Stochastic divergence indicator

Stochastic indicators in Forex trading have long been a fundamental aspect of technical analysis. These powerful tools provide traders with valuable insights into market momentum and potential trend reversals. Stochastic indicators are part of a trader's arsenal, helping them navigate the complexities of the foreign exchange market with confidence.

The relevance of stochastic indicators for traders cannot be overstated. In the dynamic world of Forex, where decisions are made in the blink of an eye, having a reliable indicator to gauge overbought and oversold conditions is invaluable. Stochastic indicators offer traders the ability to make informed decisions, enhance risk management, and improve the overall accuracy of their trading strategies.

Understanding stochastic indicators

The history and development of stochastic indicators can be traced back to the late 1950s when George C. Lane introduced the concept. Lane's innovation aimed to capture the cyclical nature of price movements and provide traders with a more nuanced understanding of market dynamics. Since then, stochastic indicators have evolved and adapted to the ever-changing Forex landscape, becoming a fundamental tool in technical analysis.

Stochastic indicators, in the context of Forex trading, are essential tools used by traders to assess the momentum and potential turning points in currency pairs. These indicators are designed to compare the current closing price of a currency pair to its price range over a specific period, typically 14 periods, and provide insights into whether the asset is overbought or oversold.

The basic concept of the stochastic oscillator revolves around two key components: %K and %D. %K represents the current closing price's position within the recent price range, while %D is a moving average of %K. By analyzing the relationship between these two lines, traders can identify potential entry and exit points. When %K crosses above %D in the oversold region, it may signal a buy opportunity, whereas a cross below %D in the overbought region could suggest a sell opportunity.

Stochastic indicators hold immense importance in technical analysis due to their ability to identify potential trend reversals and divergence patterns. Traders rely on stochastic indicators to confirm trends, spot overextended price movements, and make informed decisions.

Stochastic indicator MT4

MetaTrader 4 (MT4) stands as one of the most popular and widely utilized trading platforms in the world of Forex. Known for its user-friendly interface and robust analytical tools, MT4 has become the go-to choice for both novice and experienced traders. Its versatility and compatibility with various trading styles make it an indispensable asset.

Accessing and using the stochastic indicator on MT4 is a straightforward process. Traders can find the stochastic oscillator in the platform's list of technical indicators. Once selected, it can be applied to any chart of a currency pair, allowing traders to visualize the stochastic oscillator's %K and %D lines.

Setting up the stochastic indicator on MT4 involves a few key parameters. Traders can customize the lookback period (typically set to 14), %K period, %D period, and the smoothing method.

To effectively use stochastic indicators on MT4, it's vital to understand the nuances of interpreting its signals. Traders should consider combining stochastic analysis with other technical indicators to confirm signals and minimize false alarms. Additionally, maintaining a disciplined approach to risk management is crucial, as stochastic indicators, like any tool, have their limitations.

Stochastic forex strategies

Stochastic indicators serve as versatile tools for traders, and there are several trading strategies that incorporate them. One common strategy involves identifying overbought and oversold conditions in the market. When the stochastic oscillator moves into the overbought region (typically above 80), it may indicate a potential sell signal. Conversely, when it dips into the oversold region (usually below 20), it can suggest a potential buy signal. Another approach is using stochastic divergence, which involves looking for disparities between price action and stochastic indicator movements.

Traders can effectively use stochastic indicators to pinpoint entry and exit points in their Forex trades. When the %K line crosses above the %D line in the oversold region, it may be a suitable entry point for a long position. Conversely, a %K crossing below %D in the overbought region could signify an entry point for a short position. Additionally, traders can look for bullish or bearish divergence between price and the stochastic indicator for potential reversal points.

Real-world trading scenarios using stochastic indicators can provide valuable insights into their practical application. These examples will illustrate the versatility of stochastic strategies and how they can be adapted to suit various trading styles.

While stochastic indicators offer valuable insights, it's crucial to emphasize the importance of risk management when implementing stochastic strategies. Traders should define their risk tolerance, set stop-loss orders, and adhere to sound money management principles.

Stochastic settings for scalping

Scalping is a high-frequency trading strategy employed in Forex markets where traders aim to profit from small price movements over short periods. Scalpers execute numerous trades within a single day, capitalizing on tiny fluctuations in currency prices. Given the rapid pace of scalping, selecting the right technical indicators is paramount for success.

When it comes to scalping, specific stochastic settings can enhance decision-making. Scalpers often opt for shorter lookback periods, such as 5 or 8, to capture the rapid market changes. Lower %K and %D periods, like 3 and 3, provide a more sensitive stochastic oscillator, making it quicker to respond to price shifts. This heightened sensitivity aligns with the fast-paced nature of scalping, allowing traders to identify potential entry and exit points more efficiently.

Scalpers can harness stochastic divergence indicators effectively to refine their strategies. By comparing price movements and stochastic oscillator patterns, scalpers can spot divergence that may signal an impending price reversal. This insight can be invaluable in identifying prime moments to enter or exit positions swiftly.

Scalping with stochastic indicators offers advantages in terms of quick decision-making and potential profitability from small price moves. However, it comes with challenges such as increased transaction costs due to frequent trading, a need for a robust and reliable trading platform, and the necessity for split-second decision-making. Traders adopting this strategy must be well-prepared, disciplined, and capable of managing risk effectively to thrive in the fast-paced world of scalping with stochastic indicators.

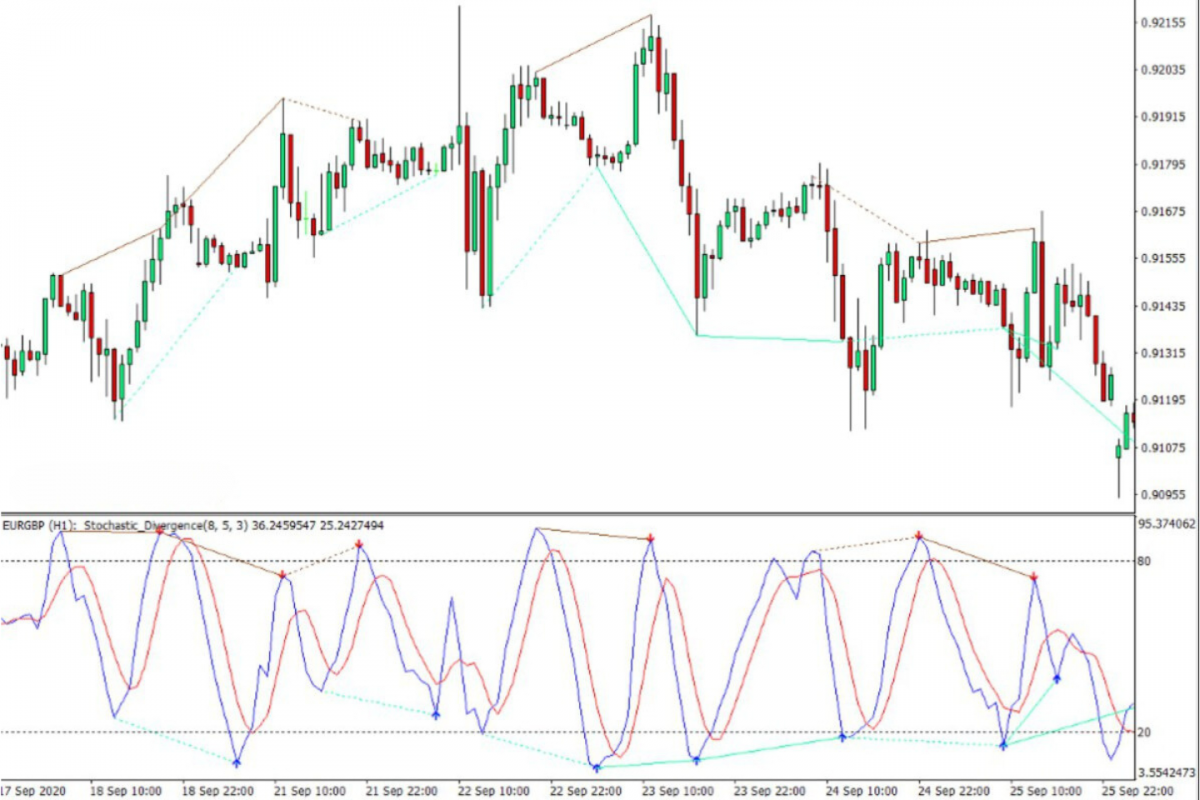

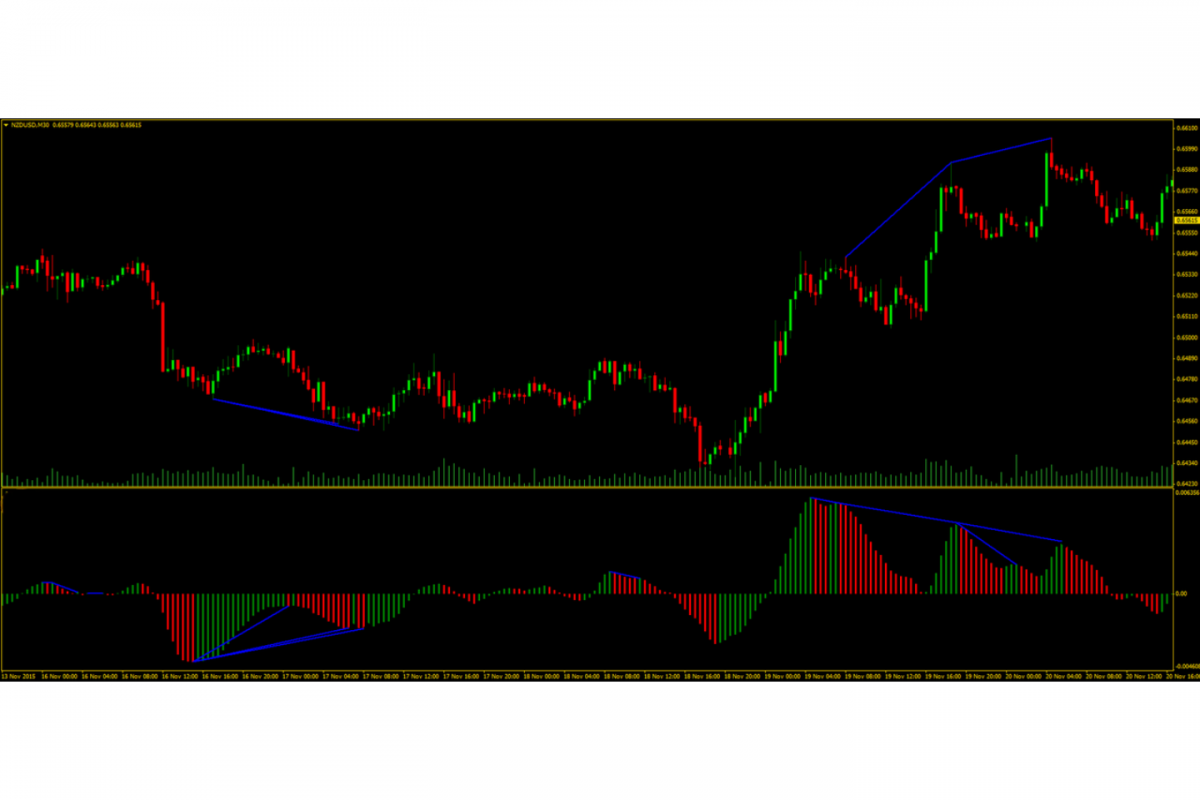

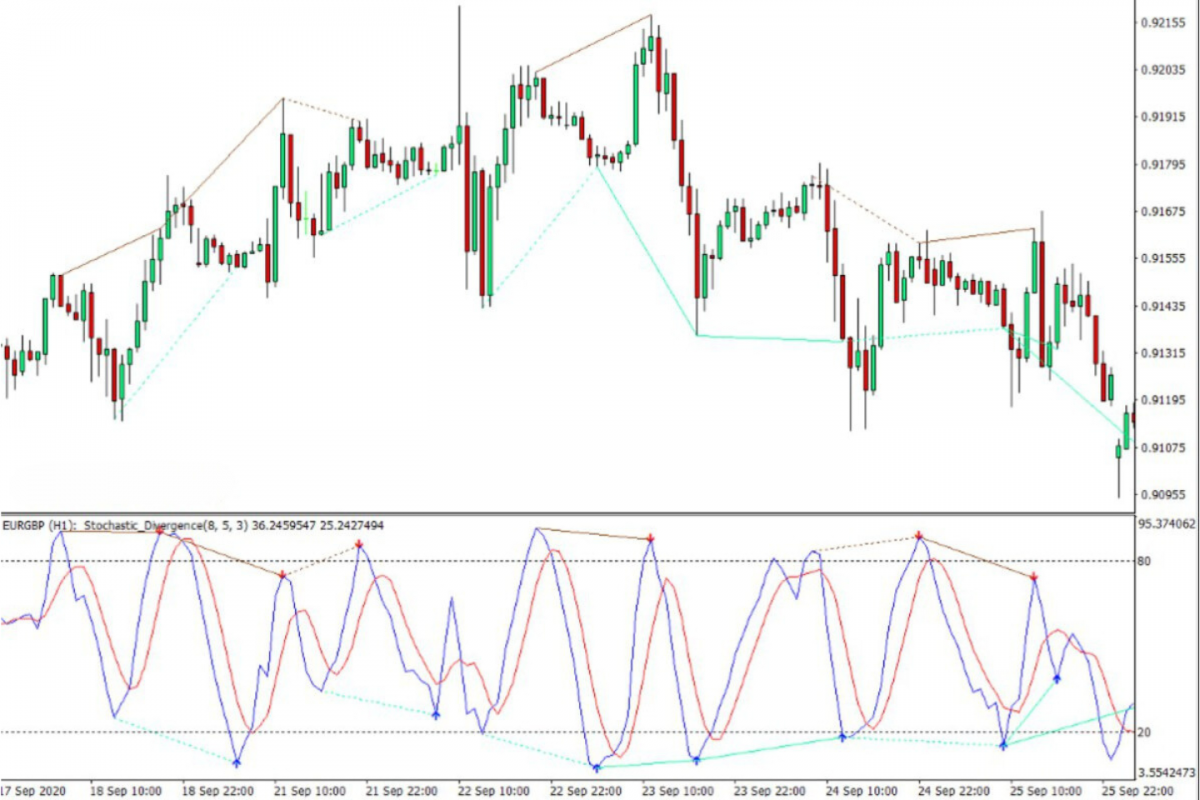

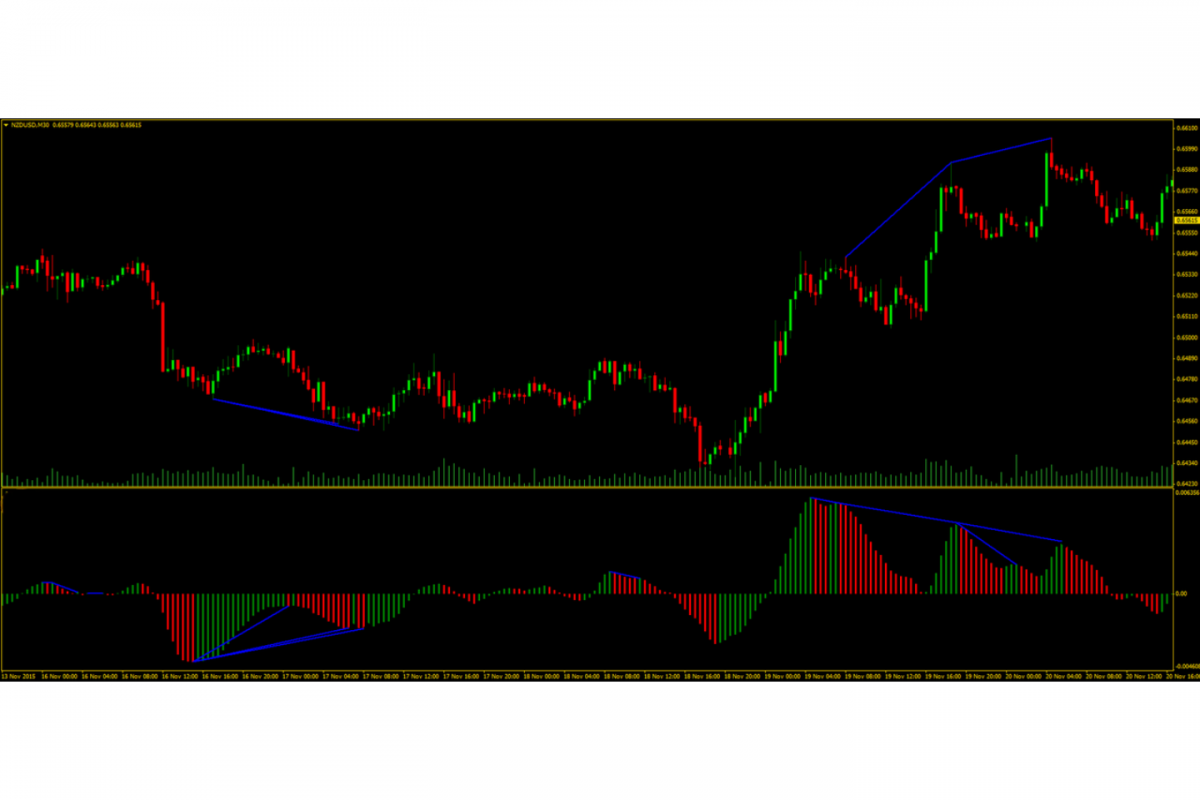

Stochastic divergence indicator

Stochastic divergence is a crucial concept in Forex trading that occurs when there is a disparity between the price action of a currency pair and the movement of the stochastic indicator. This disparity can signal potential shifts in market momentum and is classified into two main types: bullish and bearish divergence. Bullish divergence occurs when the price forms lower lows while the stochastic oscillator forms higher lows, suggesting a potential upward reversal. Conversely, bearish divergence emerges when the price forms higher highs while the stochastic oscillator forms lower highs, indicating a potential downward reversal.

The Stochastic Divergence Indicator is a specialized tool designed to automatically identify and highlight instances of stochastic divergence on a price chart. It does so by analyzing the relationship between price movements and the stochastic oscillator, simplifying the process for traders. When a divergence pattern is detected, the indicator generates visual signals, making it easier for traders to spot potential trend reversals or entry/exit points.

Utilizing the Stochastic Divergence Indicator can provide traders with several benefits. It helps traders identify divergence patterns quickly, enabling them to make timely and informed decisions. By recognizing potential trend reversals in advance, traders can position themselves advantageously and potentially capture significant price movements. This indicator can be a valuable addition to a trader's toolkit, enhancing the accuracy of technical analysis.

To effectively interpret and act on signals generated by the Stochastic Divergence Indicator, traders should closely monitor divergence patterns and combine this information with other technical analysis tools. For example, if the indicator identifies bullish divergence, traders may consider entering long positions with appropriate risk management measures. Conversely, bearish divergence signals may prompt traders to evaluate shorting opportunities. The key lies in using the Stochastic Divergence Indicator as part of a comprehensive trading strategy, ensuring that it complements other analytical methods for better decision-making in the Forex market.

Conclusion

In conclusion, stochastic indicators hold a pivotal role in the realm of Forex trading, serving as indispensable tools for traders of all experience levels. These indicators, grounded in technical analysis, provide valuable insights into market dynamics and price movements.

Stochastic indicators offer a window into market momentum, identifying overbought and oversold conditions. They help traders make informed decisions, enhancing precision and risk management.

MetaTrader 4 (MT4), a popular trading platform, provides access to stochastic indicators, enabling traders to efficiently utilize them in their strategies. Customizable settings allow traders to adapt the indicator to their specific trading preferences.

Divergence patterns, identified by stochastic indicators, serve as powerful signals for potential trend reversals. This specialized capability opens doors to advanced trading strategies, adding depth to technical analysis.

Stochastic indicators can be tailored to suit various trading styles, including scalping, day trading, and swing trading. Their versatility makes them valuable companions in diverse market conditions.

To master stochastic indicators, traders should focus on continuous learning, experimenting with different settings, and integrating them into comprehensive trading strategies. Combined with disciplined risk management, stochastic indicators become an integral part of a trader's toolkit.