How to trade forex during high-volatility events

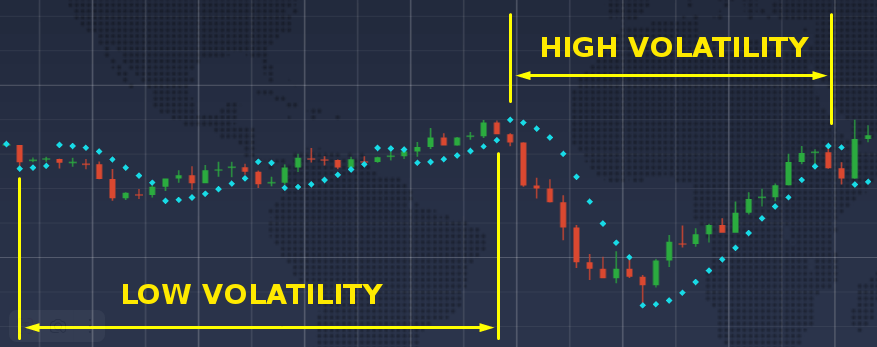

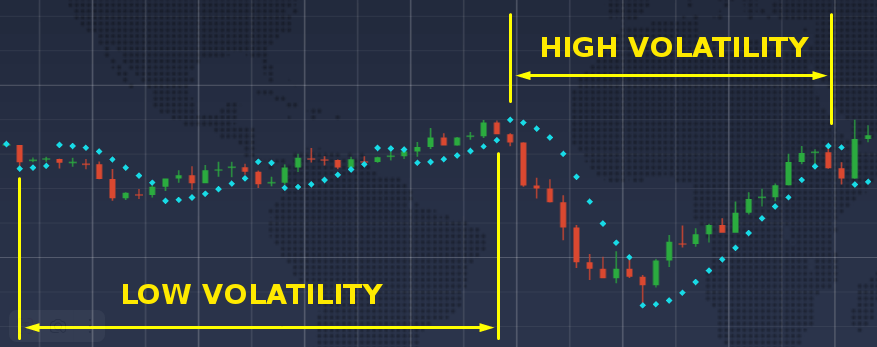

The forex market experiences high-volatility events when currency prices exhibit sudden and unpredictable large movements. The market experiences these fluctuations because of major economic announcements and geopolitical tensions and central bank decisions. The market conditions during these periods create both higher profit potential and elevated trading risks for traders. The ability to handle market conditions during volatile times becomes vital for traders who want to protect their capital while making smart trading choices.

The market conditions of volatility lead to increased spreads and higher chances of slippage and unstable liquidity levels. The execution of trades becomes unpredictable and unexpected losses occur when traders fail to implement appropriate risk management strategies. The USD experiences rapid price increases following unexpected U.S. Federal Reserve interest rate hikes because traders who predicted the move benefit while those who did not prepare suffer losses.

What triggers high volatility in forex markets

The forex market shows high volatility because of scheduled macroeconomic data releases and central bank policy decisions. The market experiences volatility through the release of non-farm payroll (NFP) reports and consumer price index (CPI) updates and gross domestic product (GDP) figures and interest rate announcements from central banks. The U.S. dollar experiences rapid appreciation when the U.S. Bureau of Labor Statistics publishes inflation rates above expectations because traders believe monetary policy will tighten.

Market volatility depends heavily on the way central banks communicate with the public. The Federal Reserve along with the European Central Bank and Bank of Japan use forward guidance and surprise policy shifts and changes in tone to produce significant movements in currency pairs. The market reacts with immediate changes in pricing and expectations whenever there is any indication of monetary policy adjustments.

The market experiences sudden reactions because of geopolitical tensions which include military conflicts together with elections and international sanctions. Political instability creates uncertainty which pushes investors to choose safe-haven currencies including the U.S. dollar and Japanese yen.

Black swan events such as natural disasters and pandemics together with unexpected corporate defaults trigger high-volatility market periods. The situations create both reduced market liquidity and fast price movements which become more pronounced during times when trading activity is low.

Understanding the risks and rewards

The process of trading during high-volatility events allows traders to earn both higher profits and face greater risks. The fast and unpredictable price movements during these periods result in both substantial gains and substantial losses that occur rapidly. Spreads become significantly wider during these periods. Under normal market conditions the EUR/USD spread remains at 1 pip. Major news releases cause the spread to increase to 5 pips or higher which affects the trading costs for opening and closing positions.

Slippage is another common issue. The execution of market orders at different prices than requested happens due to fast price movements. A buy order placed at 1.1000 will execute at 1.1005 or higher based on the current market liquidity. The likelihood of this occurrence increases when major announcements such as U.S. NFP data or ECB rate decisions take place.

The market liquidity decreases during volatile periods especially for currency pairs with low trading volumes. The reduced availability of buy and sell orders near the current price leads to increased price gaps and unpredictable market behavior.

The market movements during these periods create opportunities for traders who can execute trades swiftly while handling their risks properly. Certain trading methods use market volatility to achieve profit targets within brief time periods after news events trigger breakout patterns.

Preparing before the event

Trading into high-volatility events requires proper preparation in advance. The first step involves monitoring upcoming economic data releases through a dependable economic calendar system. The economic event schedules from trading platforms include detailed information about expected market effects together with analyst projection data. Traders who monitor U.S. Non-Farm Payrolls reports should study past data alongside projected numbers to develop market response strategies.

The identification of a key event requires traders to implement scenario planning as their next step. The process requires traders to create scenarios based on different outcomes which they will analyze for their effects on currency pairs. The market currently predicts that the Federal Reserve will maintain its current interest rates. A sudden rate hike announcement would cause the U.S. dollar to experience a rapid increase in value. The identification of this possibility beforehand enables traders to better manage their risk exposure.

Proper position sizing is another important step. The management of exposure becomes more effective when traders decrease their trade volume during periods of market volatility. Trading one mini lot (10,000 units) instead of a standard lot (100,000 units) reduces the pip value and limits potential losses when the market moves against the trade.

Trading strategies during high-volatility

High-volatility environments demand adaptable strategies. Trading in the direction of the prevailing trend represents a typical method for market participants. Strong economic data that matches current market trends tends to create faster momentum in the market. The EUR/USD pair will break through key resistance levels during an uptrend when the European Central Bank delivers a hawkish policy surprise thus creating continuation trading opportunities.

The breakout trading method serves as an effective approach when news events cause market volatility. Traders set their buy stop and sell stop orders near resistance and support levels to execute trades when prices break through these zones. The USD/JPY resistance level stands at 1.0950. A buy stop order at 1.0960 provides traders with a chance to enter a clean breakout when the price increases following Bank of Japan policy announcements.

Some traders also prefer pullback strategies. Traders who prefer this method wait for price to pull back to established technical levels such as Fibonacci retracement zones or previous breakout points instead of rushing into price spikes. This approach enables traders to enter at better levels and decreases their chances of buying at peak or selling at trough points in short-term market movements.

Risk management essentials

Risk management becomes even more critical during periods of high market volatility. A fundamental trading technique involves defining maximum acceptable loss and desired profit targets with stop-loss and take-profit orders before entering a trade. A stop-loss order for a EUR/USD trade with a micro lot pip value of $1 is set 30 pips away from the entry point. The defined stop-loss limit of $30 functions as a capital protection mechanism during market volatility.

Adjusting leverage is also important. The use of high leverage allows traders to both increase their profits and their potential losses. A $500 account with 1:100 leverage allows traders to control $50,000 in currency through a single trade. The high market exposure during sharp price movements can result in margin calls when traders fail to properly manage their risks. Trading with reduced leverage and smaller position sizes enables traders to keep their investments under control during unpredictable market conditions.

Diversifying between currency pairs and timeframes helps to minimize the effects that one trade's outcome would have on the overall portfolio. Trading USD/JPY and EUR/GBP simultaneously with uncorrelated movements can produce a smoother performance outcome for the portfolio.

Another essential practice involves avoiding overtrading. The practice of rapid trading during news events leads to emotional trading decisions which produce inconsistent results. The practice of selecting only clear trading setups helps traders maintain their discipline and stay focused.

Tools and indicators that can help

The decision-making process improves through reliable tools and indicators when markets experience volatility. The Average True Range (ATR) serves as an indicator which shows market volatility during a particular time period. The ATR value of 0.0090 on GBP/USD indicates that the pair usually moves 90 pips throughout a daily period. The volatility during news events can help traders determine appropriate stop-loss and take-profit distances through the ATR readings.

Bollinger Bands are another practical tool. The bands expand during times of market volatility while they contract during periods of market stability. The price breaks through the upper band following an European Central Bank policy update. The price movement indicates strong market momentum when volume indicators confirm the trend.

The sentiment analysis tools available on different trading platforms help users understand how retail traders position themselves in the market. The majority of USD/CHF traders holding long positions before Federal Reserve announcements will experience a sudden market reversal when rate expectations are not fulfilled.

The other brokers' platforms provide trading calculators and risk management plugins which help users determine accurate lot sizes and calculate pip values and check margin requirements in situations where speed is crucial.

Conclusion

The forex market requires traders to maintain equilibrium between their preparedness and technical knowledge and disciplined trading practices when dealing with high-volatility events. The fast and sharp price movements in the market result from macroeconomic data and central bank actions and geopolitical developments. The sudden interest rate change from the Bank of Japan leads to rapid JPY pair price increases which require traders to act swiftly yet maintain control.

The foundation for success during these conditions begins before the event takes place. Traders achieve better results through economic calendar review and risk definition and plan development which includes trade scenarios and position sizes and protective orders. The numerous trading platforms provide useful instruments for traders to prepare for upcoming events.

The combination of risk management with trading strategies including breakouts and pullbacks and hedging becomes essential during events. The combination of ATR and Bollinger Bands with stop-loss and take-profit levels suitable for expanded price ranges enables traders to make better decisions. The upcoming U.S. Federal Reserve speech leads to increased market volatility. Traders who reduce their leverage and verify their setups through indicators will preserve their trading structure when market conditions become intense.