How to trade forex using price action

The price action represents the way a currency pair's price changes when displayed on a time axis. Price action traders analyze market patterns through candlesticks and key levels and market structure without using lagging indicators directly from the chart. The method uses only historical price points to analyze price behavior which enables traders to make decisions promptly.

Professional traders choose price action because it provides them with direct market sentiment information. The price action between buyers and sellers occurs in real time through each candle which provides essential information about support and resistance levels. The repeated inability of a currency pair to surpass a specific price point indicates strong selling activity at that level. The identification of these market dynamics enables traders to predict upcoming market changes.

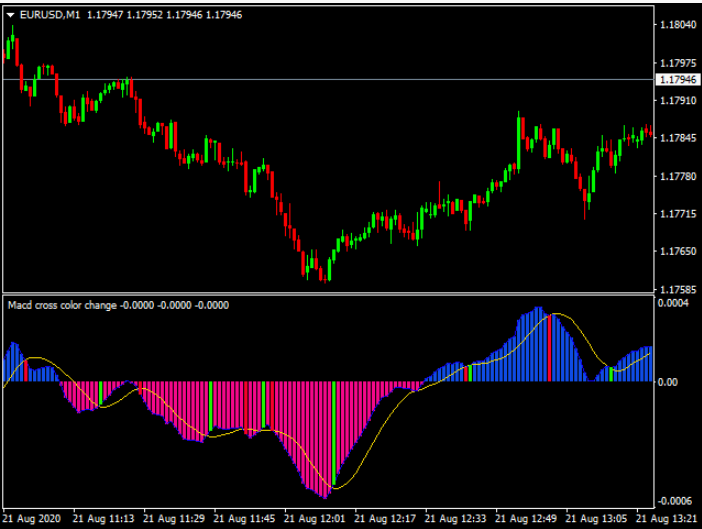

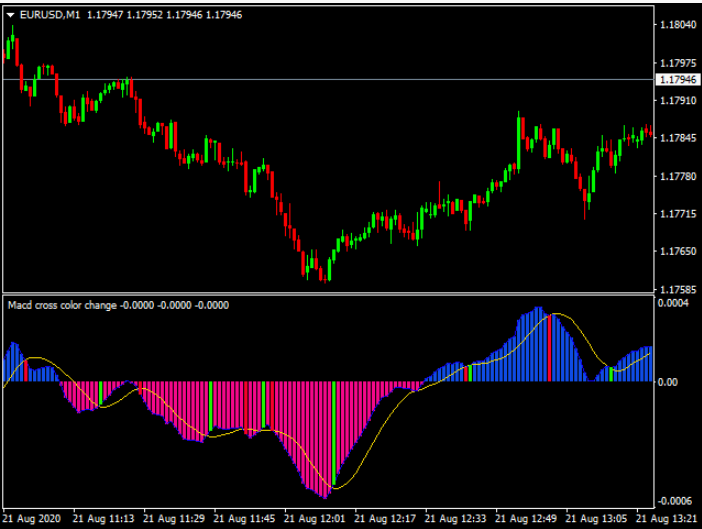

The EUR/USD price approaches its previous support zone while creating a bullish engulfing pattern. The combination of volume data and market structure analysis with this visual clue enables traders to identify high-probability entry signals without needing RSI or MACD indicators. The simplified method helps traders avoid excessive analysis and creates more transparent charts.

What is price action in forex trading

Price action refers to the analysis of price movements that appear on candlestick charts throughout time. The method uses actual currency pair price movements without indicators to predict future market behavior. The method bases its analysis on price reactions at specific levels including support and resistance zones and previous high and low points instead of mathematical formula predictions.

Price action in forex trading reveals market sentiment by showing which side between buyers and sellers takes control. The GBP/USD price repeatedly fails to surpass a particular level which makes that area function as a resistance zone. The trader should observe how price behaves when it approaches this zone during subsequent occurrences. Does it break through with momentum? Or does it stall and reverse?

A trader who observes three consecutive higher lows and higher highs on the AUD/USD would interpret this pattern. This structure signals an uptrend. A bullish pin bar near a key support zone together with three consecutive higher lows and higher highs on the AUD/USD suggests the trend will continue. The interpretations derive directly from chart patterns instead of moving averages or oscillators.

The method requires basic charts which show only candlesticks and essential levels while excluding all other elements. The uncluttered design of these charts helps traders concentrate on price movements while minimizing distractions.

The core principles behind price action

The fundamental principles of price action trading enable traders to understand market movements without depending on technical indicators. Market structure stands as the first fundamental concept which describes how price forms higher highs and higher lows during an uptrend and lower highs and lower lows during a downtrend. The identification of market structure enables traders to determine both the existing trend direction and potential reversal points.

Price action analysis heavily depends on support and resistance levels as essential components. The horizontal price zones represent previous reaction points where price either bounced back or broke through these areas. The price level at 148.00 functions as support because USD/JPY repeatedly touches this point without breaking through it. Traders verify support and resistance zones through rejection wicks and bullish engulfing candles when price returns to these areas.

The identification of supply and demand zones represents an essential principle because these zones mark areas where substantial buying and selling activities took place. The identification of these zones at their early stages enables traders to create better trading plans because they produce rapid market movements.

Candlestick patterns serve as visual indicators which reveal market sentiment to traders. A pin bar indicates price level rejection especially when it forms at major support or resistance points. The market control between buyers and sellers appears to change when an engulfing pattern occurs.

Common price action patterns

The market shows specific recurring price behavior patterns which traders use to identify trading possibilities. These formations emerge from price movements near essential levels while operating within specific market structures. The identification of future price movements becomes more accurate when these patterns are analyzed together with market trend directions and support and resistance zones.

The pin bar pattern consists of a long wick together with a small body. The price reaches a level before receiving immediate rejection. A bullish pin bar on EUR/USD support indicates that buying pressure is increasing which may lead to price appreciation.

The inside bar pattern emerges when the new candlestick body stays completely inside the boundaries of the previous candlestick. The market shows either indecision or consolidation through this pattern. A bullish inside bar in USD/CHF after an upward price surge indicates that the trend will continue after a successful breakout.

The engulfing pattern is also common. A bullish engulfing candle closes above and completely covers the body of the previous bearish candle, hinting at a shift from selling to buying pressure. The pattern shows its strongest effect when it appears near important support levels.

Traders frequently monitor breakout and retest patterns that show price breaking through resistance or support levels before returning to test these same levels before moving forward. This pattern provides traders with better entry points while making risk management easier.

How to read a forex chart using price action

The foundation of price action trading starts by studying candlestick charts to understand price movements across different time periods. The selected timeframe contains each candlestick which displays its open price and high and low points and closing price. Traders use these formations together with key levels to make logical decisions about market direction.

Timeframes play a central role in analysis. Daily and 4-hour charts offer traders an overview of the current market trend. The 15-minute and 1-hour charts enable traders to improve their entry and exit strategies. The EUR/USD daily chart shows higher highs so traders should examine bullish patterns on the 1-hour chart to initiate trades that follow the dominant trend.

The AUD/USD daily chart shows a clear support zone which traders can identify. The 30-minute chart shows price moving toward the level before creating a bullish engulfing candle. The alignment of price across different timeframes makes a potential long setup more compelling.

Chart cleanliness also matters. The elimination of extra indicators enables better observation of price movements. The tools horizontal lines and trendlines and zones enable users to draw support levels and resistance levels and trend directions on charts.

Entry and exit strategies with price action

Trading effectively through price action requires well-defined entry and exit criteria. Trading decisions stem from observing particular price behaviors near essential levels instead of emotional or random choices. A structured trading method enables traders to maintain consistent practices and better control their risk exposure.

The entry process starts by identifying three essential elements which include trend direction and key levels of support and resistance together with price action confirmation. The GBP/USD price shows an upward trend before returning to a support area that has been tested multiple times. A bullish engulfing candle appearing at that level indicates a possible entry point for a long trade.

After confirming a setup the next step involves determining the stop loss position. The stop loss position should be located immediately after the price structure. The stop loss for a bullish pin bar entry should be placed several pips below the candle's lowest point. The trade protection mechanism functions to prevent losses if the pattern fails to play out.

Take profit levels should be based on logical targets, such as previous highs or Fibonacci extensions. The standard practice in risk management involves establishing a risk-to-reward ratio at either 1:2 or 1:3. Traders who want to protect their profits as their trades advance will set trailing stops using swing highs/lows or moving averages.

Developing your own price action trading plan

A trading plan determines the exact timing and execution methods for trades through established rules. The price action trading plan includes specific setups together with defined timeframes and risk parameters and review procedures. A structured routine helps traders avoid emotional trading decisions while maintaining long-term consistency.

The first step involves choosing between scalping, intraday or swing trading according to available time and risk tolerance. A swing trader would concentrate on 4-hour and daily charts to enter trades when engulfing candles appear at support or resistance zones.

Next, define setup criteria. The trading plan requires traders to enter positions only when a pin bar forms at daily chart rejection levels while the 1-hour chart provides confirmation. The defined rule reduces trading uncertainty because it requires trades to occur under identical market conditions.

Conclusion

Price action trading provides traders with a functional system to analyze the forex market through price movements instead of lagging indicators. Traders who observe price behavior directly can develop trading strategies from recognizable market patterns and crucial price levels and structural elements. The approach provides an uncluttered market perspective which works for traders at every skill level.

The success of any trading method depends not just on the strategy, but also on consistent application, discipline, and risk control. Traders commonly use trading platforms to analyze charts and backtest strategies and monitor results. The regular use of data-driven tools enables traders to improve their decision-making abilities and maintain their learning process. Before moving to live trading it is suggested to test price action strategies on demo accounts.