TRADING TOOLS - Lesson 5

In this lesson you will learn:

- The importance of Trading Tools

- Various types of Trading Tools

- How they are applied in Forex Trading

When trading forex, regardless of the experience one may have, trading tools become very useful when looking to increase productivity and improve performance.

It is essential to have a trading plan, which should consist of the appropriate trade size based on the amount of equity in the trading account, risk per trade, margin required and the overall cost of each trade. All the afore mentioned should be taken into consideration in advance, before a trade is opened, and this is when trading calculators become handy. They can generate the exact metrics and help in managing the overall risk. Calculating pips, position size, margin and pivots is crucial.

However, traders should also pay attention to other tools such as the economic calendar, current forecast poll, current trading position, etc. which will help with understanding the traders’ sentiment and the impact economic news may have on the markets.

Tools are indispensable in trading and FXCC is offering a vast selection to our clients in order to enhance the trading experience. Traders are welcome to explore our selection and find the tools that are most suitable option for them.

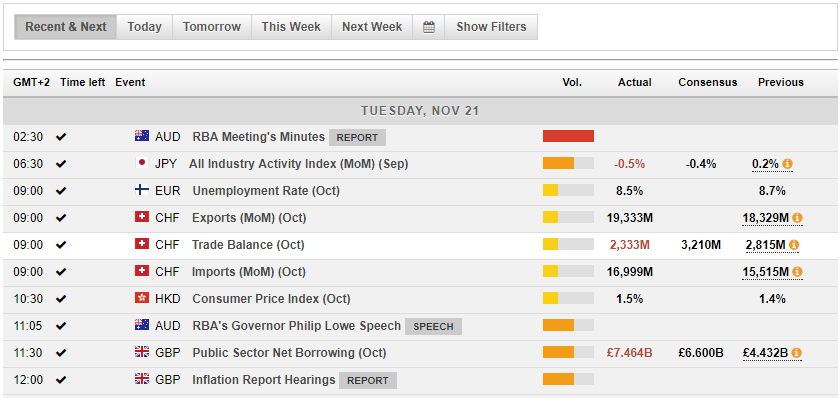

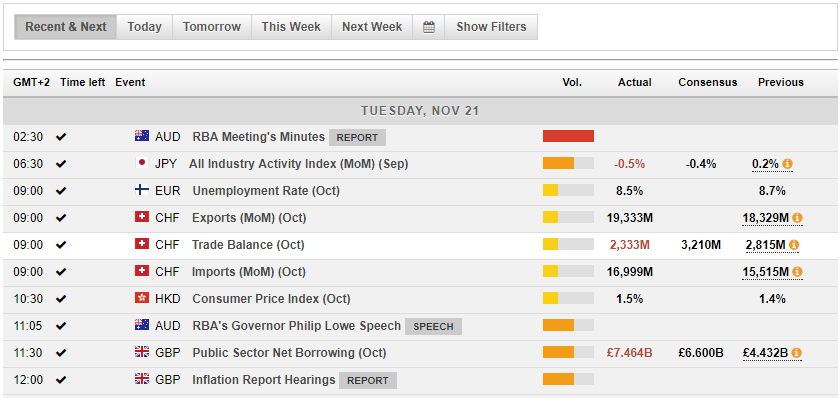

Economic Calendar

This tool is designed mostly for traders who engage in fundamental analysis, therefore enables them to keep up to date with the economic news updates on the forex market.

The Economic Calendar lists all the upcoming fundamental events, previous and expected values and defines the importance of the news impact (Vol.). It is automatically updated upon the news release and the effect of the news can be seen immediately on the MT4 platform.

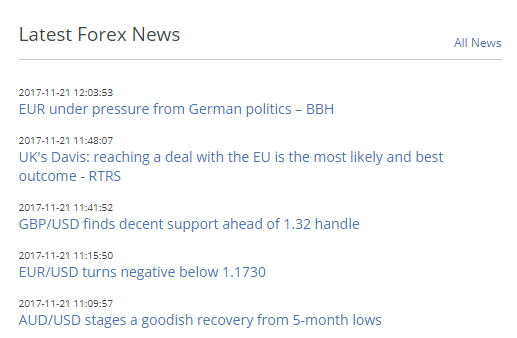

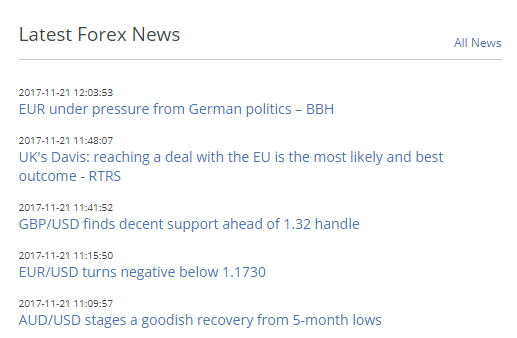

Latest Forex News

Having access to the forex news is of great importance in order to be informed of the latest news releases.

This tool enables the traders to follow the markets and the changes more efficiently, and provides an understanding of the reasons for possible market move.

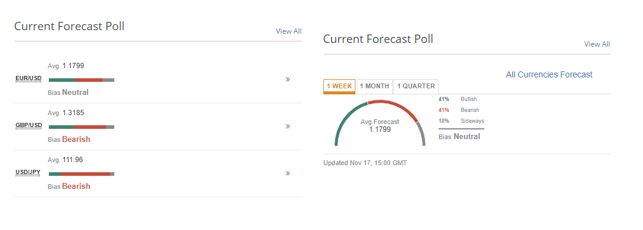

Current Forecast Poll

Current Forecast Poll is a sentiment tool that highlights selected experts’ near and medium term mood and is considered to be a heat map of where sentiment and expectations are going.

This tool offers a condensed version of leading trading advisors ad it is useful to be combined with other types of analysis of technical nature or based on fundamental macro data.

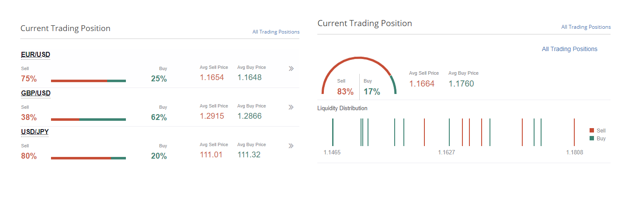

Current Trading Position

Current Trading Position gives an insight of whether the emphasis is on buying or selling the selected currency pair.

Percentage will be displayed of the direction that leading trading advisors have taken regarding selling or buying a currency pair in the given moment, as well as the average sell and buy price.

By having all this information, traders can contrast their own forecasts with those of a group of leading money manager and trading advisors.

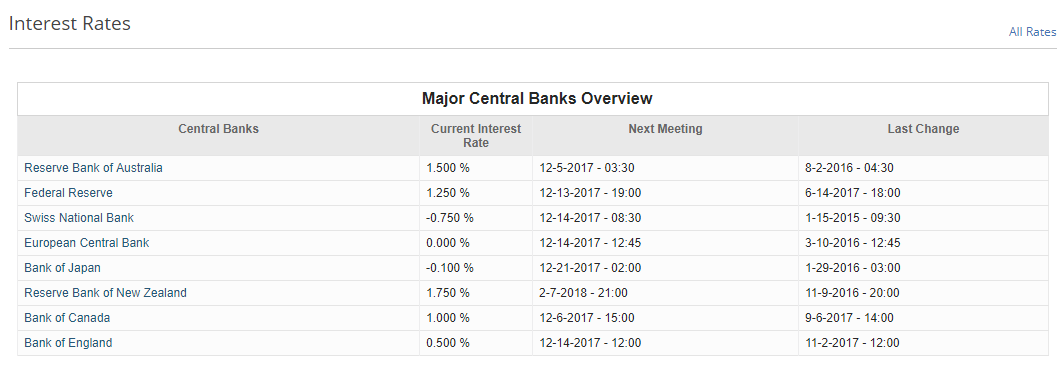

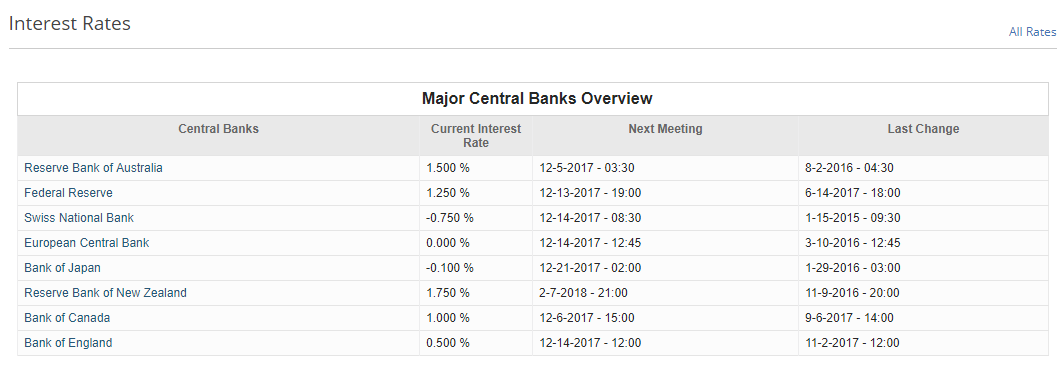

Interest Rates

World Interest Rates reflect the current interest rates if main countries around the world set by Central Banks.

Rates typically reflect the health of the economy (rates rise when the economy is growing and rate cuts occur in struggling economies).

When basing their trading on fundamental analysis, it is important for traders to be up to date with the upcoming policy changes and meetings/decision, as they can move the forex markets significantly.

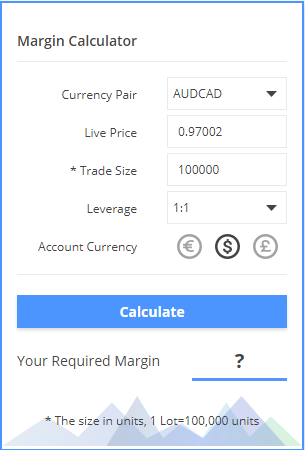

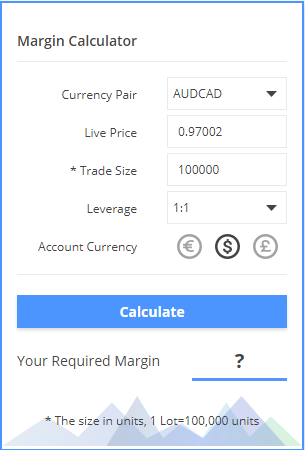

Margin Calculator

Margin calculator is an irreplaceable tool that will provide the trade with control of market exposure for each trade.

This feature calculates the margin required on each trade. For example, if trading EUR/USD, at the quoted price of 1.1717, with trade size of 10,000 units (0.10 lots) and with leverage of 1:200, then one will need to have $58.59 in the account to cover that exposure.

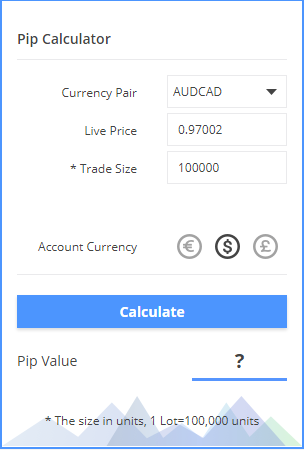

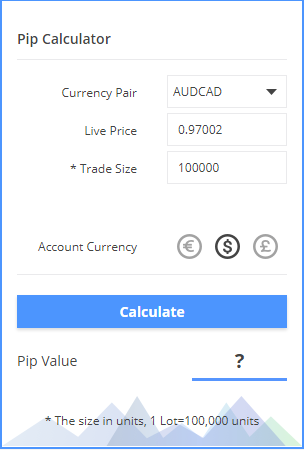

Pip Calculator

Pip calculator is a simple tool that aids the traders when calculating the pip value for each trade.

It is important to know the pip value for the chosen currency pair in order to be aware of the possible profits or losses that the particular trade may bring. For example, when trading EUR/JPY at the quoted price of 131.88 and trade size of 10,000 units (0.10 lots), where our account currency is in US dollars, the value of a single pip will be $0.89.

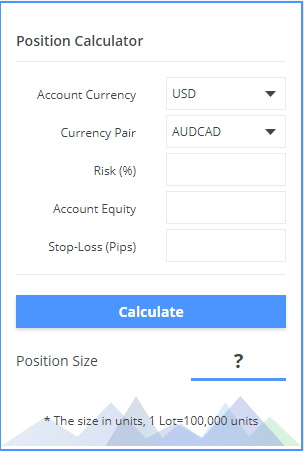

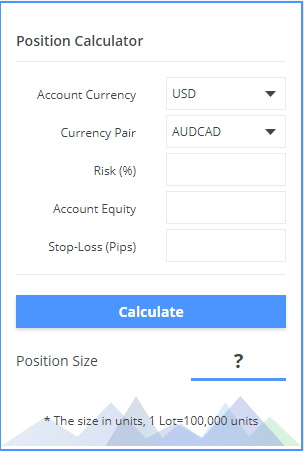

Position Calculator

Position calculator is essential for managing the risk per trade and for monitoring the overall exposure into the market.

This calculator will enable the trader to know exactly which position size is appropriate to take for each trade based on the parameters entered, therefore minimizing the risk of loss. For example, for EUR/USD trade, a trader wishes to risk only 1% of the account equity per trade. The stop loss is set on 25 pips away from the current price and the account size is $50,000. Therefore, the appropriate trade (position) size is 2 lots.

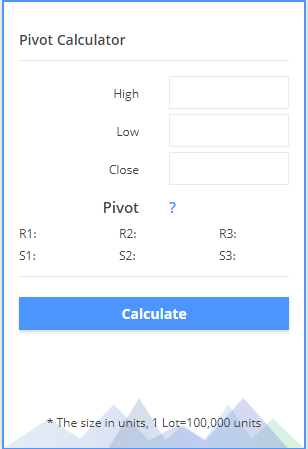

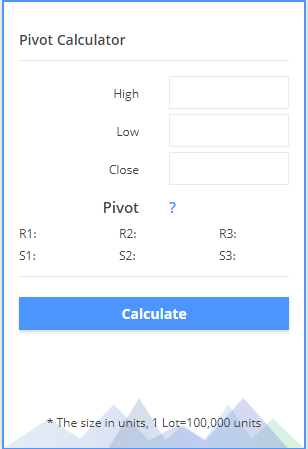

Pivot Calculator

Pivot calculator is a useful tool as it enables the trader to find and identify the intraday support and resistance levels.

The reason why pivot points are used and are attractive is because they are objective. The trader will simply fill in the required fields with the high/low/close price and the calculator will provide the support and resistance levels. Traders can then choose if they wish to trade the bounce or the break of these levels.

Using the provided tools takes just a few moments and leads to placing an informed and well though trade, whilst not using them open the door to possible costly trading mistakes that can be easily avoided.