Wyckoff method applied to forex trading

The Wyckoff Method is a market analysis framework developed in the early twentieth century to explain how price moves as a result of supply and demand. The trading system lets traders track market price fluctuations instead of attempting to forecast future market directions in forex trading. The method helps traders identify when market leaders establish accumulation zones and distribution areas which result in trend formation.

The trading market for currency pairs operates through limited access zones which traders can enter throughout various weeks. The Wyckoff analysis system transforms this apparent random activity into an organized process which shows how buying and selling forces move against each other. The price system functions similarly to position size management because it increases market exposure through controlled price changes when demand surpasses supply. The method enables traders to handle their risk through controlled market entry because it provides practical tools for forex trading which include position sizing and margin usage and leverage control.

Origins and core philosophy of Wyckoff theory

The Wyckoff Method developed from the financial concepts which Richard D. Wyckoff observed during his lifetime when modern financial markets began to form. The main principle of this system depends on the theory that market price fluctuations result from the continuous interaction between market supply and demand forces which institutional investors control. The research method of analysis uses direct market price observations to study price fluctuations and trading range movements instead of depending on indicators.

The currency pair shows restricted price fluctuations while volatility indicators show that market trading activity remains at a low level. The Wyckoff theory shows that traders use this method to construct their positions through controlled steps which match the process of adding small investment amounts to build up a full position. The evaluation of each price change requires assessment of work done against achieved outcomes which resembles determining the number of pips gained or lost compared to the margin investment.

The trading philosophy matches the principles which responsible forex traders should follow. The main elements for trading success include controlled leverage and exact position size determination and complete understanding of market conditions. The current price structure analysis helps investors stick to their investment plan because they can select assets which reduce their market risk exposure.

Market structure and the composite operator concept

The concept of the Composite Operator explains how market structure forms through the actions of large institutional participants acting with a shared objective. The forex market shows no evidence of a single controlling entity because banks and funds and liquidity providers create price movements through their combined market activities. The research investigates price changes as strategic business development stages instead of treating them as unanticipated market fluctuations.

The main currency pair trades between fixed levels while showing typical market price fluctuations. During this period, buy and sell orders are absorbed gradually. The process follows the same pattern as building exposure through various small investments instead of using one large position. The market impact grows through controlled stages because each new lot enters the market according to the pattern of margin expansion which occurs through multiple stages instead of a single large increase. The market price starts to rise because demand outpaces supply which causes each pip gained to represent the present market imbalance.

The price structure serves as a system which enables investors to connect market price fluctuations with their risk management approaches. The three elements of position size and pip value and leverage need to match the current market phase.

Supply and demand dynamics in the forex market

Supply and demand form the foundation of price movement in the forex market. The market value of a currency increases when people want to buy more currency than what exists in the market. The market price decreases when supply levels surpass demand levels. The Wyckoff Method identifies market imbalances through price structure instead of using indicators for its analysis.

The EUR/USD currency pair maintains a restricted price range because of its previous market decline. The market phase shows declining selling power because investors begin to buy the available inventory. The price shows no signs of increasing at present but its inability to decrease indicates that market forces have started to change. A trader who opens a 0.10 lot position gains control of 10,000 currency units. The pip movements show how market forces of supply and demand respond to varying margin requirements which traders create through their different leverage applications. The application of higher leverage levels leads to increased investment danger but it does not modify the basic market mechanisms which function in the market.

Wyckoff market phases and their characteristics

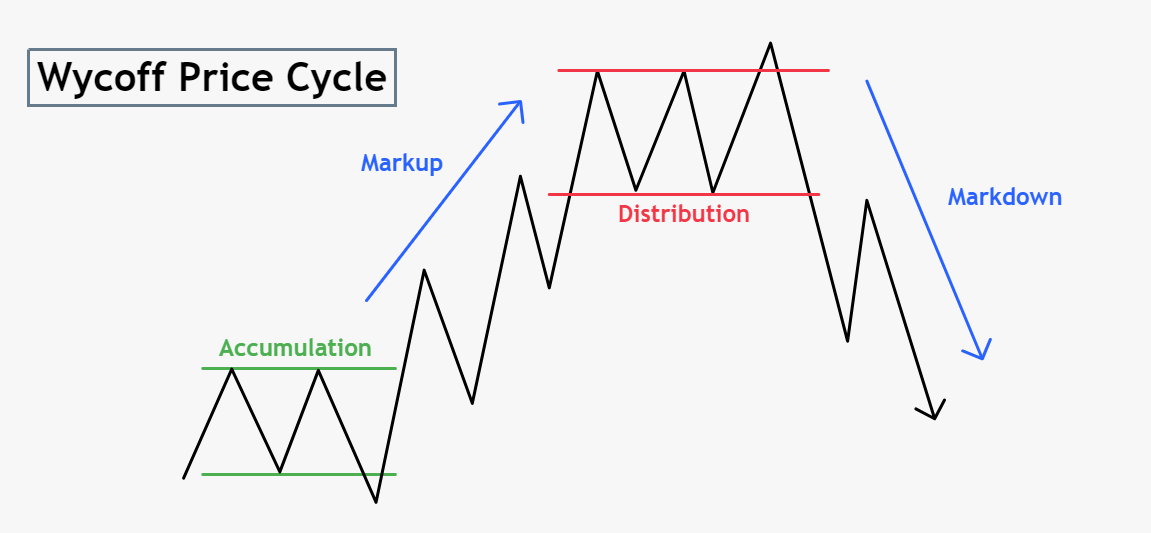

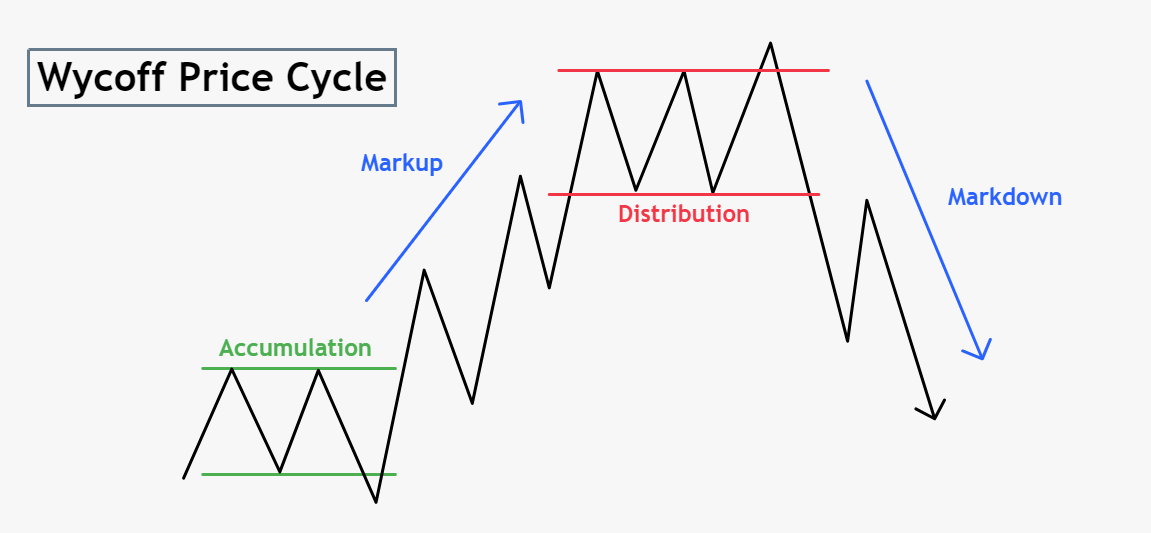

The Wyckoff analysis system identifies market patterns which show how prices shift from stable periods to active price movements. The process consists of four main stages which are accumulation followed by markup and then distribution and finally markdown. The different stages between supply and demand levels help traders understand market conditions which guide their risk management decisions in forex trading.

A currency pair shows no change in value during a time when its market worth has been decreasing for an extended period. The accumulation phase brings about a decrease in selling pressure which allows buying interest to consume the available supply. The market price shows no change while the number of transactions continues to rise. The trader should establish multiple small positions of 0.05 lots during this phase to protect their investment while keeping the ability to enter the market when prices start moving. Traders maintain control of their pip gains and losses through controlled margin increases which enable them to handle each trading outcome.

The market experiences price increases because demand exceeds the available supply of products. Later, distribution appears as upward progress slows and sell orders absorb demand. The last stage of markdown occurs when supply exceeds market demand which results in price reductions. The identification of these market phases enables investors to establish their position size by considering their leverage amounts together with current market conditions.

Wyckoff schematics and price behavior in forex

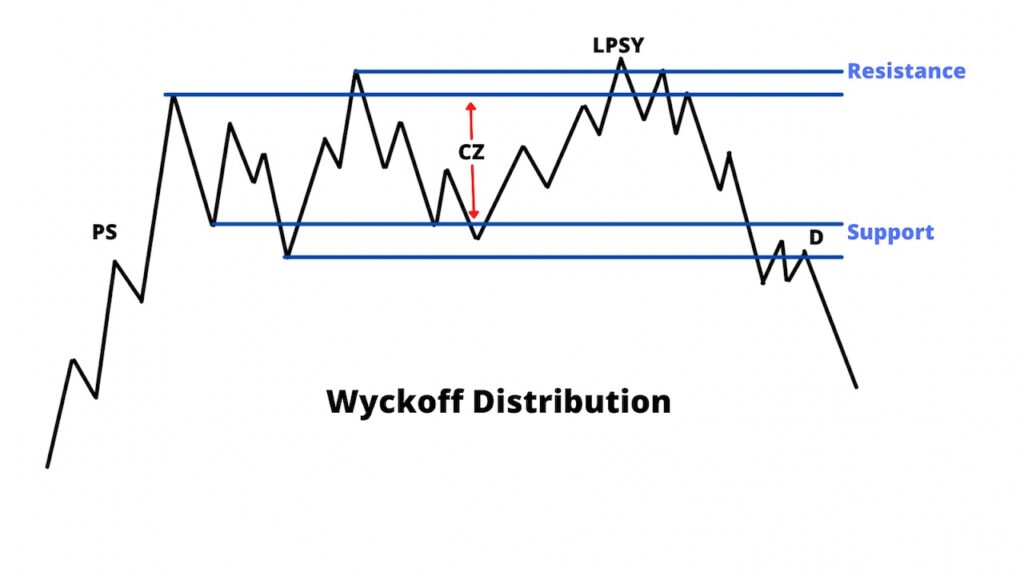

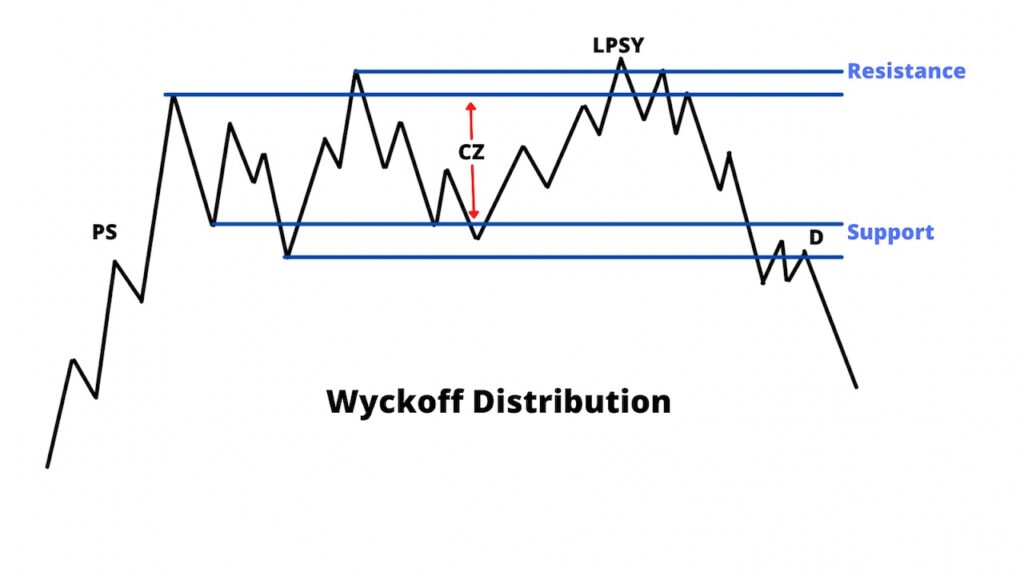

The visual design of Wyckoff schematics enables traders to monitor price movements which occur between accumulation and distribution phases. The schematics show standard price reaction patterns which demonstrate how market forces between supply and demand influence market behavior. The forex market provides its value through structure identification instead of exact market reversal prediction.

The market decline leads to a specific trading range which forms between currency pairs. The market experienced rising price fluctuations during its initial period before it started to move in a more controlled manner because investors lost interest in selling their assets. The sequence follows an accumulation schematic pattern. A trade becomes vulnerable to a specific pip risk when it enters a 0.10 lot position which is located near the support level of the range. The stop loss distance of 20 pips establishes a direct relationship between the highest possible loss amount and the entire amount of invested margin. The market shows signs of price resistance but demand growth becomes stronger so investors should increase their positions while keeping their leverage at protected levels.

The distribution schematics follow an identical pattern which emerges after the system reaches its peak point. The ability to identify these patterns enables traders to establish their trading position size according to the prevailing market conditions.

Volume analysis and its interpretation in spot forex

Volume analysis within the Wyckoff framework focuses on the relationship between trading activity and price movement. In spot forex, centralized volume data is unavailable, so tick volume is commonly used as a proxy. The Tick volume indicator shows how many times prices shift which helps investors understand how many market participants are active at what level of market intensity.

The market shows two key indicators when a currency pair surpasses its resistance level while tick volume reaches higher levels. This suggests stronger participation behind the move. Market demand determines price growth during high-volume breakout activity because the 15 pip price movement occurs in a 0.10 lot position. The margin usage stays at the same level but the trading performance enhances because more investors join the market. A breakout that occurs with low trading volume tends to fail in sustaining its momentum because it usually leads to a rapid market reversal.

Conclusion

The Wyckoff Method provides traders with a systematic method to analyze price movements through its analysis of market supply and demand and its identification of different market stages. The system provides forex traders with a tool which merges their trading experience with market conditions to determine position sizes and calculate pip risk and margin consumption and leverage levels. The framework operates as a decision support system which enables users to select appropriate risk exposure levels but it lacks the ability to execute risk calculations.

The system uses margin efficiency to control leverage but it does not affect the pip-based risk which functions as the main control variable. The system operates at exposure levels which correspond to customer account sizes and market conditions at present.