Types of Forex Orders

In Forex Trading, ‘orders’ refers to a trade offer or set of instructions issued through a broker’s trading platform to buy and sell currency pairs. The term ‘order’ also refers to the set of instructions put in place to open and manage trade positions from the point of entry to exit.

Before diving into the buying and selling of financial assets on your trading platform of choice, it is essential to know the types of trading orders that can be used to enter, manage and exit trades. While they may vary among trading platforms, there are basic forex order types that are made available by all forex trading platforms. The order types are basically market orders and pending orders.

Having a firm understanding of these order types and the ability to use them effectively can help traders execute trade ideas effectively and exit with more profits and fewer losses. Furthermore, traders can also use the order types to develop customized trading styles that match their personality, work, and lifestyle.

Market orders

This is the simplest and most direct form of trading. Market orders are instant executions to buy and sell financial assets at the most current and available prices.

As an example, let's consider the GBP/USD currency pair, where the bid price at the moment is 1.1218 and the ask price at 1.1220. If you place an immediate market order to buy GBP/USD at that time, you will be sold GBP/USD for 1.1220.

How to trade with follow when placing market orders

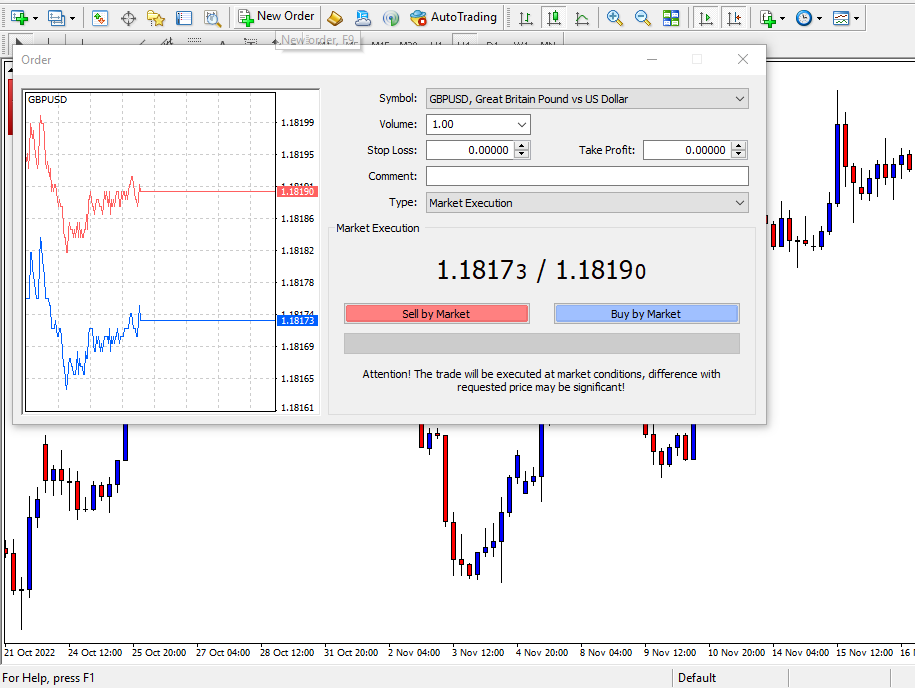

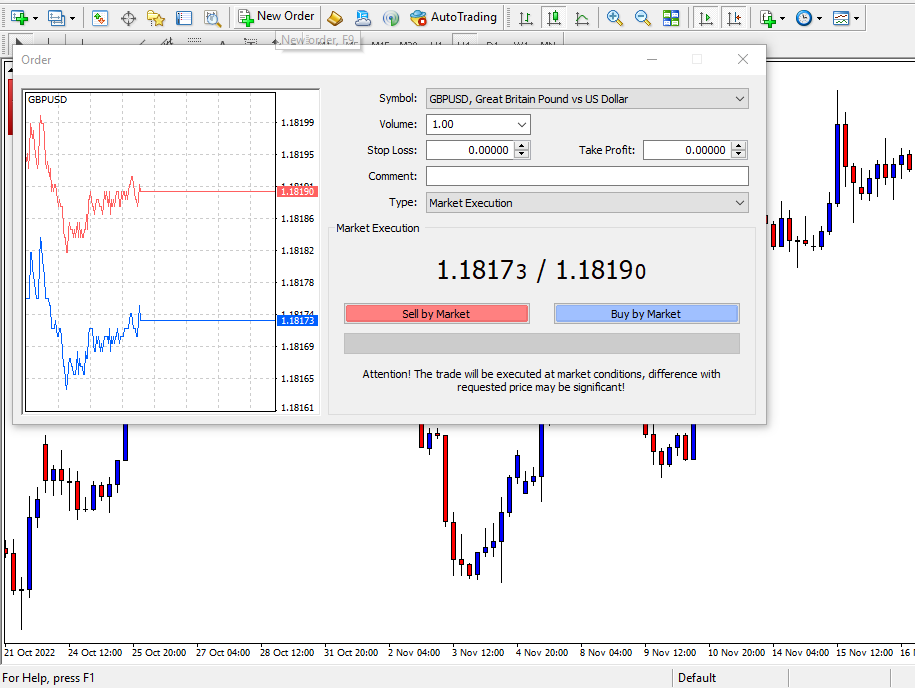

Most trading platforms have their default forex order type as market order or market execution. This makes it easy and simple such that when the price movement of the currency pair you wish to buy or sell is at your desired price level. You can press the F9 key on your keyboard or click on the ‘New Order’ button at the top of the platform to open a new order dialog box.

On the new order dialog box as is shown in the image above, you can

- Choose the currency pair you wish to trade

- You can input the appropriate volume size, stop loss, and take profit that best fits your risk management appetite.

- And lastly, you can click on the buy or sell button

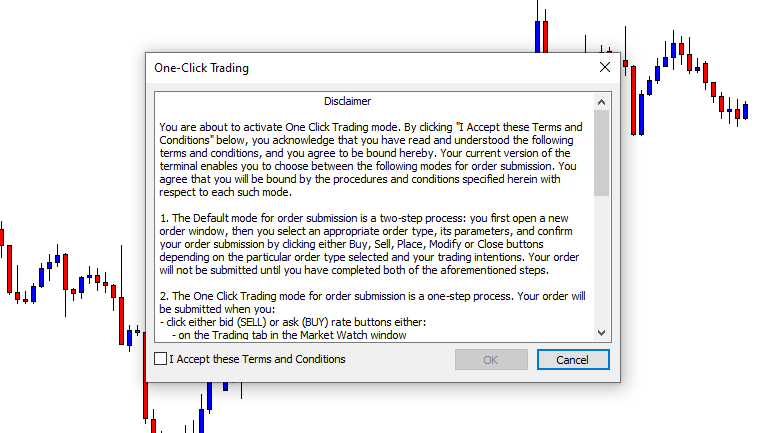

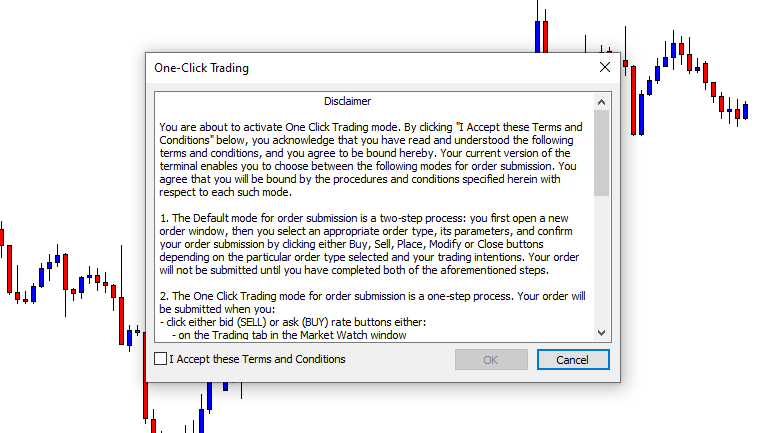

A more direct approach is to activate 'One-Click Trading'. With the one-click trading feature on trading platforms, traders can instantly buy and sell any financial asset at the most current time with just a single click.

This feature can be activated by pressing the ‘Alt and letter T’ keys together. Once activated, a buy and sell button will appear at the top left corner of your trading platform and trading becomes as easier and simpler than ever before.

Here are some of its advantages and disadvantages

- If your speculation on the direction of price movement is accurate and you don't want to miss out on a price move. You can easily execute an instant market order to participate in the price move and exit in profit.

- If your speculation on the direction of the market is wrong at that particular time, price movement will retrace in the opposite direction from your entry point and may retrace even further than expected. This exposes the open trade to potential losses. Furthermore, this type of market order requires you to be aware of factors like slippages that may affect your requested price.

Pending orders

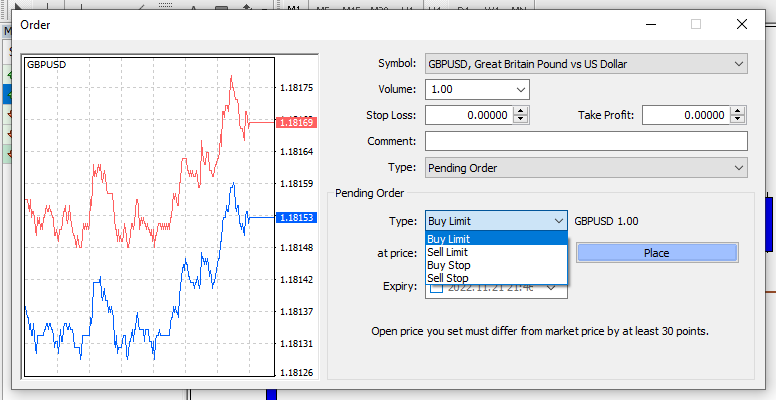

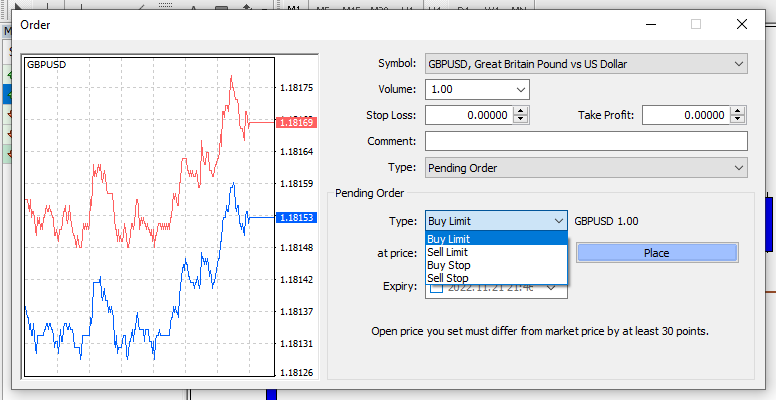

The second type of forex orders known as pending orders is unique because they can be set away from the current market price to be of effect at a later time and thus a new position will be opened once the conditions of the pending order have been met. Orders of this type are mostly used to trade breakouts or strategies that require the entry price to be set away from the current price. These orders may be buy and sell limit orders or buy and sell stop orders as shown in the image below.

There are many benefits to trading with pending orders including not having to be in front of your trading platform for long hours chasing instant market moves.

- Buy and sell limit order

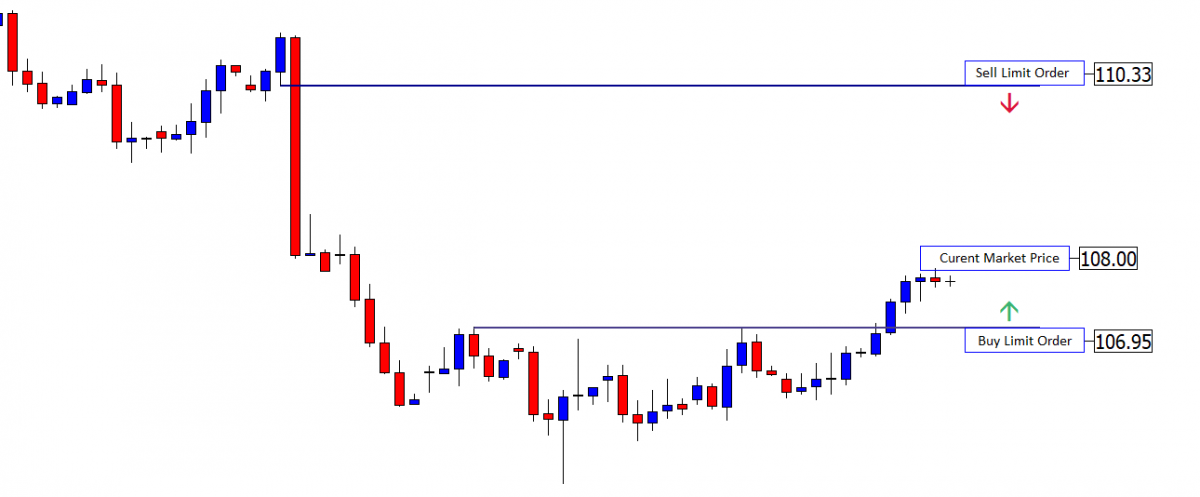

This type of market order, trade positions are opened only when price movement fills the pending order at a predetermined price level. This is mostly used for trading anticipated pullbacks and market reversals. Consider the case where the market is trading higher and you don't want to chase price like most novice traders and neophytes because you understand that the current market price is overbought.

What do you do? As a professional and experienced trader, instead of buying at a premium price, you wait for price movement to retrace lower so that you can buy at a discount price hence reducing potential risk.

How do you do this? Setup a limit order at a discount price so that when price movement retraces, your pending order will be filled and activated.

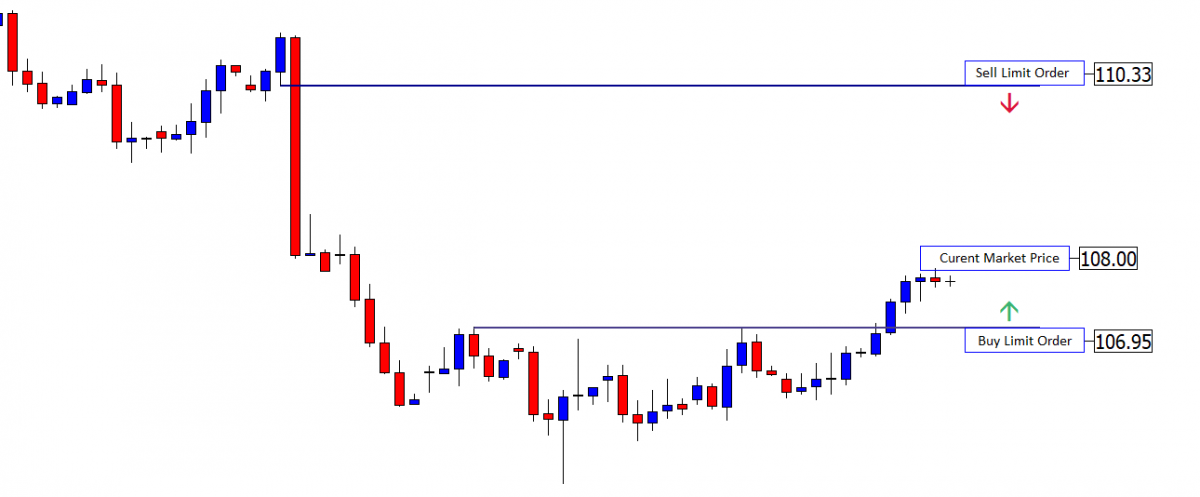

Sample image showing possible buy or sell limit order that can be setup on a price chart.

Here are some benefits and setback

Benefits: With the ability to set up a limit buy order at a cheap price or a limit sell order at a higher price, your risk-to-reward ratio becomes significantly improved.

Set-backs: The disadvantage to trading with limit orders is that you might miss out on potential price moves because sometimes the market may not pull back to fill your desired entry price level.

Secondly, if your limit order is contrarian to the current trend, this puts your trade at risk against the tide of the market. For instance, if you set up a sell limit order at a price higher than the current price when the market trend is bullish, price movement may continue in the upside momentum much more than was expected. Therefore, to manage risk effectively when trading with limit orders, it is crucial to include a stop loss.

- Stop orders: This type of pending order is of two types.

- Stop orders to open a trade: Buy and sell stop order

This type of pending order is set up to profit from the current momentum of price movement.

In a practical sense, assume the price movement of EURUSD is currently trading below the 1.2000 round figure and price movement is speculated to surge a 100 pips higher if it gets to the 1.2000 price level.

In order to profit from the 100 pip price move from the 1.2000 price level; a buy-stop order must be set at 1.2000. Once price movement gets to the buy-stop order, the buy order in the form of a buy stop gets executed and the 100 pips profits will be made if price movement surges higher as was predicted.

Let's consider a typical example, where the price movement of a currency pair is in a consolidation. According to market cycles, when the current market condition is consolidating, the next phase of price movement from the consolidation is a breakout and a trend.

If the trend is expected to be bullish, a buy-stop order can be set at a price level above the consolidation. Conversely, if the trend is expected to be bearish, a sell-stop order can be set at a price level below the consolidation.

Sample image showing possible buy or sell stop order that can be setup on a price chart.

Here are some Pros and Cons:

The Pros to stop order entry is that your trade entry is set up in alignment with the current momentum. The disadvantage to using stop order entry is that price movement could reverse in the opposite direction as soon as your buy or sell stop order is triggered.

- Stop orders to close a trade : Stop loss order

The types of market orders that we have discussed above are the forex orders used to open buy and sell trades. Stop orders to close a trade is the opposite of all the forex orders earlier discussed. They serve as an exit or protective setup to reduce the risk exposure of open trades from unforeseen negative market events. This helps to protect a trader's capital and prevent open trades from accumulating much loss.

Assume, you bought EURUSD at 1.17300 support price level in anticipation that the market will continue to trade higher and you want to limit your risk by 30 pips. You can set the protective stop loss 30 pips below the entry price level at 1.17000.

If the trade idea did not pan out as planned, your stop-loss level will be hit and your incurred loss will be limited. But If the market collapses all the way lower without a stop loss order, this puts your whole capital at risk.

Here are some Pros and Cons:

Stop Loss order does not prevent losses but it helps to reduce risk exposure and potential losses. It is better to lose a trade with a small end bite than with a large crocodile bite. By doing this, you can cut down on losses instead of leaving your capital exposed to unforeseen price movements and losses that are beyond your control but it might hurt to see price movement reverse back in your direction immediately after your stop loss order gets triggered.

Bonus tip: Trailing stop order

Trailing stop order is a type of stop loss order that trails the price movement of a profitable trade with a defined pip range.

Assume you are in a profitable sell trade and you set a trailing stop order at 20 pips. Any retracement of 20 pips or more will trigger the trailing stop and exit your open trade position. This style of risk management can only be of effect when an open trade position is already profitable and it is mostly used by professional traders to prevent a profitable trade from losing all its profits as well as maximizing potential upside in profit.