How to use economic calendars for forex trading

The economic calendar gives traders a clear schedule of upcoming data releases and central bank meetings and market-moving announcements. The sequence of events together with their projected results enables traders to create strategic plans which protect them from making impulsive decisions when markets experience unexpected changes.

A trader maintains an active position in EUR/USD at this time. The European Central Bank will announce its interest rate decision at the time specified in the calendar while showing the market's predicted outcome. The system provides traders with the ability to determine their next steps by choosing between risk reduction and tighter parameter settings and preparation for post-announcement market opportunities. Investors who fail to prepare themselves become exposed to market price swings which result in avoidable financial damage.

What exactly is an economic calendar?

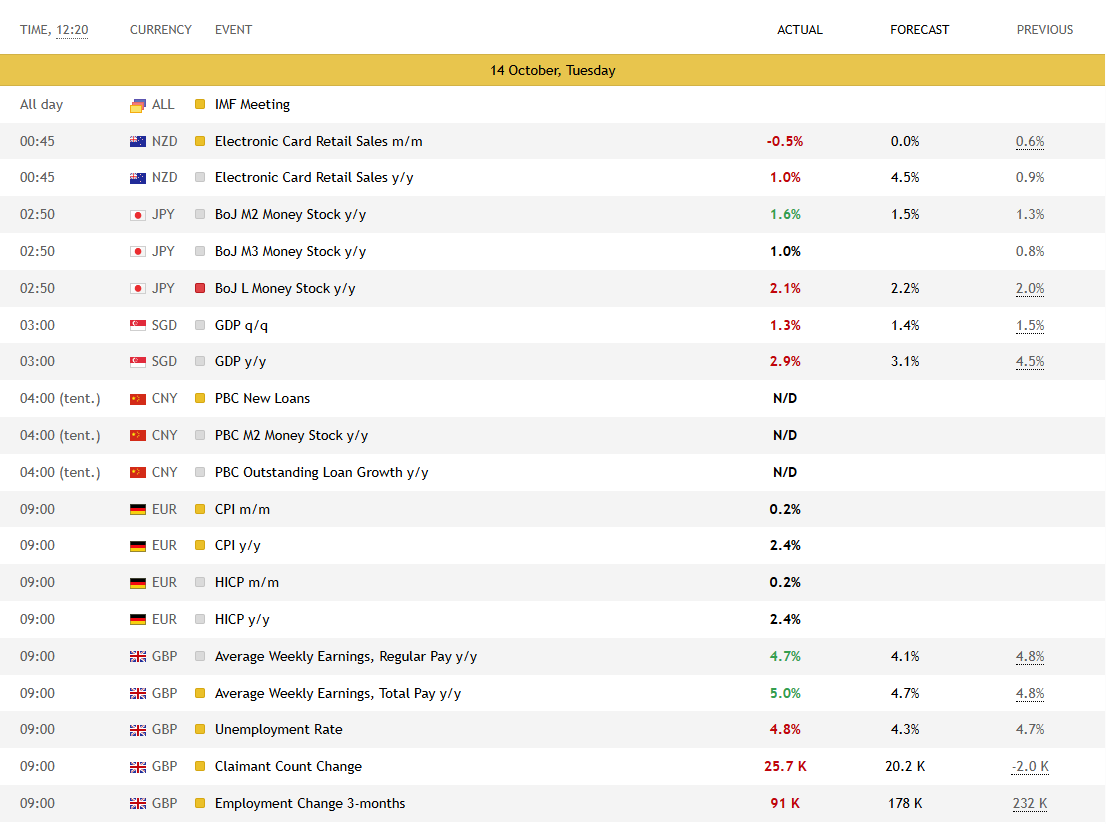

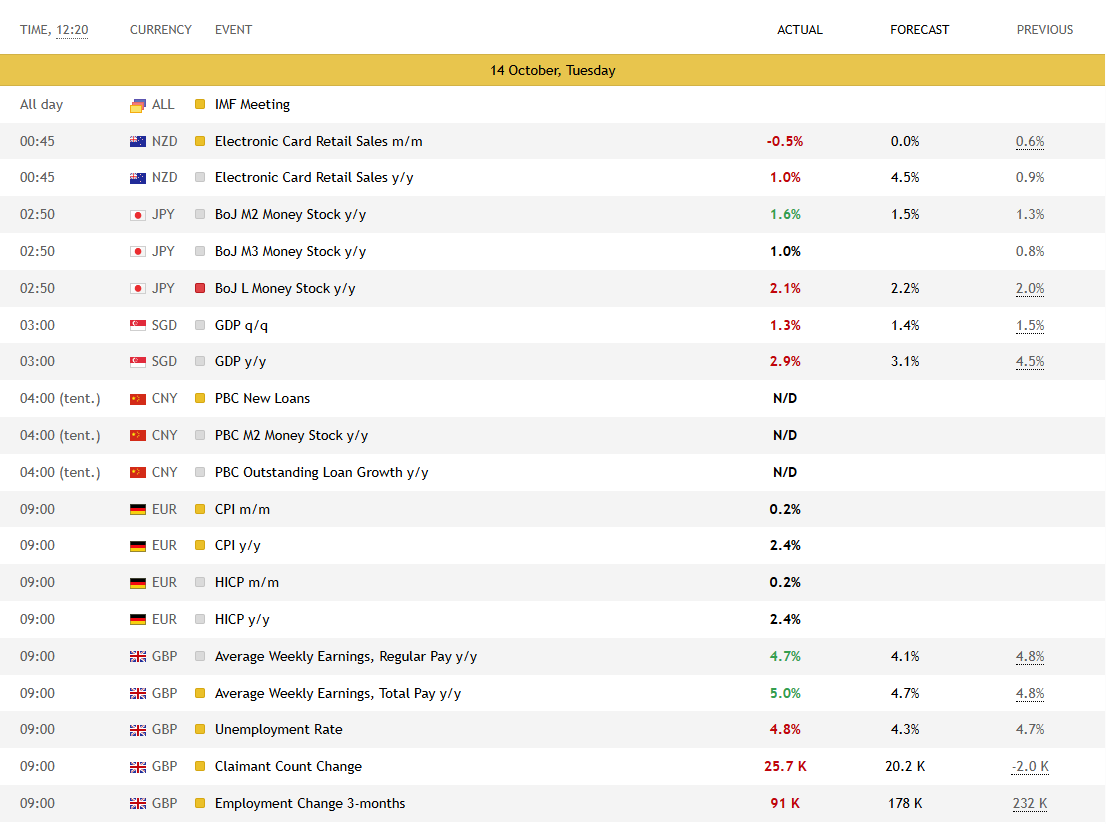

The economic calendar functions as a scheduled system which shows upcoming economic data releases together with announcements from official bodies. The typical format of each entry contains the date and time along with the affected country or currency and a description of the event and three values showing previous data and forecasted and actual results. The previous figure shows the last reported number, the forecast reflects market expectations, and the actual number is published at release time. Market participants base their responses on the gap between predicted and actual results.

For example, if U.S. nonfarm payrolls are expected to increase by 180,000 jobs but the actual figure comes in at 250,000, the U.S. dollar may strengthen as markets interpret the stronger labor market as supportive for tighter monetary policy. The market will experience increased volatility when actual results exceed or fall short of expectations. A figure that is significantly lower than what was expected will create market volatility in the opposite direction.

Economic calendars exist in two forms which include aggregators that unite worldwide events into one platform and official sources that include central banks and government agencies. The trading community depends on official releases for precise information yet they also use aggregators for their ease of use.

Where to get reliable calendars

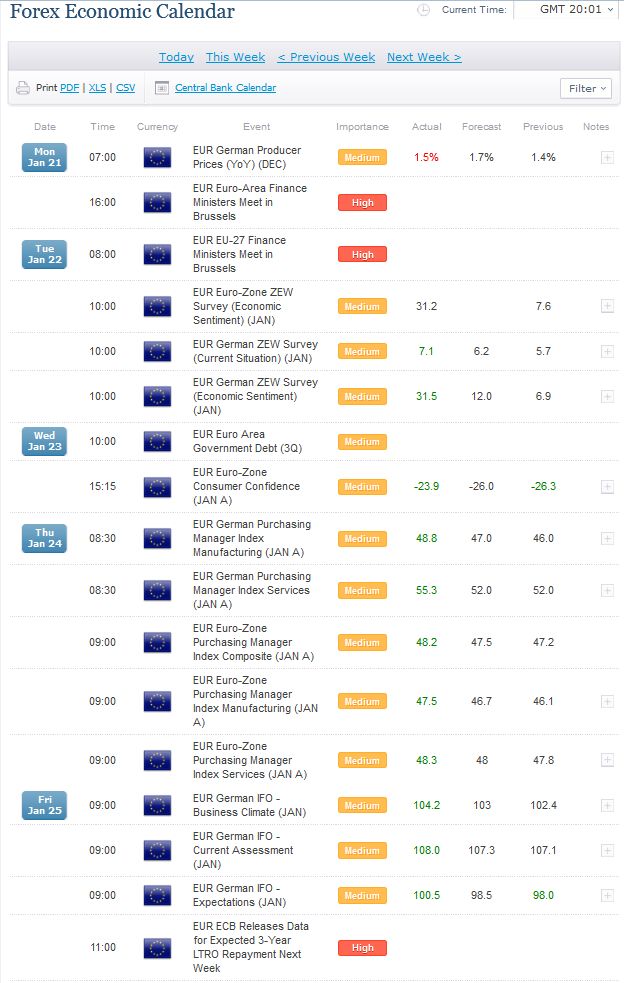

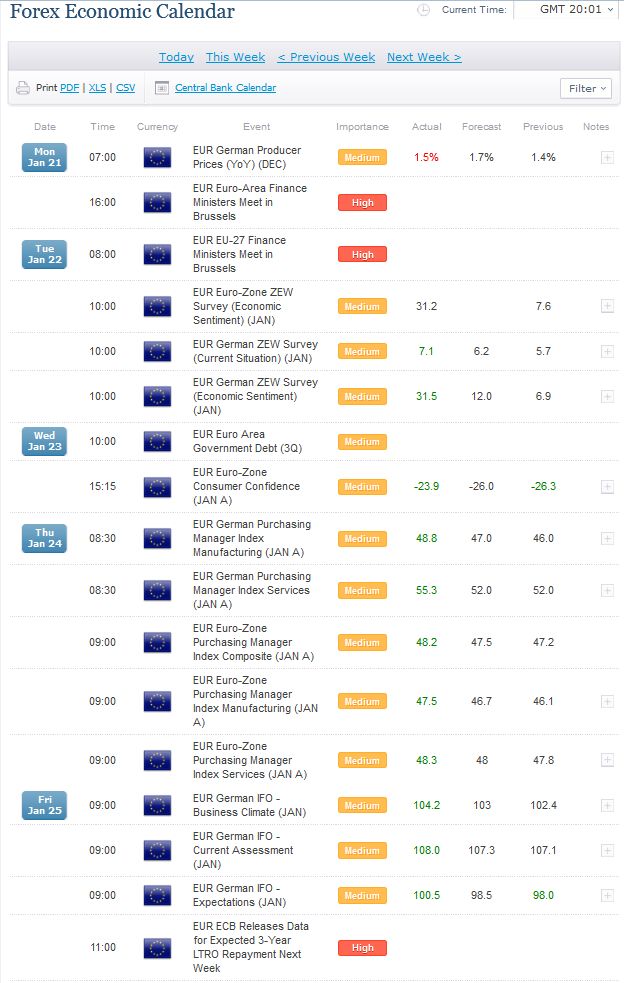

Users must choose reliable information sources from different platforms which offer economic calendars. Aggregated calendars provided by major trading portals present a convenient way to see global events in one place. The platforms enable traders to organize their data through currency selection and impact level and session filters which helps them prepare for their trading strategies. The system allows users to focus on specific events through filtering by selecting “high impact” events which includes central bank meetings and employment reports and inflation data releases.

The official sources function as vital distribution channels which provide precise information to the public. Central banks and government agencies publish the exact release times and the underlying methodology of their data. The official source provides definitive information about figures and schedules which prevents the discrepancies that third-party calendars may contain. Experienced traders verify aggregated calendars by comparing them to official release schedules from institutions including the Federal Reserve and European Central Bank and national statistical offices.

Major market-moving events to track

Not every economic release has the same influence on currency markets. Traders tend to focus on specific events which generate substantial price movements when creating their weekly trading plans. Central bank announcements stand as the most important announcements. Market sentiment receives its direction from interest rate decisions and policy statements and press conferences which the Federal Reserve and European Central Bank and Bank of Japan release.

The Consumer Price Index (CPI) reports and inflation data serve as critical high-impact indicators. A higher-than-expected CPI reading will boost expectations for tighter monetary policy which typically results in currency appreciation. The U.S. nonfarm payrolls and unemployment rates in labor market reports receive intense scrutiny because they directly show how the economy is performing.

The early signs of business activity emerge from growth statistics which include GDP reports and Purchasing Managers' Index (PMI) surveys but retail sales and industrial production numbers validate consumer and manufacturing trends. The external balance data and sentiment surveys generate market expectations about capital movements and risk tolerance which then impacts currency exchange rates.

How to read calendar data like a pro

The three essential values for each event entry in economic calendars consist of previous data and forecasted and actual results. The analysis of these numbers requires a complete understanding of their relationships. The forecast represents the market consensus which analysts and economists typically create through their surveys. The actual value appears at the scheduled time yet market volatility emerges from the difference between forecasted and actual values. The U.S. unemployment rate will achieve 3.8% based on current projections. The actual release of 4.2% would indicate a weaker labor market which would push the U.S. dollar value down.

Revisions also matter. For example, a previous month’s GDP growth may be revised upward, which can offset a slightly weaker current figure. Traders monitor the release status of data because flash and preliminary and final releases may show different numbers. The market interpretation of a release depends on three main factors which include seasonal adjustments and base effects and the quality of the data source. The ability to read past the headline number leads to improved market readiness and corrects public perceptions about market reactions.

Time zones, session overlap, and DST gotchas

The release times shown on economic calendars exist in various time zones which differ from one platform to another. The incorrect interpretation of release times results in both lost chances and unanticipated media exposure when market conditions start to become unstable. The time display for Federal Reserve announcements in the U.S. uses Eastern Time but brokers show their platform data in GMT or server time. The process of matching trading platform times with calendar times enables users to avoid confusion.

Daylight Saving Time (DST) introduces additional operational challenges. The United States and Europe operate on different time change schedules which results in brief annual periods when event start times become out of sync with local business hours. The weeks introduce new liquidity patterns which create temporary overlaps between London session events and other market periods.

Session overlaps between different time periods create additional volatility in the market. The market shows its highest level of activity during the London-New York overlap so economic statements made at this time will produce the most substantial market responses. The correct timing of all essential events becomes possible through the use of UTC calendar alerts or manual time adjustments.

Building a weekly and daily prep routine

An economic calendar is most effective when used within a structured routine. The start of each week brings traders to search for significant market-moving events which include central bank announcements and inflation statistics and major employment data releases. The identification of these periods in advance enables traders to predict future market volatility which helps them modify their position sizes and risk limits.

The daily routine requires additional emphasis on preparation activities. A trader who tracks GBP/USD will observe that U.K. GDP statistics will become available during the morning hours. The trader can create a plan by studying the forecast range together with its possible outcomes because stronger-than-expected growth would lead to upward price movement but weaker growth would trigger selling activities. The process of setting alerts in advance guarantees that every release will be caught.

Weekly macro planning together with daily event organization leads to dependable results. The system enables users to predict significant market movements and protects them from sudden price fluctuations during announcement events.

Trading around releases

Market prices experience immediate changes when economic data becomes available which makes traders decide between decreasing their market involvement or creating an active trading plan. Standing aside during high-impact events is a valid strategy, especially for those who prefer to avoid unpredictable volatility. The process of trading through announcements requires traders to prepare thoroughly while maintaining strict risk management protocols.

Let’s say U.S. CPI is scheduled for release. A trader needs to identify important support and resistance levels before creating a breakout strategy. The data exceeding expectations could lead to price breaking through resistance levels which would create an entry opportunity. The market needs to achieve stability first before traders can decide between maintaining the current trend or changing direction based on market reactions.

The process of risk management for release activities requires anticipation of increased price volatility and delayed execution and reduced order fulfillment rates. The use of smaller position sizes together with predefined stop-loss levels functions as a method to decrease exposure. The primary goal requires managing unexpected situations while maximizing potential opportunities.

Post-release analysis

The assessment of market details following the initial reaction should receive equal attention to the headline number. Many traders revisit the full report to understand which components drove the outcome. The CPI release demonstrates that core inflation data which excludes food and energy prices delivers superior information about price trends than the overall headline figure does. Labor reports include supplementary data about wage growth and participation rates which provide more details than the unemployment rate alone.

Revisions are another key factor. The current release headline change remains secondary to major adjustments made to past months' data. The market responds rapidly to these changes so analysts need to include them in their assessments.

Post-release behavior also matters. The currency pair that first increases in value before returning to its original level indicates that traders either predicted the outcome or the market-wide consensus influenced the data. The evaluation of market reaction to the report and its subsequent price movement enables traders to create greater future plans which result in better trading control.