Managing risk with portfolio diversification in FX

The foreign exchange market operates with constant price volatility because interest rates and economic statistics and worldwide investment movements affect its operations. Risk management systems create operational frameworks which enable market participants to conduct their activities under these market conditions while protecting their trading funds from major financial losses. The first step in practical application requires traders to learn about position size and pip value and margin and leverage because these elements control how market price fluctuations impact their account equity.

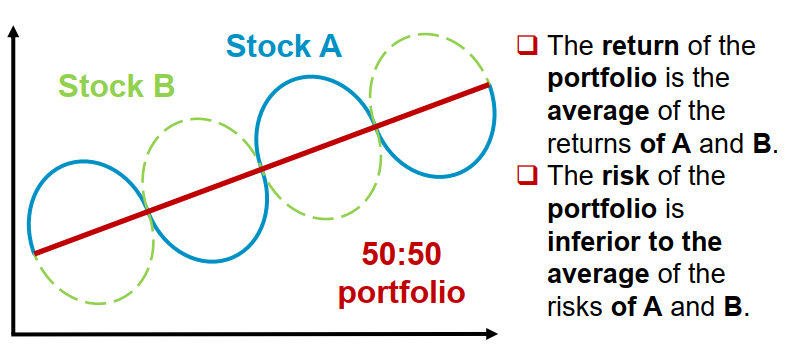

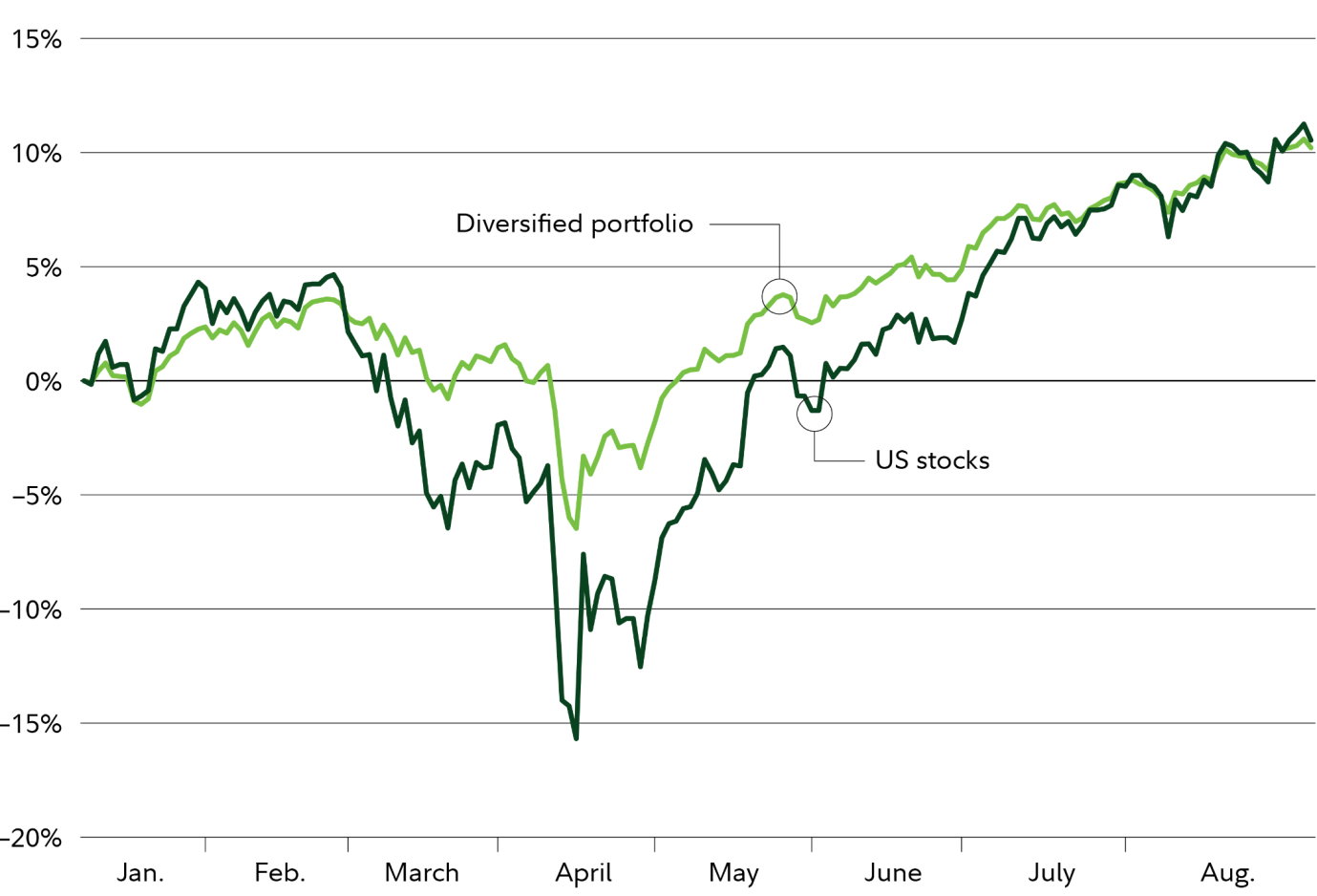

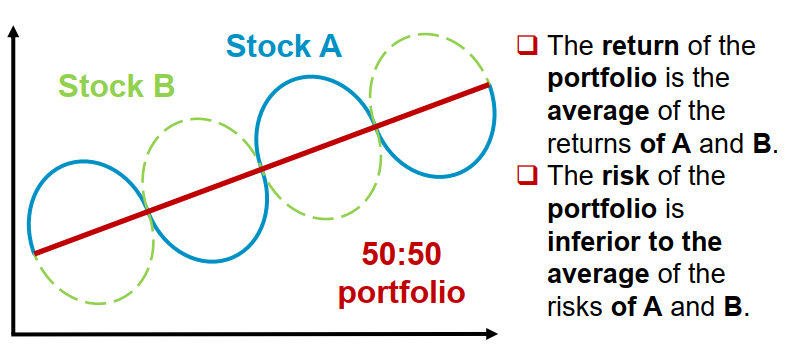

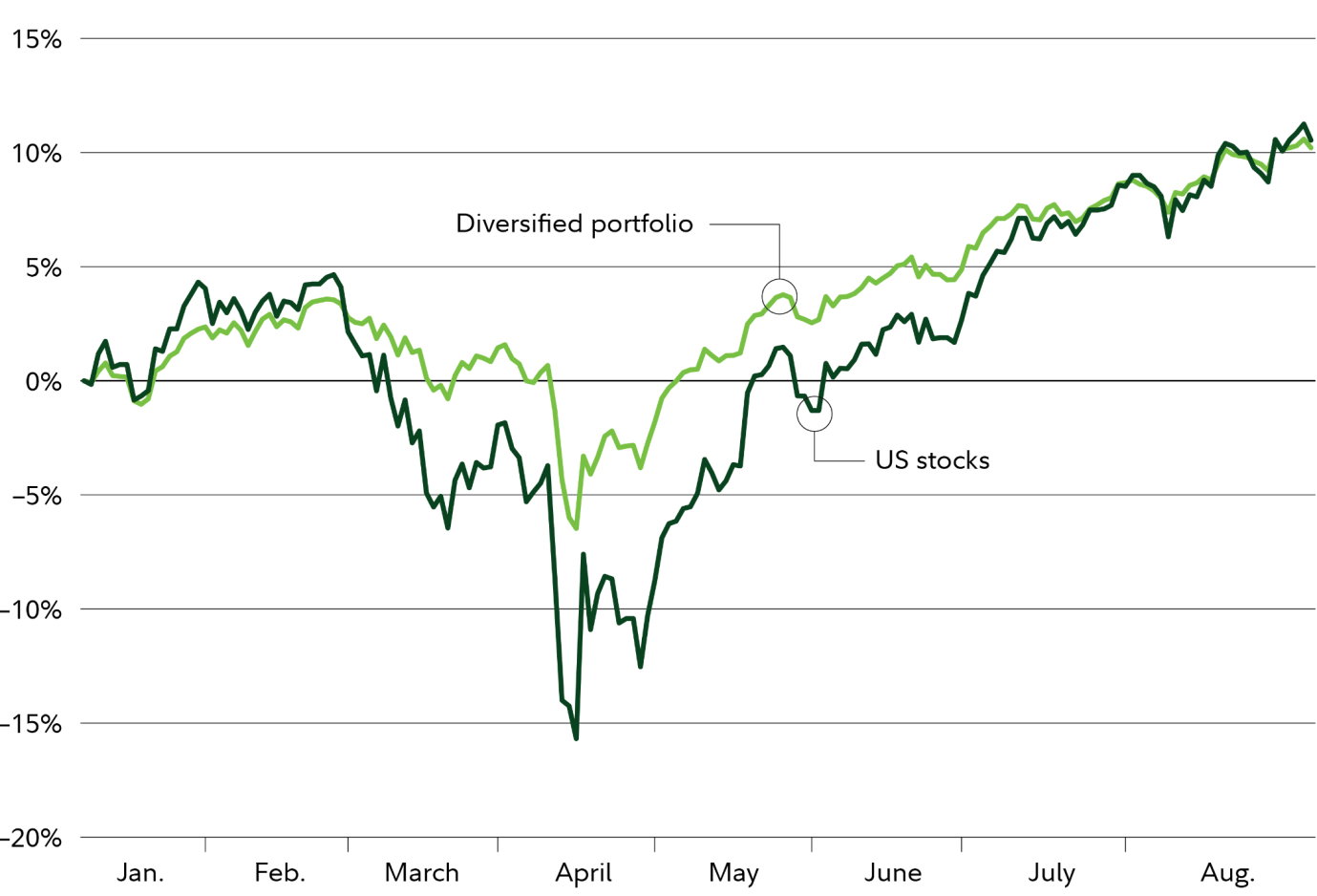

The risk management system at the portfolio level extends its analysis to cover all trades within the portfolio. The distribution of exposure across multiple currency pairs which have distinct drivers helps to minimize overall market volatility. This approach works to reduce its operational expenses as it progresses toward delivering reliable and stable outcomes.

Understanding portfolio diversification in Foreign Exchange

Foreign exchange portfolio diversification requires investors to spread their investment risk across different currency pairs instead of putting all their money into one particular position. The FX trading requires traders to establish positions through the selection of lot sizes and pip values and margin requirements and leverage levels. The process of diversification reaches its objective through the management of variables which impact different instruments. The imperfect alignment of price movements between positions allows investors to reduce their losses through stability or gains from different investment areas.

Let’s say two positions are opened with equal risk: one standard lot on EUR/USD and one standard lot on USD/JPY. The 10-pip movement of EUR/USD results in a 100 USD value but USD/JPY produces different monetary effects because of its exchange rate rules. The two positions need to maintain equal margin levels but they process economic data in distinct ways which minimizes total account volatility.

The process of diversification requires no need for investors to increase their leverage or margin usage. Instead, it relies on distributing lot sizes intelligently so that no single currency or economic driver dominates account exposure.

Types of risk specific to FX trading

The process of foreign exchange trading contains multiple specific risk categories which determine how well positions perform. The market risk becomes most apparent because price movements occur through pips. The financial consequences of this risk will depend on the specific characteristics of each individual lot. For example, a 15-pip adverse move on a 0.5 standard lot typically results in a loss of around 75 USD, assuming a 10 USD pip value per full lot. The example shows how position sizing uses market price changes to create actual financial results.

The established relationship between banks and their margin usage depends on their current risk exposure levels. The use of higher leverage allows traders to meet margin requirements but it does not affect the value of pips in their trades. A trader who uses 1:100 leverage can manage one standard lot through investments which require minimal margin funds. A small change in market prices which results in substantial losses that will impact the overall value of your investment account. The market conditions which occur during news events and off-market hours create liquidity risks because trading spreads expand which leads to execution prices that differ from investor expectations.

Currency correlation and its impact on portfolio risk

Currency correlation describes how two currency pairs move in relation to each other over time. The direction of pair movement determines correlation values because positive correlation occurs when pairs move together but negative correlation happens when they move against each other. The positions in a portfolio create direct effects on risk because different investments will track each other as one investment exposure instead of working independently as individual trades.

Let’s say one standard lot is opened on EUR/USD and another standard lot on GBP/USD. The value of each position equals about 10 USD per pip. The two positions will move in sync because they share exposure to US dollar fluctuations which will cause a 400 USD loss when each position experiences a 20-pip decline. The position risk profile resembles that of one major investment asset because the account contains two separate trading instruments. The appearance of diverse margin usage does not hide the fact that price risk continues to focus on specific areas.

For example, the trading results from EUR/USD and USD/JPY differ because the Japanese yen market reacts to interest rate predictions and market risk perceptions which differ from those of European currency markets. Organizations can achieve lot size alignment with their total pip exposure targets through their ability to monitor correlation data.

Diversification across currency pairs

The strategy of currency pair diversification aims to distribute investments across different markets because it prevents any individual market fluctuation from controlling the entire account performance. The value of each currency pair depends on its pip value and its market volatility and traders need to meet specific margin requirements. The portfolio management of these differences enables investors to achieve stable returns because different market segments face distinct levels of market fluctuations.

The exposure amount will be distributed across three trading positions which include 0.5 lots for EUR/USD and 0.5 lots for AUD/USD and 0.5 lots for USD/CHF. Each position has a pip value close to 5 USD. A 20-pip adverse move on one pair would result in a loss of about 100 USD, while the other pairs may move less or in a different direction. The distribution of total pip risk becomes more even when using 1.5 lots on multiple pairs instead of placing them on a single pair although the total margin usage remains equivalent.

For example, the economic factors which affect commodity-linked currencies differ from those which impact European and safe-haven currencies. The method of adjusting lot sizes enables traders to achieve equal combined pip exposure which stops them from creating secret concentration points.

Geographic and economic exposure in FX portfolios

The way currency positions react to various regions and central banks and macroeconomic cycles defines geographic and economic exposure. The economic situation of each country determines its currency value through its interest rates and inflation rates and projected economic growth. Investing in different geographic areas helps protect portfolio performance from major economic incidents which could harm a single region.

Let’s say positions are opened on EUR/USD and AUD/USD and USD/JPY with each position using 0.3 as the lot size. The total pip value for each trading position equals 3 USD which results in a 75 USD loss when a single pair experiences a 25-pip decline. The positions will remain unchanged because the relocation decision depends on data which shows particular regional patterns including European inflation rates and Australian employment statistics. The separation between these two accounts prevents any negative effect on account equity while maintaining a fixed total margin usage.

Diversifying by trading style and time horizon

Diversification also applies to how and when positions are held. The way traders operate and their investment duration period determines how much they expose their trades to pip movements and how they use their margins and how much their profits or losses will change from market price fluctuations. The combination of different methods helps to reduce equity market volatility when market conditions experience changes.

Let’s say one position targets short-term moves using 0.2 lots on EUR/USD, aiming for 10 to 15 pips. With a pip value of about 2 USD, a 15-pip adverse move would result in a loss of roughly 30 USD. The system operates two distinct trading positions which use 0.3 lots for USD/JPY trading with different stop loss levels of 40 pips. Even though margin is allocated to both trades, the timing and price behaviour differ, reducing overlap in risk.

The role of safe-haven and high-yield currencies

The two types of currencies in FX portfolio diversification operate independently because they behave differently when worldwide risk factors shift. Market stress causes investors to buy safe-haven currencies but high-yield currencies experience greater price fluctuations based on expectations of economic growth and changes in interest rates. The two strategies let investors spread their portfolio investments across various economic time periods at equal rates.

The portfolio contains 0.4 lots of USD/JPY trading positions and 0.4 lots of AUD/USD trading positions. The average pip value for each position amounts to 4 USD which means a 20-pip market movement would result in an 80 USD profit or loss for each trading operation. The USD/JPY exchange rate would rise during risk-off market conditions while AUD/USD would decline which would reduce the total pip effect. The current margin usage levels show no change but the market prices have different reactions because of different investment capital patterns.

Conclusion

The practical method to handle FX risk includes portfolio diversification which becomes effective through exact position measurements and exposure management. Risk becomes quantifiable through the use of lot size and pip value and correlation instead of depending on the total number of active positions. The portfolio includes multiple investment positions which use different currency drivers to create equal pip exposure from all its investment assets. A 30-pip negative price movement in one currency pair will decrease account value but the total effect on the account will stay limited because other trading positions either change in different ways or maintain their current state.

Diversification works most effectively when combined with conservative leverage and consistent margin monitoring. The practice of spreading exposure does not provide sufficient reason to raise the overall level of risk. The combination of multiple small positions which total more than established drawdown limits will still produce excessive market value declines. The regular process of lot size recalculation helps investors maintain risk levels that match their account value because market prices continue to fluctuate.