How to use MetaTrader 4?

If it's your first time using the MT4 platform, the sheer number of tabs, windows, and buttons can be overwhelming.

But don't worry, as, in this guide, we are going to breakdown how to use MetaTrader 4 and how you can take advantage of its features.

1. Setup your account

To begin, you must first download MetaTrader 4, after which you must run the downloaded.exe file and follow the installation instructions. IOS, Android, and iPhone versions of MT4 are also available.

You'll need to enter your account credentials after you've activated the platform. If the login screen does not appear automatically, go to the top left corner of the screen and select login.

2. Entering the trade

Using MT4 to place a trade is a breeze. Simply click on the 'New Window' button after selecting the currency pair you want to trade in the 'Window' tab. Then press F9 or click on the 'New Order' button on the toolbar.

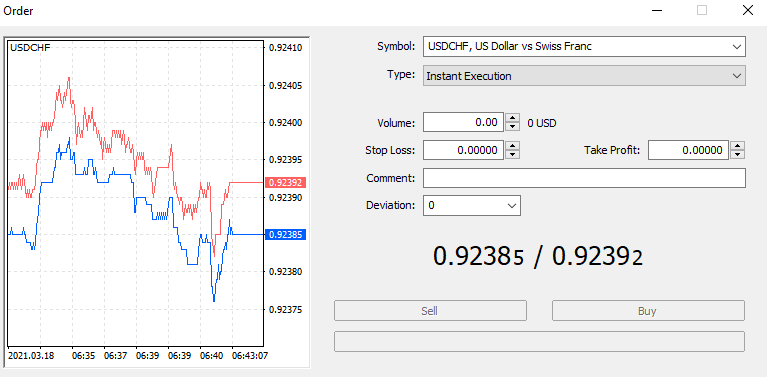

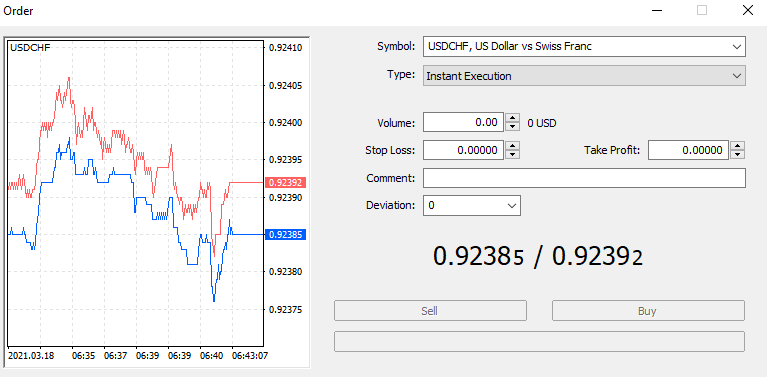

The 'Order' window for trading the USD/CHF pair is shown in the screenshot below. Trading a currency pair on MT4 is easy, as you can see from the screenshot; all you have to do is enter the trade size information in the 'Volume' box and click Sell or Buy.

You can place an instant order on the MT4 platform by selecting the 'Market Execution' order category.

Entering the trade on MT4

Alternately, by changing the order form, you can position trade using a cap or stop order. In comparison to 'Market Execution,' which trades the asset immediately at its current price, this allows you to position trades at unique prices.

3. Exiting the trade

Simply move to the 'Trade' tab from the 'Terminal' window (pressing CTRL+T will open/close the 'Terminal window').

You can see all of the trades that are currently available under the trade tab. To close an order, right-click on the desired trade and select "Close Order," then click the yellow "Close" button.

4. Setting stop-loss and take-profit

You can enter a stop-loss and take-profit level in their respective fields when putting a trade in the 'Order' window. The current market price of the desired asset can be found by clicking one of the arrows in the Stop Loss field. It's important to remember that the platform uses the asking price. You can see the relationship between your target stop-loss amount and the current bid prices by looking at the tick chart on the left.

Now that you know how to use the trading platform, it's time to move to some of the key features and benefits of MT4.

Key features and Benefits of MT4

a. Mobility

The best part about MT4 is that you can trade on your smartphone as well as your laptop and pc.

With MT4, you can conveniently handle all of your trading deals on your smartphone. You can check your account or complete a transaction at any time using any Internet-connected computer.

b. Automated

MT4 provides a wide range of trading and analytical tools, as well as a number of other useful features.

Algorithmic trading is one of MT4's strong suits. Expert Advisors also use a predetermined algorithm to trade.

c. Security

The information exchanged between you, the terminal, and the platform servers on MT4 is encrypted using 128-bit keys. The framework also supports a sophisticated protection scheme based on RSA, an asymmetric encryption algorithm.

d. Analysis tools

There are up to 30 built-in indicators and 33 analytical objects in MT4. Two types of market orders, four types of pending orders, two execution modes, two stop orders, and the trailing stop feature are all available.

It also includes Fibonacci retracements, moving averages, and other fundamental and technical indicators and charts.

e. Trading history

You can use MT4 to learn about your previous trades. You can then evaluate your transactions and make informed choices in the future.

f. Multidirectional

The platform allows you to open opposing (multidirectional) positions. The hedging technique helps to track trading activities and open multiple orders for each instrument. This is a traditional trading strategy used in the forex market.

Few simple hacks on MT4

To make your trading experience better, we have compiled a list of simple hacks that you can perform on MT4.

1. Charts settings

In MT4, you can open up to 99 charts at the same time. Bookmarks are needed to move between them.

You may alter the graph's parameters, such as the color of the lines. To do so, go to the menu and click on "Colors" under the "Properties" tab.

You can check your saved adjustments on the map in the left part of the window.

2. Types of timeframe

The timeframe refers to the period shown on the chart. The timeframe is divide into:

- Long-term: This is D1 (one day), W1 (one week), and MN (one month) (1 month). They are analyzed in order to assess the trend's course.

- Short-term: There are two types of short-term trading: intraday trading and day trading. M30, H1, and H4 timeframes are included. Other timeframes for scalpers include M15, M5, and M1. The letter M stands for minutes.

You can benefit from trading on any timeline, but you must choose the most appropriate one for each strategy, such as M1-M30 for intraday trading.

3. Pending orders

You can open a pending order in MT4. A pending order is a special feature that enables a trader's order to sell or buy to be performed automatically until the price hits a certain amount.

4. Financial news

In your MT4 platform, you can get news from financial institutions and political and economic news from different countries.

To keep up with the news, simply go to the news menu at the bottom of MT4.

If you're a trend trader, this hack will come in handy. You can exchange and stay up to date without having to go to other websites for news.

5. Adding one indicator to another

You can use two indicators at the same time in Mt4. To do this, you need to first add the primary indicator, followed by the secondary indicator.

Open the navigator window after inserting the primary indicator and move the secondary indicator onto the chart. The parameters, levels, and visualization will be shown in a window. You're ready to go once you've added the data from the first indicator.

Pro tip: You can use MT4 to check for almost anything. Simply go to the top right corner and press the search button.

When talking indicators, MT4 has a plethora of them. Technical indicators help predict market movements. Therefore, it is important that you know what some of the best technical indicators on MT4 are.

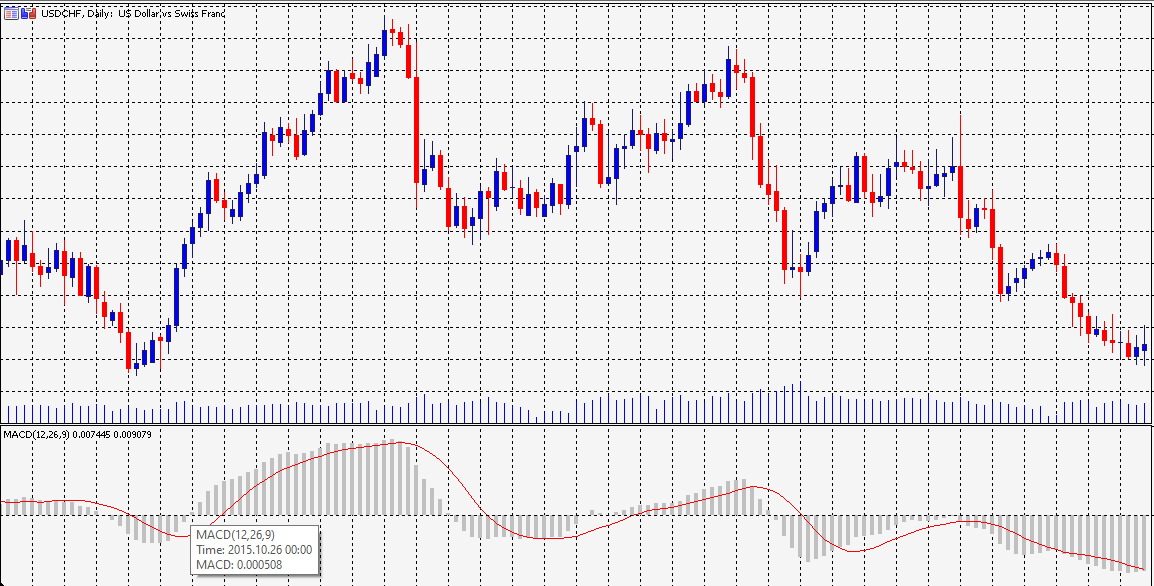

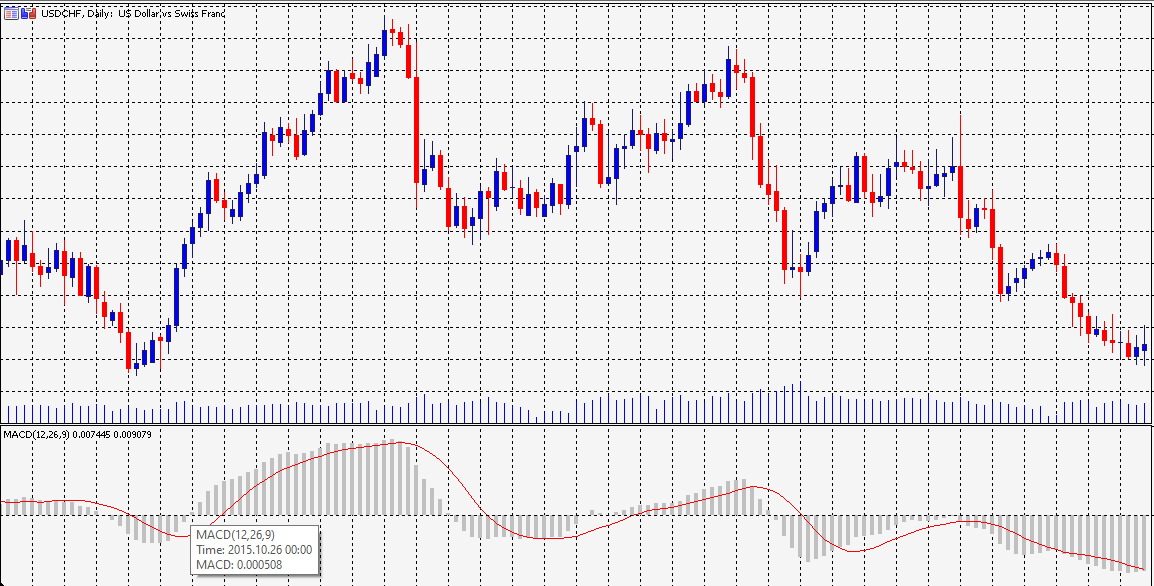

1. MACD

Price fluctuations are defined by the MACD, or moving average convergence divergence, which is determined by adding two moving averages. Swing and intra-day traders use it for trend trading.

The MACD is a combination of two moving averages: the 26-day EMA and the 12-day EMA (exponential moving average). It subtracts the 26-day EMA from the 12-day EMA for calculations. A 9-day exponential moving average (EMA) serves as a signal line.

MACD on the chart

It's a buy signal when the 12-day EMA crosses over the 9-day EMA. When the 12-day EMA crosses below the 9-day EMA, on the other hand, it's a sell signal.

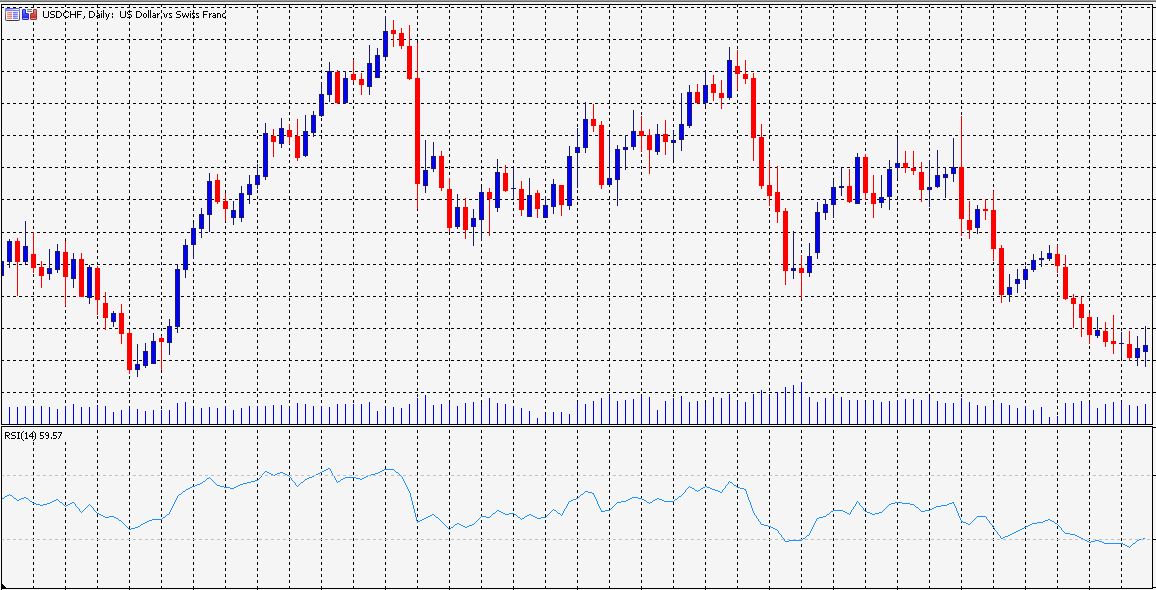

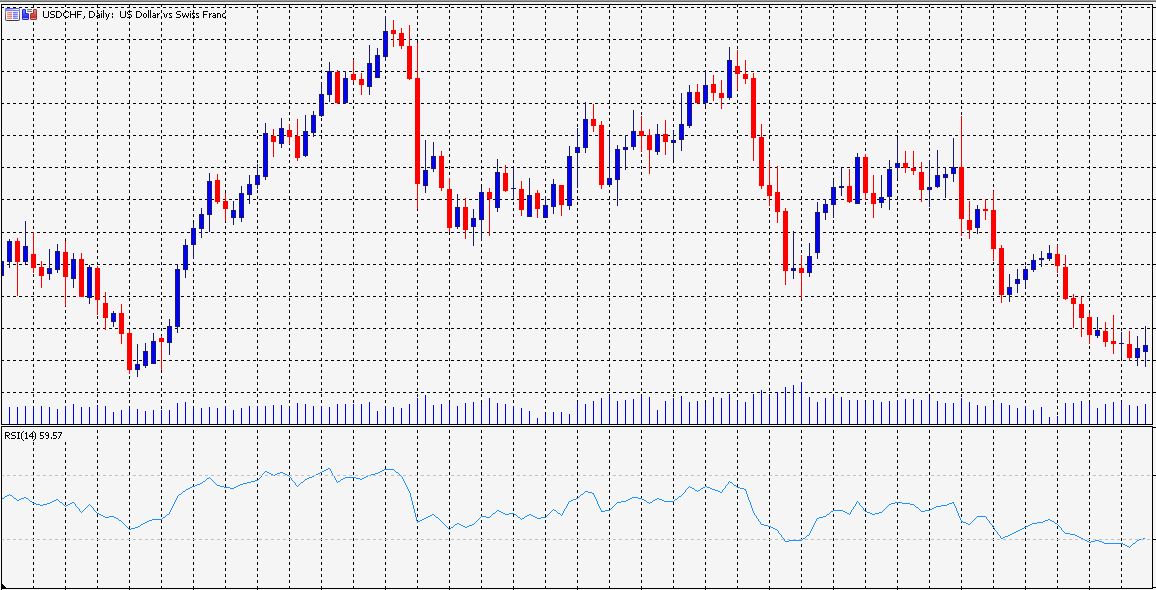

2. Relative strength index (RSI)

The RSI (Relative Strength Index) is a momentum oscillator that calculates the ratio of upward and downward price changes between 0 and 100.

RSI on the chart

An overbought situation arises when the RSI reaches 70, implying that there is strong buying pressure and the currency pair is trading above its normal level. When the RSI drops below 30, the market is considered oversold.

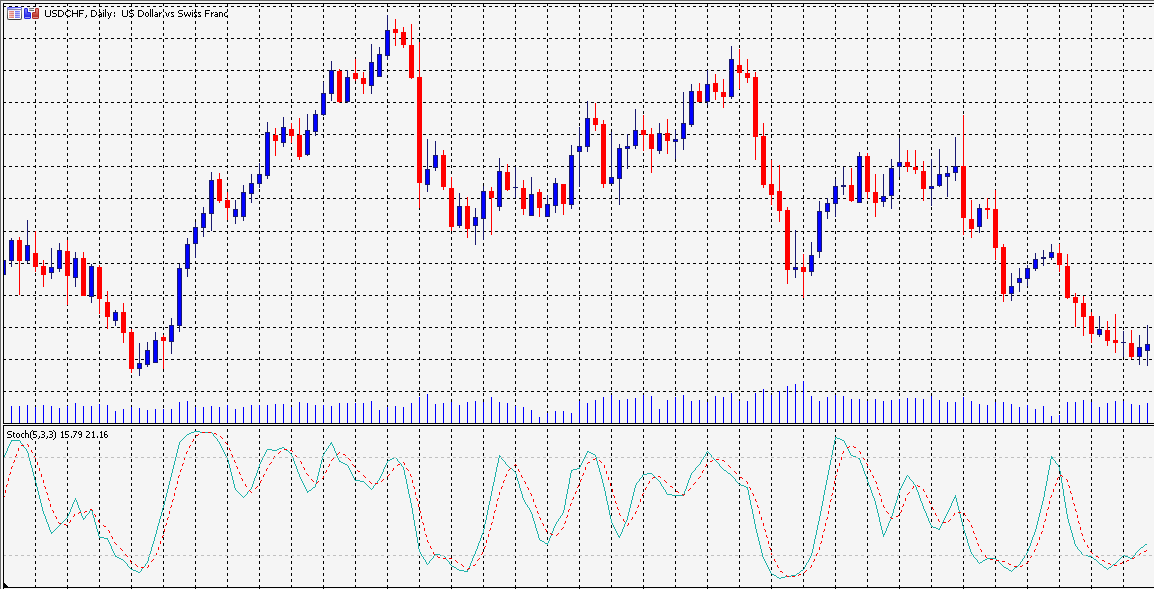

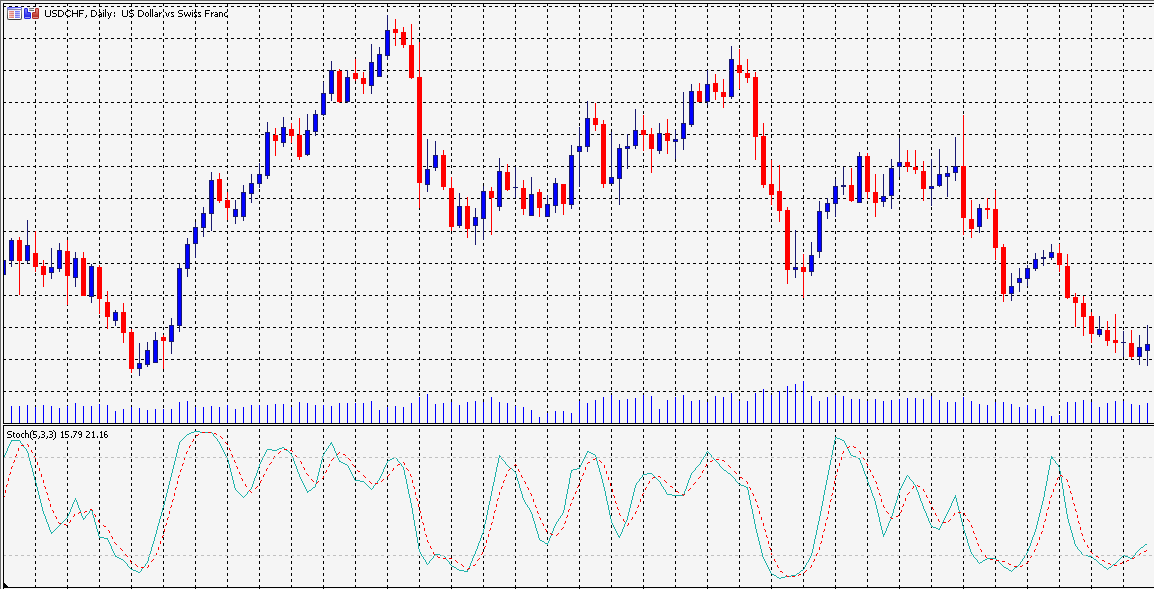

3. Stochastic momentum indicator

The Stochastic indicator is an oscillator that operates similarly to the RSI. In contrast to ranging markets, stochastics are most often used in trending markets.

The stochastics on the MT4 platform reveals two lines, %K and %D. K% signifies the current value of stochastics, while the D% represents the 3-period moving average of k%.

Stochastic indicator on the chart

The stochastics ranges from 0 to 100. An oversold condition occurs when the value is less than 20, and an overbought condition exists when the value is greater than 80.

4. Bollinger Bands

Bollinger Band identifies key support and resistance level by measuring price volatility. It is divided into two bands: the upper and lower bands. These bands have a value of 20 and are basic moving averages. The value of the upper band is greater than 20, while the value of the lower band is less than 20.

Bollinger Band on the chart

The bands widen with rising volatility and narrow with decreasing volatility in a highly volatile market. On the upper band, you should sell, and on the lower band, you should buy.

Bottom line

Trading with Meta Trader 4 is easy and convenient. If you are a beginner who is looking for a trading platform, MT4 is a great pick.

Click on the button below to Download our "How to use MetaTrader 4?" Guide in PDF