Top forex trading myths debunked

The Forex market draws millions of participants who range from new retail traders to large institutional traders. The market's extensive reach and accessibility does not stop myths from persisting which frequently mislead new traders and build unrealistic expectations. The market functions through marketing exaggerations and selective success stories and fundamental misunderstandings about market operations. These beliefs lead to bad choices and unattainable targets and monetary damage.

Many people believe Forex offers an easy path to wealth accumulation with little work involved. Trading success according to many people depends on luck or continuous market surveillance. Forex trading demands a systematic method which includes proper risk control and fundamental knowledge of lots and pip value and margin and leverage together with continuous learning. Traders who lack these essential foundations become more susceptible to deceptive claims that lead them into dangerous situations.

Myth #1: Forex is a get-rich-quick scheme

People commonly believe Forex trading provides fast financial gains through minimal work. The belief about Forex trading success stems from social media advertisements along with unregulated promotional content that shows unrealistic gains. The actual situation in Forex trading stands in contrast to what social media advertisements present according to data from retail trading platforms and regulatory bodies. The majority of retail traders lose money because they lack proper preparation and fail to manage risks and make decisions based on emotions.

Forex trading operates on probabilities, not guarantees. A trader who opens a 1-lot EUR/USD position (equivalent to 100,000 units) with a stop loss of 50 pips and a target of 100 pips demonstrates a 1:2 risk-reward ratio. The system will generate profitable results when traders execute their trades consistently even if they win only half of their trades. The described trading scenario depends on disciplined strategic planning instead of impulsive decisions made through hope or fear.

The Forex market gives its rewards to traders who spend time building trading plans and learning market behavior and risk management skills. New traders need to understand fundamental trading concepts which include margin requirements and leverage. The margin requirement for controlling a $100,000 position with 30:1 leverage amounts to approximately $3,334. Market movements against positions lead to fast equity reductions that trigger margin calls and force account liquidation.

Myth #2: You need a lot of money to start trading

The Forex market requires a big first deposit according to many new traders but this is not the case. Most reputable brokers provide flexible account types that allow trading with smaller starting balances. Micro and mini accounts allow traders to start with positions that range from 1,000 to 10,000 currency units instead of the standard 100,000-unit lot. A trader who has between $100 and $500 can begin their learning process through controlled position sizes.

A new trader starts trading EUR/USD using a micro-lot (0.01 lot). The market value of each pip movement amounts to about $0.10. The trade generates a profit of $5 when it moves 50 pips. The small profit amount does not diminish the essential risk control feature that new traders need to understand market behavior and volatility management.

The trading system incorporates leverage as a fundamental component. The maximum leverage available from regulated brokers in Australia and the European Union for major currency pairs is set at 30:1. A $500 account enables traders to access market exposure worth $15,000 when using this leverage ratio. The use of high leverage leads to increased gains but simultaneously increases potential losses. Using small capital with high leverage without proper risk management techniques will cause your account balance to decrease quickly.

The process of starting with minimal funds enables traders to learn at their own pace. The primary objective for new traders should be developing an automatic trading system while mastering position management techniques and asset protection instead of pursuing big gains.

Myth #3: The more trades you make, the more you earn

Beginner traders commonly believe that trading more often results in greater financial gains. The practice of frequent trading creates avoidable risks because it stems from emotional choices or attempts to recover past trading losses. The combination of transaction costs and slippage and suboptimal trade setups leads to quick capital depletion when traders overtrade.

A trader who initiates 10 trades each day maintains a constant position size of 0.1 lot for every trade. The spread for major currency pairs including EUR/USD amounts to 1 pip per trade. The daily transaction expenses amount to 10 pips. The trading costs amount to $10 each day which translates to $200 per month before considering any losses. Small trading accounts experience substantial expense from these costs.

The majority of professional traders choose to focus on quality instead of quantity in their trading approach. The use of high-probability trade setups that stem from technical or fundamental analysis produces superior long-term results than random unstructured trading activities. The popular trading platform lists high-impact economic events which create predictable market movements when traders use appropriate risk management strategies.

Fatigue is another factor. The continuous need to monitor charts throughout different trading sessions leads to decision fatigue which results in higher chances of making mistakes. A swing trading approach combined with trading during specific sessions such as London or New York overlap enables traders to maintain a sustainable and focused strategy.

Myth #4: Forex is purely luck-based

Some people view Forex trading as a game of chance because they believe market outcomes result solely from random market movements. Price movements in the market follow established patterns which result from macroeconomic factors together with monetary policy decisions and market sentiment. The knowledge of these drivers enables traders to transition from speculation into informed decision-making.

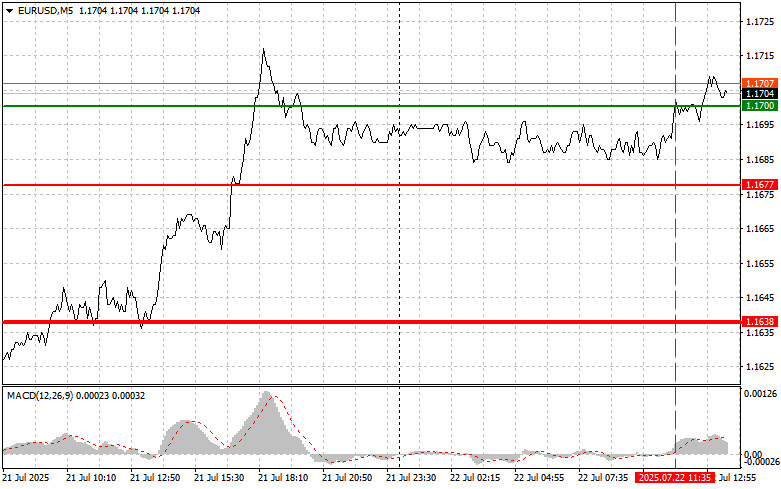

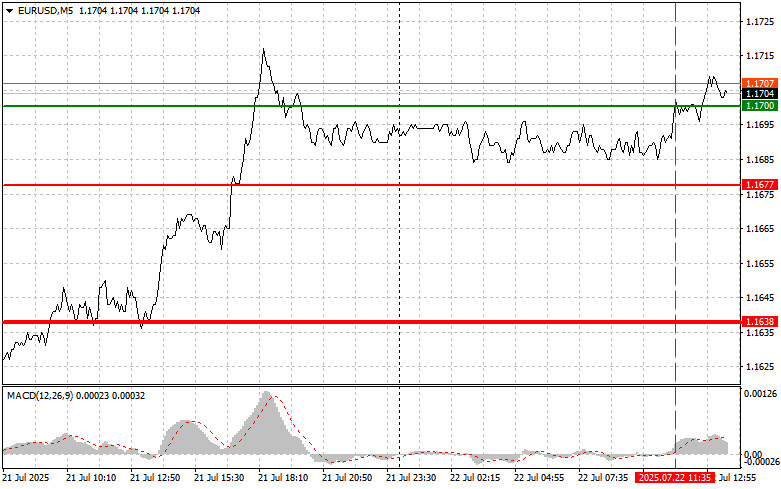

Technical analysis examines historical price data to detect patterns together with support and resistance levels and trend structures. A trader who observes a bullish engulfing pattern near a key support zone on the USD/JPY chart can make an educated prediction because of probability rather than chance. The leading trading platforms enable users to examine these setups while running historical tests through their built-in backtesting tools.

Fundamental analysis also plays a critical role. The values of currencies change substantially based on central bank rate decisions together with inflation data and employment statistics. A sudden Federal Reserve rate increase strengthens the US dollar which generates trading possibilities for USD pairs. Some trading platforms offer scheduled announcements with market expectations that traders can access before events occur.

Sentiment analysis adds another layer. Other trading platforms' data show that most retail traders hold long positions in EUR/USD, while the price declines might create a potential trading opportunity against the market consensus. The combination of tools enables traders to develop systematic strategies through their research and observational work.

Myth #5: You need to monitor the market 24/7

The Forex market operates 24 hours per day throughout five business days across Asia Europe and North America trading sessions. The continuous market availability leads some traders to think that trading success demands permanent screen monitoring. Successful trading strategies in practice depend on scheduled chart analysis and defined trading windows instead of non-stop monitoring.

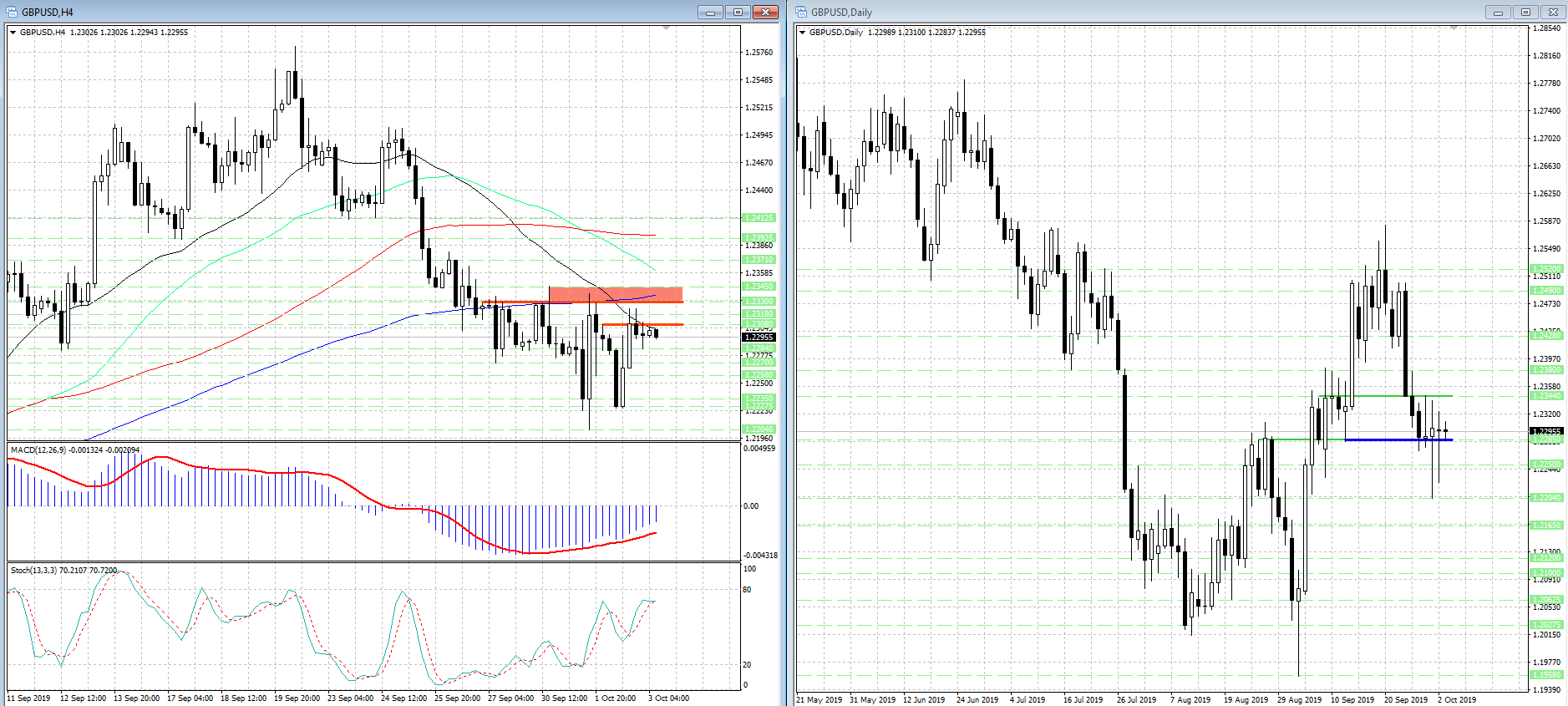

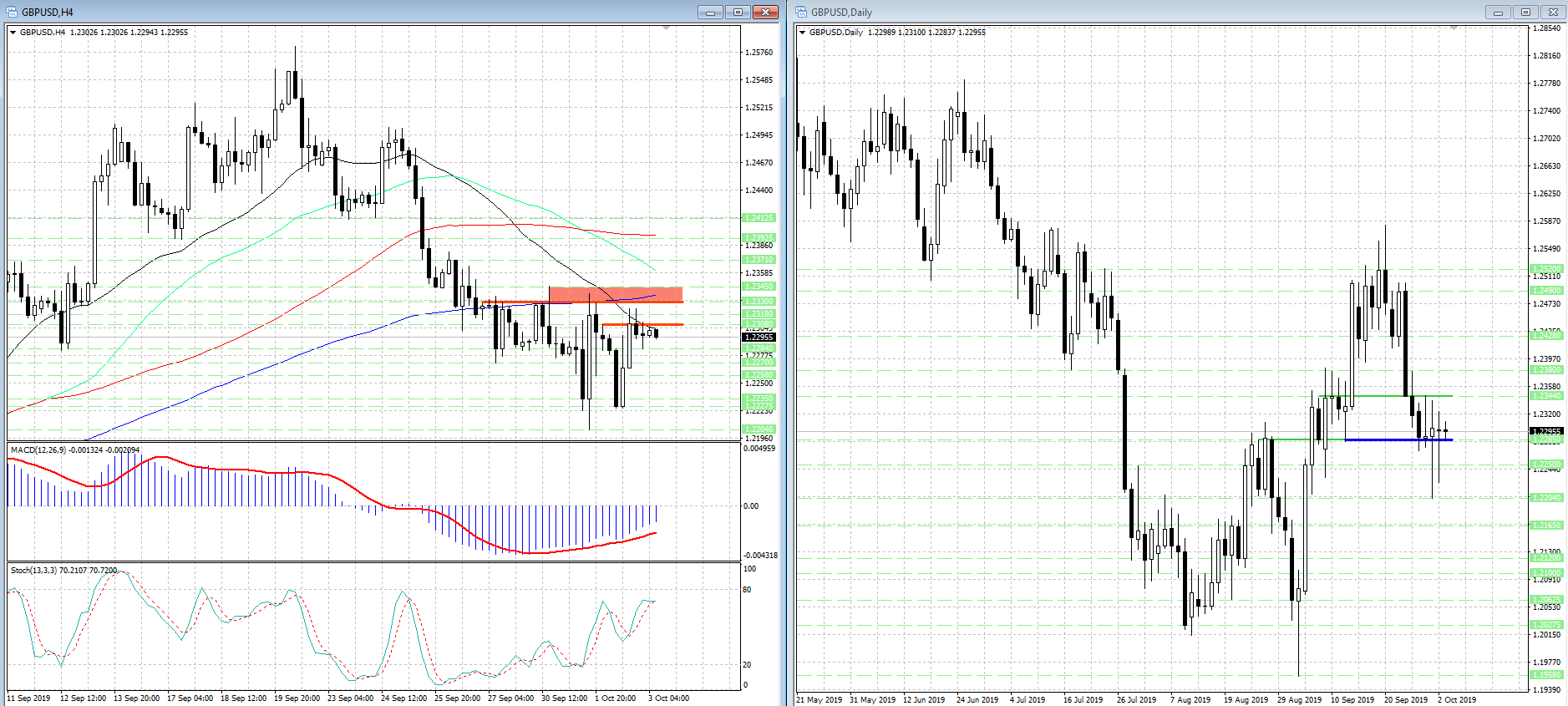

Swing traders check charts one or two times daily using 4-hour or daily chart timeframes for their analysis. The method minimizes market noise while preventing hasty choices that result from short-term market fluctuations. A trade on GBP/USD during the London session receives both stop loss and take profit orders. The trade can operate independently because risk parameters have been established in advance.

Professional trading platforms enables users to set automated alerts and automated orders and trailing stops for managing trades without needing constant supervision. The stop loss function limits potential losses while the take-profit function automatically secures profits. The tools enable traders to manage their time better while maintaining control over their risks.

The practice of monitoring every tick results in decision fatigue and overtrading and emotional stress. Trading success often comes from specializing in two currency pairs during the high-liquidity periods of the London-New York overlap. This approach enables traders to establish a trading system that is both enduring and reliable.

Myth #6: High leverage guarantees higher profits

The concept of leverage in Forex trading is commonly mistaken as a direct path to achieve higher profits. The use of leverage enables traders to control larger positions with their available capital yet simultaneously increases their exposure to significant losses. High leverage without risk control measures will deplete trading accounts at a rate that exceeds trader expectations.

A trader who uses 100:1 leverage can manage a $100,000 position by putting only $1,000 of their own money into margin. A 50-pip adverse move in EUR/USD would result in a $500 loss when trading a standard lot (1.0 lot) because it represents 50% of the account in a single transaction. Some unregulated environments offer 500:1 leverage which enables small price movements to trigger account liquidation.

Regulated brokers operating in the EU, Australia and UK enforce a maximum leverage of 30:1 for major currency pairs which protects traders from significant drawdowns. The use of 30:1 leverage requires traders to deposit $3,334 to open $100,000 positions thus reducing their exposure and promoting better risk management practices.

The amount of margin needed to open and maintain positions directly depends on the leverage ratio. Lower leverage requirements force traders to use more capital for position opening and maintenance which limits both the number of trades they can enter and the trade sizes. The use of leverage supports long-term account sustainability during periods of market volatility.

Leverage functions as a trading instrument rather than a trading approach. The strategic use of leverage enables traders to maximize their capital effectiveness. The misuse of leverage results in excessive risk exposure that surpasses acceptable limits. Risk-to-reward frameworks provide better account growth results than depending on high leverage levels.

Myth #7: You must always follow news to trade successfully

Market-moving news affects Forex price movements but trading strategies exist that do not need economic release monitoring. Some traders adopt technical and price-action-based trading systems which do not need continuous news monitoring. Traders who understand how different strategies interact with market events can determine which information remains relevant.

News traders monitor high-impact releases including non-farm payrolls reports and inflation data and central bank announcements. The release of such events creates significant market volatility especially when USD pairs are involved. A Federal Reserve surprise interest rate hike leads to a stronger US dollar value. The dovish tone of central bank statements leads to a decline in the value of the currency. The multi-functional platforms offer economic calendars which display upcoming releases with forecasted numbers and past data for comparison.

The technical approach to trading depends on chart patterns and indicators and support/resistance levels instead of news events. A trader identifies a double-top pattern on GBP/USD near a significant resistance level. The trading setup maintains its validity regardless of economic announcements if traders maintain proper risk management practices.

All trading styles require news awareness but complete news avoidance does not suit every trading approach. Traders who want to minimize surprises should stay away from high-volatility trading periods unless they plan to execute news-driven trades.

Conclusion

Unrealistic expectations and poor decision-making result from Forex trading misconceptions. The belief that Forex market success depends on luck or constant monitoring or aggressive leverage use leads traders to unnecessary risk exposure and emotional trading behavior. The elimination of these myths enables traders to concentrate on proven performance methods which include education and planning along with disciplined execution.

Knowledge about margin and pip value and lot sizing mechanics enables traders to avoid mistakes. A $2,000 account with a 1% risk allocation requires a maximum 0.1 lot position size for a USD pair when using a 20-pip stop loss. The basic calculation shows how correct position sizing helps protect capital while enabling long-term market survival.

The selection of an appropriate trading strategy holds significant importance. Traders achieve success by either concentrating on major market sessions with particular currency pairs or by reacting to economic data releases. The two trading approaches remain effective when traders use them with proper risk management strategies.

The realization that trading requires skill development instead of providing a path to wealth creation helps traders establish realistic performance expectations. Stop-loss orders combined with economic calendars and charting platforms enable traders to perform structured analysis and planning.