How to trade forex with minimal capital

Forex trading with limited capital does not restrict entry into the market when traders adopt suitable methods. The foreign exchange market remains accessible to individuals with small starting balances because of improved trading platforms and broker accessibility and customized account types. The market's mechanics require understanding along with practical risk reduction strategies to maximize learning potential.

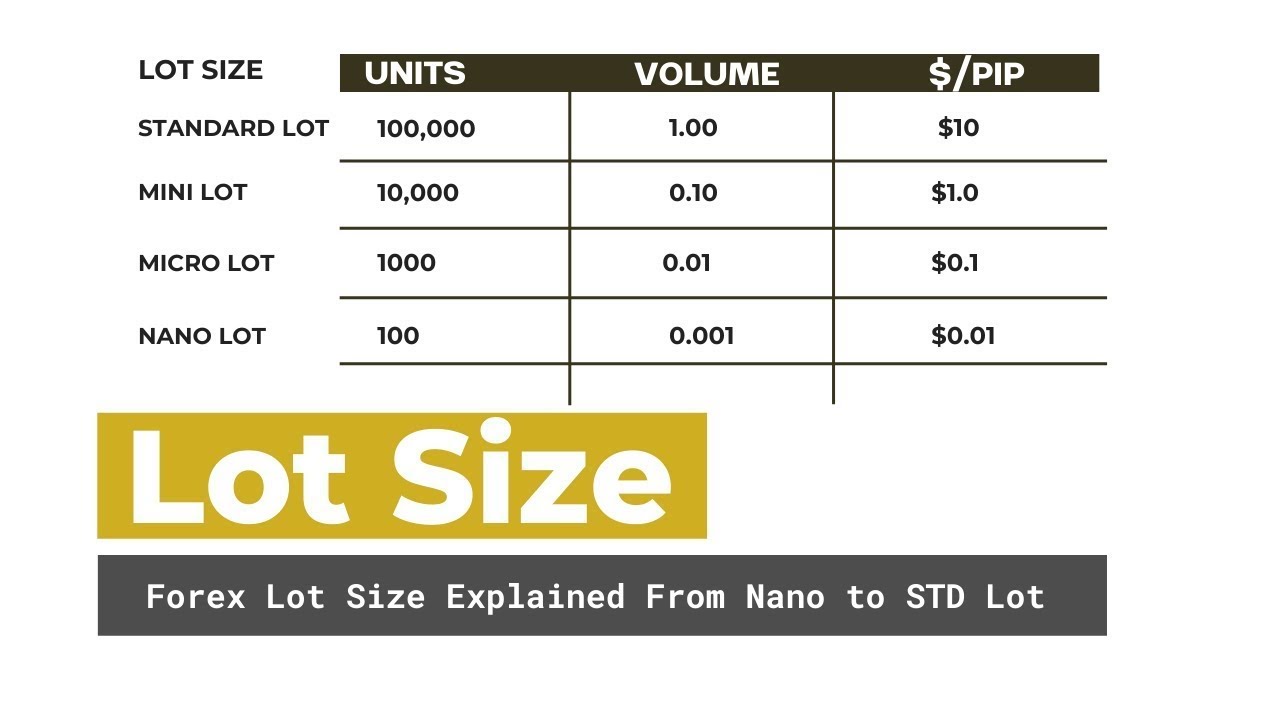

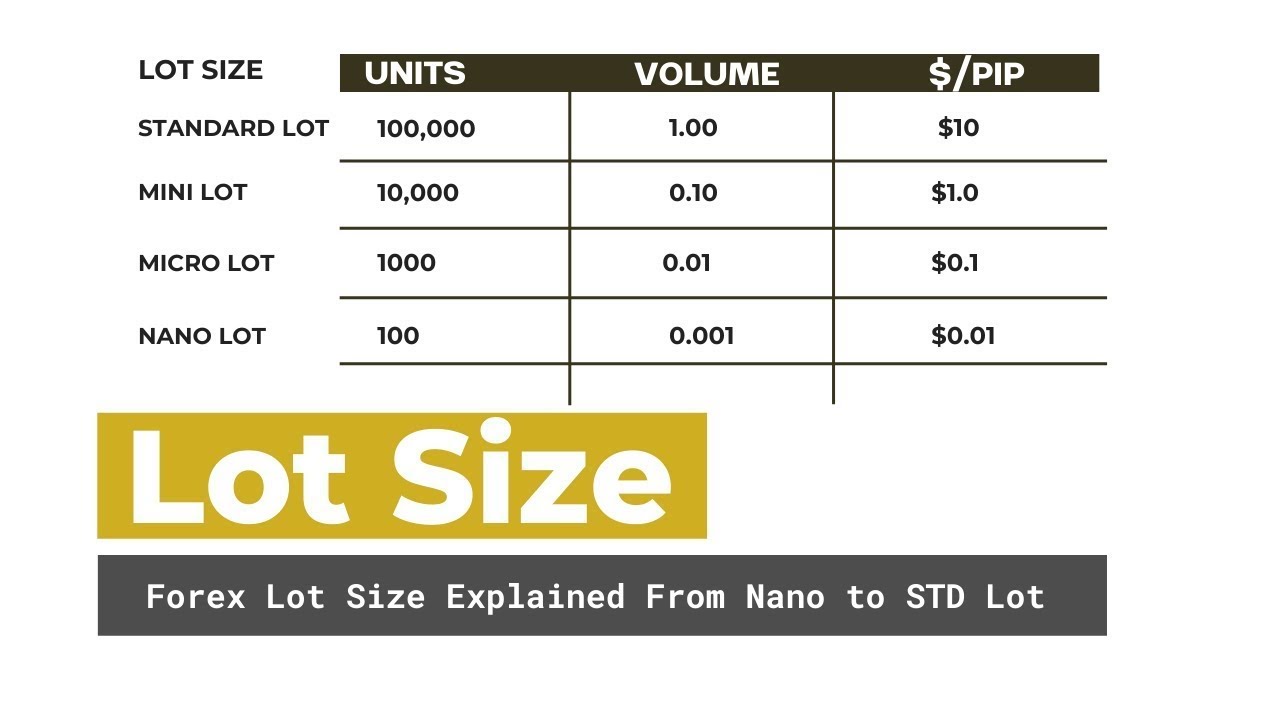

The foreign exchange market operates continuously throughout 24 hours during five days each week while handling more than $7.5 trillion in daily transactions. The market's high liquidity enables traders to easily enter and exit their positions. The introduction of micro-lot and nano-lot trading options through brokers allows limited-fund traders to enter the market with more flexibility. Standard lot sizes represent 100,000 units of base currency. The trading of small balances becomes more accessible through micro lots which represent 1,000 units and nano lots which represent 100 units.

Regulated brokers provide traders with leverage which enables them to manage bigger positions through smaller capital investments. A $100 deposit enables traders to control a $3,000 position when using 1:30 leverage. The use of stop-loss orders and strict capital allocation methods becomes essential because leverage both amplifies gains and increases potential losses.

Basics of forex trading

Before starting real money trading you must learn about the operation of the forex market and its governing terms. Foreign exchange trading known as Forex allows traders to exchange currency pairs like EUR/USD or AUD/JPY through market rate fluctuations. The price movement is measured in pips, which stands for “percentage in point.” The value of one pip equals 0.0001 for most major currency pairs. The price change from 1.1000 to 1.1005 represents a 5-pip movement.

The volume of each trade is defined through lot sizes. A standard lot represents 100,000 base currency units yet mini lots contain 10,000 units and micro lots consist of 1,000 units. Small account holders should use micro-lot trading because it provides better control. A single pip movement in micro lots corresponds to a value of $0.10. The reduced trading size enables traders to access the market while keeping their risk under control.

Margin is another foundational concept. The capital needed to establish and sustain open positions is what margin represents. The leverage of 1:30 requires traders to deposit only 3.33% of the full trade value. A $1,000 position would require roughly $33.30 in margin. Knowledge of these concepts reduces uncertainty while helping traders make better decisions.

Can you start trading with little money?

The forex market allows new traders to enter with small deposits through specific account types and flexible trading conditions which regulated brokers provide. The majority of modern brokers offer micro and cent accounts which serve as entry points for new traders who start with limited capital. Trading micro lots through these accounts enables traders to maintain both their risk exposure and trading costs at a manageable level.

The minimum deposit requirement at this broker stands at $50. A trader can establish a micro account with this amount to start trading using fractional lot sizes. The system provides beginners with practical trading experience while protecting their savings from major financial loss. The combination of low minimum order sizes and competitive spreads on reputable trading platforms enables traders to start with small capital.

Several established brokers provide trading accounts that start at $5 or $10 based on regional and regulatory requirements. The trading features of these accounts match those of larger-balance accounts because they offer real-time quotes together with full charting tools and basic technical indicators. Small capital allows traders to begin their trading journey but they should focus on developing discipline and building consistent trading habits.

Leverage: A double-edged sword

Forex traders who begin with limited capital should understand that leverage functions as their primary trading tool. The trading system enables users to manage positions beyond what their available account funds would normally allow. The trading platform provides leverage at a ratio of 1:30 to its clients. A trader who has $100 in their account can use it to control positions worth up to $3000. The use of leverage creates both increased profit opportunities and higher risk exposure so traders need to grasp its operational principles.

A leveraged trade requires traders to deposit a specific amount of funds known as margin. A trader needs $33.33 in margin to open a c. The broker will initiate a margin call or automatically shut down positions when the account balance drops below the required margin amount because of adverse market movements.

The protection of retail traders through leverage restrictions exists in different jurisdictions. Major forex pairs in Australia have a leverage limit of 1:30 according to the Australian Securities and Investments Commission (ASIC). The European Securities and Markets Authority (ESMA) maintains the same leverage restrictions throughout the European Union while the Commodity Futures Trading Commission (CFTC) in the United States sets leverage at 1:50.

The effective utilization of leverage depends on maintaining strict risk management practices. The management of risk requires traders to set stop-loss orders and establish trade exposure at a small percentage of their account balance and understand position pip values. The implemented measures prevent small losses from growing out of control which maintains account sustainability throughout time.

Smart risk management strategies for low capital

Effective risk management stands as a critical requirement for conducting trades with restricted capital. Small trade sizes become dangerous when volatility exists without appropriate risk management systems because they result in fast losses. A structured risk management plan enables traders to protect their capital while achieving consistent results throughout time.

Experienced traders use the practice of setting trade risks at 1% below their total account value. Let’s say the rule is 1% per trade. The maximum risk per trade should not exceed $2 when trading with a $200 account. The implemented risk management system protects the account from consecutive losses while maintaining stability during market price changes.

The implementation of stop-loss orders serves to enforce this rule. The stop-loss system executes position closures when market prices move against the trader thus establishing a predetermined loss limit. The stop-loss order set at 20 pips distance in micro-lot trading protects $2 of investment because each pip equals $0.10. The stop-loss order matches the 1% risk threshold when applied to a $200 account balance.

Position sizing is equally important. The pip calculator helps traders determine suitable lot sizes through calculations of stop-loss distances and risk levels. The combination of risk-to-reward ratio at 1:2 and disciplined execution with consistent stop-loss usage and position sizing tools enables traders to make rational decisions.

The need for extra risk management attention arises when trading with minimal capital. A well-structured plan which incorporates position sizing tools and consistent stop-loss usage and disciplined execution creates a solid foundation for long-term progress.

Choosing the right broker and account type

Choosing a dependable broker stands as the first essential decision when trading forex with limited financial resources. A broker under proper regulation enables traders to access appropriate account types while offering clear fee details and fundamental risk management capabilities. The financial protection of client funds occurs through ASIC ESMA and CFTC regulation which mandates segregated accounts that follow strict financial standards.

The practicality of trading with small accounts increases when using brokers that offer micro or cent accounts. The micro and cent account types enable traders to execute trades with 0.01 lots which minimizes both trading margin requirements and exposure amounts. A micro account from this broker requires a minimum deposit of $50. The trading platform allows users to start market participation at a low cost per pip which amounts to $0.10 while maintaining risk management principles for small capital amounts.

The combination of low spreads together with commission-free structures proves beneficial for trading operations. Brokers who maintain narrow spreads on major currency pairs including EUR/USD and USD/JPY enable traders to decrease their total trading expenses. Negative balance protection is another key feature. The protection system prevents losses from exceeding the deposited funds which remains vital for traders who use leverage.

The feature-rich trading platforms find widespread support among reputable brokers. Through these platforms traders gain access to real-time quotes and order execution as well as built-in indicators and automation features. A broker that provides fast execution and extensive customer support will help new traders advance while practicing risk-aware trading.

Strategies that suit small accounts

Small forex account trading demands specific approaches that focus on protecting capital while managing risks and delivering consistent trading results. The trading methods of scalping and intraday trading prove effective when traders minimize their transaction expenses. A trader who operates a micro account with 0.01 lot positions should target 10–20 pip profit goals while implementing tight stop-loss orders. The combination of low spread costs on major currency pairs enables traders to execute multiple small trades which build their skills and confidence.

The trend-following method works best when traders use higher timeframes. The trader should focus on strong directional moves and confirm setups with indicators to decrease trading frequency while maintaining clear entry and exit criteria. Moving averages combined with support and resistance zones function as filters to eliminate incorrect trading signals.

The trading strategies which need minimal capital should prevent excessive exposure to risk. The practice of opening multiple positions at once or trading volatile pairs without stop-loss orders leads to increased account drawdown risk. The risk-reward ratio of 1:2 or 1:3 should guide each trading position when trading one position at a time.

The technical tools available through different trading platforms enable traders to improve their strategies. These trading platforms provide backtesting capabilities along with demo environments and customizable indicators which help traders practice and validate their strategies before moving to live trading. Small trading capital can support skill development and steady account growth when traders demonstrate discipline and make proper adjustments.

Using demo accounts to practice without risk

The ability to trade in a real market environment through demo accounts allows new investors with limited capital to practice without financial risk. Virtual funds in demo accounts duplicate real market conditions to let traders practice their strategies and master platform functions and track performance without risking actual money.

A broker provides demo accounts with $10,000 virtual funds to their traders. The intention to trade with a smaller live account later requires traders to adjust their demo account trade sizes to match realistic balances of $100 or $200. The practice of trading with suitable position sizes develops trading habits that will transfer effectively to actual capital.

Through demo trading accounts traders can test different order types while placing stop-loss orders and evaluate their strategies across multiple market sessions. The analysis of EUR/USD price behavior between London and Asian trading sessions enables traders to make better timing choices.

The main advantage of demo trading involves becoming comfortable with trading platforms. The leading trading platforms provide advanced features that include charting tools and indicators and automated trading capabilities. Learning to use these tools before opening a live account helps users avoid mistakes during execution and build stronger confidence in their decision-making process.

Conclusion

Forex trading with limited capital remains achievable because it serves as an effective method to understand market dynamics while developing trading strategies and building self-discipline. Micro accounts combined with low-cost brokers and leveraged trading environments enable smaller accounts to access identical tools and markets available to larger accounts. The key to success depends on risk management and plan consistency and emotional control.

A trader starts with $100 while following a structured plan which includes defined position sizing and protective stop-loss orders and a maximum risk per trade of 1%. This method allows small profits to build up gradually while protecting the capital. The application of learned concepts such as pip calculation and margin requirements and leverage effects becomes possible through every trading opportunity.

The combination of demo accounts with trading journals and reliable platforms helps traders improve their performance continuously. The combination of technical tools with tracking resources helps traders monitor their performance and maintain risk control. A trader should choose a well-regulated broker that offers suitable account types to ensure their smaller balance receives proper trading conditions without sacrificing quality or transparency.