You have come to the answers to one of the most searched phrases about forex trading on the internet, mostly by novice traders and those struggling to find profitability in trading the forex market.

The statistic is made clear and open by forex brokers' websites to the public that 80% of retail traders lose their money. Some have published losing rates to be as high as 90% but regardless of the actual numbers and the varying statistics, these figures aren’t far off. For this reason, forex trading beginners seek information on how to rank among the top 5 - 10% of profitable traders and also, traders that struggle with finding profitability do seek information that will help them advance their trading techniques and develop a profitable trading edge.

Unfortunately, the Internet is full of misinformation about forex trading. Many websites promote forex trading as a get-rich-quick scheme and wrongly advertise trading as simple and easy, and a way to make thousands of dollars per day without much risk and prior knowledge or experience.

How does this successful 5-10% stand out from the crowd and what do they do differently? Successful forex traders stand out from the rest for a variety of reasons and how this 5 - 10 % differ from the crowd of forex traders is what this article will be addressing as the top 10 forex trading secret.

- Commitment

The worst thing anyone can do is to trade forex with real money, having neither prior experience nor trading plan.

If you want to become truly successful in forex trading, commitment is a must and thus requires full involvement, focus, obsession, strong ethics, patience and the desire to learn every day about yourself as a trader, about your losses, your wins and generally, about the market.

The saying goes that 'practice makes perfect' hence it is imperative that forex traders who desire to get to a level of mastery, profitability and consistency at the top 5 - 10% must commit to regular trading exercises with no days off.

- Patience

The main activity of forex traders is price movement analysis (both technical and fundamental) and then opening of buy or sell market orders.

Oftentimes, a day trader or short-term trader might get bored with regular analysis if there isn't enough price movement or volatility in the market and this often triggers trade decisions that are based on belief and not according to a trading plan and strategy. Not only are such decisions unethical, they are usually accompanied by emotions and 9 times out of 10, the result of such trades usually ends in losses.

Traders who fall prey to these mistakes may likely lose all their money or may quit trading as a result of compounded negative emotions and frustration. To be a successful forex trader, patience is required to learn, develop a trading plan, analyse the market for potential opportunities, relax for trade executions to pan out either profitably or not, and then learn from both outcomes.

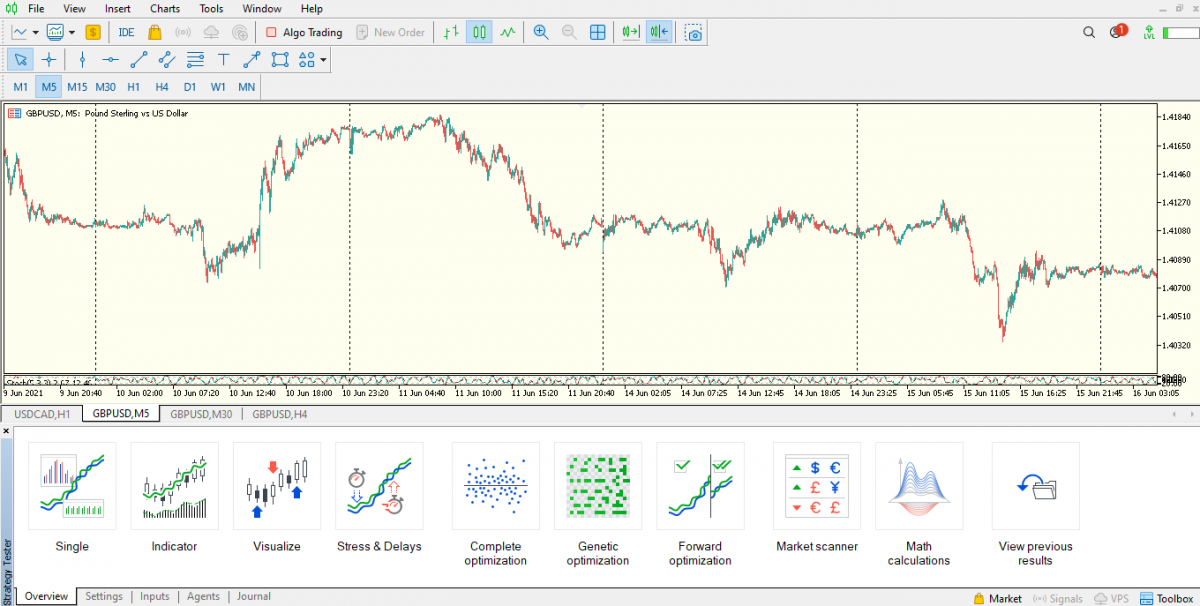

- Clear chart of price movement

Beginners and novices in the forex market are most susceptible to the idea of adding lots of indicators on their trading charts because it seems like a smart idea. Not only is the approach unprofessional, but it is accompanied with lots of confusion especially when the signals of the indicator are not well understood or are contradictory.

Image (i): Clean chart with consolidation and price movement markup

Keeping a clear chart is very important and of psychological advantage. Of course, this doesn't imply that you shouldn't use technical indicators and oscillators, but rather that each indicator overlayed on your chart should be of clear purpose and correct application.

- Trading plan

Like in a sports team, the gameplay comprises different skills, techniques, and game plans... trading is no different. Every aspect of your trading plan (pre and post-trade) can help improve your odds of profitability and get you among the top 10% profitable traders.

There are several contributing factors which include your ideal timeframe for analysis of price movement, your best time to trade, the price movement strategies you use, the key levels you identify, and your risk-to-reward ratio.

The things you do after a trade are your post-trade routine, such as how you handle losses, and how you respond to wins, these all contribute to a solid trading plan that will help to make better decisions in the future.

Despite the fact that there is a lot in regards to the forex market, you don't have to understand all of them in order to put the odds of trading in your favour. Learning multiple trading styles and strategies at once can be very confusing and may stunt your growth. It’s better to master one trading style or strategy and then slowly expand to other aspects of trading.

An ideal scenario will be to first identify key price levels and then move from there to determine trend strength. Afterwards, you can focus on one entry pattern e.g pin bars, support or resistance, engulfing candle. By expanding your skill set in this manner, you will soon have a personalized master plan of your own.

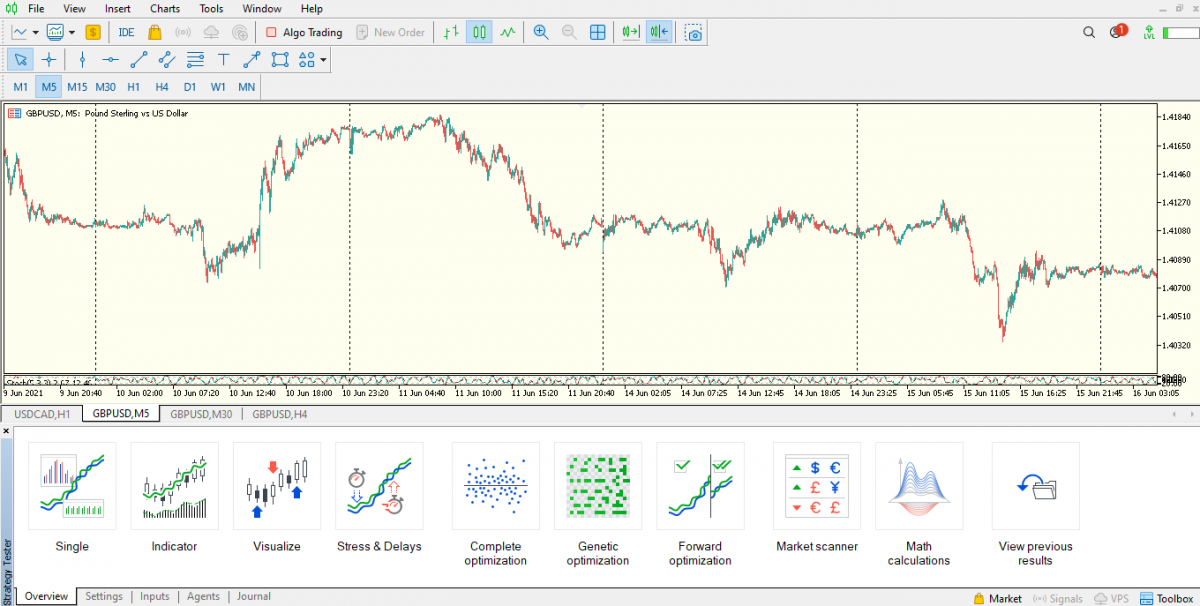

- Back testing and forward testing

It is frightening to see how many traders try to profit from the forex market without stress testing their strategies on paper and demo trade. Crafting a solid trading plan or strategy on paper can be done in a few hours but executing and putting the plan into action is the only way to rate the performance of the strategy.

If you have crafted a trading plan that dictates how you approach the forex market every day. We can't underestimate the importance of stress testing (backtesting and forward testing) the profitability of any strategy before committing to it long term. There are countless simulation tools that serves this purpose. With these tools, a lot of secrets will be gleaned about price movement you can test your strategy on a variety of historical data and trading scenarios.

Image (ii). Default Mt4 strategy tester. Third party strategy testers and simulators can be installed and used on your Mt4 platform

- Keeping a trade journal

Paper trading or manual trade journaling as opposed to brokers real-time trade records is key to tracking your forex trading performance such as margin usage, profits and losses per trade, buying power, and so much more. The art of journaling is not so much fun which is perhaps why most traders avoid it and prefer to use their brokers' real-time records. The problem is that broker's records do not have as much information as is needed for the trader to revise and learn. The old-school journaling approach, although time-consuming, is the key to identifying recurring patterns and specific behaviours in price movements that is personally unique and a secret to the trading journalist.

- Loses and mindset

Of Course no one likes to lose and making money is always more satisfying than losing money. Even the best of all traders incur loses sometimes. To handle losses in forex trading, one must have the right mindset and perception of what a loss entails.

A loss in the Forex market is often perceived as a bad thing by most people especially novice. However, successful traders do not view loss as a “bad” thing nor do they fault the forex market for whatever loss they incur because they understand that the market is unaware of their entry price or the location of their stop-loss.

So what does a loss mean to successful forex traders? a loss simply mean a premium paid for doing business.

Apply this trading mindset every day, so whenever you incur a loss, it's best to take a constructive feedback, analyse the situation and reflect on what could have been done better rather than being all emotional and sad. Be open-minded, and the market will show you top trading secrets that you need to know.

- Daily economic calendar

Due to a lot of attention on technical analysis, the art of fundamental analysis has been kicked to the side. Most traders don’t pay enough attention to the news that drives price movement in the market.

One of the secrets to being a step ahead of other traders is to rely on important financial and economic news releases from around the world like Fomc, NFP, central banks interest rate decisions, GDP and so on.

- Sign up with a good broker

One of the top secrets of the forex trading industry is that brokers' licenses are different and they come with different levels of trust and security. Oftentimes, licenses from offshore regulatory bodies are worthless.

Assume you get into trouble with a broker licensed by offshore regulatory bodies. How easy would it be to submit a complaint to authorities in offshore countries and get your case resolved?

However, because forex trading is not regulated in every country, some brokers do serve this various jurisdictions under offshore licenses but it is best to do business with brokers regulated by a well-known authority like the EFSA (Estonian Financial Supervision Authority), CySEC (Cyprus Securities and Exchange Commission), or Financial Conduct Authority (FCA).

- Avoid dealing desk trading accounts

Traders often look out for brokers with the most competitive spreads. In the real world, the cheapest products may not always be of high quality and may be farther from superior. This same applies to forex brokers.

Zero pip attractive spreads are mostly offered on accounts with a 'Dealing Desk' execution where the broker can provide inferior data feed as well as impede your trading activities with the forex market. That said, it is best to trade with a commission-based account and also have your orders processed via ECN or STP system.

It is important that forex trading is taken seriously as a career because the process to mastery and consistent profitability is not a day job. It is also important to set realistic goals and objectives for your trading career while taking into great consideration these forex trading secrets.