The role of fundamental analysis in forex trading

The core of forex trading analysis through fundamental methods involves studying economic and financial elements which determine exchange rates. Fundamental analysis examines the underlying causes of currency price changes while technical analysis focuses on chart-based price pattern analysis. The model bases its currency performance evaluation on interest rates and inflation rates and employment statistics and monetary policy actions.

A central bank of a nation would increase interest rates in this scenario. Foreign capital tends to flow toward nations with higher interest rates because investors want to maximize their earnings which in turn increases demand for the local currency. The other hand shows that weak economic performance together with political instability decreases investor trust which results in currency value decline. The value of currency can change when inflation increases rapidly while wages remain steady because traders need to adjust their positions.

Fundamental analysis is especially useful for medium to long-term traders who want to align positions with economic trends. The system provides no exact entry and exit signals but shows which currencies tend to stay strong or weak in the long run.

How currencies are valued in the real economy

Currencies are essentially prices that reflect the value of one nation’s money relative to another. Their actions follow specific economic indicators which determine their behavior. A key factor is purchasing power—how much a unit of currency can buy in terms of goods and services. The value of a currency tends to decrease when prices increase at a higher rate in one nation compared to its trading nations because the currency becomes less valuable for both home and foreign purchases.

The real effective exchange rate (REER) functions as a fundamental economic indicator which merges exchange rate values with price inflation data and trade-based averages. The measure enables traders to determine if a currency exists at higher or lower value than other currencies in its group. A strong currency that persists despite weak export performance through the REER may signal reduced competitiveness which could trigger market adjustments in the future.

The evaluation of long-term currency trends in practice requires traders to analyze purchasing power and trade balances and competitiveness metrics. The indicators serve to detect long-term currency trends rather than short-term market movements. They help investors identify currencies with enduring structural strength or weakness.

Macroeconomy that drive FX

The strength of a currency directly relates to national economic performance so traders track multiple important indicators to predict market movements. Gross domestic product (GDP) serves as the main indicator because it shows the total economic expansion of a nation. The economy's steady GDP growth rate attracts foreign investors who support the currency value but a declining GDP growth rate leads to currency devaluation.

Inflation is another matter. The central banks work to keep prices stable so they increase interest rates when inflation rises which attracts more investors to the currency. Employment statistics serve as fundamental metrics which help track workforce performance. The labor market shows rising demand and higher wages which points to future interest rate increases.

The demand for currency depends on the trade balance and current account position. A surplus indicates that foreign buyers need more local currency to buy exports but a continuing deficit leads to currency value depreciation. These indicators together enable traders to forecast which currency will gain value or lose value during extended periods.

Monetary policy and interest rates

The value of currency is heavily influenced by monetary policy which stands as one of the most powerful economic tools. The Federal Reserve and European Central Bank along with other central banks use interest rate adjustments to manage inflation levels and boost economic expansion. Higher interest rates generally make a currency more attractive because investors can earn greater returns on deposits and bonds denominated in that currency.

The U.S. dollar tends to rise against other currencies when the Federal Reserve increases its benchmark interest rate but other central banks maintain their current rates. The movements of currency pairs heavily depend on the interest rate differences that traders monitor between two countries.

Expectations also matter. Market participants modify their positions according to central bank forward guidance and future tightening signals even when interest rates remain unchanged. The tools of quantitative easing and balance sheet adjustments function to change liquidity levels while they impact currency market demand. The currency market trends of the future will become available to traders who stay informed about policy statements and economic forecasts.

Terms of trade, commodities, and commodity currencies

A country's currency strength emerges from the comparison between export values and import expenses which forms its terms of trade. The value of export prices exceeding import prices leads to increased foreign exchange earnings which helps strengthen the national currency. A nation that exports oil or metals will see its currency demand rise when global prices increase because foreign buyers must use that currency to make their purchases.

Some currencies are particularly sensitive to commodity cycles. The Australian dollar together with the Canadian dollar and New Zealand dollar receive their "commodity currency" label because their economies depend on exporting minerals and energy resources and agricultural products. The Australian trade surplus and value of the Australian dollar would increase when worldwide iron ore consumption experiences a significant increase. The value of these currencies tends to decrease when commodity prices drop because export earnings decrease.

The evaluation of commodity prices together with their trade balance effects helps traders forecast currency market movements for countries that base their economy on resource exports.

Structural and valuation lenses

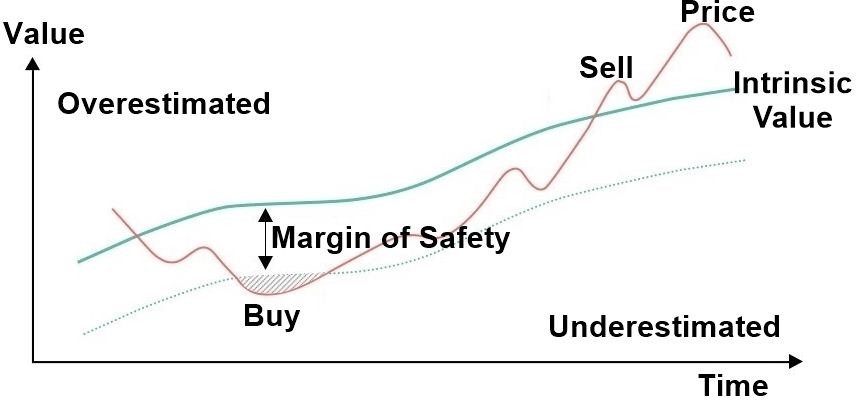

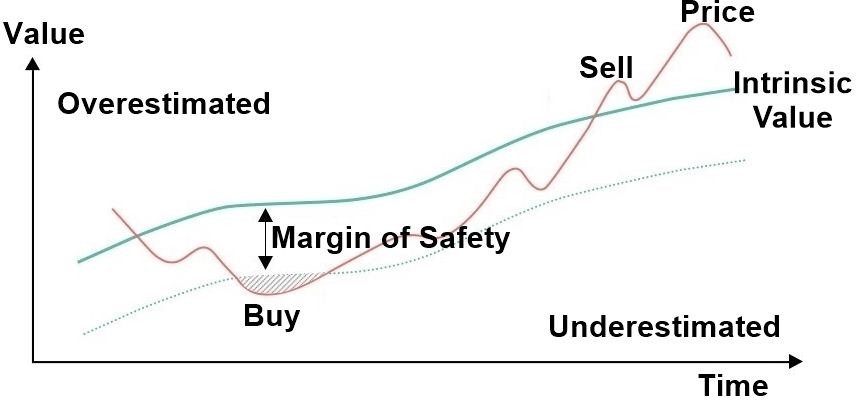

The assessment of currency value through fundamental analysis requires traders to examine structural indicators which help identify whether a currency exists in an overvalued or undervalued state. The purchasing power parity (PPP) method functions as a standard method to compare the prices of equivalent product bundles across various countries. The local currency becomes undervalued when one economy maintains lower prices for its goods compared to other economies.

The real effective exchange rate (REER) serves as a crucial indicator for this purpose. The calculation of REER differs from basic bilateral exchange rates because it takes into account inflation rates and trade relationships with various countries. A country's REER indicates currency strength above its historical average which leads to reduced export competitiveness and subsequent downward pressure on the currency value.

The structural factors that influence economic growth consist of productivity levels and demographic changes and institutional stability. Economies that have strong governance systems and innovation capabilities tend to draw enduring investments which help their currencies maintain stability during worldwide economic instability. The combination of PPP, REER and structural fundamentals allows traders to gain a complete understanding of fair value and long-term currency trends.

Flows, positioning, and market microstructure

The movement of currencies depends on factors that extend beyond economic indicators because capital flows together with market positioning play a major role. Capital flows describe the movement of funds between countries through investments in bonds and equities and direct business operations. For example, if global investors increase purchases of a country’s government bonds, demand for its currency rises as they need to pay in local currency. The opposite situation happens when there is an unexpected reduction of funds.

Market microstructure elements which include liquidity conditions and order flow patterns establish the speed at which currencies adapt to news events. The market experiences larger price swings when major data releases occur during periods of low trading activity. Market flow analysis with macroeconomic fundamentals enables traders to detect future market risks and trading opportunities in currency markets.

Reading the data: calendars, surprises, and revisions

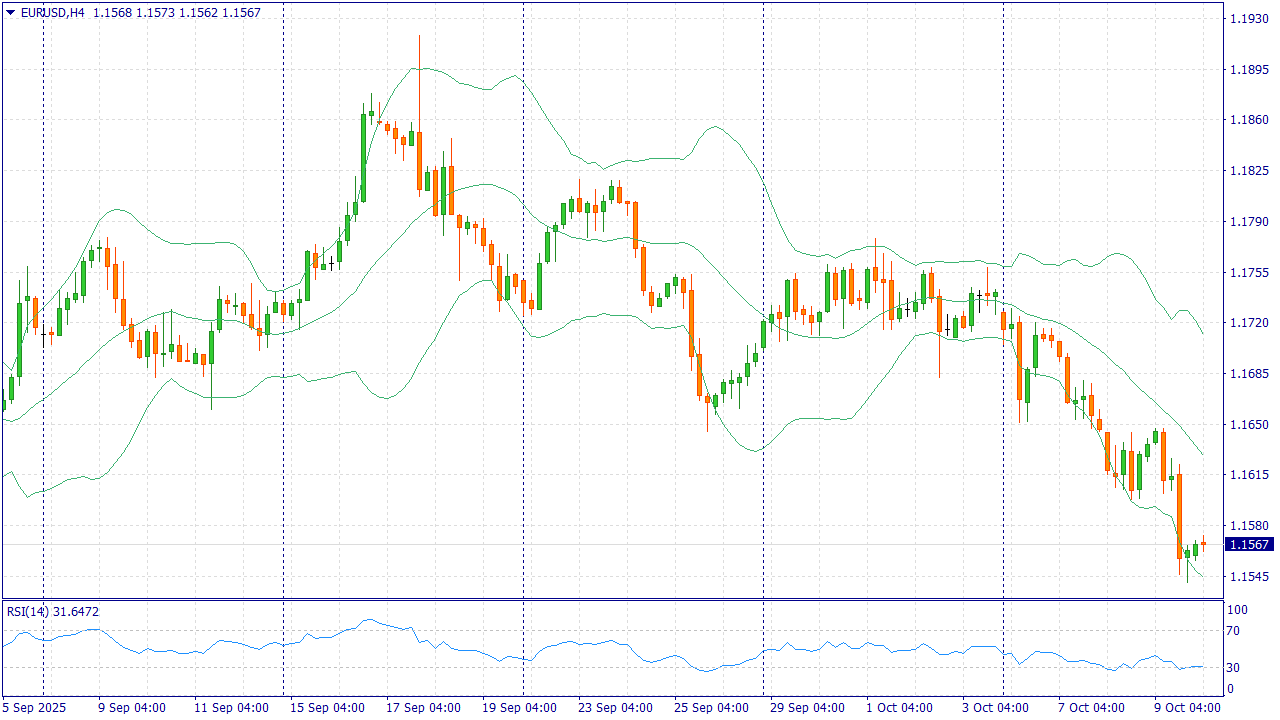

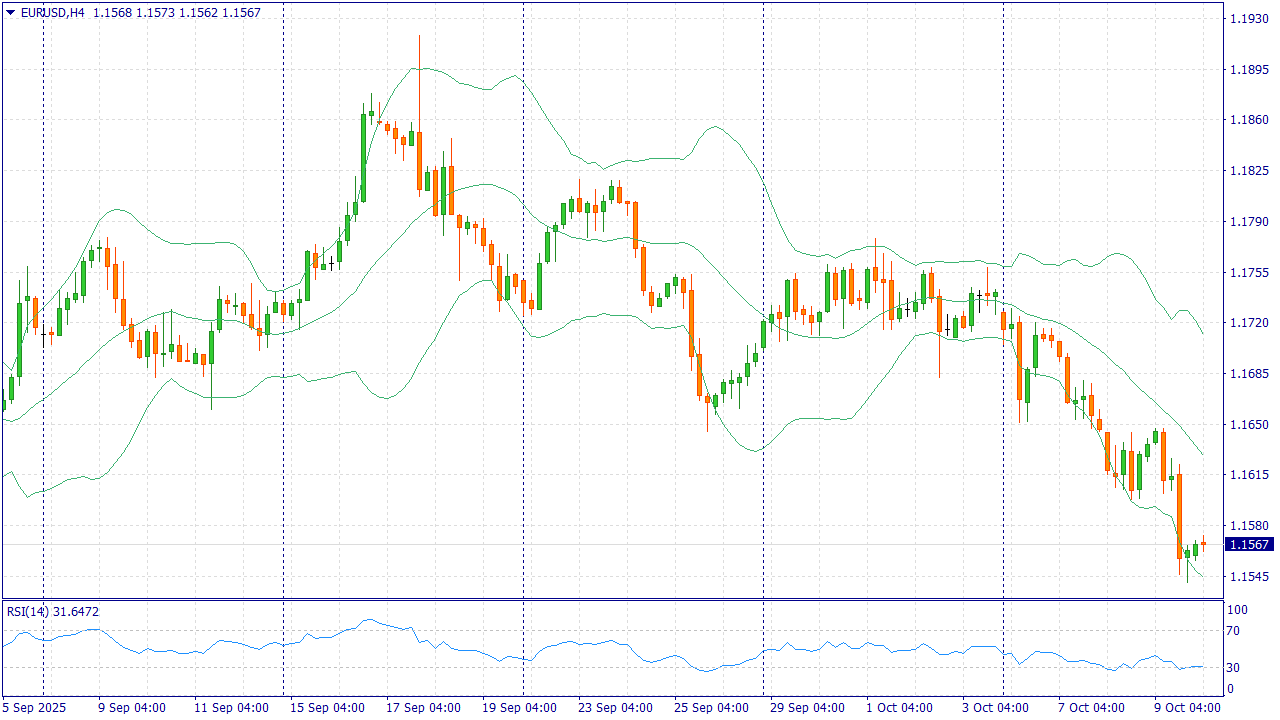

Short-term currency movements depend on economic data releases which traders monitor through scheduled release calendars. Various forex trading platforms provide users with upcoming event schedules which include GDP statistics and inflation data and employment reports and central bank announcements. The scheduled release times enable market participants to forecast how prices will change in the upcoming market period.

Market reactions often depend on the difference between actual results and expectations. The dollar tends to rise when the actual job numbers exceed the forecasted numbers because investors expect the Federal Reserve to tighten monetary policy. For instance, when economists predict 200,000 new U.S. jobs but the actual numbers reach 300,000 the dollar tends to appreciate because traders believe the Federal Reserve will implement tighter monetary policies. The difference between what people agree on and what actually happens in the world is known as the “surprise factor.”

Revisions are just as important. The initial GDP reading showed a moderate growth rate yet subsequent revisions resulted in higher numbers which altered market sentiment and transformed future economic projections. The system enables traders to track both the first reports and their updated versions which enables them to spot actual economic patterns. A scheduled data calendar system implemented by traders helps them manage unexpected market changes and data revisions which leads to better decision outcomes.

Practical workflow for traders

A proper application of fundamental analysis needs a structured methodology. A defined workflow helps traders convert their general economic understanding into particular trading decisions. The first step requires developing a top-down thesis which starts with worldwide economic elements that include interest rate patterns and commodity market fluctuations. The next step for traders involves selecting specific economies and currency pairs that demonstrate these market themes.

The identification of catalysts represents the third step which includes particular market-moving events such as GDP announcements and central bank meetings and employment statistics. Market participants will begin their interest rate increase preparations after inflation data shows price increases before a central bank policy meeting.

The conversion of outlined scenarios into specific trading opportunities starts after the scenario development stage. The process requires choosing suitable currency pairs and establishing entry and exit points while evaluating risk levels against potential gains. The core perspective needs an invalidation level to establish when its basic assumptions show evidence of being incorrect. The risk management process becomes operational through this workflow structure when risk management follows a structured methodology.