What is a stop out level in Forex

One of the purposes of risk management practices and its place in forex trading is to avoid the unpleasant and dreary events of a stop out.

What exactly is the stop-out in forex? In this article, we will get into the nuts and bolts of stop out level in forex

Forex stop-out occurs when a broker automatically closes all or some of a trader's active positions in the foreign exchange market.

Before getting into the details of the stop out level, what it means and how to avoid it. It is imperative to know why stop out happens in forex trading and why brokers do close active positions of traders.

In actual fact, currency price movements are actually very minute hence the need to invest large amounts of equity into each trade is required to yield decent potential returns but due to a lack of access to large amounts of capital, leverage was designed to provide traders with sufficient liquidity. To proffer solutions to the needs of traders, most forex brokers provide leverage as margins for traders because forex trading requires a large sum of capital to be worthwhile thus alleviating traders the entire cost of a trading position by the set amount of capital a broker is willing to provide.

For instance, if a trader has access to leverage of 1:500, he or she can open a position worth $500,000 with a deposit, or margin, of just $1,000.

Granted. Forex traders can maximize the capacity of their trading account balance and leverage their trade positions by controlling larger trades on margin, in the hopes of increasing payouts.

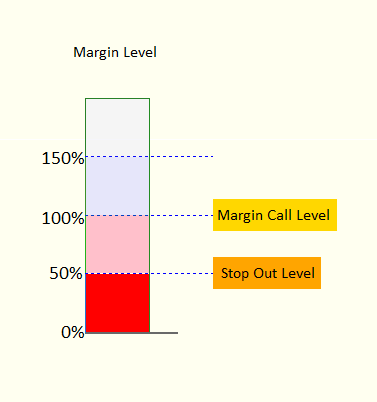

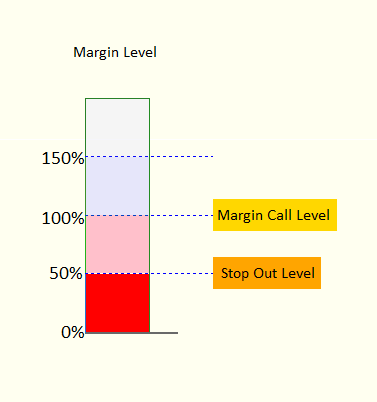

When trading on margins, in order to maintain active trade positions, there is a level of free margin that is required by brokers to maintain active trade positions and there are also two elements associated with the margin level that must be monitored carefully. This is the margin call level and the stop out level.

The Margin call level

As described in the diagram above, the margin call level is a specific level or threshold of the margin level prior to the stop out level.

Traders must always keep in check the margin level to ensure that the margin call level does not go below 100% which is generally considered a good margin level.

Sometimes trade positions may not go as planned and the margin could drop below the maintenance margin level of 100%. When this happens, there are unpleasant aftermaths that might follow. What brokers most brokers do at his point, is to initiate a margin call that alerts the trader of his/her negative trade positions and requests that the trader top up the account balance or close out some positions until the maintenance margin level is restored.

The margin call level is also referred to as the ‘maintenance margin level’. It is the balance between the locked up funds (used margin) and the existing (available) equity. It is the level where a margin call gets triggered because the floating losses on the balance is now greater than the used margin.

The Stop out level

Below the ‘margin call level’ where the free margin is almost exhausted before the trader gets indebted to the broker. This is where the ‘Stop out level’ comes to play. In the interest of the broker to protect their borrowed capital from losses as a result of a trader’s indulgence or lack of sufficient equity on the account balance. A margin call get triggered. If the trader fails to take the necessary steps suggested by the broker. The traders might risk the active trade positions on the account suddenly stopped out at a stop level of 50% or lower of the margin level.

The stop out level does vary between brokers and is also referred to as liquidation margin, minimum required margin or margin closeout value. They are all the same and they represent the level where the broker starts liquidating active trade positions because the trading account is unable to support the existing position due to insufficient margin.

The active trade positions of the trader begin to automatically close out in order, beginning from the most unprofitable trade to the least, until the maintenance margin level is restored.

However, some brokers may choose not to liquidate positions until the equity runs down to zero or until the trading account balance is reimbursed with more capital.

Therefore traders must always try to maintain the margin level above 100%, this will give the trader more opportunities to scout and open new trade positions, and it will also help to maintain existing trade positions

How to calculate the margin level in forex

The margin level is the balance between the available equity and the used margin. It is a percentage of how much funds is present on the account balance that can be used to open new leverage positions.

Generally, a margin level above 100% is considered good because there is free margin for new trade positions to be opened and existing trade positions are not at the risk of getting a margin call or stop out but a margin level below 100% is a bad state for a trading account. Below a 100% margin level, some brokers will send you an instant margin call, you will be restricted from adding new trade positions and your existing trades are at the brink of getting stopped out automatically at or below the 50% of the margin level.

While some brokers separate the margin call level from the stop out level. It is possible that some brokers have it stated in their trading terms & conditions that their margin call level is the same as their stop out level. It can have the unpleasant consequence that no warnings are given to you in advance of closing your positions.

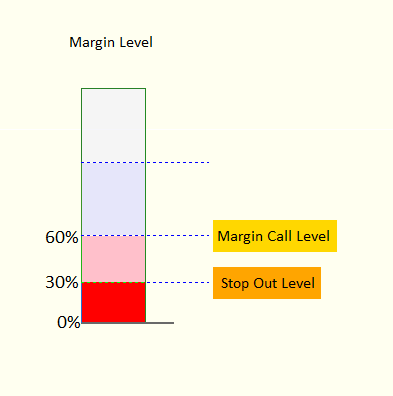

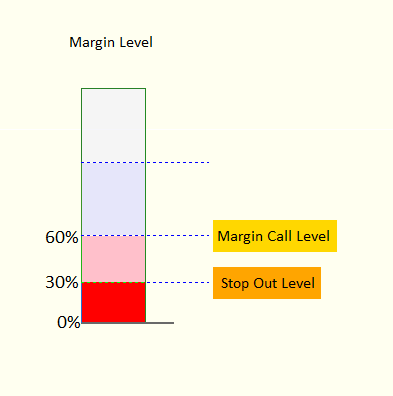

For brokers that separate margin call level from stop out level. If the broker has a stop out level of 20% and a margin call level of 50%. What this means is that when a trader’s equity gets to 50% of the used margin (which is the amount of equity needed to sustain the position). The trader will then get a margin call from the broker to take the necessary steps to prevent a stop out. If no precautionary measures are taken and the equity of the account drops to 20% of the margin used, the forex broker will automatically close the necessary active positions on the account.

Luckily, if you have such a broker, you do not have to worry about margin calls - they are simply a warning, and with good risk management, you will most likely avoid reaching the level where your trades might be closed. It may be cautious for you to deposit more money to fulfil the margin requirement suggested by these brokers.

Example of Stop Out Level in forex

The concept can be illustrated below.

An example of this would be if you have a trading account with a broker that has a margin call of 60% and a stop out level of 30%. You have about 5 open trading positions with a margin of $6,000 on your account balance of $60,000.

If the open trade positions are at a loss of $56,400, your account equity will fall to $3,600 ($60,000 - $56,400). A margin call warning will be issued to you by the broker because your equity is reduced to 60% of your used margin ($6,000).

If you do nothing and your position loses $59,200, your account equity will be $1,800 ($60,000 - $59,200). As a result, your equity has fallen to 30% of the margin used, and your broker will automatically trigger a stop out.

Stop Outs in Forex Trading: How to Avoid Them

Taking steps to prevent stop outs will help you avoid any troublesome outcomes. It is important to manage risk appropriately, however, we do have some useful risk management tips for you to consider.

First and foremost, you must stop yourself from opening too many positions in the market simultaneously. This is to ensure that enough equity is available as free margin, so you avoid the risk of a margin call or getting stopped out of your trade positions.

Using stop-losses, you will be able to control your losses and keep chaos at bay. If your current trades are unprofitable, you should also consider whether you should keep them open. While you still have some funds in your account, closing some of the trades would be a much better choice. In the event of a worsening situation for you, your broker may be forced to close some of your trades.

Losses are inevitable in forex trading. You may also want to adopt some forex market techniques that professionals use to cover their losses. These include a hedging strategy. This will ensure that losses are minimized to the barest minimum.

If peradventure you get a margin call, you may choose to immediately add money to your trading account to avoid a forced closure of your positions. However, always remember that you should only trade with money that you could afford to lose.

Click on the button below to Download our "What is a stop out level in Forex" Guide in PDF