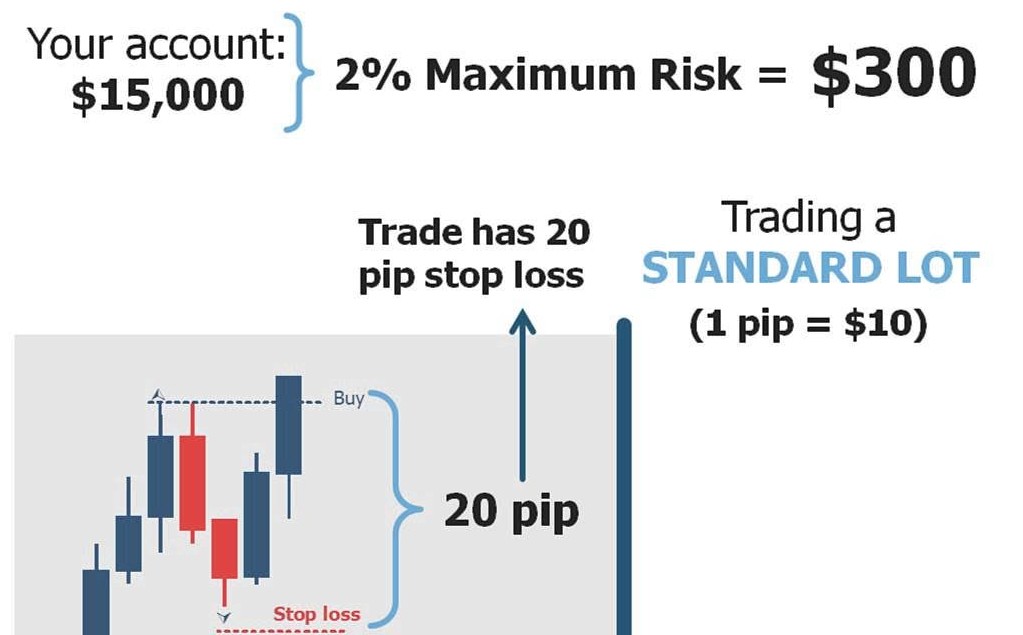

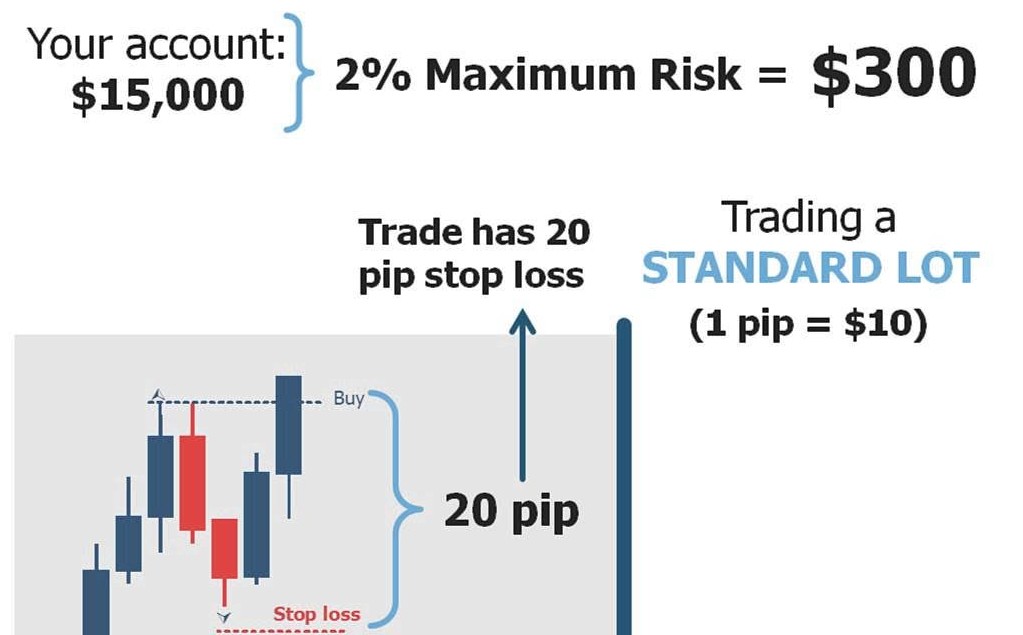

Risk-reward ratio is another key element. The plan establishes a risk-reward ratio of 1:2 which means traders must risk 50 pips to gain 100 pips. The system allows accounts to grow through time even when only half of the trades result in profits. The calculation of position size depends on account size together with leverage and acceptable risk per trade which should be between 1% and 2% of total equity.

The evaluation of strategy performance takes place through historical data testing before market implementation. The reliability of trading strategies can be evaluated using tools available on the vast majority of trading platforms. Practicing with demo accounts enables traders to develop both familiarity and confidence in their trading system.

A trading plan needs to be documented and inspected periodically. The process of updating the plan maintains its consistency with market changes and individual trading goals. The written plan serves as the base for developing discipline through systematic rule-based trading execution.

Practical strategies to improve discipline

Trading discipline improvement needs more than mistake recognition because it demands the establishment of systems and routines that promote consistent behavior. The most powerful approach to trading involves maintaining detailed records in a trading journal. Each trade entry and exit should be documented in the journal together with decision reasons and emotional states at the time. Reviewing journal entries throughout time allows traders to detect regular behavioral patterns while identifying areas which need modification.

Trading discipline benefits from specific measurable goals which traders establish. The trader sets a goal to perform a limited number of trades within each session to prevent overtrading. The trader should maintain the same risk-per-trade percentage for every trading position. The established goals serve as monitoring tools which help traders avoid making decisions based on emotions.

Pre-trade checklists serve as an effective method for traders to use. A checklist should contain questions which evaluate if the trade follows the strategy and if the risk-to-reward ratio meets standards and if volatility received proper consideration. The decision-making process becomes more thoughtful when traders use a checklist to review their orders before execution.

The practice of dedicating specific time slots to market analysis and trade reviews helps traders avoid making impulsive trades. The trader plans to open positions exclusively during 9 a.m. until 12 p.m. based on morning session data. The established routine helps traders avoid spontaneous trades while providing an organized framework for their trading activities.

Risk management as a discipline enforcer

Risk management stands as an effective tool which strengthens trading discipline. The practice of risk management helps to restrict losses while maintaining consistency and minimizing emotional influences. Well-analyzed trades can still result in account drawdowns because of poor execution or overexposure when risk rules remain undefined.

Position size management relative to account equity stands as an essential practice for traders. The $10,000 account balance requires each trade to have a maximum risk exposure of 1% which translates to $100. The position size calculator helps maintain trade size within the defined threshold regardless of stop-loss distance variations.

Stop-loss orders function as protective measures for traders. The system executes automatic trade closures when market prices move against positions beyond established limits. The system helps traders exit losing positions before time expires while promoting strategic thinking before making trading decisions. The placement of a stop-loss order at 50 pips from the entry point defines the risk level before traders start pursuing gains.

Take-profit orders function as stop-loss counterparts by securing profits after reaching specific targets. The practice of setting both stop-loss and take-profit orders before entering a trade helps traders maintain emotional control and develop a systematic risk-reward approach. A consistent reward-to-risk ratio of 2:1 will boost profitability even when the win rate remains low.

The role of psychology

The ability to maintain discipline in trading directly depends on the mental habits and daily structure of a trader. The most well-defined trading strategies can fail because of psychological factors that include stress together with impatience and overconfidence. The combination of consistent routines with mental clarity helps traders avoid making decisions based on emotions.

A successful trading strategy requires traders to establish a pre-session routine. The pre-trading routine consists of news review and economic calendar checks and chart analysis across different time periods. The trader dedicates 15 minutes before each trading session to verify that market conditions align with their established plan. The preparation process helps traders stay focused while reducing their tendency to act on impulse.

Scheduled breaks throughout the trading day help traders maintain their discipline. Prolonged screen usage causes fatigue which deteriorates decision-making abilities. Traders should limit their review of open positions to scheduled intervals and take breaks between trades to avoid unnecessary order modifications.

The ability to control emotions stands essential for maintaining discipline. The practice of deep breathing and mindfulness alongside brief journaling after trades helps traders maintain their emotional stability. The implemented practices enhance traders' ability to recognize emotional triggers that cause impulsive decisions including both increasing lot size after losses and abandoning established setups after minor drawdowns.

Tools and technology to help stay disciplined

Technology enables traders to maintain discipline through automated decision-making systems which enhance consistency and minimize emotional influences. The modern trading platform enables users to set pre-defined stop-loss and take-profit orders which automatically enforce risk parameters during every trading transaction.

The implementation of pre-set stop-loss at 30 pips together with take-profit at 60 pips ensures traders maintain a consistent 1:2 risk-reward ratio. The automatic system prevents traders from making emotional adjustments during trades because these changes could result in early exits or increased losses. Most trading platforms include alert systems which send notifications to traders when price targets are achieved thus eliminating the need for continuous screen watching.

The journaling software tracks performance metrics including win rate and average return and risk-to-reward ratios. These tools generate objective data which enables traders to conduct regular performance assessments while identifying patterns in their trading behavior. The discovery of lower returns from trades executed outside established strategies leads traders to maintain strict adherence to their original plan.

Checklists and templates are also helpful. A structured process for trade setup validation combined with entry criteria and risk calculations helps traders minimize their inconsistency. The trading interface of certain platforms enables users to embed their checklists directly into the system.

The combination of automation features with analytics tools and structured routines enables better decision-making and faster reaction times during high-pressure situations while developing trading discipline into an automatic habit.

Conclusion

The ability to maintain trading discipline exists as a skill which people can develop through practice and measurement. The development of this skill happens through time while traders receive feedback and practice consistently within structured environments.

The most effective method to build discipline involves creating routines and establishing structured systems. A trader who implements stop-losses and uses fixed risk parameters and performs weekly performance reviews will maintain systematic behavior when under pressure. The repeated practice of this performance across multiple trades strengthens control and minimizes impulsive choices.

Small adjustments can create long-term improvements. A trader starts using pre-trade checklists to validate their market entries. The repeated practice of this routine during several weeks leads to decreased losses from unplanned trades. The repeated execution of disciplined actions leads to performance predictability which builds confidence through systematic execution rather than luck or intuition.

Setbacks are part of the learning process. The analysis of plan deviations should focus on determining their underlying causes. The identification of triggers helps traders prevent future occurrences whether these triggers stem from emotions or environmental factors or strategy-related issues.